Table of Contents

First, what’s an annual budget?

An annual budget projects a business’ income & expenses, assets & liabilities, and cash position over a 12-month period. Annual budgets may also be referred to as an operating plan, annual operating plan or financial operating plan depending on the company.

Monitoring the variance between your annual operating plan and actual business performance is crucial for long-term planning and success.

The old way of creating annual budgets

You might know the saying, ‘To a man with a hammer, everything looks like a nail’.

On a similar note, when it comes to every business decision that involves number crunching, chances are they would be performed in a spreadsheet.

Finance teams have been overusing spreadsheets to the point where almost all of their activities (planning, budgeting and forecasting) is done with spreadsheets. Here are some of key challenges this over-dependence creates:

- Difficulty when collaborating: Planning, budgeting, and forecasting require input from almost every department in an organization. With this need for collaboration comes security concerns and challenges with managing multiple-user access.

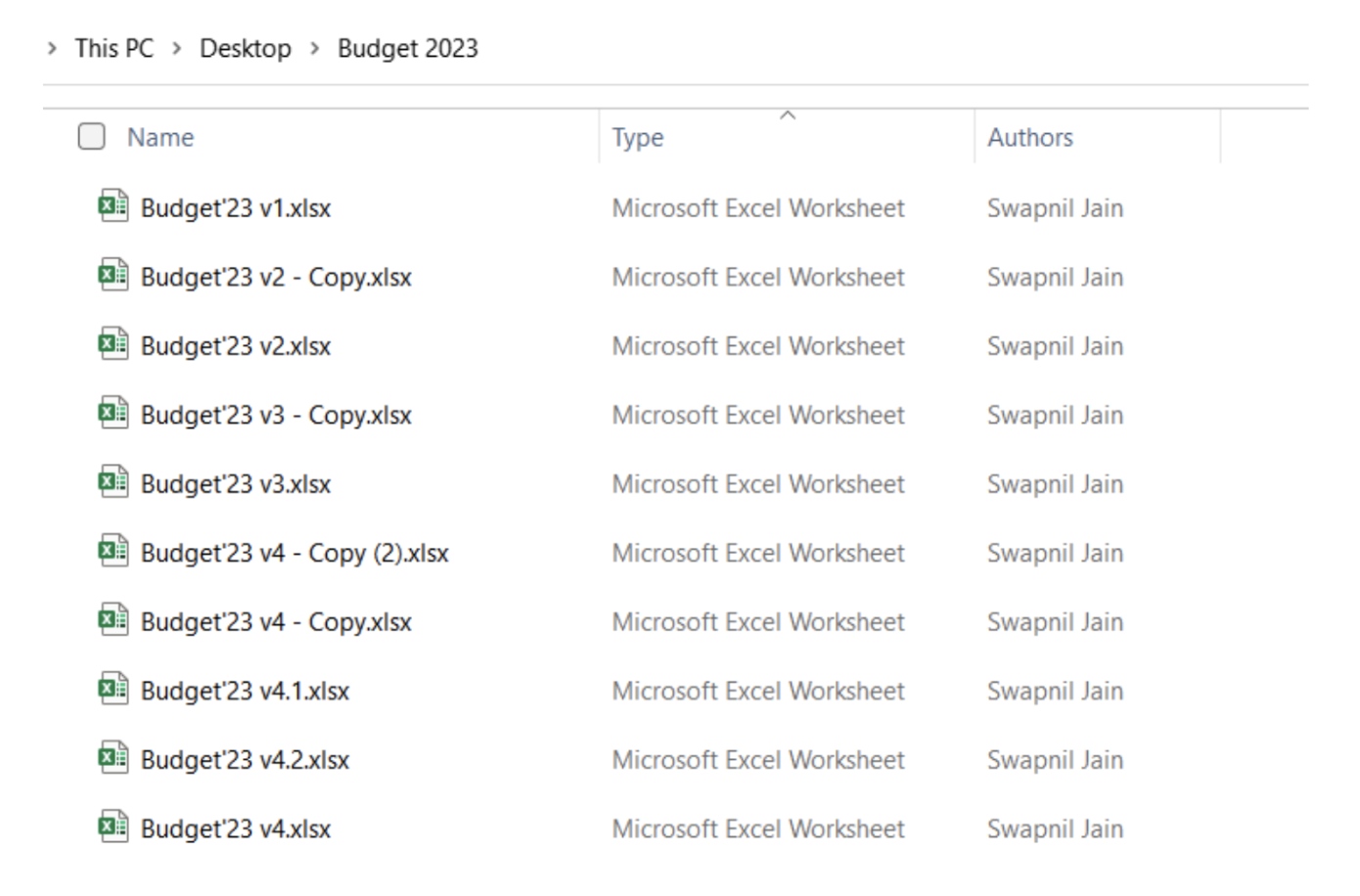

- Version control: With multiple versions of a budget in circulation, it can be difficult to ensure everyone is working off of the most relevant version (see below– look familiar? 😅 )

- Broken links and other errors: Human errors like incorrect data entry, or an incorrect formula are all possible in spreadsheets. One simple mistake like accidentally deleting a row or erasing a cell can ruin an entire spreadsheet (we’ve all been there). And with no audit trail, it becomes difficult to reconcile to the last working version with spreadsheets.

- Data integration: Integrating data from other sources is difficult, time consuming and manual. For example, bringing in actuals from QuickBooks/Xero and comparing against budget is all done manually in spreadsheets.

How to create an annual budget using Forecast+

Forecast+ was created with the aforementioned challenges in mind.

It enables teams to use historical SaaS metrics data to forecast growth more deeply and accurately in its revenue model, create custom metrics and formulas, answer complicated questions about things like headcount, runway and more– all while working in an user-friendly environment.

In other words, with Forecast+ users can:

- Get more done without having to hire more people to the finance team

- Forecast future revenue in a detailed way using historical SaaS metrics data

- Reduce errors by eliminating spreadsheets, and more!

Examples using Forecast+

Forecast+ simplifies the entire process of budgeting and forecasting. Hence, unlike traditional spreadsheets, budgeting and forecasting can be done using the same steps.

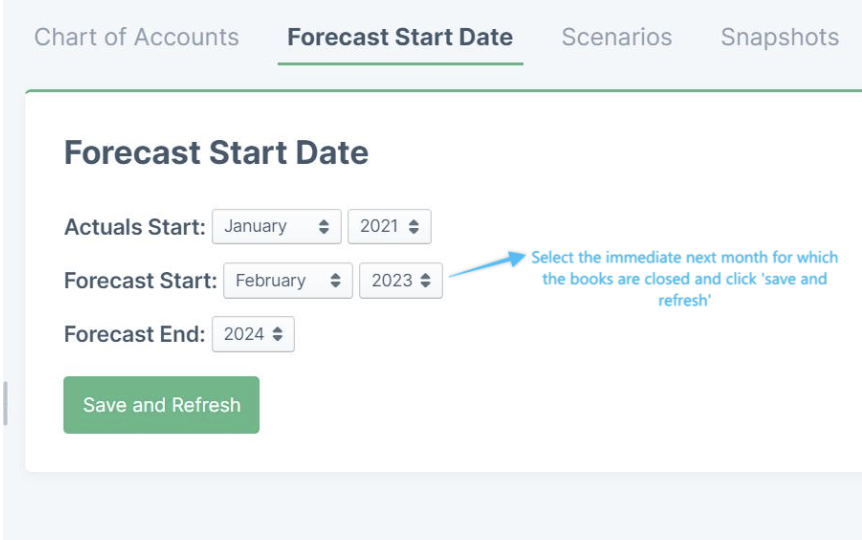

Ideally, a twelve months forecast starting January 2025 is the budget for 2025 (although there could be an exception, which can be managed using Forecast+ as well).

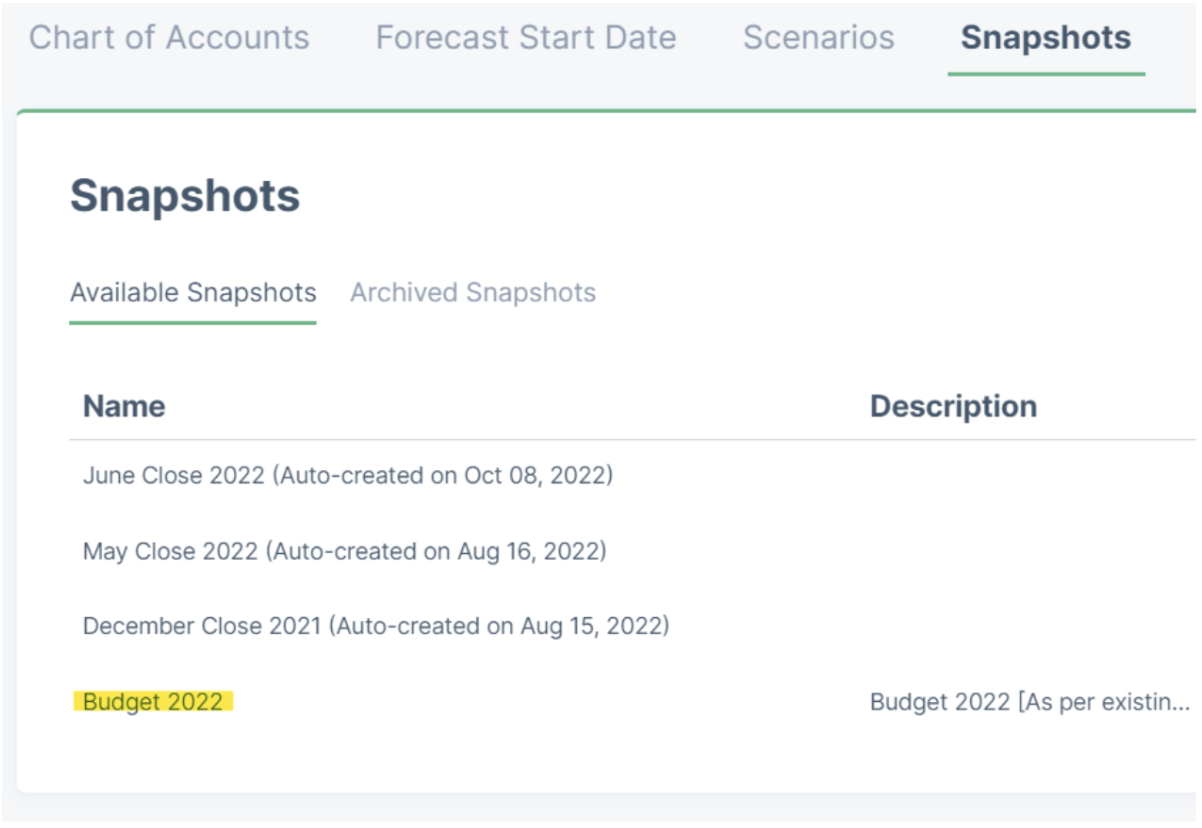

Once the budget is finalized and signed off by the CFO, CEO and the Board, it gets saved in Forecast+ as a snapshot.

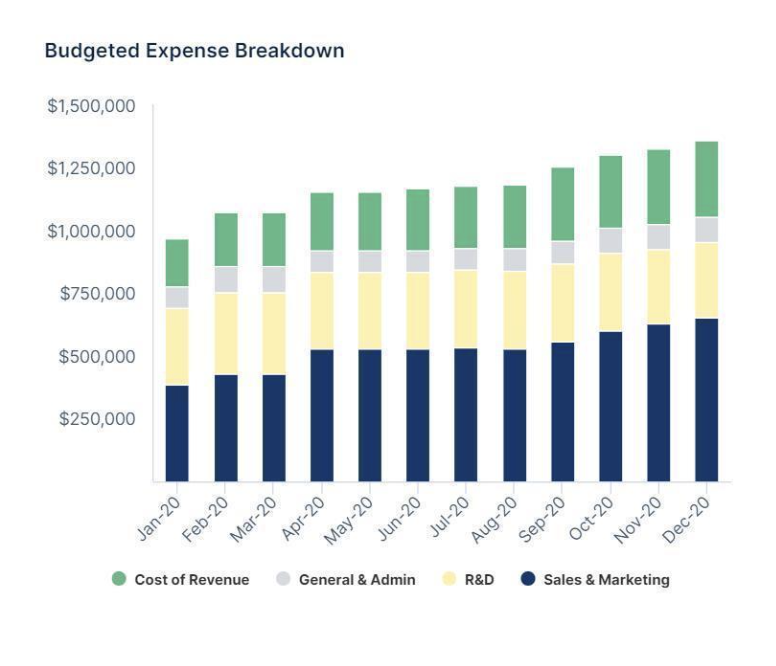

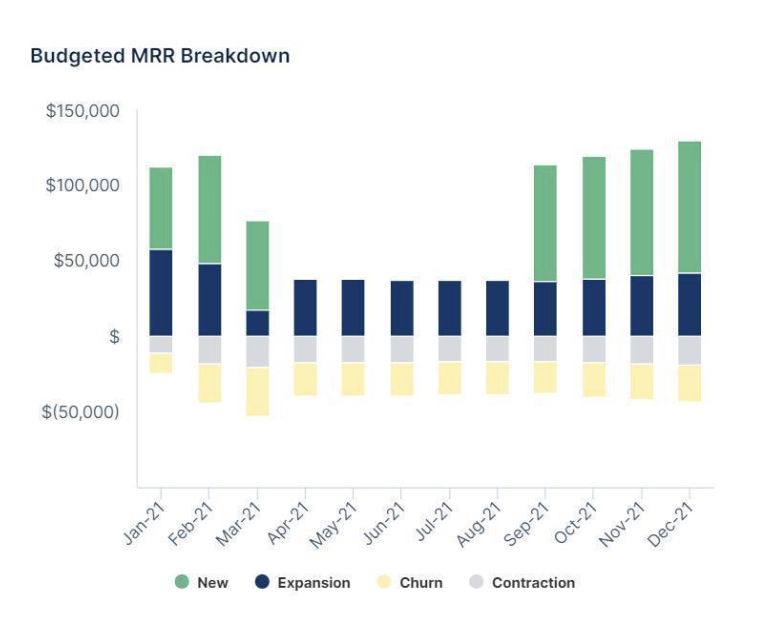

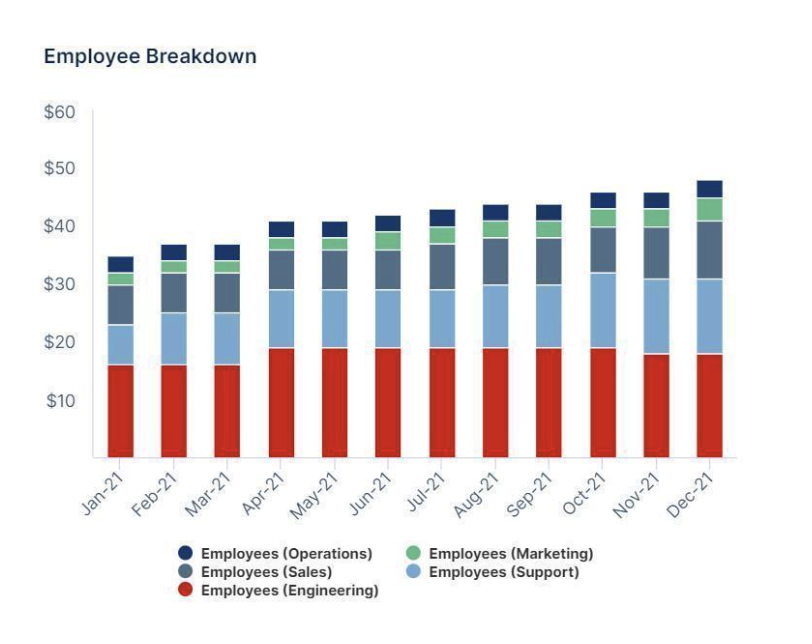

Dashboards summarizing your budgets using charts and tables can be created. You can present these dashboards to your board instead of creating time consuming PPTs.

Next steps:

-

Once the books are closed for each month, the Forecast+ team can update the actuals in the operating model for you, or it’s so simplified and automated that you can do it too with the click of a few buttons.

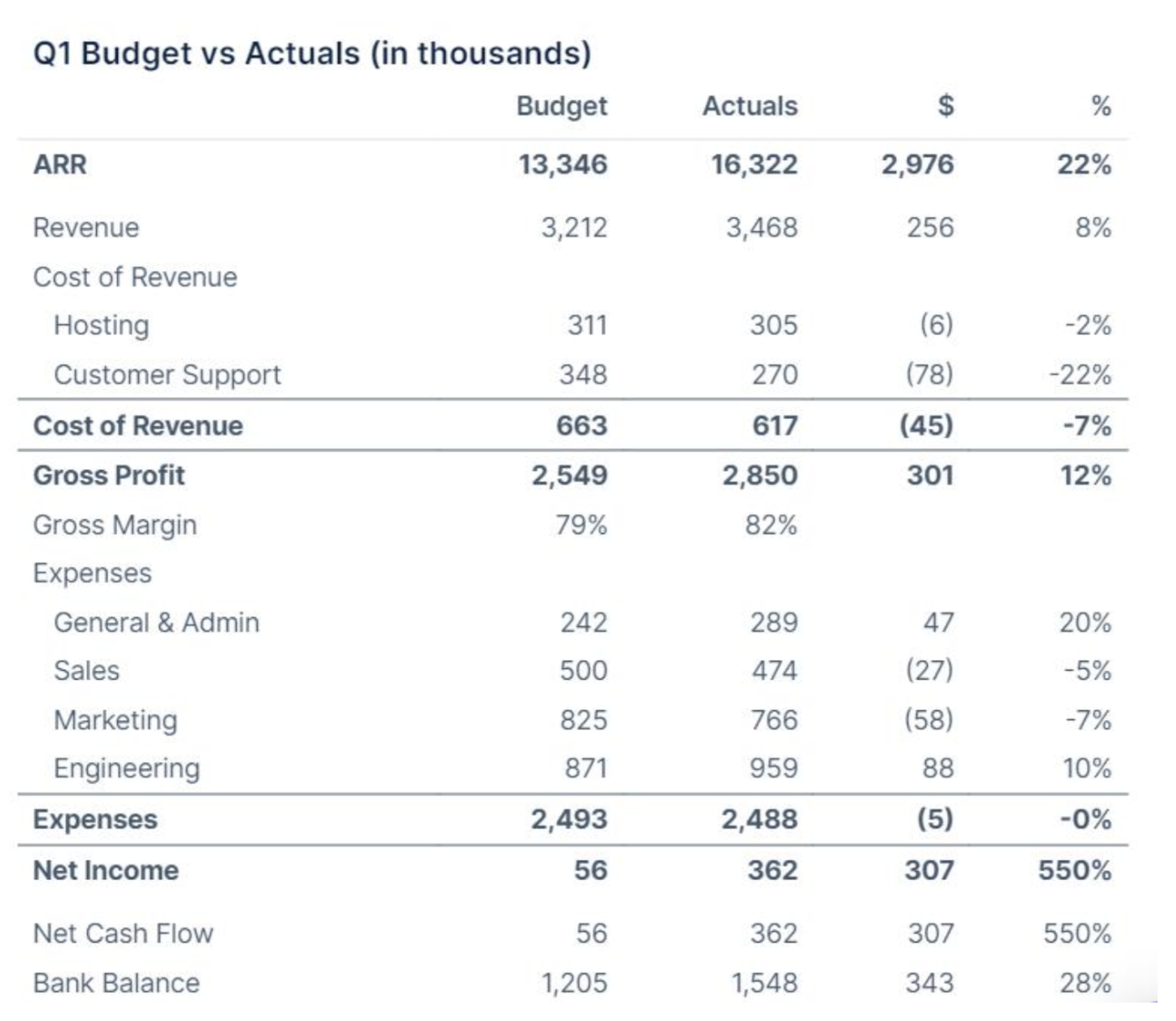

Once the actuals are updated, the dashboard gets auto refreshed to give you an actual vs budget comparison depending on the level of details and different parameters you’d like to see the variance analysis for.

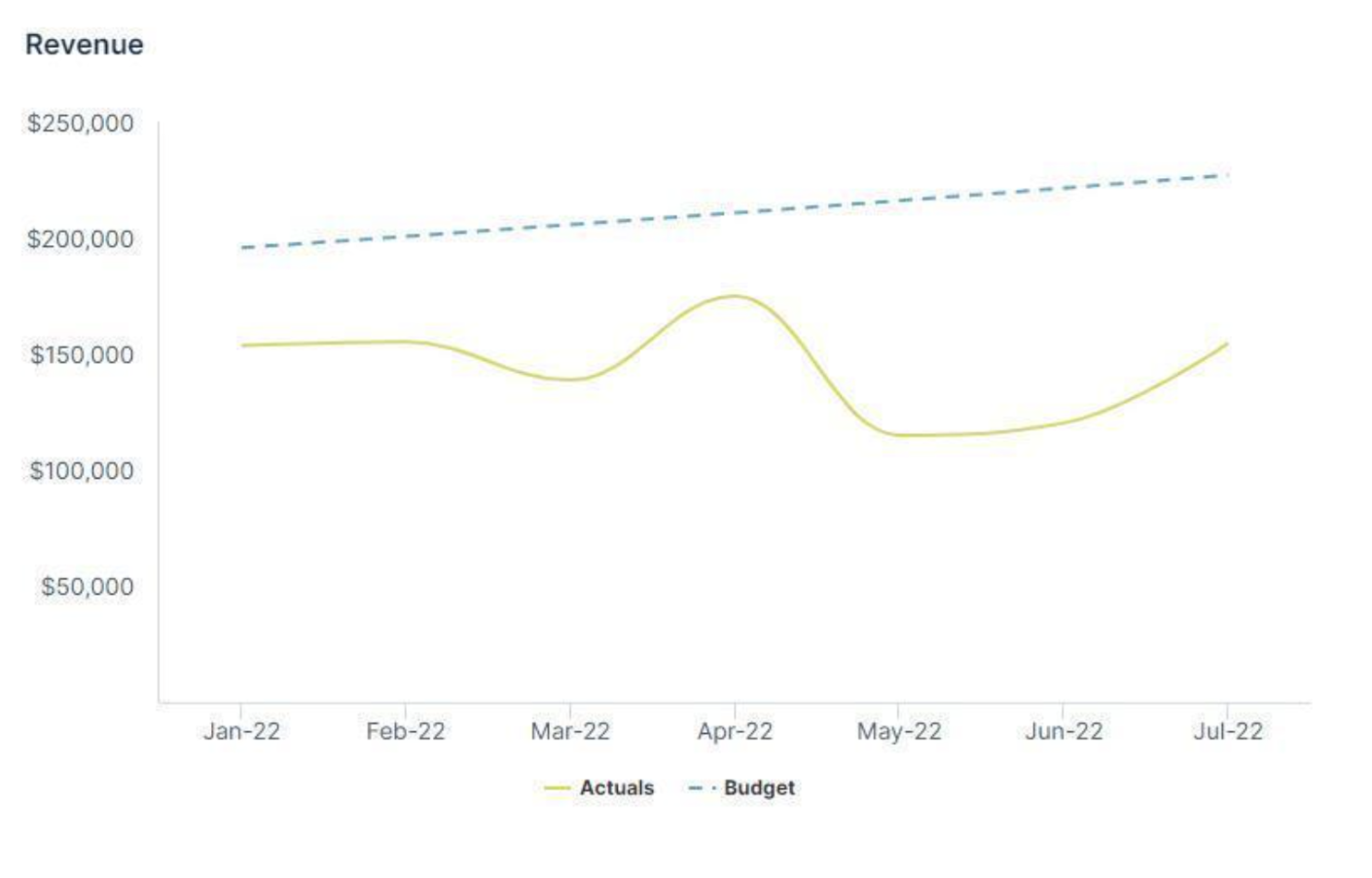

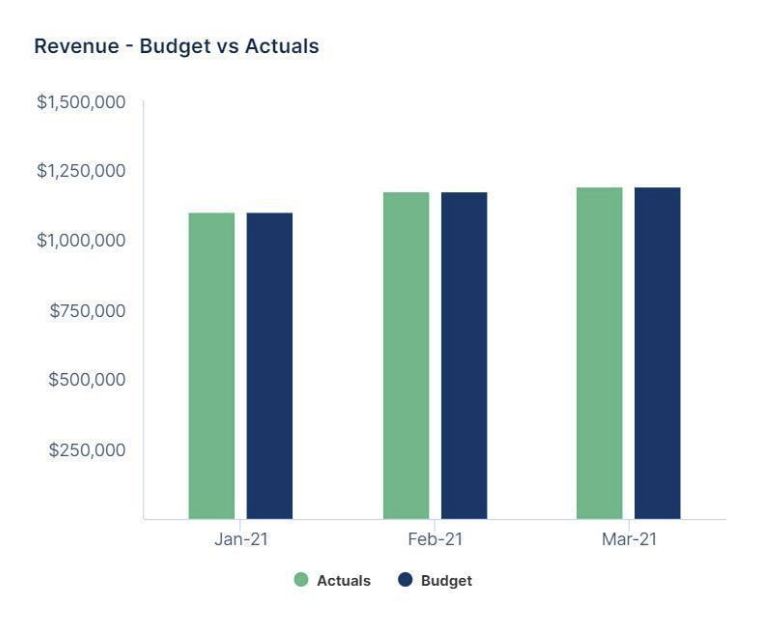

Again, all of this can be done by Forecast+ team for you, under your guidance. Here are some examples of reports pulled from an update budget vs. actuals.

1. Summarized P&L table- Budget vs. Actuals

2. Revenue- Budget vs. Actuals

For more on how to compare your budget vs. actual data, check out our article: Budget vs. Actual: How to Use Variance Analysis to Drive SaaS Success

How to build zero-based budgets and incremental budgets with Forecast+

While incremental budgeting builds on the current year’s budget or actuals by adjusting for expected increases/decreases in the revenue and expenses, zero-based budgeting prepares the budget for the next year from zero-base (i.e. from scratch) by analyzing the budget requests of each function.

While zero-based budgeting is time consuming, it does help in eliminating non-value added expenditures.

Using Forecast+, you can adopt any of the above approaches to build your budgets. You can also do a combination of both approaches in building your budget. For example, certain critical items can be budgeted using Incremental budgeting whereas noncritical items can be budgeted using zero-based budgeting.

As you choose an approach and start building your budget, keep in mind that budgeting is most effective when done collaboratively with leadership and lower-level employees.

The budgeting process typically starts with leadership figuring the following key drivers:

-

Scenarios to be defined

-

Equity/Debt raise assumptions

-

New product launches, geographical expansions, etc.

-

Top-down revenue, margins and net profit expectations

These drivers can then act as a guiding document for other departments to base their budget assumptions on. Here are some examples:

| Phase | Component | Inputs | |

|---|---|---|---|

| Phase 1 |

Revenue |

Consult the sales team with realistic revenue assessments for 2025Benefit: the sales team can help you set realistic expectations for sales revenueHere are some ways to come up with the best estimate:1. Analyze the recent monthly growth rates achieved by the company and figure out the expected growth rate for 2025.2. Review industry guides and other expert publications that focus on your industry.3. Discuss the expected sales with your sales department |

|

|

Phase 2 |

Human Capital = Employees + Contract Staff |

Consult the HR team/Chief of Staff to create a realistic hiring plan for 2025

I. New hires planned across teams

2. Appraisal cycle and expected average appraisal

3. Bonus for last year’s performance

4. Any role that is planned to be made redundant

5. Changes in benefits |

|

|

Phase 3 |

Other Expenses (other than marketing, HR and IT) |

Variable Costs: Some costs relate directly to revenue. Typically, the gross margin of a business does not fluctuate substantially. Other expenses are fixed costs such as rent, insurance, equipment leases, and certain other services purchased.

These are simple to budget as mostly these are driven by contracts.

However, information like new lease, change in Insurance agency, new equipment lease etc will need to be baked into the model. |

|

|

Phase 4 |

Capex |

|

|

|

Phase 5 |

Marketing Spend |

Submit the sales assumptions to the marketing and business development teams for them to come up with a marketing plan along with required amounts |

|

|

Phase 6 |

IT Spend |

Involve the IT head to:

1. Determine fixed IT subscriptions to arrive at Fixed OpEx

2. Expected capex on acquiring new IT assets |

Pro-tip: Keep your team members in the loop!

It’s worth repeating: When creating a budget, always consult, take input from, and share updates with the different teams contributing to the budget.

This will ensure that the budgeted numbers are not only realistic, but more accurate, as well. Involving employees in the budgeting process creates a sense of ownership and motivation to achieve the set targets. This also helps with variance analysis in the future. If you build your budget without your team, you risk demoralizing them by coming up with numbers that are unrealistic and therefore unmotivating to achieve.

Conclusion

Budgeting doesn’t have to be a painful experience in Excel. With the right toolkit and input from your team, it can be efficient and even exciting.

Looking for a better way to build your 2025 budget but not using Forecast+ yet? Book your free consultation with our finance experts today.