Table of Contents

Most SaaS businesses adopt a subscription-based model supported by a recurring payment system.

Setting up a recurring payment system can be complicated and requires the right tools to measure, manage, and review payments regularly.

What is Recurring Billing?

Recurring billing happens when a merchant automatically charges a customer for a service on a prearranged schedule. It requires the customer to sign up and provide their information and permission.

After that, the vendor makes recurring charges with no further permissions required. That typically continues throughout the customer lifecycle until the client terminates the subscription or a pre-agreed upon expiration date is reached.

Processing such payments can be complex. However, you can read more about choosing a payment processor on the Baremetrics blog and sign up for a Baremetrics demo to see what recurring revenue metrics and insights would look like in your company.

1. How Does Recurring Billing Work?

Generally, there are two methods of setting up recurring billing.

First, the company must set up a recurring billing merchant bank account to take deposits from credit or debit cards.

Yet, having a merchant bank account does not include the processing and actual delivery of payments from your customers.

Therefore, companies typically outsource the entire process to a payment service provider, such as Stripe. Stripe can process and deposit funds and meet the compliance requirements for security and recurring billing.

When using a payment service provider, such as Stripe, customers can choose their recurring payment option when they opt for a specific product or service tier on the SaaS website. The payment service provider will take care of everything from prompting the customers for credit card numbers, to sending payments between accounts. After accepting the terms and conditions and receiving authorization, customers just provide their payment information and agree to the amount they have to pay.

Recurring Payments are usually made daily, weekly, monthly, and yearly. Customers typically receive a receipt or notification when billing is processed, either via email or text message.

2. What Are The Types of Recurring Billing?

Recurring billing can be fixed or variable.

Fixed recurring billing charges a customer the same amount each time, like a Netflix subscription or gym membership.

When customers are charged using variable recurring billing, the payment amount depends on the cost of the services the customer uses during the payment period. The most common example of variable recurring billing is a cell phone or utility bill that varies depending on your usage for the month.

3. Who Is Recurring Billing For?

Recurring billing can be used by businesses that offer their services on a recurring basis, such as telecom companies with metered billing, newspaper subscriptions, or SaaS applications like Slack or Dropbox.

By using recurring billing, companies benefit from consistent cash flow, an ongoing relationship with their customers, and a lower barrier to entry.

That said, there are not only benefits for businesses, but for customers, too. With recurring billing, especially recurring billing facilitated by a payment provider, customers reduce the time and effort they spend on manual billing and are much less likely to miss a payment leading to a disruption in service.

Manually track new customers, upgrades, and lost customers

Get deep insights into MRR, churn, LTV and more to grow your business

4. Examples of Recurring Billing (And How to Measure Your Billing Metrics)

Most of us encounter recurring billing on a day-to-day basis. Some companies charge a flat rate, such as the eCommerce Saas platform Carthook.

Carthook charges $300 per month for access to all features. There are no fees for additional usage or seats.

Monday.com or Jira are good examples of standard recurring billing based on the number of seats. If more users are added, pricing goes up.

Companies like SaaS social media management platform Storrito sell usage plans based on the number of social media posts they help their users publish per month or year.

Few SaaS companies get billing right from the start. Churn, demand, growth, and changing customer expectations may see your billing strategy change over time.

This is why it is crucial to keep an eye on your subscription and revenue analytics. It’s also crucial to manage your accounts receivable through tools such as Recover.

Baremetrics provides subscription analytics for individual brands and companies that are running Subscription Billing through a payment provider service. This includes monitoring for Monthly Recurring Revenue, Annual Run Rate, subscriptions, subscription value, and more.

Baremetrics can integrate with most billing software solutions, including Stripe, Checkout, Shopify, and more. View a live demo now to see how everything works.

Pros and Cons of Recurring Billing

There are advantages and disadvantages to recurring billing for businesses and consumers. Fortunately, the positives far outweigh the negatives:

1. Pros for Businesses Using Recurring Billing

Businesses typically find that recurring billing is straightforward and accessible, with low risks. They can also set up clients with a free trial and then sign them to a recurring payment schedule when the trial ends. Other benefits include:

- Payments are always received on time

- Predictable cash flow

- Lower billing and collection costs

- Automation of accounts receivable functionality

- The ability to introduce price discounts to new customers

- Reduced administrative work

- Convenience

- Cost-and-time-effective

- Higher customer lifetime value

2. Cons for Businesses Using Recurring Billing

As with everything, recurring payments are not without drawbacks. Companies must use the right tools to track and manage their recurring billing subscriptions integrated with their existing software platforms.

Some of the disadvantages to recurring billing include:

- Difficulty in correcting billing mistakes

- Dunning is hard to detect and manage without the right tools

- Diverse payment amounts and contract lengths can be confusing without a singular dashboard view

Keeping track of recurring revenue is nearly impossible without proper subscription analytics. Using a tool like Baremetrics is almost essential to keeping it all straight. Still, most of the cons are overcome or at least managed with the right analytics and insights at your disposal.

Does SaaS Have to Be Recurring?

Most SaaS companies use the MRR (Monthly Recurring Revenue) model. However, no SaaS company is compelled to use a recurring revenue model. Recurring revenue is just a monetization strategy, one of many to choose from, in fact.

Some SaaS companies sell the use of their platform at a fixed price and don’t charge for upgrades. Microsoft, for example, sells technology as a unit at a fixed price. Licensing fees apply, and new releases have to be bought as they roll out.

Most SaaS companies opt for an MRR model because it is highly beneficial for them and their customers. The SaaS model is so popular because it offers flexibility and scalability, even as customers’ needs change.

Customers can scale up or down, add features or remove them when they need to. Month-to-month subscriptions allow them to stay agile.

Recurring Billing FAQs

1. How to Set Up Recurring Billing With Stripe?

Use Stripe Billing to bill customers with subscriptions and capture your recurring payments globally. Here’s how to set it up:

- Go to your account dashboard and assign a pricing plan to your product or service that you want to collect recurring payments for

- Subscribe a customer to said pricing plan

- When invoices are processed, customers receive emails detailing what they owe along with payment options (transfer, check, debit or credit card).

Setting up recurring payments with Stripe is free, but each recurring transaction costs 2.9% plus a flat rate of 0.30 USD.

2. How to Monitor Recurring Billing With Baremetrics?

Baremetrics is a subscription analytics platform, enabling businesses to monitor their customer’s recurring monthly revenue, lifetime revenue, and churn rate.

i. Monthly and Annual Recurring Revenue

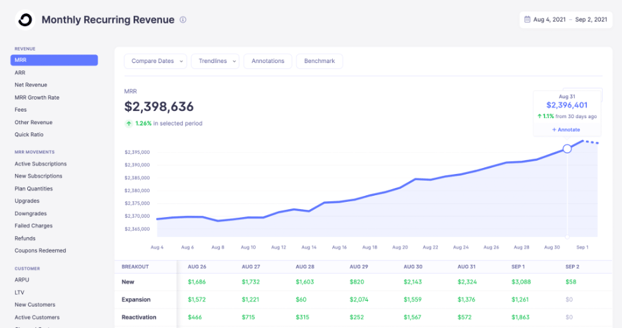

Your ARR or Annual Recurring Revenue is your recurring revenue per annum. In a SaaS business, you’ll regularly see new customers joining and existing customers leaving, which can cause your monthly revenue to fluctuate.

MRR captures the movement to show whether or not your revenue is growing or shrinking, giving you an overview of the financial health of your business. It also makes it easier to forecast your future revenue so that you can make decisions about investing, scaling, or budgeting.

Check out this example of monitoring MRR and ARR in Baremetrics:

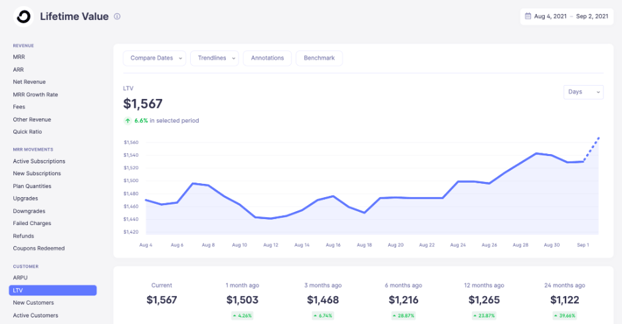

ii. Customer Lifetime Value

Your Customer Lifetime Value helps you measure how valuable a client is over time, then you can compare that to the cost of acquiring that customer (CAC). You need to have this data available at a glance to help plan out your marketing and sales.

iii. Churn Rate

Your churn rate measures the rate at which customers stop doing business with your organization (e.g., cancel subscriptions). Unsurprisingly, you need to keep churn rates low to maintain a healthy business.

Baremetrics also provides insight into dunning, helping companies recover revenue due to payment errors such as failed credit cards. On top of that, Baremetrics offers revenue and subscription forecasting tools for detailed insights into your financials.

Manually tracking new customers, upgrades, and lost customers is considerably challenging, especially if you offer customization or usage-based billing. So, it’s a good idea to use a recurring revenue analytics tool so you can actually see how much money you’re making.

Conclusion

Recurring revenue isn’t the only monetization method SaaS companies use, but it’s an effective one.