Table of Contents

March was a busy month on the product side of things. We added multiple new metrics and some really big features, which ultimately led to pretty great growth across the board.

As with February’s Inside Baremetrics post, we’ll take a look at all the juicy numbers as well as what did/didn’t work.

Revenue

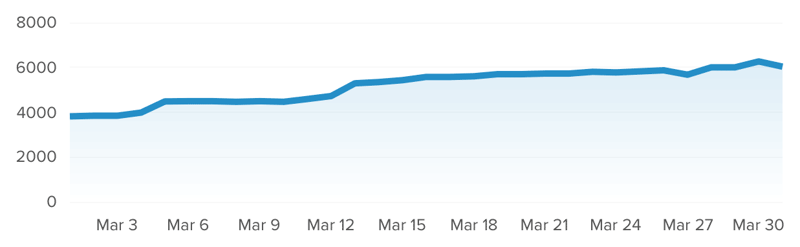

The big “how much money did I make” numbers saw a nice bump.

Monthly Recurring Revenue: $6,033 (+59%)

Net Revenue: $6,841 (+80%)

The Net Revenue is higher than MRR as we started upselling annual plans to some customers, so we got an influx of cash that outpaced monthly recurring revenue.

Customer Value

In the “how much is a customer worth” department, we also saw pretty good increases.

Average Revenue Per User: $62 (+31%)

Lifetime Value: $553 (+52%)

I’m really excited about these as the higher these numbers get, the fewer customers are needed to have a really solid business.

This was a big month for upgrades. Had a lot of customers upgrade from the $29/mo to $79/mo plans, thanks to a number of new features on the higher paying plans. That played a big part in increasing both ARPU and LTV.

Customers

Customers: 97 (+21%)

The growth rate is lower than the previous month, but even though customer growth slowed, but that’s actually perfectly fine since ARPU grew so much. Just means new customers were worth more, which is precisely what I’m after.

User churn fell by almost 2% as well, but it’s still a heck of a lot higher (11%) than I’d like.

What worked?

So what went well in March? The single biggest thing we launched was our new Notifications feature. It drove most of our $29-$79 plan upgrades.

Also adding two new metrics was a big win as they were both highly requested.

February was a tough month with app performance and speed and March was exponentially less stressful in that area. The fixes we made in late-February and early-March have continued to work well.

What didn’t work?

As more customers signup and more unique use-cases for Stripe’s API come in to the system, we’ve spent a good bit of time dealing with odd bugs that we previously wouldn’t have encountered.

Usually these bugs only affect a small percentage of customers ~1-2%, but it’s still frustrating for everyone involved.

Looking forward

Two big pushes for April are polishing the product and marketing.

I’ve got a lengthy list of weird bugs (mostly UI related) that I need to suck up and just fix, and the collective fixing of all these should result in a better experience for everyone.

I also have a non-scalable marketing initiative (sound so fancy) I’ll be tackling in the coming weeks. I’ll write more about this after I’ve finished it.

Also still need to do a better job of informing people how every number is calculated. That continues to be the biggest source of support requests and a solution for that is definitely in the works.

I think that covers everything for this month. Happy to answer any questions, though!