Table of Contents

.jfif)

Revenue churn answers the question: how much MRR did we lose last month?

Your answer says a lot about the long term health of your company as a SaaS or subscription business.

The SaaS business model is built on the concept of retaining as much of your monthly recurring revenue (MRR) as possible. Even if you’re bringing in new customers and more MRR each month, it’s hard to achieve long term growth if you can’t get your churn under control.

That’s what this guide is all about. Here’s a quick overview of what we’ll cover:

- How to calculate revenue churn

- How to calculate net revenue churn

- Revenue churn vs. customer churn

- What’s a good revenue churn rate?

- What’s negative revenue churn?

- Four ways to reduce revenue churn right now

BE HONEST

How well do you know your business?

Get deep insights into MRR, churn, LTV and more to grow your business

How to calculate revenue churn

Revenue churn is the percentage of your MRR lost over a specified period of time. To keep things simple, we’ll just assume you’re calculating your revenue churn monthly.

It includes revenue lost from customer cancellations, failed charges and downgrades. In other words, any recurring revenue you got last month that didn’t carry over to the next month.

Revenue churn formula

(MRR Lost to Downgrades & Cancellations in the last 30 days ÷ MRR 30 days ago) x 100

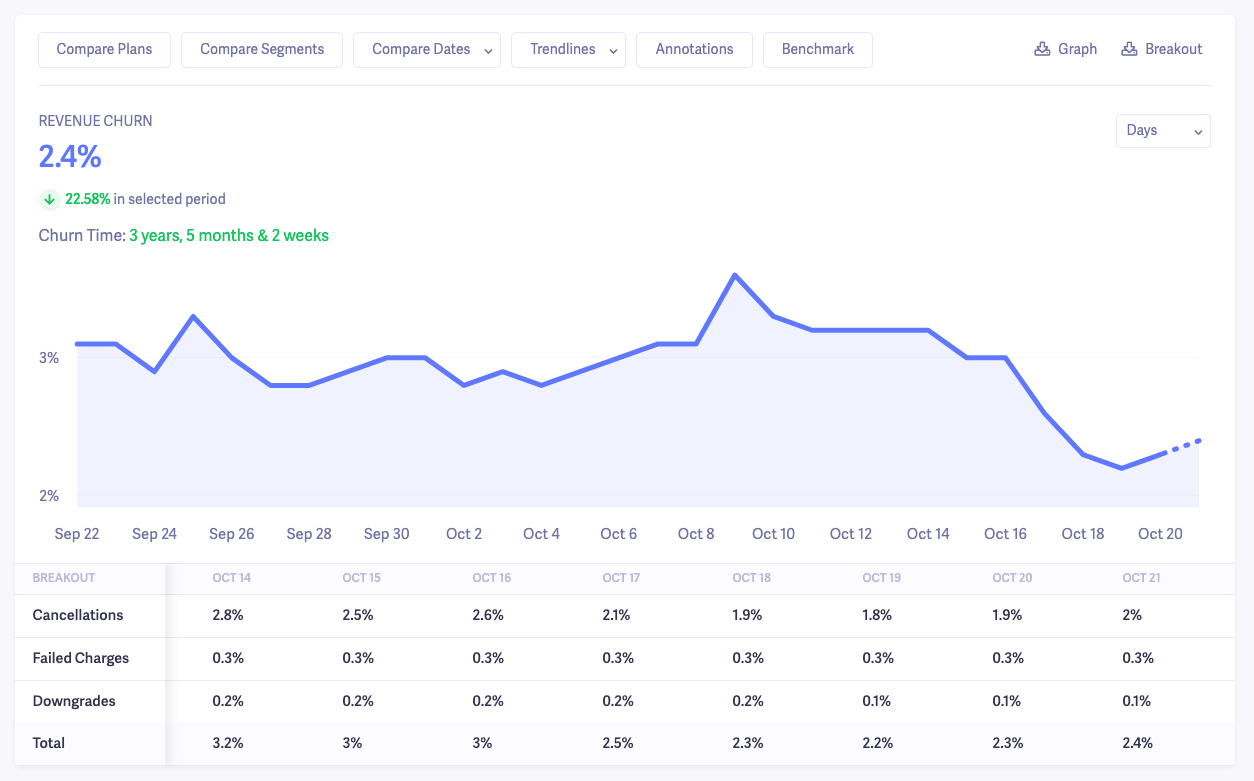

Unless you have some sort of weird obsession with doing math, you don’t have to do this calculation manually. There are tools like Baremetrics that can do it for you, and you can even create an entire dashboard for it.

How to calculate net revenue churn

You might’ve noticed that the gross revenue churn formula doesn’t account for any new revenue you gained over the month.

For instance, you may have lost $5K in MRR to cancellations, but gained $7K MRR from upgrades.

If you want to know the difference between what you gained and lost, you’re going to need to calculate your net revenue churn rate.

Net revenue churn rate formula

(Churned MRR - Expansion MRR) ÷ Starting MRR 30 days ago x 100

Both of these churn metrics are important to track. Gross tells you how much you’ve lost, and net shows you how much you’re offsetting the losses.

Revenue churn vs. customer churn: What’s the difference?

The difference between revenue churn and customer churn rate is pretty simple. Customer churn is the percentage of customers who’ve cancelled in a given period, and revenue churn is the percentage of lost revenue from your existing customers.

To put it in even simpler terms:

Don’t make the mistake of fixating solely on your customer churn rate. Just because customers aren’t cancelling doesn’t mean you’re not losing money. Downgrades can have a big impact over time if you don’t keep an eye on it.

That’s why you need to pay just as much attention to your revenue churn as you do to customer churn.

What is a good revenue churn rate?

Say you have a revenue churn rate of 3%. Is that good? Bad? Normal?

Without some sort of baseline or benchmark, it’s almost impossible to tell. Even if you use your previous numbers as a benchmark, how do you know if it’s good or bad compared to similar companies?

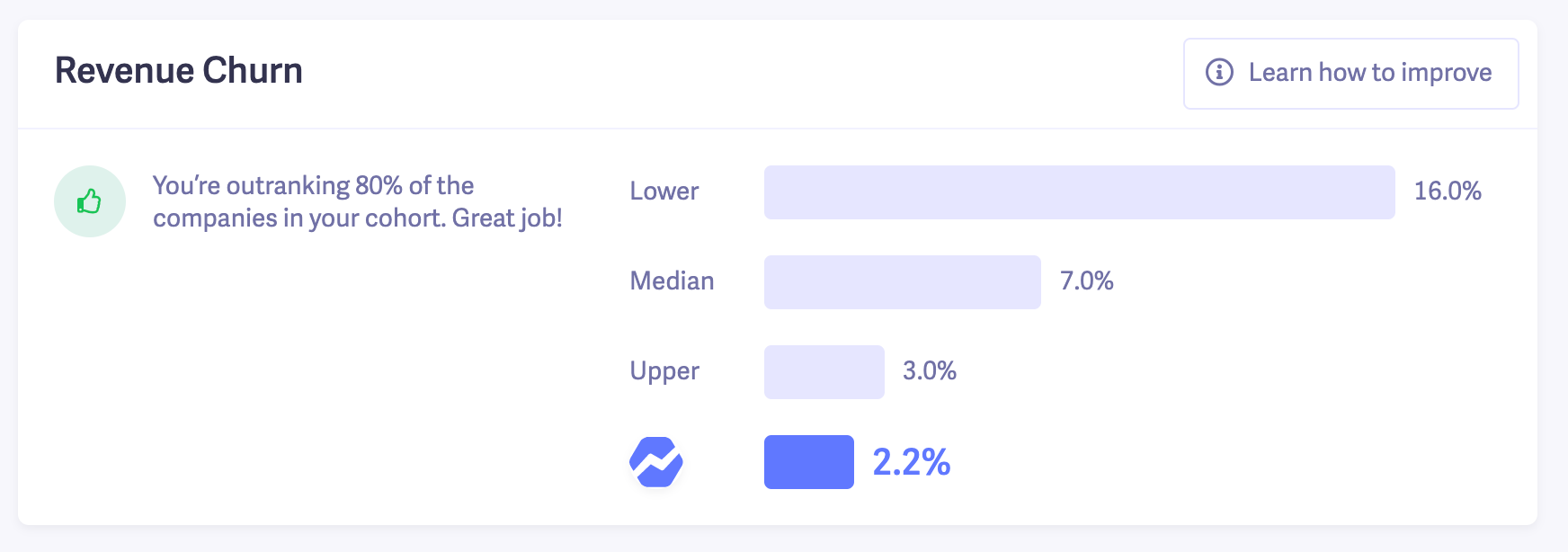

While there’s no definitive answer, we (Baremetrics) are trying to help companies get a better idea of how their revenue churn stacks up. You can take a look at our Open Benchmarks page to see how your revenue churn compares to companies that have a similar average revenue per user (ARPU).

And if you’re a Baremetrics user (which you totally should be) you can compare your revenue churn to others directly in your dashboard.

On average, we’re seeing anywhere from about 4-8% revenue churn for SaaS and subscription companies. Again, this varies from business to business, and you can see exactly how you compare in Baremetrics.

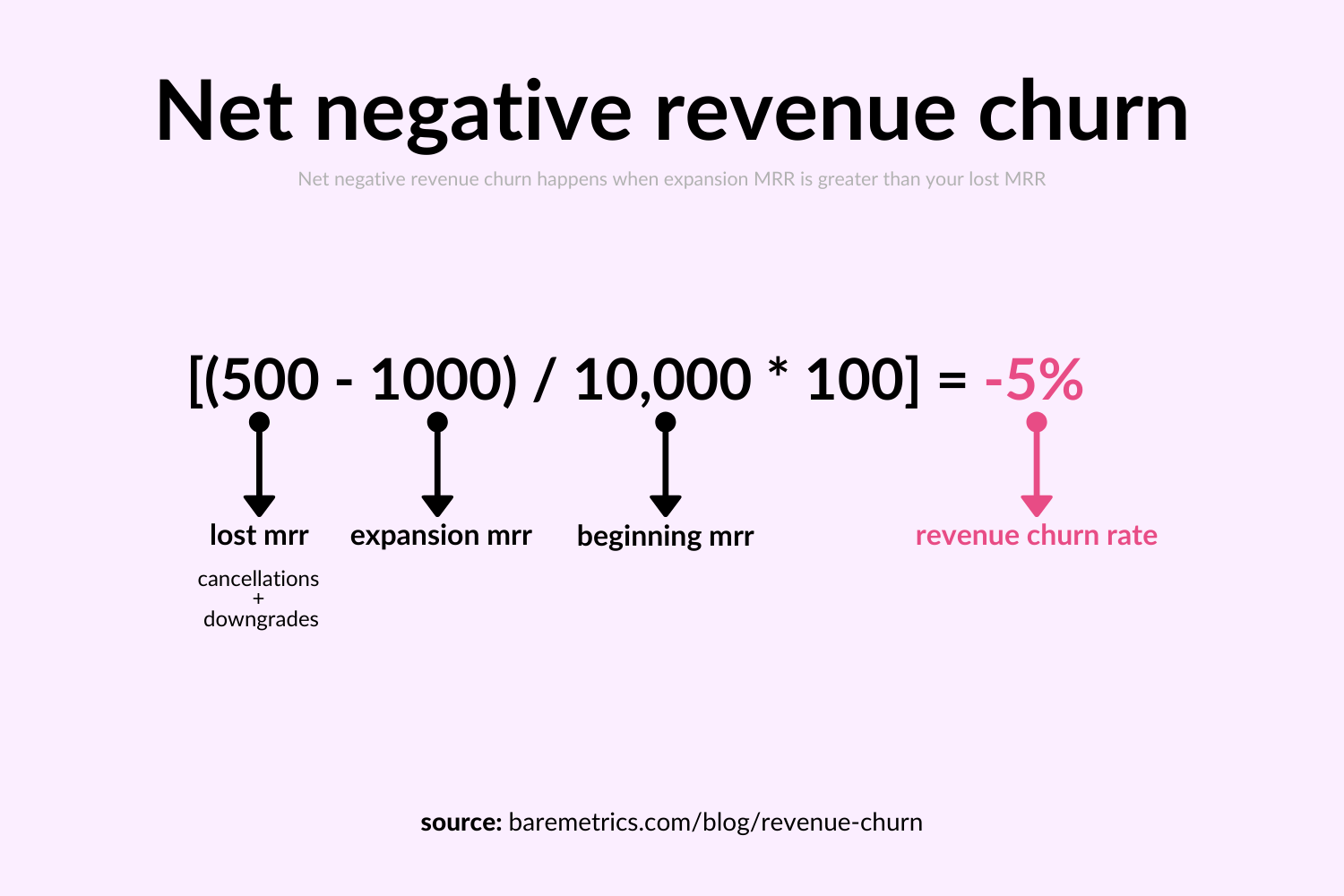

What is net negative revenue churn?

Net negative revenue churn is when your expansion revenue is greater than the MRR you lost from cancellations and downgrades.

For instance, let’s say you started out with $10,000 in MRR at the beginning of the month. You lost $500 in MRR from cancelled customers and downgrades. But you gained $1,000 MRR from your existing customers upgrading their accounts.

Let’s plug those numbers into the revenue churn formula:

That gives us a net revenue churn rate of -5%. So even though you lost some revenue, you still came out ahead.

It’s a huge achievement, but it’s possible (we even did it!)

And that brings us to the final piece of the puzzle.

4 Ways to reduce revenue churn

As a SaaS business, the goal is to retain as much of your monthly revenue as possible. It’s essential to your growth.

So no matter what your current revenue churn rate is, there’s always room for improvement. Even if you have a negative churn rate, you can still get it lower.

Let’s take a look at some tactics you can use to reduce churn.

1. Analyze your pricing

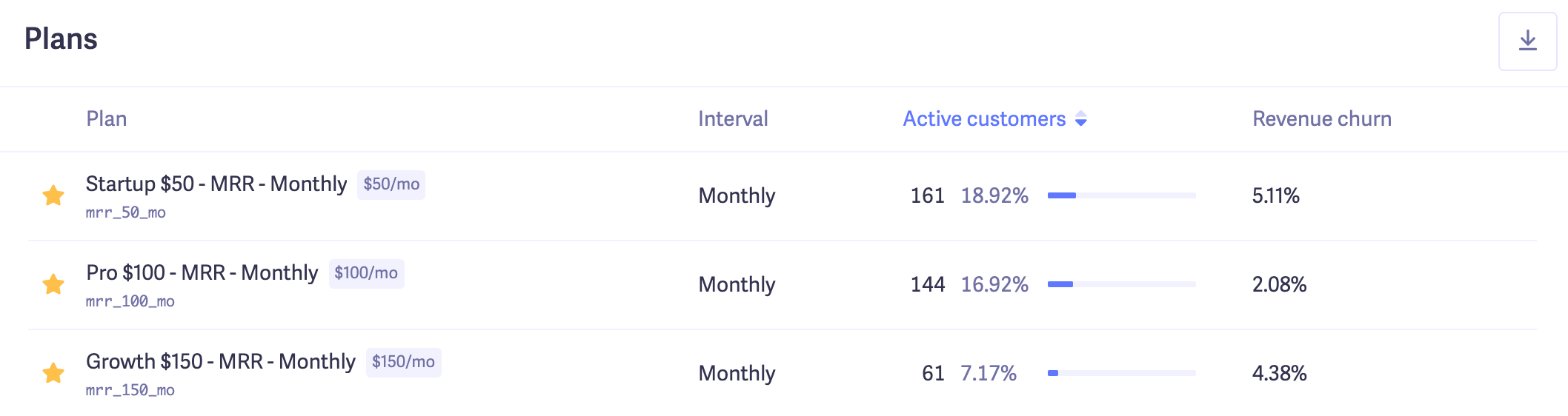

If a lot of your revenue churn comes from customer downgrades, it could be a sign your pricing is off. Luckily, it’s pretty easy to spot.

I’ll show you how in Baremetrics.

Head to the Revenue Churn dashboard. If you scroll down you can see the revenue churn for each of your different pricing plans.

Look for any plans with unusually high revenue churn rates. These are the ones that are losing you the most MRR.

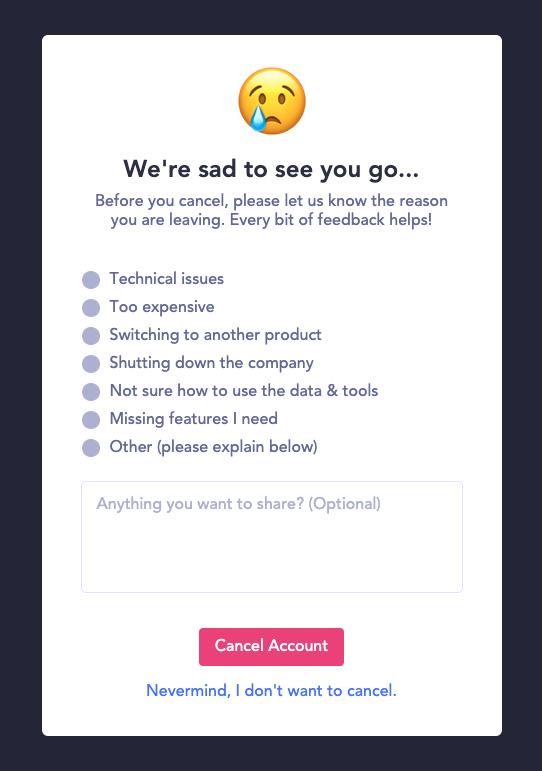

To take it a step further, you can use Cancellation Insights to see why people on your high-churn plans are cancelling. Cancellation Insights automatically asks customers why they’re cancelling and collects the feedback for you.

If you see a lot of responses like “too expensive” or “switching to a competitor”, don’t assume that means you need to lower your price. It could just be that you’re not providing enough value for the price you’re charging (your value:price ratio).

That’s when you should take a look at what your competitors are offering for around the same price point.

For instance, Ahrefs, Moz and SEMrush all offer a $99 plan, so people looking for an SEO tool within that budget are likely going to compare the features of all three to see where they get the most value.

And you can bet they’re doing the same with your product.

2. Win back customers before they cancel or downgrade

Another thing you can do is try to reduce revenue churn by preventing cancellations altogether.

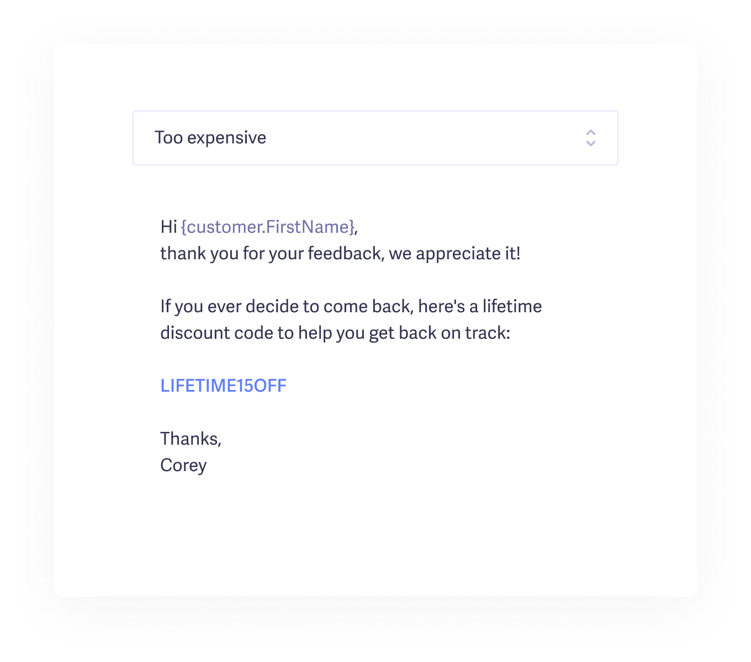

In Cancellation Insights, you can create custom emails to send to users who want to cancel, based on their cancellation reason.

For example, if a customer chooses “Too expensive” as their cancellation reason, you could send an automated email offering them a discount coupon.

It’ll still result in revenue churn, but not as much as you’d lose if they were to cancel completely.

Create responses for each of your cancellation reasons, and see if there’s anything you can do to prevent the customer from churning.

Here are a couple of resources to help you out:

- How to Write a Subscription Cancellation Email for SaaS

- How to Create Cancellation Surveys That Get a Response

3. Focus on expansion MRR

We’ve written about expansion revenue quite a bit at Baremetrics:

- How to Use Customer Expansion to Skyrocket Growth (+ examples)

- How to Improve Your MRR Growth Rate (without new customers)

- What is Expansion MRR?

It’s such an important, yet underutilized SaaS growth strategy that can have an immediate impact on your net revenue churn.

Your first priority should be to retain as much revenue as possible. But like we saw in the net negative revenue churn example, expansion can balance out some of the inevitable lost MRR.

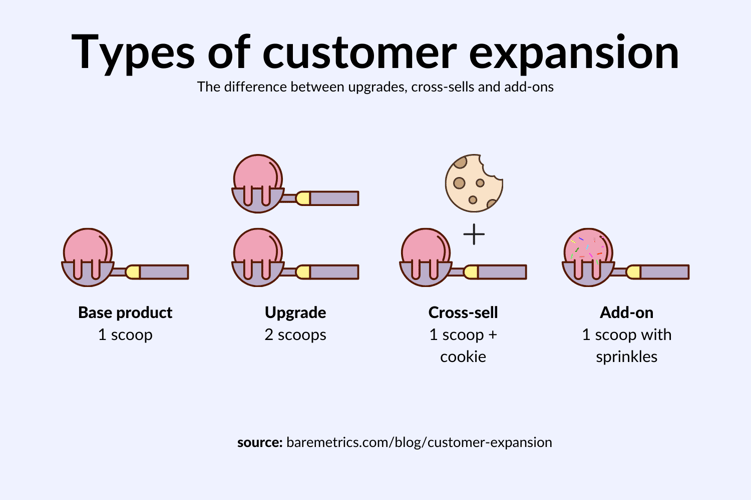

The main three ways to increase your expansion MRR are:

- Upgrades: Offering a better/higher priced version of your product

- Cross-sells: Offering a complementary product

- Add-ons: Offering additional functionality or features to improve your customer’s existing subscription

Here’s a graphic to help you visualize each one.

Your opportunities for expansion MRR will depend on your business.

But typically for SaaS companies, the easiest path is through upgrades. Offer your existing customers more value if they decide to upgrade to a higher priced plan.

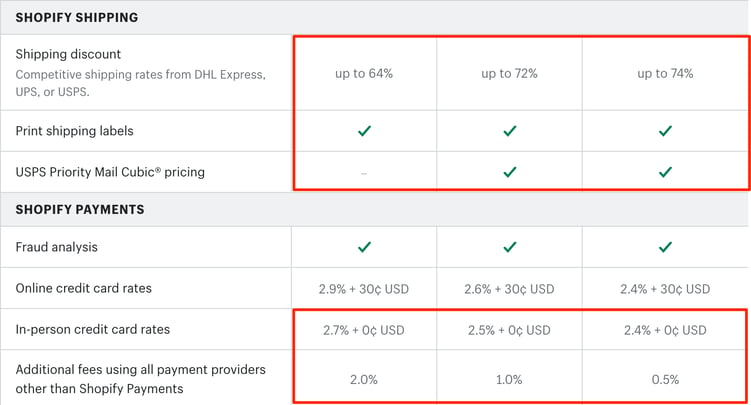

In order to be successful at it though, the extra value needs to be compelling. A good example of this is Shopify. Their Basic Shopify plan is enough to get your online store off the ground and covers the basics.

But when you compare that to the upgraded plans, you can see the additional value you get like additional features and lower fees.

That’s an easy sell for Shopify: “Earn more money from your sales by upgrading your account”.

Read through my customer expansion guide to learn more about increasing expansion MRR, and to see more examples.

4. Product education

If you continue to show your customers how to get value from your product, they’re more likely to stick around. But you need to be proactive, not reactive.

What I mean is don’t wait until your customers come to you with questions or complaints about how to use your product. Give them articles, videos and resources that show different product use cases and tips on a regular basis.

This is an area we’re starting to focus on more at Baremetrics. But a company that’s already doing a good of it is SpamZilla. It’s a tool that helps you find expired domains to buy.

After you sign up, they send you a series of emails that teach you how to use the product and all the things you can do with it.

You could even go the Canva route and share tips on social media if you’ve built up an audience there:

Get it straight! #CanvaTip 📏

— Canva (@canva) October 19, 2020

You can add rulers and guides to your design to keep everything perfectly in line. Simply hit File in the top menu, then click Show rulers and Show guides. pic.twitter.com/gIwduFF2vC

And there’s always a good old fashioned blog like we do here.

The customer journey doesn’t end when a customer signs up. Do what you can to make sure customers are successful with your product after they sign up.

Get your revenue churn under control

Churn can be the death of SaaS and subscription businesses (really any business with a monthly recurring revenue model).

In order to keep yours under control, or even hit net negative revenue churn, here’s a quick recap of what to do:

- Monitor your revenue churn on a regular basis and spot trends before they get too bad. Use Baremetrics to track and analyze it all.

- Find out why customers are cancelling and find out if there’s anything you can do to keep them. Automate the process with Cancellation Insights.

- Keep customers engaged with continuous product training

- Find your pricing plans with the highest revenue churn rate and optimize the value:price ratio.

While it’s going to take some time to see the decrease in your revenue churn, these are all things you can implement right away. The faster you take action, the more revenue you’ll be able to retain long term.