Table of Contents

How to Increase Billings

In a digital world, cash is still king. To constantly improve your service and grow your business, you need it to come into your business early and often. Understanding billings is the first step to improving cash flow through pre-payments or automated monthly payments.

Because even if you start with outside funding, any startup’s goal is to become self-sustaining. To do that, you need to generate your own cash and work towards profitability.

Assuming you have solid bookings and excellent products, how can you increase billings and improve cash flow?

Discounts for Annual Pre-Paid Service

Encouraging customers to pay upfront for a whole year ensures you have the cash necessary to meet their needs. You can often drive them in this direction with discounted prices, “free” extras, or upgrades.

The extra cash in the bank is worth more than the future reduction of monthly revenue or gross margin impact.

Getting paid in advance is especially critical when you’re first ramping up or if you experience a sudden increase in bookings. Depending on your SaaS business, you might require a lot of resources for customer onboarding and support, driving higher costs. But not billing right away increases the risk of a cash flow crunch or overworking your staff because you can’t afford to build out the team.

Monthly => Annual Contracts

Convert your existing monthly contracts to annual contracts.

Monthly contracts can be attractive to customers and a nightmare for companies for the same reason — the freedom to cancel anytime.

Push monthly customers to an annual plan through small discounts or other incentives, i.e., locking in prices before an increase. Once they’re satisfied with your product, this should be easy. They may even be happy to switch!

Hustle

Every single day counts when closing a big deal. Invoicing as soon as possible means the money ends up in your bank account sooner.

Cash in the bank is essential for continuing to provide excellent services.

Also, SaaS invoicing can be a headache, so use tools to track billings and invoicing. Failed payments and expired credit cards cost you money, and inaction means the money, and maybe the customer, is gone. Baremetrics has Recover, an automated solution to help manage failed payments.

Improve Your Billings Forecasting with Forecast+

Tracking and forecasting billings manually is a challenge, but Forecast+ gives you the tools to do it better.

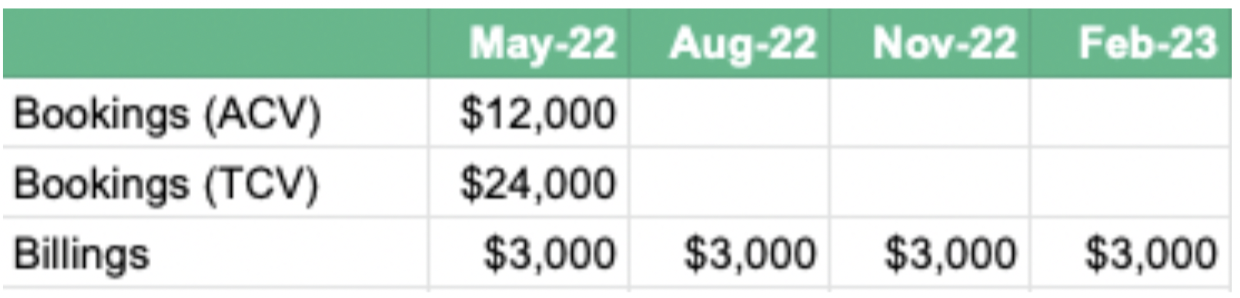

Here’s how you can bring billings into Forecast+:

- Import your invoices via QuickBooks Online or Xero (Forecast+ integrations).

- Create a new worksheet and use the tool’s logic to update your balance sheet (deferred revenue, accounts receivable, and cash balance) and income statement.

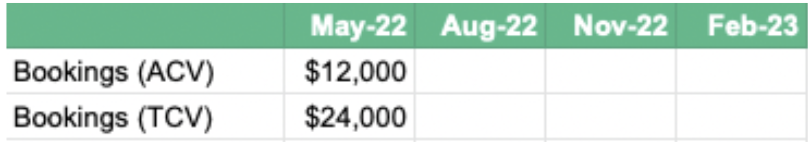

This worksheet helps you manage your bookings and billings and accurately forecast your revenue.

Are you satisfied with your SaaS company’s cash flow? Regularly forecasting your revenue metrics like billings and bookings can help you better plan your cash flow.

Try Forecast+ by Baremetrics for free to experience how better revenue tracking can benefit your SaaS.