Table of Contents

Average revenue per user (ARPU) is an underrated metric that companies can’t afford to ignore.

Although metrics such as monthly recurring revenue (MRR) receive most of the spotlight for those in SaaS, ARPU is crucial for keeping a pulse on your business’ health.

Because digging into how much the average user spends can clue you in on ways to optimize your support budget, pricing and product positioning.

What is ARPU?

Average revenue per user measures how much revenue you’re generating for each active customer.

Companies typically calculate ARPU on a monthly basis. In short, the metric gives you an idea of how much the average customer spends per subscription.

But unlike MRR, ARPU is more granular as it puts your individual customers’ spending under a microscope.

ARPU formula

To calculate your ARPU, simply divide your MRR by the total number of active users over the course of a particular month.

MRR / # of active customers = ARPU

Pretty simple, right?

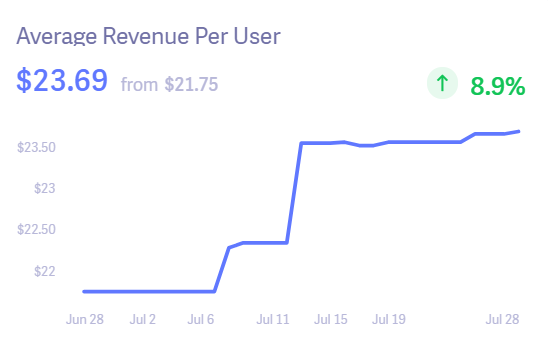

Let’s look at an actual example using a company from Baremetrics’ own open startups with an MRR of $3,459 and 146 customers.

$3,459 (MRR) / 146 (# of customers) = $23.69 (ARPU)

And here’s what the calculation looks like in Baremetrics:

What variables should I consider when calculating ARPU?

Good question! While calculating ARPU might seem straightforward, there are some key factors to remember as you compare your MRR, ARPU and user-base at large.

Paying customers versus free users

This is important. Sure, free sign-ups and trial users are obviously welcome to your business. That said, they shouldn’t calculate into your ARPU since they’re not actually generating revenue (yet). If you did include them, they’d skew your numbers.

Upgrades and downgrades

Customer spending isn’t static. This is especially true if your business offers a variety of paid plans or add-on features. Keeping an eye on customers moving tiers not only gives you a better sense of which subscription tiers drive the most revenue but also which ones might be lacking.

Customer churn

Inactive or lost customers (churn) impact your MRR and likewise your ARPU. For example, losing a higher-paying customer is going to drop your ARPU more steeply than a smaller one.

Why does ARPU matter so much?

ARPU might not get as much love as MRR or ARR, but that doesn’t mean it’s not a key SaaS metric.

For starters, your average revenue per user has a direct impact on your ability to scale.

Let’s say you have a relatively low ARPU of $5/mo. This isn’t going to give you much wiggle room to grow, let alone spend on resources related to customer support or acquisition.

If the cost of your support staff or marketing campaigns outpaces your revenue, your business is in trouble long-term.

Think about it. As soon as a low-cost customer requires attention on behalf of your company (think: support calls, emails), they’ve already consumed their value.

Low ARPU means that you will have to acquire a ton of customers to reach the holy grail of $1M ARR. This also means that you will have less to spend on support and marketing infrastructure that enables you to scale in the first place.

If nothing else, tracking your ARPU encourages you to dig deeper into your customers’ desires so you can learn what drives them to spend.

For example, you might notice that your best and most loyal customers gravitate toward higher-priced plans. On the flip side, your lowest-value customers are the first to churn. These revelations have a direct impact on how you position your product and ultimately grow.

The takeaway here? You're fighting an uphill battle if you aren’t actively increasing your ARPU.

How to increase your ARPU

Below are some tried-and-tested tactics for increasing your ARPU. Each strategy is fair game for SaaS companies looking to maximize their earning potential.

Tweak your pricing to attract higher-paying, long-term customers

We could talk forever about SaaS pricing models, but perhaps what matters most is that you don’t build your customer-base on bargain pricing alone.

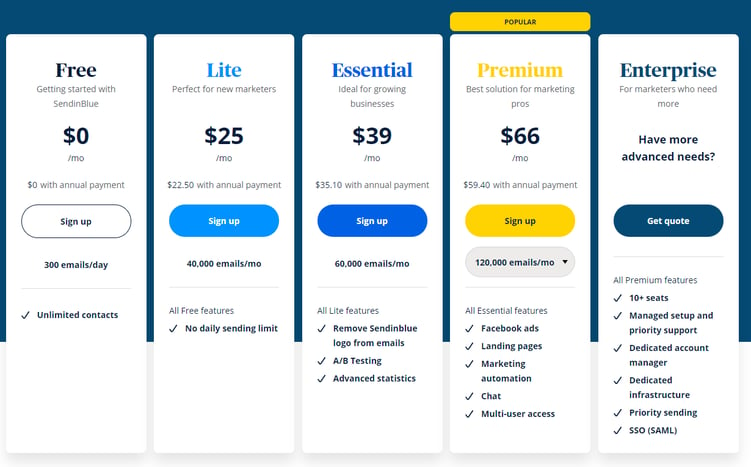

Ideally, you should be able to point customers to a variety of subscription plans so you’re not freezing out leads with lower budgets. Adding in a “recommended” or “popular” pricing tier creates a sort of bandwagon effect for customers to get the most bang for their buck.

Sendinblue’s pricing is actually a great example of this. Notice how they highlight their second-highest pricing tier with bright colors and a “POPULAR” tag.

Their other pricing tiers are still present, but their most valuable one is front-and-center for good reason.

If you are unsure which of your pricing plans provides the best value, you can use Baremetrics to compare your different plans and see in black-and-white which ones are driving the most revenue.

Rethink your free (or freemium) plans

Forever-free plans are all-the-rage in SaaS, and rightfully so.

That said, free plans don’t factor into your average revenue per month.

If you’re looking to raise your ARPU and you offer a free service, it might be time to examine whether or not that service is doing too much at no cost.

This doesn’t necessarily mean gutting your free tools or eliminating them altogether, but making some small tweaks to the features offered.

Despite popular belief, making changes without turning your free users into an angry mob is possible.

For starters, don’t change features without, at the very least, giving those users a heads-up and providing context to your changes. It’s also a good idea to brainstorm features you can actually add to your free plans as a sort of give-and-take.

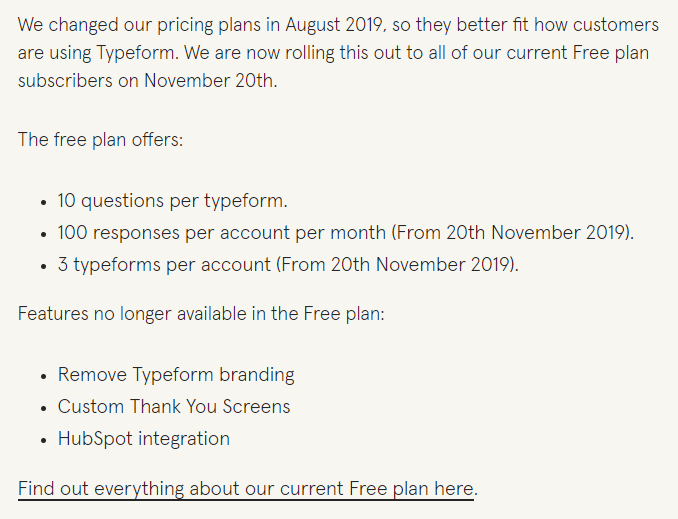

Check out this statement from Typeform, for reference. They manage to frame their free account changes as giving priority to their paid users (while inviting free users to become paid ones themselves).

They also manage to frontload the statement by mentioning new features to their free plans.

See how that works?

Start offering add-ons or “a la carte” features

No surprises here.

The more opportunities you give your users to spend money on your service, the more likely you will increase your LTV (and ARPU).

This is exactly why we’re seeing a rise in SaaS companies offering optional add-ons in addition to their subscription plans.

Not only does this provide customers with a sense of flexibility, but it also provides an additional avenue to drive revenue from existing customers.

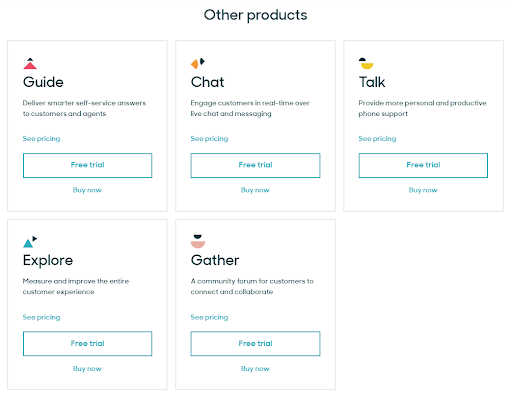

Here’s an example from ZenDesk, offering a variety of individual, add-on services. These add-ons manage to close the gap between ZenDesk’s main pricing tiers ($5/mo per user and $89/mo per user), allowing prospects to only pay for relevant features.

Give your most valuable accounts the attention they need

All of your customers deserve your attention.

However, some might deserve more attention than others.

Make a point of flagging tickets and questions from your biggest accounts to keep them around for the long haul.

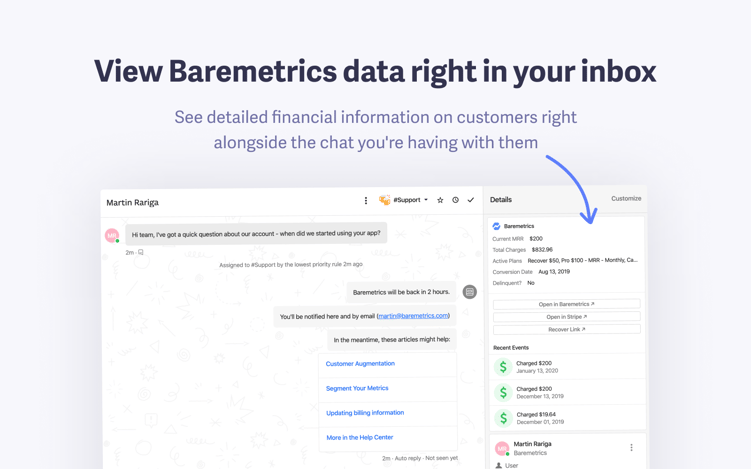

If you use Intercom for your customer support, you can combine it with our integration to see your customer’s MRR, total charges, and other information whenever they message you.

Providing speedy, one-on-one service to these accounts is good news for your ARPU, as opposed to dedicating all of your resources to freebies.

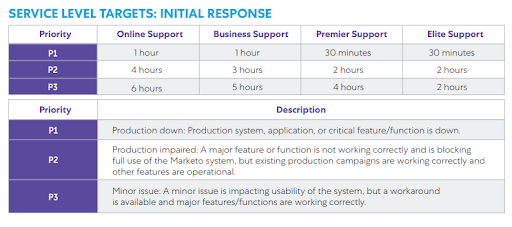

You can likewise include this sort of VIP service as part of your pricing plans. For example, check out how Marketo highlights their response times based on their users’ subscription tiers.

Adjust your personas to focus on higher-paying customers

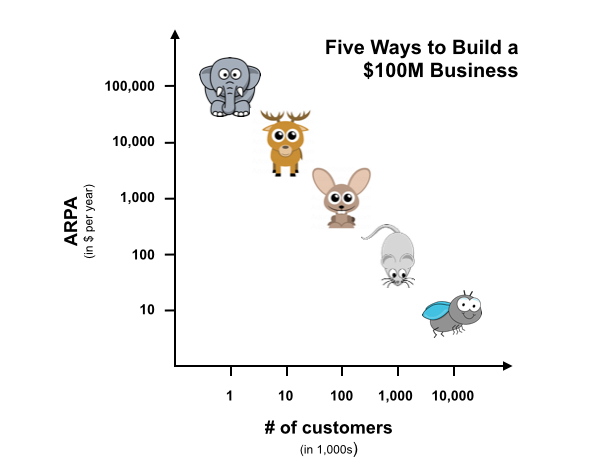

We’ve discussed how to reach $1 Million ARR based on your average contract value strategies.

Simply put, you can either acquire a hundred elephants or 100,000 mice.

This speaks to which sort of customer personas your business is targeting. For the sake of upselling and increasing your ARPU, perhaps it’s time to start looking toward customers with bigger budgets.

When you know your customers well, price correctly and sell effectively, ARPU increases. To understand the “why,” you need to talk to prospects and customers to learn more about what pain points are driving their purchases.

Start tracking your ARPU to uncover trends and opportunities

Finally, you can’t improve your ARPU without keeping an eye on it.

Is the needle ticking upward? Downward? Either way, you shouldn’t be in the dark.

This means paying attention to your dashboards using tools like Baremetrics.

From getting granular with your customer data to making more accurate sales forecasts, our platform provides easy-to-read reports on all of the above.

The ability to see your ARPU at a moment’s notice makes it easy to track trends and ensure that your efforts to improve it are paying off.

FAQ's

-

What is the significance of Average Revenue Per Customer?

The Average Revenue Per Customer provides insights into the value of each customer and can help in decision-making related to pricing, customer retention, and profitability. -

What is Average Revenue Per Unique Visitor and how does it differ from ARPU?

Average Revenue Per Unique Visitor (ARPUV) measures the average revenue generated by each unique visitor to a website or online platform. It differs from ARPU as it considers visitors rather than registered users or customers. ARPUV is calculated by dividing the total revenue generated by the total number of unique visitors within a specific time period. -

What is Average Revenue Per User (ARPU) and how is it calculated?

Average Revenue Per User (ARPU) is a metric used in subscription analytics to measure the average revenue generated by each user or customer. It is calculated by dividing the total revenue generated by the number of users or customers during a specific period. -

How can I calculate ARPU for my business?

To calculate ARPU for your business, you need to sum up the total revenue generated from subscriptions within a given time frame and divide it by the total number of users or customers during that period. -

How can I increase my ARPU?

To increase your ARPU, you can consider implementing several strategies. These may include upselling or cross-selling additional products or services to existing customers, introducing premium or tiered pricing plans, improving customer engagement and satisfaction, and focusing on customer retention efforts.

Written by: Brent Barnhart