Table of Contents

This plan isn’t for everyone.

If your business struggles to turn a profit, this won’t help. But once you make much more than you need to cover expenses, it’s time!

A Good Problem to Have, but Still, a Problem

Different than most, I was actually happy when my taxes were first on track to exceed the median US salary.

Truly.

No, I’m not a glutton for (financial) punishment. It’s just that having to pay high taxes meant my business was very profitable.

However, that didn’t mean I wanted to pay more in taxes than I had to. A couple of quotes from Judge Learned Hand support my view:

-

“Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” – Gregory v. Helvering, 69 F.2d 809, 810 (2d Cir. 1934)

-

“Over and over again courts have said that there is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions. To demand more in the name of morals is mere cant.” – Commissioner v. Newman, 159 F.2d 848, 851 (2d Cir. 1947) – dissenting opinion

This doesn’t mean we shouldn’t consider the good of others, for example, by making charitable donations.

It’s just that once I meet the tax code’s requirements, I’d rather target my money to causes I care about, rather than leave it to government officials, elected or appointed, to spend my money as they please.

The Best Retirement Plan for Solo Business Owners

As a small-business owner you have options.

The three most popular ones are the SIMPLE IRA, the SEP IRA, and the One-Participant or Individual 401(k).

For my money, the last is the winner, and the one I opened for both my main business (and my wife’s, once her practice qualified).

Assume your profits (plus your spouse’s income, if any) are high enough to cover your family expenses and leave plenty over.

Your marginal federal income tax could be as high as 37%. If you live in a high-tax state like California, you might have to pay up to 12.3% to the state, and the 2017 tax law limits your ability to deduct state taxes plus property taxes to a measly $10,000.

That means you’d get double-taxed and your total income tax burden could near 50%!

Enter the Individual 401(k).

If your tax bracket is higher now than you expect it to be in retirement, a traditional 401(k) lets you defer taxes on a total (employee salary deferral plus employer elective contribution) of up to $61,000 for 2022, plus an extra $6,500 if you’re over 50 years old!

If you think your retirement tax bracket will be higher, there’s a Roth option with the same limits.

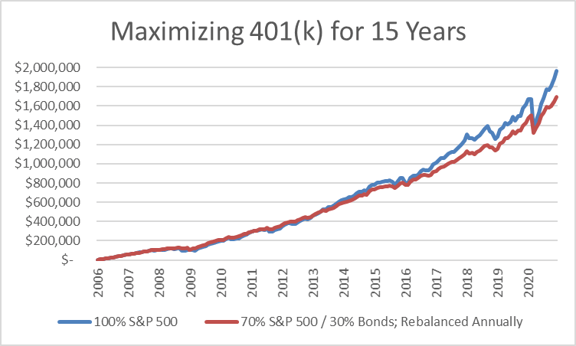

Say you started contributing to a 401(k) when you turned 50, at the start of 2006, maxing out your contributions each year (from $49k in 2006 to $63.5k in 2020, including catch-up amounts, in equal monthly amounts), here’s how your balance would have developed over the following 15 years.

If you were aggressive and invested 100% in the S&P 500, you’d have ended 2020 with nearly $2 million!

Had you been a bit more conservative, investing 70% in the S&P 500 and 30% in bonds, and rebalanced annually, you’d have finished 2020 with just under $1.7 million, still far from shabby, and your portfolio balance would not have been as volatile.

Better yet, if your spouse worked for your business, with a high enough salary to let you max out his or her contributions too, you’d have ended 2020 with over $3.9 million with the all-stocks portfolio, or just under $3.4 million with the 70/30 portfolio.

With $3.4 million, using the 4% rule, you’d be able to withdraw $136,000 in the first year of your retirement, adjusting each year for inflation, and having an excellent chance of maintaining that for the rest of your lives.

Obviously, if you start today, your results over the coming 15 years will be different, but the above illustrates the power of combining the high annual contributions with tax-deferred investing of a traditional 401(k).

Doing the same with a Roth 401(k), your contributions would have been in after-tax dollars, which is harder. However, while your balances would have been the same, all Roth distributions in retirement would be tax-free!

In my case, I started my Individual 401(k) in 2012, and while I’ve maxed out what I could given the salary I pay myself, that’s less than what I could have set aside with a higher salary (remember that the employer contribution is limited to 25% of your compensation).

With 10 years of somewhat less than the absolute maximum allowed, and only my contributions, my results are less than the above hypothetical, but still pretty great.

You know what really blew my mind?

In a good year for the markets, your 401(k) returns might outpace your business profits!

Not convinced?

Say your annual profits (before accounting for the salary you pay yourself and your 401(k) contribution) are a healthy $300,000. If your 401(k) returns 35% for the year on a $1 million balance, your investment returns just blew past your business profits, even ignoring returns on current-year contributions.

I doubt this will happen very often, especially in the early years, when your plan balance is pre-7-figures, but when it does it’ll probably blow your mind like it did mine!

Simple IRA vs. SEP IRA vs. Individual 401(k)

If you’re still not sure the Individual 401(k) is best for you, here’s a handy comparison table for the three most popular small-business retirement plans.

|

SIMPLE IRA |

SEP IRA |

Individual 401(k) |

|

|

Eligibility for opening plan for your business |

Any business owner, generally with 100 or fewer employees |

Any business owner, with or without employees |

Any business owner with no employees*, other than spouse |

|

Contribution limit |

Total of up to $19,200 in 2021 and $23,150 in 2022, with an additional $3,000 catch-up contribution if 50 or older |

Up to $58,000 in 2021 and $61,000 in 2022 (no elective deferrals or catch-up contributions allowed) |

Total of up to $58,000 in 2021 and $61,000 in 2022, with an additional $6,500 catch-up contribution if 50 or older |

|

Taxes on contributions |

Contributions are made pre-tax, reducing taxable income for the year |

Contributions are made pre-tax, reducing taxable income for the year |

Traditional 401(k): Contributions are made pre-tax, reducing taxable income for the year. Roth 401(k): Contributions are made with after-tax dollars |

|

Taxes on qualified distributions in retirement |

Qualified distributions are taxed as income |

Qualified distributions are taxed as income |

Traditional 401(k): Qualified distributions are taxed as income. Roth 401(k): Qualified distributions are tax-free |

* Previously, part-time employees working less than 1000 hours/year would not affect your ability to open an Individual 401(k), but the SECURE Act changed that. Now, if you have one or more employees who worked between 500 and 999 hours/year for three years, they’re considered long-term part-time employees, who must be given access to your 401(k) plan. This means your business no longer qualifies for an Individual 401(k) (though if willing to take on the greater expenses and complications of a regular 401(k) plan, that’s still available to you).

Clearly, the SIMPLE IRA limits are much lower than the SEP IRA’s, which are similar to the 401(k)’s if you’re under 50.

If you’re over 50, the Individual 401(k) allows $6,500 higher contribution than the SEP IRA, due to the catch-up provision.

Even if you’re under 50, in certain situations the 401(k) is better, as its limit is 100% of salary as deferral plus 25% of compensation as elective employer contribution, vs. 20% of business revenue for the SEP IRA of a sole proprietorship or sole-member LLC (that isn’t set up to be taxes as an S-corp).

In addition, the 401(k) allows a Roth option, and may allow loans, neither of which is allowed for SEP IRAs. As a minor downside, Individual 401(k) plans with total balances over $250,000 require you to file a (relatively simple) form 5500.

By the way, some advisory companies allow you to open a so-called Solo 401(k), where you can invest in assets beyond stocks, annuities, ETFs, and mutual funds. These include e.g. residential or commercial real estate, raw land, mortgages, private loans, tax liens, private businesses, gold, currencies, etc.

How to Open Your Own Individual 401(k) Plan

First, talk with your tax advisor to make sure your business is set up right and is profitable enough to make a 401(k) advisable. Assuming your advisor agrees, find a solid provider and follow their process.

I use T. Rowe Price, but there are many others out there.

The Bottom Line

If your solo business is raking in high profits, and you want to build wealth for retirement, you’d likely do well to open an Individual 401(k) plan as soon as possible and contribute as much as you can for as long as you can.

Do that for a decade or more and you may easily become a 401(k) (multi-)millionaire!

Disclaimer

This article is intended for informational purposes only, and should not be considered financial, investment, business, or legal advice; nor is it an endorsement of any particular retirement-plan provider. The above information is accurate to the best of my knowledge, but I am not a tax professional. You should consult a relevant professional before making any major decisions.

This article was written by Opher Ganel, consultant and financial strategist. Opher’s career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting his own small consulting practice supporting NASA projects and programs. Along the way, he started other micro businesses and helped his wife start and grow her own Marriage and Family Therapy practice. Now, he uses all these experiences to offer financial strategy services to help independent professionals achieve their personal and business finance goals.