Table of Contents

In April of 2022 we raised Baremetrics’ pricing.

This was the first time we increased our prices since launching in 2013. We didn’t make a small correction—we increased our prices by 250%.

We charge customers based on their MRR tier. When their MRR goes up, so does their price. This model works well for us since:

- If we can help a customer grow, we make more money,

- The more money a customer makes, the easier it is for them to cut a larger check (eg. it’s pretty difficult to charge a $5k MRR company $6k per month), and

- We have a huge incentive to prevent our customers from going out of business.

I love this alignment since it forces us to focus on the same things that our customers care the most about, which is primarily growing the most when things are good, and staying afloat when the environment is challenging.

However, even with this sliding scale we realized that the base price didn’t reflect our value. I know from working with SaaS businesses that if you’re not testing your price, you’re under priced, and if you aren’t updating prices regularly, you’re under priced.

With that said,at this large percent increase we put ourselves on par with our competitors, matching the value we’re already providing and allowing us to double down on all the focus areas that matter to us and to our customers.

For example, we’ve built up our team to dramatically reduce the amount of time it takes to get an answer, including going “negative” by proactively reaching out to customers when we find growth opportunities for them. We’ve more than doubled our development team to deliver product improvements more quickly.

And this wasn’t clear at the time of the price increase, but with the changes to economic landscape it’s become clear that many of our customers need to shift from growth mode into cash generation mode—we’ve built a team and acquired a product to help companies manage their cash runway, forecasting expenses and revenue, and proactively thinking through multiple area.

As customer acquisition becomes more difficult, inflation rises, and due diligence requirements become more stringent, it’s clear that a huge part of our role moving forward is to make sure our customers have cash in the bank and a plan for both growth and profitability.

Our price increase ensured that we had the team and tech in place ready to go to support our customers the moment the market changed.

While many customers were (understandably) frustrated with the increase, one question came up more than any other in private conversations: “How do I do that for my business?”

Here’s how we executed the price increase, how it affected our business, and why it was all worth it.

What we did

Phase 1: Experimentation

Phase 2: Notifying customers

Phase 3: Customer conversations and negotiations

Phase 1: Experimentation

Setting up our pricing experiments

Every situation is different (which is why I’m always happy to take a call to apply lessons directly to your business,) but for us one major factor was that we had not raised prices in about 8 years.

This put us in the spot where we really needed to start with “price discovery”—we had to completely separate ourselves from the current pricing, both from our business model, and the resulting price points.

We considered switching our tier based pricing, and also changing the way we priced our add-on products (Recover, Cancellation Insights, and Forecast+)—but for the reasons outlined above we decided to keep the tiers, and in order to keep our experiment clean we decided to keep the same pricing relationship with our add on products.

For example, while Metrics and Recover are tier based, Cancellation Insights is not—we definitely asked “why not?” internally.

The deciding factor of keeping everything in the same proportion was the fact that we had so little data around the rough price point that we should land on that also modifying packaging would make it harder to determine if we’re in the right place.

We had two hints of where to start:

-

We could see our competitors pricing, and while you should never base your price solely off of a competitor, if your competitors are 200% to 300% above your price, that’s a clue that there’s room to increase.

-

Baremetrics had previous pricing experiments that we could review the data from. The tests were inconclusive, but again since we’re operating from nothing, any hints are helpful.

To get started we needed to understand the rough multiple of where we were playing. In order to do this we did many A/B/C tests on landing pages and our marketing site. In order to understand where we should focus, we started with three variants, our current price, 25% more, and 50% more.

As we tracked click throughs and purchase intent, I was shocked to see that 50% more won. So, we re-ran the experiment, 50%, 100%, 150%.

Again… the largest price won.

So again, 150%, 250%, 300%.

The same result, at a period we were testing a 3.5X price increase through the funnel. I ultimately decided on the 2.5X increase for two reasons. First, we had the most complete and conclusive data at that price point, and secondly (and most real) I was scared as the test results kept coming in at larger and larger increases.

While letting fear make decisions internally is a bad idea, now with the Consumer Price Index increasing at nearly twice the rate as when we were price testing, I’m definitely glad we didn’t max out in a single move—everyone is hurting more now than they were when we ran our tests.

This also brings up the point that this was not a fast process. We spent over a year from start to finish, and just the pricing experiments took over 8 months to get through.

Now with lessons learned we could move much more quickly, but this is also a great reason why pricing should be considered on a regular basis—if you wait 8 years to increase your prices, you’re probably going to need at least a year to discover the right price moving forward.

Phase 2: Notifying customers

After letting new prices run in production for several months it was time for the “easy” part—letting existing customers know that prices would be going up.

Increasing prices for existing customers is a touchy subject. I’ve spoken to a number of our customers who feel this way when doing a price increase, and some of them have convinced me that not increasing prices on existing customers is the right thing for them.

Generally, it comes down to balancing chaos and upside. For us, given how long we’d gone without an increase and our goals, increasing everyone’s price was worth the chaos.

One customer in particular stands out to me, he said “What’s most important to me is maintaining stability.”

If anyone says that to me, increasing everyone’s price is definitely not the way to go—I was glad that they decided to test an increase for new customers while leaving their current base alone. (Although we are a customer and I’m pretty sure I saw a price increase come through later, so maybe I changed their mind 😅.)

We notified all existing customers of the price increase in March, one month before the increase took effect.

My expectation was that when we announced the increase the floodgates were going to open and we’d have thousands of emails, chats, and phone calls with confused, upset, or generally discontent customers.

However, what actually happened was that a very small percent of our customers reached out on our first email.

This group was definitely the most proactive of the bunch (clearly), and the conversations we had were pretty organized. They saw the change was coming, they wanted to understand exactly what it meant for them, and then they wanted to see what options they had.

Some of these customers decided to leave, but very few of them—since they had the chance to talk to us before anything “happened” we were able to put a plan that worked for them in place.

Phase 3: Price increase goes into effect

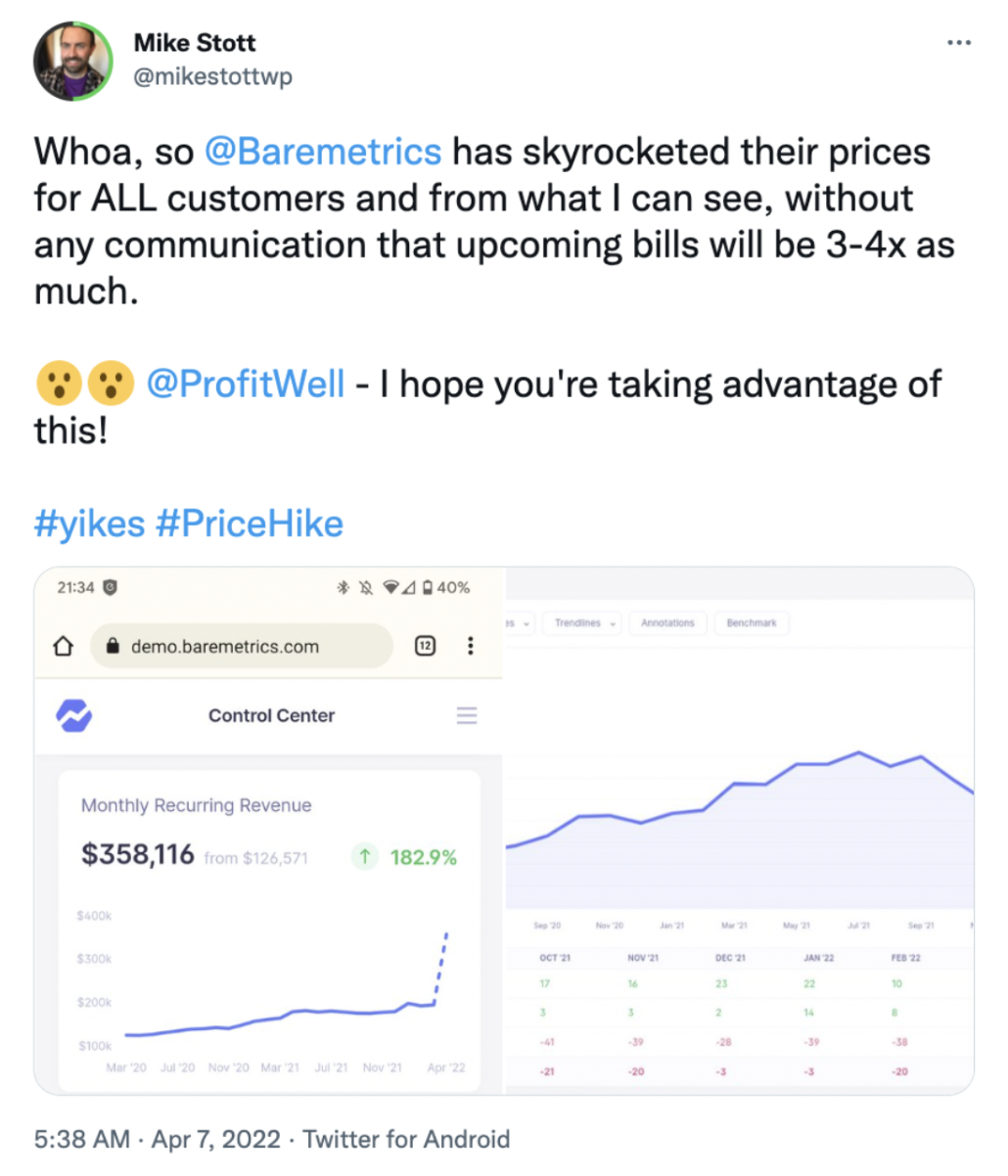

The increase took effect in early April. This time, the “second wave” response was immediate:

The majority of angry responses came from folks who believed they hadn’t been notified at all. In all of these cases, they were sent the email, but either missed it or didn’t read it.

Through both the email announcement and our support team fielding messages from customers, we invited customers to schedule time with me personally if they wanted to discuss the price increase.

Over a span of three months, I had about 100 calls with customers. The sentiment of these calls can be broken down into the following categories:

-

People who wanted to yell at me (totally understandable)

-

People who wanted to work out a deal right away

-

People who wanted to better understand what was happening and how it would impact their pricing

-

People who were close to churning anyway and needed to be resold on Baremetrics for reasons including but not limited to the price increase

I expected these calls to be mostly of the first category, but reality is that most of these calls were super productive, and if not “good natured” then at least “professional.”

One thing that caught me off guard was that we ask for customer feedback all the time… but there’s something special about getting customer feedback through a price increase. It really cuts through all the fluff, it’s not like when you ask for feedback and people say “everything is great!” or “well, this one small change might make the product slightly better for us.”

Quite the opposite, we were showing up with a materially higher price, so people cut right to the core of what the product did for them. Customers shared where we excelled, where we were lacking, and what deal breakers existed.

The conversation would go something like: “We love Baremetrics and use it every day. It’s crucial for us to slice and dice our data to really understand if experiments are working or not. However, at this higher price we really need to get more out of the product. We would hate to spend the time and money moving these dashboards internally, but if you can’t help me understand how you’re adding to our growth we’ll need to evaluate that option.

Or, another very popular conversation would start “Your team has been great to us, but this is way too expensive for a dashboard.”

These conversations were great because it gave us a chance to have a deeper conversation—generally I’d say “I agree! If we were just a dashboard I wouldn’t pay that much for it either. If you’re willing I can show you a few ways that our customers who are OK with the new price use Baremetrics to make us worth the money… if you still don’t agree then we can help migrate you to another solution.”

Putting aside the specific way we had these conversations, I want to reiterate that these customers felt this way about our product before the price increase. Anyone who was thinking we were “just a dashboard” felt that way before we emailed them, they were (happily) using about 5% of the product and leaving the majority of the value we provide on the table.

Clearly, increasing prices can’t be the only way you have this conversation, but if you want to have all of these conversations, all at once, this is a great way to do it.

And these conversations had all sorts of interesting twists, for example through the call I was invited to speak on the Bootstrapped.fm podcast with Ed Freyfogle.

I appreciated talking with Ed about some of the early feedback we got from customers about the price increase, as well as things not related to the price increase like my transition from founder to non-founder CEO and the unique challenges of taking over somebody else’s business. You can listen to the episode here, or click below.

The results

The good: Revenue gained

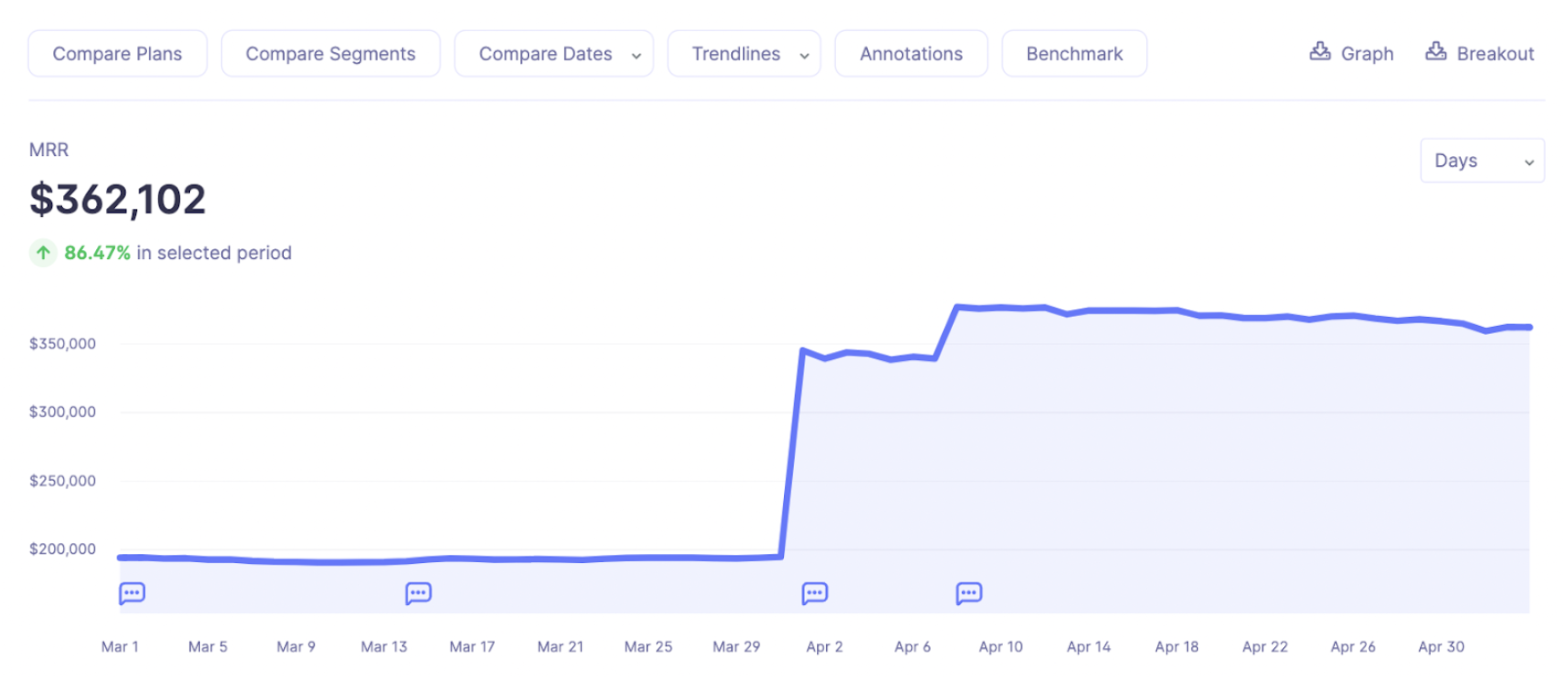

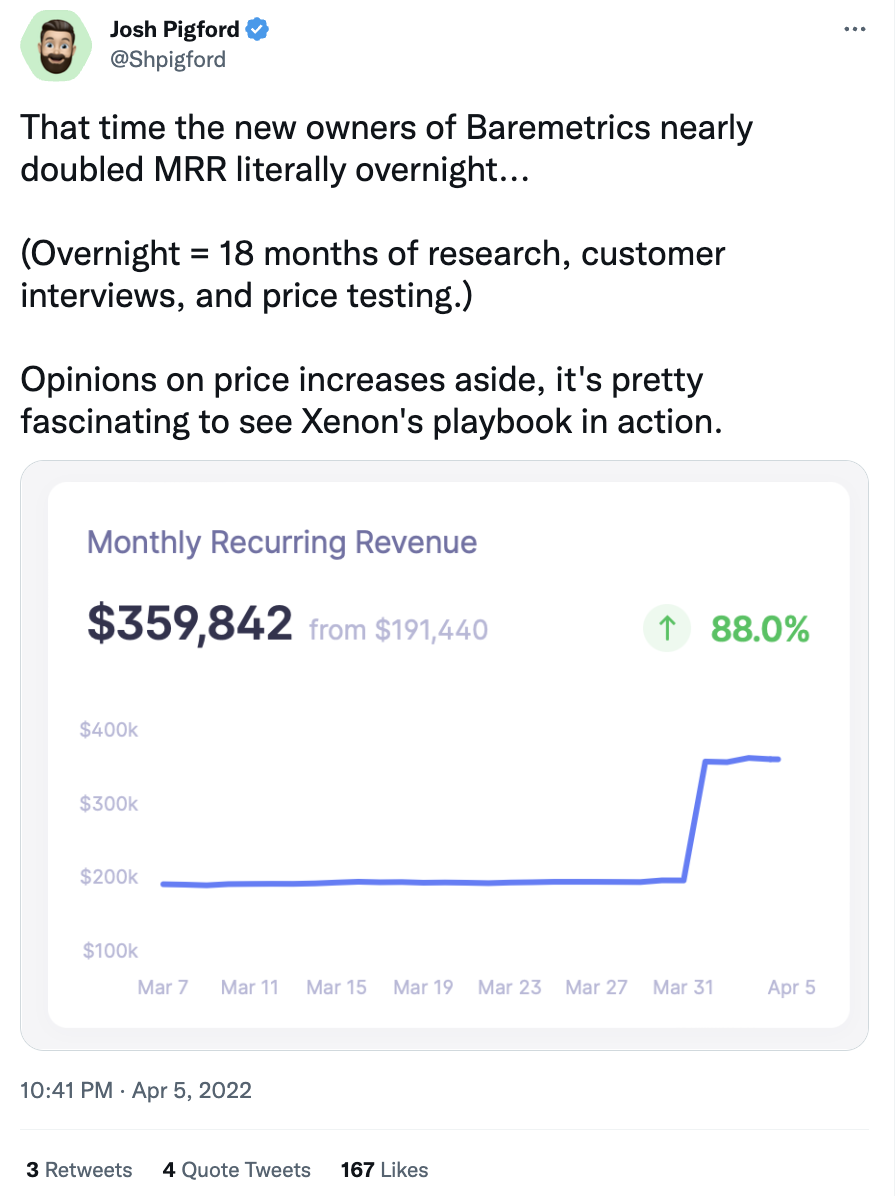

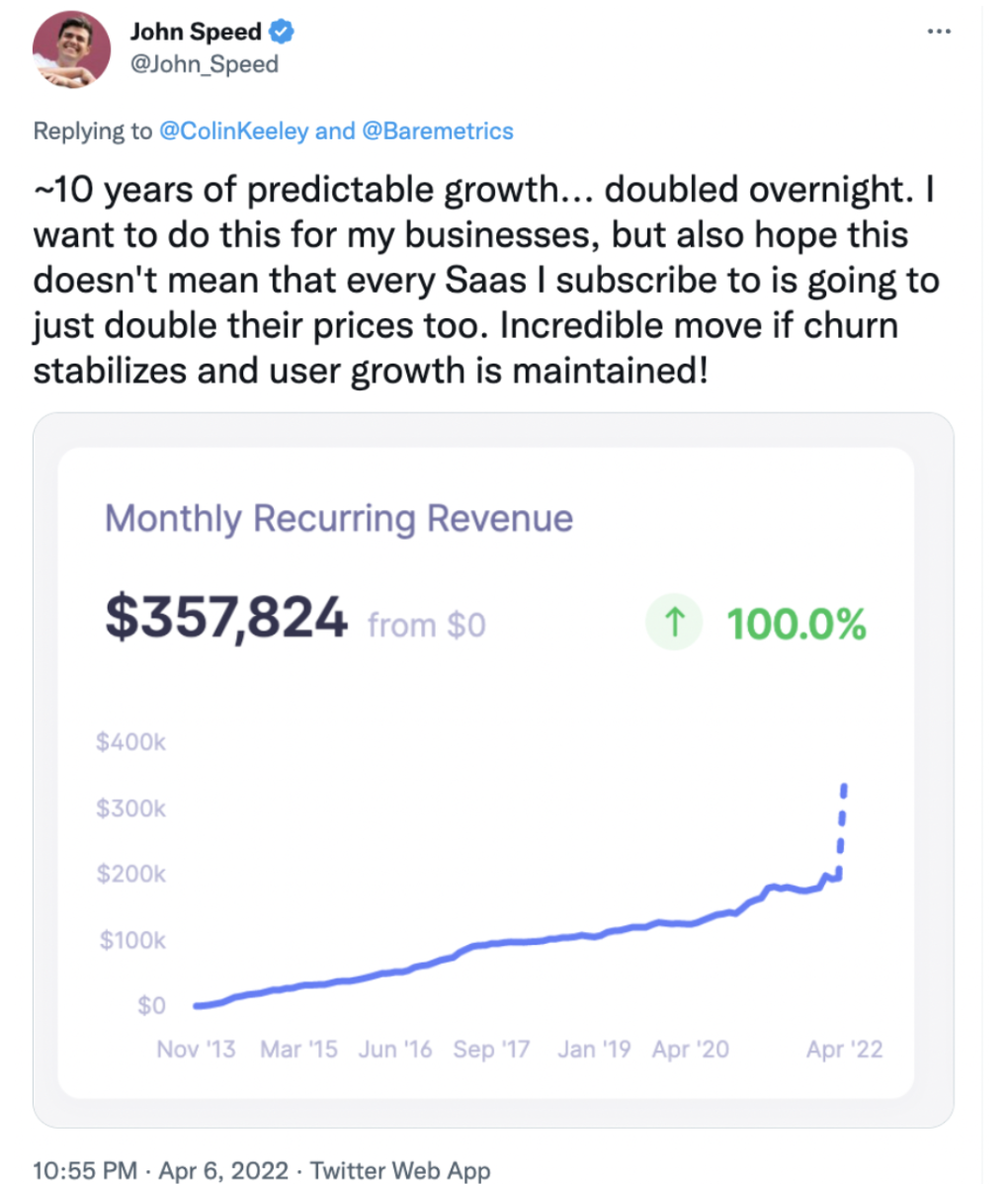

Practically overnight, our MRR increased by over 86%. While this was exciting to see, we knew that this number represented the maximum possible outcome—we had a lot of hard conversations ahead of us and we knew that not everyone was going to be willing to pay the new price.

Still, as we were on the verge of crossing $200k MRR, it was great to see the first digit of our MRR at “3”, and it felt right.

Baremetrics MRR (March 1, 2022- May 1, 2022)

The bad: Churn increased

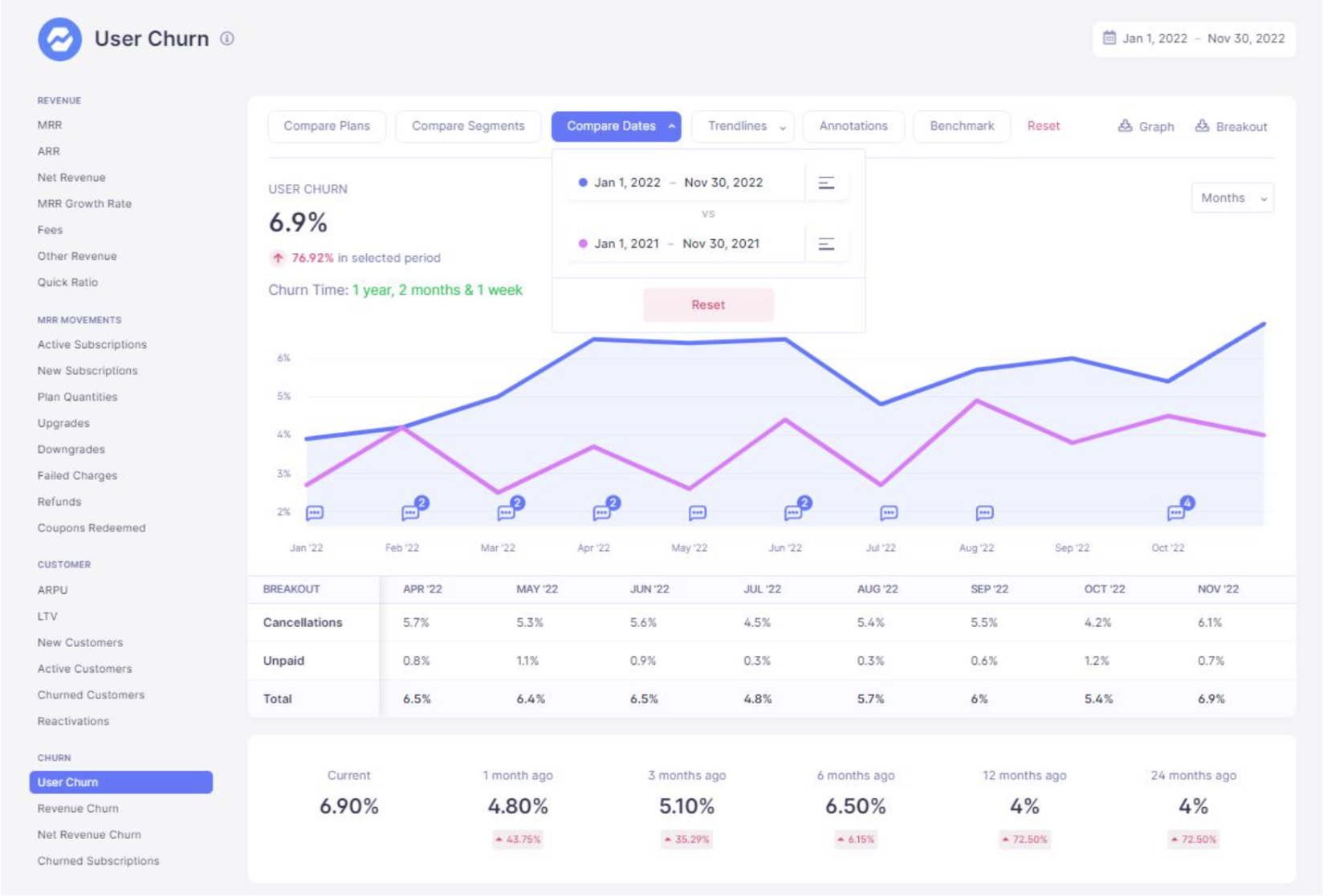

Since implementing the 2.5X pricing 7 months ago, our user churn rate has fluctuated between 4 and 6.9%.

Baremetrics’ user churn rate YoY

Obviously, you get your normal churn during this period, but increasing prices also creates churn all of its own.

In the spirit of naming terrible things somewhat innocuously, I’ve been referring to this as the “price increase double whammy.” The price increase creates excess churn above baseline, and customers are now churning out at a higher level.

During the first quarter we looked at user churn instead of revenue churn to level out the second effect, but the impact is persistent and should be expected. For example, a business who has a baseline monthly churn of $10k who increases their price by 100% should expect at least $20k churn per month.

This is clear, but you’d be surprised how many people don’t account for this higher baseline of churn in their forecasts. Churn mitigation is always a top priority for SaaS businesses, but, doubling or tripling the value of each customer puts increased importance in making sure each and every one of your customers is satisfied.

Moving into Q4 of this year we got to experience the rare “price increase triple whammy” — as the economy has turned for the worse we would have experienced heightened churn even without a price increase.

We’re seeing companies getting incredibly lean and preparing for “SaaS winter.” We’re seeing funding rounds slow (or stop all together). We even heard from one of our serial entrepreneur customers that their most recent seed round had more due diligence than the series B of their previous company.

The bright side for us is that we can solve these problems for our customers, but again this is a matter of having that value conversation—if a customer makes up their mind that it’s time to leave, then it’s tough to do anything in the moment.

The bad: Impact on our team

I was expecting frustration from our customers, but I simply didn’t anticipate the amount of stress and distraction that the price increase was going to create for everybody on our team.

It’s obvious in retrospect (as all things are) that this was going to be a huge investment of time, but it’s slightly different from the perspective that everyone is dealing with what feel like “high stress, high importance” conversations on a regular basis.

Every team at Baremetrics is organized around how they can make our customers successful, so this phase has been quite a shake up—historically it’s always been us and our customers against a problem, but in these conversations now we’re on opposite sides of the table. That’s a tough transition for the team to make.

It’s also become a persistent conversation, earlier I said that I had anticipated most of the conversations to happen after sending out our price increase email, when in fact the bulk of the conversations happened 2-3 months after pricing had been increased.

My only saving grace here is that the entire company was involved and engaged in the price testing, we all understood why it was important to do, and it was clear how we were going to deploy additional money to triple down on our objectives as a team. Without an understanding of the mission I suspect this process would have been much more soul crushing.

Also, everyone did a great job of working together and staying mission driven. No one felt like it was solely their responsibility to “make it work”. Everyone was empowered to approach these customer conversations the same way we always do— what can we do to help our customers?

Things we could have done differently

Every time you make a big move you learn something new, even if you’ve done it a hundred times before. The number one thing I learned from this process was that being crystal clear and transparent in what we’re doing and why we’re doing is paramount.

The most common (and painful) feedback after speaking to hundreds of customers summarized to “it’s not what you did, it’s how you did it.”

Here’s what I’d do differently if I had it to do over again:

-

Lead with transparency. In hindsight, the email we sent about the price increase was too long (it took about 5 minutes to read). It became this length because we went into detail about the several reasons why we were increasing prices mentioned above.

I thought that by sharing the whole story I was maximizing transparency, and that was perhaps true, but the fact of the matter is that the email grew to a length that very few people were going to read through the entire message. Even the customers who weren’t necessarily upset about the price increase were bothered by how long the email was. The other problem which is clear looking back is that in an effort to explain the testing and decision making process, along with all the other relevant details of the business, it became very “us” focused. I can see how I made this mistake in retrospect: our customers are all in the same industry, with similar problems to solve. However, I needed to keep in mind that this was not a board update, it was an email sharing news that our customers probably didn’t want to get, and instead of making us the main character, it needed to be about our customers, and what was happening as it was relevant to them.If I had another shot I’d share (quickly summarized) key reasons for the price increase, including the direct impact to the customer right away. After that, the novel with the entire story can commence, but like any great marketing email the content needs to be skimmable with the customer getting at least 90% of the intent.

-

Send multiple emails across a larger time period, timed in advance of our customers’ next payment. I suspect this came about from our long testing period—we had been in pricing mode for over a year, so it didn’t really feel strange at the time for us to announce the increase in March, effective in April. I mentioned before that the conversations we had with customers between the announcement and the price change going into effect went really well—this lets the conversation happen in advance of anything changing, which makes the conversation feel different. If you’re discussing something that’s already happened the customer can feel like there’s not much for them to do, making it way easier for them to throw their hands up and walk away.The easiest way to maximize this opportunity is to maximize the length of time between announcement and implementation. Netflix did this back in the day, giving over a year notice for an upcoming price increase. This makes a ton of sense with our experience, that’s plenty of time to have conversations with all your customers to make sure that works, and if not, you have the time to resolve issues before the price increase takes place.This is also true for customers paying annually—any pain a monthly customer feels with the increase is 10x higher for an annual customer. We send automated notifications seven days before renewal, but again this is a situation where seven days isn’t enough time for us to resolve issues before the renewal takes place. We started reaching out to customers much further out, starting 90 days out from their renewal date, to get the conversation started. If they saw any issues with renewing at the new price we’ve got three months to resolve it. We actually really enjoy having these calls and will keep this follow up pattern going moving forward. It makes sense that the customers paying annually are more committed to your team, so investing more time in making sure they’re satisfied feels great.

Overall, it’s important to keep in mind that you’re not escaping churn or hard conversations, but having those tough conversations before the invoice is charged makes a huge difference.

-

Include the updated pricing in our communications. This was a huge ball dropped on our side. We didn’t include the updated pricing in our initial email with the rationale being that talking over a call was a more effective way to further explain what was going on, give options, hear feedback from the customer, and ultimately help them migrate from Baremetrics if we couldn’t figure out a way to move forward with the new pricing.

Since we have many products on different billing models we reasoned that doing a review would be more helpful in breaking down all the costs and making sense of the change. We were half-right here, not including the price definitely increased the number of calls we had (which is what we wanted,) but there were a good number of people starting the call frustrated with the information asymmetry. Logically even the people who didn’t have an opinion wouldn’t have minded knowing ahead of the call, so there’s not a lot of reason not to share details ahead of time.Either way, you will get the same two reactions: the first group of customers will not care and will be fine with paying the higher price. The second group of customers either need to think about it or are unwilling to pay more.Sharing the new price before or after the call does not affect the decision of the first group, but not sharing the new price with the second group will catch them off-guard, making their default reaction “Just cancel me.” So while this did increase calls, that might be the wrong metric to consider. At the risk of trying to sound like a business guru, you don’t want calls, you want conversations.

What we’re doing now

While the price increase created a busy many months, we’ve been fortunate to complete a lot of what we set out to do in the first place. As mentioned previously, the price increase was successful in letting us achieve our primary goal of reorganizing the entire company around our mission to help entrepreneurs succeed.

This includes doubling our engineering team to build more quickly, doubling our support and success teams to make it easier for our customers to find growth opportunities (or, to find them for you), and doubling our accounts team to lead onboarding for new customers and customers who haven’t gotten a tour of the product in a while. We’ve also doubled our marketing team since we realized that a big issue is that we make an improvement and then never tell anyone!

We also acquired a business and built a team around leveling up cash generation within a company—we’ve seen this as a huge gap in both our product and the market as a whole, but we’re now able to help our customers understand cash flow to both make sure you invest in the right areas, and, make sure your bank balance stays positive despite a challenging economy.

It’d be too much to say that we’re a completely different company. I’d say instead that before the price increase we always had to manage our expectations and balance the way we wanted to serve our customers with the reality of our operations. Now, anything that’s brought up internally that will help us meet our mission gets a green light. For all the negatives that a price increase brings, being 1000% in on our mission feels great.

You might have also noticed some other activities that we’ve done to improve our transparency:

-

We hosted our first-ever AMA with our customers, during which I talked about the state of Baremetrics before and after the acquisition, the price increase, our roadmap, and more. This was a ton of fun. We got some great questions (and some scary ones too,) it was great being in a forum and providing the level of transparency that people expect from us. Surprisingly, this was also a great way to share lessons learned too!

-

We ended our “call to cancel” policy to make the cancellation process more seamless for our customers (you can read more about this decision here)

-

Created new brand principles centered around our customers and their success

I hope this serves dually as a price increase roadmap and inspiration. I spoke a lot to the challenges, but, hopefully you’ve made it this far to get to the “we can become the company we’ve always wanted to be” part!

It’s important to reiterate that this has been our approach, the best path for your business is specific to the nature of your business and your goals. If you’re considering a price increase for your SaaS, let ’s talk. I’d be happy to dive in deeper about our journey and/or share feedback on what you’re thinking about. You can reach me at brian@baremetrics.com.