PRODUCT

Subscription Analytics

Track, analyze, and improve your subscription business.

Payment Recovery

Get help with failing charges and recover revenue.

Cancellation Insights

Gain insights into why customers cancel and reduce churn.

Financial Forecasting

Make future planning simple with accurate financial forecasts.

RECOMMENDED

Interactive Demo

View our live demo environment to see Baremetrics in action and learn how it can benefit your business.

Try nowFREE TRIAL

TRENDING TOPICS

SaaS Metrics

Get the insights that reveal the truth of your business, and how to grow it.

Financial Forecasting

Using real-time data, you can create models based on your business, and your future goals.

Dunning

Failed payments are a monthly issue for subscription businesses. How to best recapture these customers?

Pricing

Experiment and optimize your pricing to secure the largest customer base.

Segmentation

Different customers need different treatment. Organize and analyze your user groups.

MRR

Understanding MRR is a key step toward building a profitable business.

Retention

Keep customers using your service and head-off churn before it happens.

Churn

Understanding why customers leave, using data and insights, is the first step to retaining them.

PUBLICATIONS

Blog

Founders Journey: true experiences, challenges, and what the road to success really looks like.

Academy

Access a wealth of resources designed to help you master your business metrics and growth strategies.

Founders Chats

In-depth conversations with successful founders discussing their journeys and the lessons they've learned.

HELP & SUPPORT

Developers

Extend and Integrate Baremetrics

Help Center

Get answers to common questions and learn how to get the most out of Baremetrics.

Experts

The best consultants, agencies, and specialized services to help you grow.

THE OPEN PROJECT

Benchmarks

Have an idea of how other SaaS companies are doing and see how your business stacks up.

Startups

Companies that are embracing transparency and openness by sharing their metrics with everyone.

Accelerator

Emerging SaaS startups

COMPARISONS

ChartMogul

Evaluate how Baremetrics compares to ChartMogul in terms of features, usability, and value.

Profitwell

See a detailed comparison between Baremetrics and Profitwell, including a breakdown of key differences and benefits.

Stripe

Discover how Stripe Analytics stacks up against Baremetrics in terms of features, ease of use, and overall benefits.

COMPANY

About

Learn more about Baremetrics, our mission, values, and the team behind the product.

Customers

Discover how businesses like yours are using Baremetrics to drive growth and success.

Wall of Love

Read testimonials and reviews from our customers who have achieved their goals with Baremetrics.

RECOMMENDED

Interactive Demo

Try now

FREE TRIAL

Free trial

Try for free

Financial forecasting for SaaS companies. Get modeling, forecasting, scenario planning all in one tool.

14 Days Free. No Credit Card Required.

Trusted by growing SaaS Companies

End-to-end Forecasting for your Subscription business

Accurate Scenario Planning

Scenario planning helps you create options for the future to account for multiple possible situations so you are always ready with plan A, B and C.

"Forecast+ has been instrumental to growing our company in a capital efficient manner. The insights provided by having accurate financials and forecasts at our fingertips gives us a competitive advantage, not to mention peace of mind.”

Matt Smith

COO and Founder at Later

Key Benefit

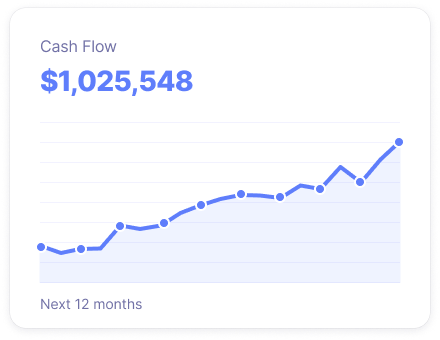

Accurate financial forecasts, faster

We integrate with Quickbooks Online and Xero to automatically bring in your actuals every month. Then, with your updated data, create the dashboards and charts you need in a few clicks.

Include Forecast to Actuals, Budget to Actuals, Revenue Breakdown, Headcount over time, Simplified P+L, or any custom report needed.

An operating model you’ll actually use

Profit & Loss statements

Balance sheets

Cash flow statements

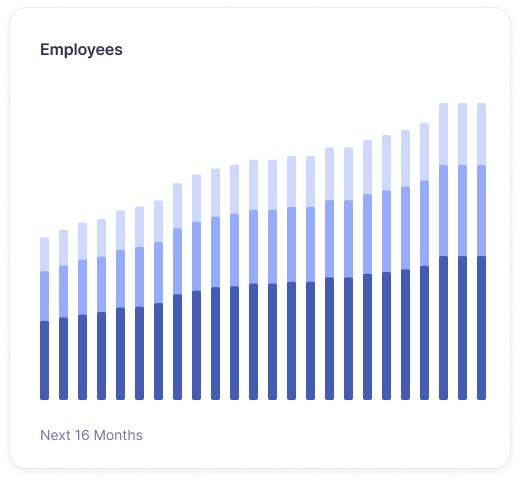

Hiring Planning

When can you afford to hire? Where should you invest next? Forecast your current and future employees. Include raises, payroll taxes, benefits, and signing bonuses for maximum accuracy.

Get started

Frequently Asked Questions

By incorporating Forecast+ into your decision-making process, you can gain a valuable edge in navigating the ever-changing business landscape. Here are some key ways to leverage forecasts:

Strategic Planning: Forecasts provide insights into future trends, resource needs, and potential risks. This foresight enables you to make strategic decisions with confidence, whether it's allocating resources for expansion, investing in new technologies, or adjusting pricing strategies. By understanding the financial landscape ahead, you can proactively adapt and stay ahead of the curve.

Risk Management: Forecasts can identify potential financial pitfalls, allowing you to implement proactive measures to mitigate risks. This could involve diversifying investments, securing credit lines, or adjusting inventory levels based on anticipated market fluctuations. By anticipating challenges, you can minimize their impact and protect your business from financial shocks.

Performance Measurement: Comparing actual results to forecasted figures helps you assess the effectiveness of your current strategies and identify areas for improvement. This data-driven approach allows you to make informed adjustments to optimize resource allocation, streamline operations, and ultimately boost profitability.

Forecast+ integrates seamlessly with QuickBooks Online and Xero making it easy to connect your data to start forecasting.

Yes, you can create different forecast scenarios to see how your business might perform under different circumstances. This is a great way to stress-test your plans and make sure you're prepared for anything.

Yes, you can easily share your forecasts with your team and collaborate on adjustments. This makes it easy to keep everyone on the same page and make informed decisions together.

More questions? Contact us.

Grow your subscription business faster without a million tools

Baremetrics is the easiest way to get the insights you need to understand how your business is performing and where you should focus next.