Table of Contents

Stripe is one of the biggest names in the payment processor business. Adyen, a Dutch payment company dating back to 2006, also has its fair share of the market. Of course, these two solutions, while popular, don’t necessarily meet the needs of every business. Each one also has its own unique features that may make them more or less suitable for you.

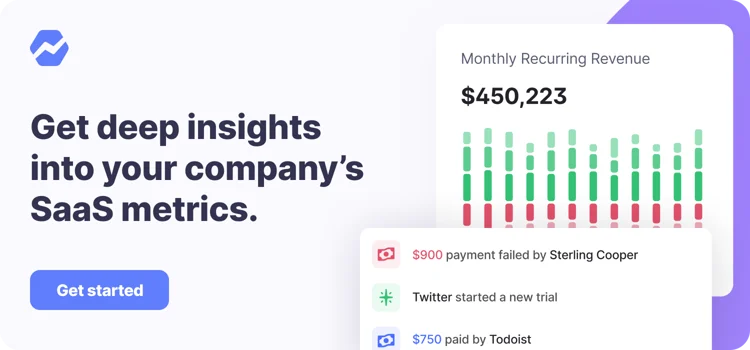

So, how do you choose? Here’s a side-by-side comparison so you can see how they stack up and a look at what Baremetrics does better. If you decide you need something more powerful, you can always try Baremetrics with a free trial.

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.

Quick look

Before we dig into the specifics of what both these service providers offer, let’s take a quick look at each brand and its core focus.

Stripe: A Third-Party Payment Processor

With industry-leading tools that developers love, it didn’t take long for Stripe to make a name for itself. Interestingly, Stripe has also taken the approach of being an all-in-one eCommerce solution, which means they have a lot of features for marketplace and subscription payments.

As a third-party processor, the platform does come with some account security concerns, but the hurdles associated with setting up a third-party processor are few and far between.

Adyen: A Dedicated Merchant Account Provider

Like Stripe, Adyen also strives to be an all-in-solution. Unlike Stripe, Adyen isn’t a third-party payment processor, but rather a merchant account provider. This means you’ll face extra sign-up steps in order to start using the platform because they’re actually giving you a dedicated merchant account. Compare this to Stripe, which is a service that will accept payments on your behalf and then transfer them into your accounts elsewhere.

Adyen allows you to accept all types of debit and credit cards along with ACH, electronic payments, Google Pay, Apple Pay, local payments, and international payments and there’s no transferring to your own accounts — the money goes directly into your Adyen merchant account where you can access and manage it.

Features

Comparing the features of these services side-by-side is important in making your decision.

Stripe Features

- Get started quickly with a simple sign-up process.

- Easily connect to other business services.

- Developers favor Stripe for its usability and APIs.

- Three types of 24/7 support and a user forum.

- Service that goes beyond payments, with multiple integrations.

- Limited reporting.

Adyen Features

- Interchange-plus pricing model can save money.

- A core focus on processing payments.

- Secure and fast payment processing with omnichannel options.

- Better for a seamless, reliable payment system across platforms.

- Risk management and optimization tools.

Pricing

When you’re dealing with money, knowing exactly what fees you’re responsible for is extremely important. Fortunately, unlike a lot of merchant account providers, Adyen is very transparent — and so is Stripe.

Adyen Fees

- Payment processing fees vary

- No setup, integration, or closure fees

- No on-going monthly fees

- Minimum invoice of $120/month

The only Adyen fees you have to pay are transaction fees. Adyen charges both a processing fee and a payment method fee for each transaction. That means the fee you pay is a combination of the interchange fee, which is the fee the card network and issuer charge, along with the markup Adyen itself charges.

Interchange-plus fee structures are considered to be the most affordable, but they’re also very complex. Your fees will change depending on the network, card, location, and other factors. Still, you can see Adyen’s thorough breakdown of all fees on their website to better understand what you may end up paying.

Stripe Fees

- 2.9% and $0.30 per debit and credit card transactions (add 1% for international cards)

- 2.9% and $0.30 for most local payments

- 2.7% and $0.05 per transaction for in-person payments (add 1% for international cards)

- 0.8% for ACH direct debit, credit, and wire transfers (maximum fee of $5)

- 0% for your first $1 million in recurring revenue, then 0.5% for recurring charges

- Optional card reader costs $59 or $299 from Stripe

Transaction fees make up the bulk of the expenses when it comes to using Stripe. However, unlike Adyen, Stripe uses a flat-rate pricing model. This means you’ll pay the same rate no matter the type of transaction, which simplifies calculations but could always end up costing you a bit more in the end.

Which Solution is Right for Your Business?

Stripe and Adyen both deserve your consideration if you’re looking for a payment processor to handle your transactions. However, the analytics and dunning of these platforms simply don’t cut it for many growing startups.

Why Baremetrics?

Baremetrics acknowledges the popularity of both Stripe and Adyen, and we respect the hard work they put into offering reliable payment services. However, companies seeking higher accuracy and more depth often turn to us when they outgrow these starter services.

Interested in learning more about Baremetrics and what we can do for your business? Schedule a free trial today to see for yourself.

be honest

How well do you know your business?

Get deep insights into MRR, churn, LTV and more to grow your business