Table of Contents

The most sure-fire way to achieve rapid growth in your business is to make sure you’re marketing to the right people.

In the early stages of founding a startup, finding clients can be a bit of a shot in the dark. If you’re not sure who could benefit from your services yet, casting a wide net and targeting a broad market is one path towards identifying them.

This process is quite inefficient, however, and you might find yourself spending a lot of time, effort, and development money on customers who, in the long run, will do little to help you grow.

So how do you find the perfect sales target?

Here’s where the Ideal Customer Profile (ICP) comes in.

You may have heard of the term “customer persona”, i.e., fictionalized archetypes of people most likely to use your services.

An ICP is more specific: the key word here is ideal, as in, within your market corner, who are the golden goose consumers who will help you grow the fastest.

Here’s a simple step-by-step guide on how to create your Ideal Customer Profile and use it effectively.

Step 1: Identify ICPs within your current user base.

Step 2: Interview a sample of current ICP users.

Step 3: Compile the data.

Step 4: Action the insights you gained in marketing and R&D.

Step 1: Identify ICPs within your current user base

The ideal customer profile has three main characteristics:

- High monthly recurring revenue (MRR)

- High lifetime value (LTV)

- Low hassle

Essentially, your ICP should bring in high revenue in both the short and long term, while requiring minimal support from your team.

The first step is to look through your database of existing customers to identify who possesses these traits.

Start by segmenting your clients.

If you want some ideas on how to do that, here’s an easy guide on how to use Baremetrics for customer segmentation. Baremetrics offers over 26 different metrics for business insights and is currently offering a free trial.

Here are some examples on which metrics to segment against revenue and LTV:

- Geography

- Industry group

- Size of plan

- Usage/specific services opted into

Looking through this data should highlight a few broad commonalities among your high revenue, high LTV, and low hassle customers, such as where they operate from, their role within their field, and how they are using your services.

Consider using the Baremetrics segmentation tool to make this process easier and track the progress of the groups separately afterwards.

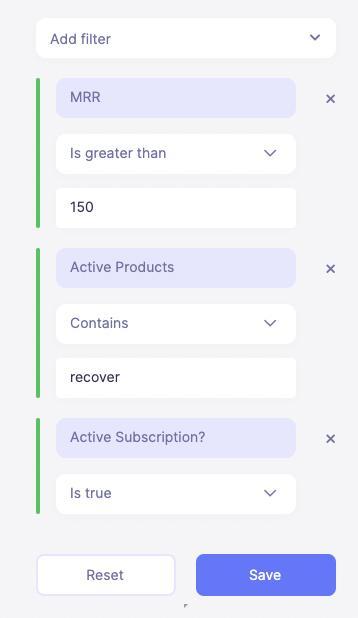

Here’s an example of segmenting customers based on:

- The MRR they earn you every month

- The product they use (Recover)

- Whether or not theyhave an active subscription

Step 2: Interview a sample of current ICP users

When it comes to getting honest feedback, nothing beats a phone call. Surveys will provide some basic answers, but these won’t be anywhere near as detailed or informational as a direct call.

One of the most valuable pieces of information to be gained here is how people are trialing comparable services, and why or why not they settled on yours.

Phone calls also provide some added opportunities. You can educate a customer on how to use your product better and encourage them to upgrade. A user about to churn could be brought back if a pain-point is addressed in the conversation.

Use the insights you gained through segmentation to select about 20–30 customers to interview.

Ideally, these interviews should be conducted by the founder or other high-level staff in your SaaS enterprise.

When looking for a contact at a customer’s company, remember that businesspeople tend to be more receptive to picking up the phone than developers, and that decision-makers are less likely to have the time for an interview, but their feedback is usually the most valuable.

Instead of focusing exclusively on high-value customers, include medium-value ones too. A large number of middle-of-the-pack users is more likely to generate actionable feedback than a small number of high-value customers using a more tailored service.

If you have the opportunity, consider expanding your interview base to include churned customers, closed losts, unconverted trials, prospects, etc.

While hearing the positives about your product from confirmed users is invaluable, so is gaining an understanding of why your services aren’t for some people. You might find that simple changes are enough to reconvert them to your product and render your services more attractive to undiscovered prospects like them.

Here are some sample questions you can use in interviews:

- What is your title/role?

- How big is your team, your company?

- How do you use [our product]?

- do you use it internally or with external clients?

- What was life like before you started using [our product]?

- What was the trigger to start looking for a solution like [our product]?

- what was the trial process like?

- who did you compare us to if anyone?

- why did you ultimately choose to go with us?

- when did you know that [our product] was the right solution?

- What would your team be doing if you didn’t have [our product]?

- Is there a specific internal goal that you were trying to hit with [our product]?

- What does [our product] do well?

- Where is there product friction or things we do less well?

- What features of [our product] are the most important for your business?

- Do you use it sporadically or on a project basis?

- If you could ask for the sun, the moon, and the stars, what else would you like to see from us?

- Are you using any tools alongside [our product]?

- what do those other tools do well?

- what do they not do well?

- What other general [product type] tools do you use?

Questions on networking/possible market expansion:

- Where do you go to meet and network with other [role] like yourself?

- are there conferences where you meet?

- are there podcasts/blogs/twitter hashtags you follow?

- What channels could we market in that would be visible and effective for you and your peers?

- What do you think an ideal use case for [our product] is?

Questions for high-paying customers:

- What additional features would be helpful for you (or would you pay for)?

- What other tools are you using and for what?

- would you pay more for [our product] if we built out that functionality in our software?

- What premier tier services could we provide for you?

Don’t like these? Adapt your own!

Here are some general tips on getting the most out of your interviews:

- Introduce yourself and start with some friendly small talk.

- Explain what you are looking to achieve, e.g., “we want see how our product fits into your life so we can make some improvements.”

- Give the customer an opportunity to ask questions too.

- Request permission to record interviews for internal use only.

- Ask open questions without inferred answers (e.g., avoid openers like”don’t you think that…”).

- Watch out for your own biases and opinions about your product or the market.

- Create a safe environment for honest feedback—be ready to face answers that might be disappointing in an emotionally neutral way for your user.

- Reward customers for their time with thoughtful thank-you gifts or gestures. Be aware that cash-equivalents such as gift cards could raise flags at their workplace and will almost certainly fall below the actual worth of their time. Consider sending chocolates, thank you cards, or even asking directly if there’s something you can provide, such as a back-link to the customer’s services or testimonial.

- Interviews don’t have to be passive. Make sure to cover the core script, but also don’t be afraid to address pain points in the moment to help your customer use your services well.

- Follow up with another phone call to convert a sale, or let a user know a problem they mentioned has been fixed.

As you discover things about your users, don’t be afraid to incorporate new ideas into subsequent interviews!

Step 3: Compile the data

Hurray, you’ve completed the interviews! Now what?

First off, you’ll want to transcribe the information with a service like de-script or outsourced help from Upwork.

Then, you need a good system for categorizing the answers.

Remember, the purpose of compiling this data is to help you understand why ICPs are choosing your product to determine where you can find high-value prospects like them.

If you’ve included churned customers, closed losts, and unconverted trials, it will also spotlight areas for development if you so choose.

In each transcript, highlight important points and make sure any quotes and references are linked back to this source document for context.

Keep track of key points from each interview in a spreadsheet and list them against metrics such as company location, role of the person interviewed, revenue, etc. This will be helpful later on when trying to find common issues or desires from customers of a certain region or industry.

Make a separate document listing real pain points to send to your developers for fixing, as well as the sales team to include, for example, in “come back” emails to churned customers.

Finally, create a rubric of answers where you can easily cross-reference how many times a similar answer was given and the type of customer who voiced it.

You’ll want to break that down further by subcategories, such as [your product] vs. competitors, friction points, triggers to buy, etc.

And that’s it! This process will show you exactly who your ICPs are, how they are using your product, and where you can reach them.

Step 4: Action the insights you gained in marketing and R&D

So now you know who your ICPs are, time to put the insights you’ve gained to work.

Marketing

This data should tell you which platforms your ICPs use, their key demographics, and what features they care most about. From there, you can build an effective marketing strategy that directs sales towards potential customers who not only will use your services, but use them in a way that benefits your business the most.

It will also give you an idea of whether your price points are where they should be, if there is room to raise subscription fees, or if you should consider creating a lower-level service tier.

With permission, you might even pull out quotes to create some customer testimonials on your website and for ad copy.

Development

The interviews will no doubt have highlighted some common areas of friction. Some might be easy fixes while others require complete overhauls. Something to bear in mind is that, even if an issue is raised multiple times, fixing it might not actually directly result in growth. In other words, weigh up development costs against lost revenue and potential growth when making major development decisions—as a founder, ultimately, it’s your call.