Table of Contents

More Glossary Articles

Of all the metrics you need to track as a SaaS company, lifetime value (LTV) may be the most mysterious. It feels difficult to calculate, and once you have the calculation, you don’t know what to do with it, whether good or bad.

Hopefully, today, we can demystify the metric and offer some insight to help you use it better within your company!

Table of contents:

- What is lifetime value?

- How to calculate LTV

- Churn variance and sample size

- CAC and LTV

- LTV and churn

- How to increase LTV

What is customer lifetime value?

Customer lifetime value (CLTV) is the predicted revenue a customer generates over the entire relationship with the company, or "customer lifetime". This metric is useful for making predictions and long-term plans, as you'll want to balance CLTV with other factors like customer acquisition cost.

This way, the CLTV metric can help you move from transaction-based thinking to focusing on the long-term value of repeat business.

Say you charge $100/mo for your service, and a customer stays with you for 12 months. Their LTV would be $100 × 12 = $1,200.

How to calculate customer lifetime value

The example above is how you calculate LTV for a single customer. But that obviously isn’t practical for running your business (since you hopefully have more than one customer).

To measure LTV, we’ll need two additional metrics:

1. Churn rate: This is the number of subscribers who unsubscribe or stop paying over a given period of time.

Example: If you had 100 subscribers last year and lost 5, your churn rate is 5%.

2. Average Revenue Per User (ARPU): This is the average revenue of all your current accounts. Or MRR/total users.

Example: If you have 100 accounts and make $50 per year from 50 of them and $100 per year from the other 50, then your ARPU is $75 yearly.

Now, let’s look at how to calculate the lifetime value of a customer.

LTV = ARPU (average monthly recurring revenue per user) × Customer Lifetime

You can also calculate lifetime value using churn (which is a number you likely have more readily available).

LTV = ARPU / User Churn

The higher your user churn, the lower your lifetime value will be. This is why paying attention to both LTV and churn is so critical.

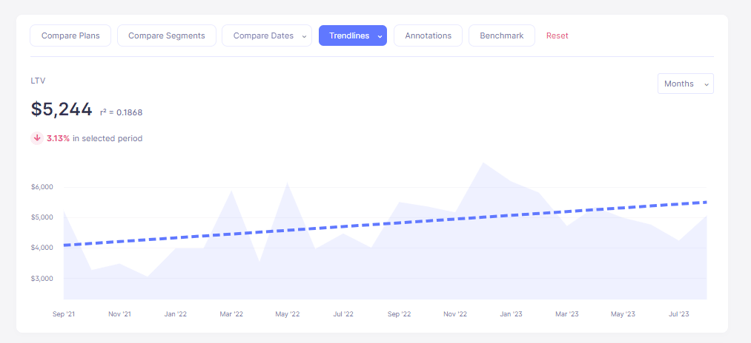

Luckily, you don’t have to calculate customer lifetime value manually. Using Baremetrics, you can automatically track and analyze your LTV growth over time!

Get a 14-day free trial of Baremetrics now and calculate your LTV automatically.

LTV inside Baremetrics

LTV inside Baremetrics

Churn variance and sample size

Quite often, churn can be messy. For example, if you think about any given cohort (a group of users that subscribed in a given period – i.e., all subscribers gained in July), there’s often a “cliff,” right after the first month of that cohort’s start date.

We can multiply our results by a discount rate to keep this churn variance accounted for. (Discount rate means “discounting” for cash flow losses that may occur in the future).

Use a discount rate of .75 to find a more conservative estimate:

((ARPU x Profit Per User)/Churn rate) x .75ex. $1200 x .75 = $900

Sample size is also important; unfortunately, the scientific method often falls by the wayside in business.

If you have few users or count too few users in your metric calculations, your data may not be scientifically valid.

Here are the scientific guidelines for sample size:

- Less than 100 users: 50% or more user data needs to be counted for valid data (100% is best)

- 1,000 to 10,000: 10% of user data needs to be counted for valid data, (i.e., if you’ve got 5,000 users then you need to include the data of at least 500 users in your calculations).

- More than 1 million: 1% of user data need to be counted for valid data, (i.e., if you’ve got 3,000,000 users then you need to include the data of at least 30,000 users in your calculations).

Customer acquisition cost and lifetime value

The lifetime value calculation is important for your SaaS business because it determines your spending to acquire new customers. If your customer acquisition cost (CAC) is $100 and that same customer has an LTV of $500, you’re basically printing $400.

Can you say “money machine”?!?!?!

The higher your LTV and the lower your CAC, the faster you can grow your business.

If you know how much a customer’s value will be over the course of a lifetime, then you can make smarter decisions about what to spend to acquire a customer.

A good rule of thumb is that if LTV/CAC isn’t above 3, you’re spending too much on acquisition.

LTV and Churn

Those LTVs will likely be so different because of one nasty word: churn.

Generally speaking, users on your lowest-priced plans will also have the highest churn, making it your most dismal LTV compared to the other plans.

Remember what we said earlier? LTV drives what you can spend to acquire customers. If the average customer takes $200 to acquire, it makes no sense to spend that to acquire a customer with an LTV of $100.

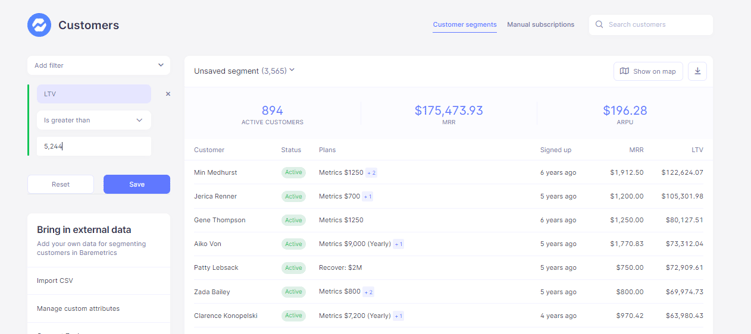

Knowing what your LTV is for each customer segment is critical.

Baremetrics (SaaS analytics & insights) offers this right out of the box, available as soon as you connect your account.

Stop wasting time on countless spreadsheets. Get a 14-day free trial of Baremetrics now.

How to increase customer lifetime value

Knowing your average customer lifetime value is nice, but just looking at a number on a graph will not help you grow your business.

Unless you do something with the KPIs you track, they’re pointless.

So, next, let's discuss how to use lifetime value analysis (it’s easier than it sounds) and other tactics to improve your LTV.

Interview your customers with the highest lifetime value

When you aim to improve your customer's lifetime value, speaking to your existing customers is a good place to start.

For this first tactic, you’ll identify customers with a higher lifetime value than your average and learn more about them.

Specifically, you want to learn:

- Where they get the most value from your product

- How they use your product

- What initially drew them to you (and how they found out about you)

- How they’ve grown with your product since the time they signed up

- Any other insights that’ll help you understand what’s keeping them around

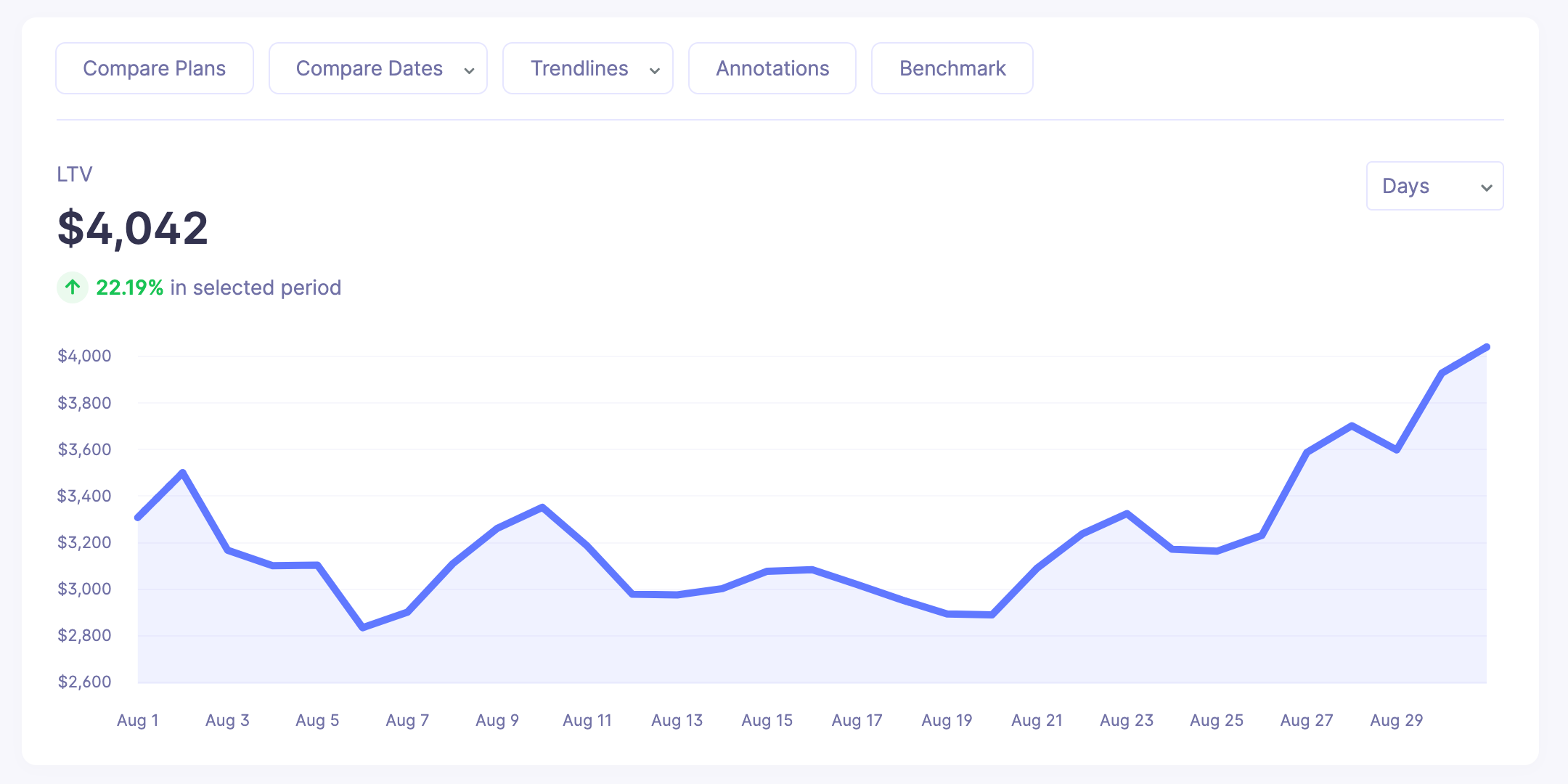

Step one is to find out what your current average LTV is.

Here's ours from our Metrics dashboard:

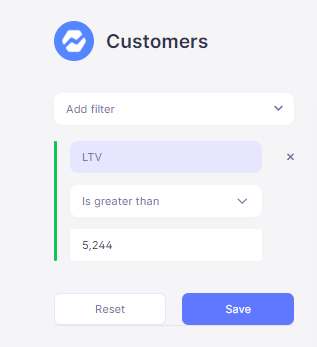

Then, head over to your customer list. We’ll need to set a couple of filters:

- Active customer: Ideally, you want to speak to active customers. Reaching out to people who canceled could be awkward.

- LTV: Filter to only show customers with an LTV higher than the average you found (in our case, higher than $5,244).

Now, you should have a list of your highest LTV customers.

From here, you can ask them if they’d be open to doing a short interview to learn more about how they use the product and get feedback.

Here’s an example of what your email might look like:

|

Subject: {first name}, {your company} handpicked you! Hi {first name}, Thanks for being a long-time {your company} customer! I’m trying to learn more about how our customers use {your product} and since you’ve been such an amazing customer, I was wondering if you’d be interested in helping? Could you spare 15 minutes for a quick call to answer a few questions? We’ll take 10% off your next bill in exchange for your time. You can grab a time on my calendar here {link}. Hope to hear from you soon! {signature} |

You don’t have to give 10% off, or any discount. But if you can offer them something in exchange for doing the interview, you’ll get more people to opt in.

Also, always include a link to schedule a time for the call with something like Calendly or Doodle. That way, it’s super simple for them to set it up.

Then, start gathering the feedback and organizing it in a spreadsheet. Look for trends you can use to improve the LTV of your other customers.

For instance, if you notice most of these customers come from a specific channel (SEO, Google Ads, email, etc.), then you know to invest more in those channels.

Or maybe most of them use a specific feature of your product. You can start marketing that feature more since customers get the most value from it. The interviews can be a huge helping hand in how you develop and market your product going forward.

Compare lifetime value by customer segment

You’re probably starting to notice a trend here. Looking at your LTV as a single number is nice, giving you a 10,000-foot view. But to make it more actionable, you need to break it down into smaller groups so you can identify trends.

Because all customers are not created equal.

You need to know what the LTV is of each major customer segment. For SaaS companies, that’s usually the various price points you offer.

Joe's LTV on your $30/mo plan will almost certainly be a fraction of Sally's LTV on your $200/mo plan—and not just because $200 is more than $30.

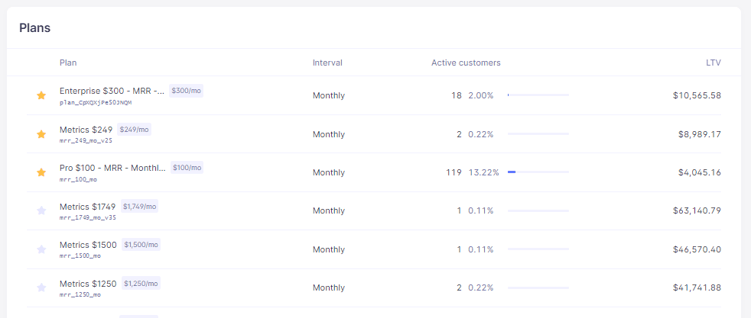

You can see your LTV by plan level in Baremetrics.

Baremetrics Dashboard view of LTV by plan

Baremetrics Dashboard view of LTV by plan

As you can see here, there’s a pretty obvious trend. Despite having the most customers, our lowest plans have significantly less LTV.

This is pretty common for SaaS companies. Customers on lower-priced plans tend to churn more and pay less. Customers on our higher-priced plans tend to stick around longer and generate more revenue for us.

Using that data, it’s clear that it’s worth our time to figure out how to get mid-large customers.

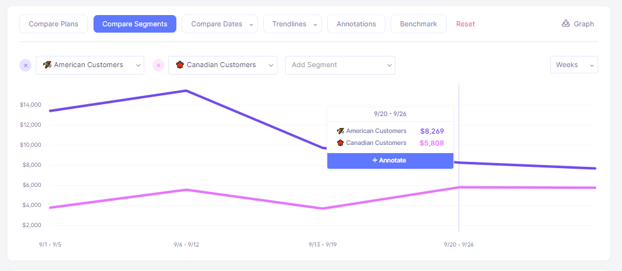

Pricing plans are only one way to segment your customers though. In Baremetrics, you can create segments based on location, acquisition source, when they signed up and tons of other criteria.

For instance, we can compare the LTV of our US and Canadian customers.

Segmentation of LTV by Customer GEO

Segmentation of LTV by Customer GEO

As you can probably tell, you can get nerdy here and slice the data in many different ways.

However, the focus should be on identifying which segments have the highest LTV so that more customers like them can be acquired.

Reduce your overall churn

If you look back at the customer lifetime value formula, you’ll notice it’s a function of two things:

- How much money customers spend with you

- How long they remain customers

So, the longer you can keep your customers paying you, the better your chances of increasing your average customer lifetime value.

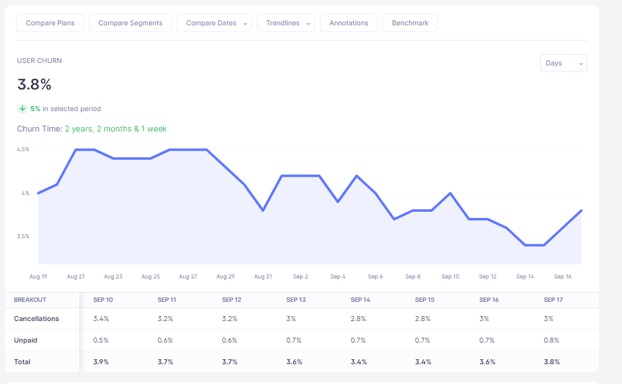

For this, we need to look at user churn time. How long do customers stay with you before they cancel?

User Churn metric inside Baremetrics

User Churn metric inside Baremetrics

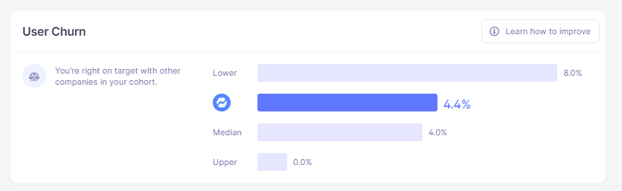

The first thing to note is whether or not your customer churn is high. If you use Baremetrics, a good way to tell how your churn time compares to similar companies is through our Benchmark.

Benchmarks will show you how your metrics compare to companies with a similar average revenue per user (ARPU) as you.

User Churn Benchmark inside Baremetrics

User Churn Benchmark inside Baremetrics

Take note of where you fall in both the user churn and customer lifetime value benchmarks. If you’re in the lower quartile for both, then there’s a good chance your churn rate is probably a problem.

Luckily, we’ve written a ton of articles about how to reduce churn and improve your retention rate:

- 6 Proven Strategies to Reduce Churn (With Real Examples)

- Three-Step Guide to Analyzing Customer Churn

- Customer Churn: How to Calculate & Reduce It

- 5 Ways to Prevent Involuntary Churn in SaaS

- What is Negative Churn? (And How to Achieve it)

- How to Use Cohort Analysis to Reduce Churn & Improve Retention

Between all those resources, you should be well on your way to lowering your customer churn in no time!

Increase your ARPU

Now, let’s talk about the second part of the lifetime value equation—revenue per user.

Since churn is inevitable, you don’t want to rely solely on reducing that percentage. You also need to figure out how to get more revenue per customer. Like you saw in the example I gave earlier, customers who pay less tend to have a lower LTV than higher paying customers.

Keeping things simple, the two main ways to increase ARPU are:

- Raising your prices

- Expansion revenue

I know raising prices is a touchy subject for a lot of founders. But the reality is pricing your product too low is a good way to stunt your growth.

You’ll have to do a good amount of testing before you make any dramatic changes to your SaaS pricing, but it’s something worth looking into if your growth has been at a standstill for a while, and your LTV isn’t growing.

The second tactic is a little less scary. Customer expansion is all about increasing the revenue you earn from existing customers through:

- Upgrading them to higher priced plans

- Cross-selling complementary products

- Offering add-ons to improve their current subscription

If you’re interested in learning more (and I highly suggest you do), I wrote an entire guide about customer expansion: How to Use Customer Expansion to Skyrocket Growth

Set a customer lifetime value goal

I saved this one for last because if I had put it first you probably would’ve scrolled right past it! But stick with me for a second.

If you’re a person who likes to work towards something actively, setting goals can be very motivational. Goals force you to create a strategy to achieve them. So, just by setting a goal, you’re planting the seeds to take action.

You can set a goal right inside of Baremetrics.

When you set goals, make sure there’s some logic behind them rather than just picking arbitrary numbers.

A good way to do this is to look at your historical numbers. For instance, here’s a look at our LTV over the past 24 months compared to today.

Comparison Trendline inside Baremetrics

We can see that it’s fallen by 25% in 12 months, and all the changes have generally been within 20% over the past 24 months. So, setting a goal to increase it by 50% in the next two months probably wouldn’t be very reasonable.

However, a goal to get it up 10% each month would be more in line with what’s possible.

What’s your customer lifetime value?

Lifetime value is more than just another SaaS metric. It says a lot about how your product is priced and how much value customers get from your product.

It’s important to not only track it, but also analyze it so you can improve it.

If you have no idea what your company’s LTV is, or you don’t have a tool that allows you to do the level of analysis I went over, don't worry.

Ditch the spreadsheets and get a free trial of Baremetrics to get started.

Summary

-

Knowing Your Customer's Value Matters: Understanding how much your customers are worth over time is crucial for any subscription service and how it can guide smarter business decisions.

-

Easy Guide to Calculating Value: We've shown you a simple way to calculate what each customer brings to your business financially using basic math. No finance degree is needed!

-

Learn from Your Best Customers: Discover the benefits of talking to your most valuable customers to learn what keeps them coming back and how you can use this information to boost satisfaction across the board.

-

Spend Smarter, Not Harder: Learn why knowing what a customer is worth helps you make better choices on how much to spend to attract new ones.

-

Tools That Help: Learn how automated tools like Baremetrics save hours of spreadsheet work and take the guesswork out of tracking customer lifetime value.

FAQ's

-

How is LTV calculated and what formula is used?

LTV is calculated using churn rate and average revenue per user. The formula is:

Customer lifetime value formula - LTV Formula

LTV = ARPU (average monthly recurring revenue per user) × Customer Lifetime -

What is Customer Lifetime Value (CLTV) and why is it important for SaaS companies?

Customer Lifetime Value (CLTV) is a metric that quantifies the total worth of a customer to a SaaS company over the entire duration of their relationship.

In other words, the higher the customer lifetime value, the more valuable they are to the SaaS company.

Conducting a lifetime value analysis can help SaaS businesses easily identify their high-value clients.

-

What is the difference between CLV, CLTV, and LTV?

They can be used interchangeably. CLV, CLTV (Customer Lifetime Value), and LTV (Lifetime Value) all refer to the predicted net profit a company can expect to generate from a customer throughout their entire relationship with the business.

The CLTV formula, the CLV formula, and the LTV formula are all the same.

-

What is the best customer lifetime value?

The best customer lifetime value varies depending on the business model, industry, and individual goals.

Calculating LTV is necessary to determining your CAC budget, and its components ARPU and churn are used in many of your growth metrics.

-

Can we predict customer lifetime value?

Yes, customer lifetime value can be calculated using various methods such as historical data analysis, cohort analysis, and predictive modeling. -

How to reduce Time to value in SaaS?

Focus on streamlining the onboarding process, providing clear and intuitive user interfaces, offering robust documentation and training resources, and ensuring prompt customer support. -

Why is time to value so important?

Time to value is crucial because it determines how quickly customers can experience the benefits and value promised by a product or service. This encourages engagement and positive word of mouth, among other benefits.

In other words, time to value measures how quickly users hit their "aha moment" in your product, which is why your trial onboarding should solve the user's core problem as fast as possible.

-

What is the difference between time to market and time to value?

Time to market refers to the duration it takes for a product or service to be developed, tested, and launched into the market. Time to value emphasizes the duration it takes for customers to derive value and achieve their desired outcomes after adopting a product or service.