Table of Contents

More Founders Journey Articles

What. A. Month. April was huge for Baremetrics. So many great things. Our best month across the board. So, let’s jump right in to the juicy bits.

Revenue

We crossed a big milestone for me personally. $10,000 in MRR was a number I always had in my head as the “if I can hit this number, Baremetrics probably has a chance of not burning to the ground before ever taking off.” And hot dog, I crossed that number yesterday (queue squealing like a little girl).

That’s an almost 80% increase over a month ago.

Customer Value

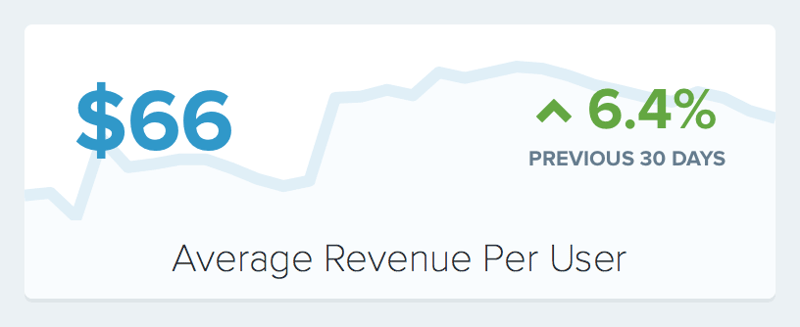

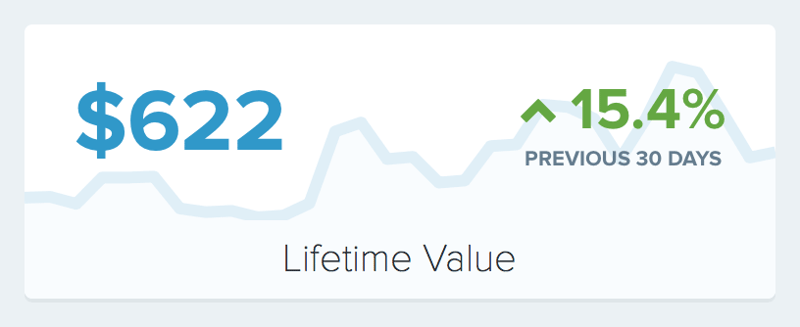

Average Monthly Recurring Revenue Per User (ARPU) and Lifetime Value (LTV) are both numbers that, for me, are major indicators of business health.

I want more revenue from fewer customers and as long as those two numbers are healthy, it makes that possible.

And both of those numbers went up in April.

Average Revenue Per User: $66 (+6%)

Lifetime Value: $622 (+15%)

Not up as much as last month, but still an increase overall.

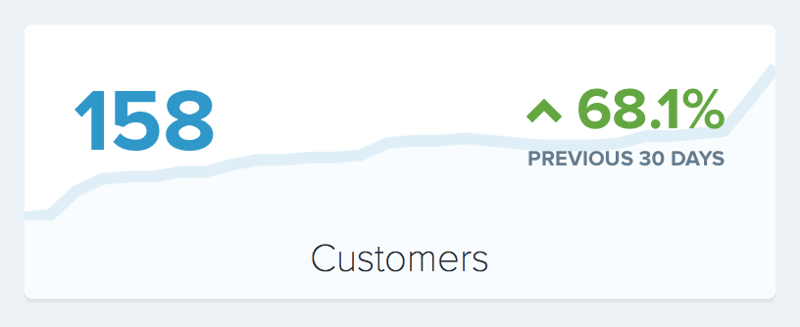

Customers

Great month as far as customer growth goes. Had a 68% increase in customers.

User churn has been all over the place but ultimately is a tad lower than last month. It’s generally been hanging around 9-10% for April.

I’m trying hard to get that down to 2-4%.

How did we swing $5k in new MRR?

How did we add some $5,000 in net new MRR in one month? There were 2 things that were responsible for the bulk of that.

First: Content

I did a big push on publishing content that I thought would be useful to other entrepreneurs, and it paid off. I made a concious effort to not write generic junk that anyone could write, and instead focused solely on the experiences I’ve had that I felt would resonate with other small business owners.

I published one article a week, and all got (and continue to get) great traffic. Three made it to the frontpage of Hacker News (if you care about that stuff), and one of those added $1500 in new MRR in 48 hours.

- How Retargeting Gets Our SaaS $650 for $6 (this is the one that added $1500 in new MRR)

- What I’ve Learned Building a SaaS App for Stripe Users

- Idea to $5,000/mo in Recurring Revenue in 5 Months

- How We Got Our First 100 Customers

Second: Buffer deal

You can read all the details there, but the gist of it is that we partnered with Buffer to have them use Baremetrics and make their dashboard public.

That just went live two days ago and in that time has added roughly $1500 in net new MRR. Certainly more will get added in the coming days just from that announcement alone. But the deal was really a long-term play, as Baremetrics will get linked to and mentioned regularly each time Buffer talks about their revenue numbers (which they do…a lot).

So, major win there.

What did we struggle with?

The last week of April was really stressful. Knowing the Buffer deal would bring in a lot of new customers and traffic, I knew I needed to address some server performance issues. And while some of the work I did before helped mitigate those issues, I still had some trouble staying on top of things as much as I’d have liked.

I’ve been a one-man show since the start of this, but that’s starting to wear thin on me, and a lot of the scaling issues I’m starting to run in to are honestly over my head. So, in the next week or so I’m bringing on another developer to help optimize things and reduce the work load on myself so I can focus on other things (and get more sleep).

What’s in store for May?

I had no clue April would have turned out so great. There’s the sense of “seems I’ve got a little momentum going here” and so I want to make the most of that and just make smart business moves and really just make the product rock solid.

I think that covers it for April. Just plain grateful to all the folks that have given Baremetrics a go the past few months and all the folks who have reached out to help. It’s humbling.

If there are any questions I can answer about any of this…fire away. I’m an open book.

(You can take a look at previous month’s posts here…)