Table of Contents

Key takeaways:

- Dunning management is an essential part of reducing churn and improving both user and revenue retention

- Dunning processes help you prevent churn due to expired credit cards or other failed payments

- Dunning tools like Baremetrics help you identify failed payments before they happen, improving revenue recovery and preventing accidental churn

Churn can undoubtedly limit the growth of a SaaS or subscription business. It’s often much more costly to acquire new customers than retain existing ones, so reducing churn as much as possible is important to scale. Luckily, tackling involuntary churn can be an easy win for many companies.

Dunning is a great, low-effort way to reduce churn, particularly SaaS churn. By proactively identifying and recovering failed customer payments, you can resolve issues before they lead to subscription cancellations. This is essential for maintaining and growing consistent revenue over the long term and inching closer to that dream goal of negative churn.

In this guide, we’ll discuss the importance of dunning and pre-dunning for SaaS companies and give you other tips for implementing an effective dunning process.

Dunning Explained

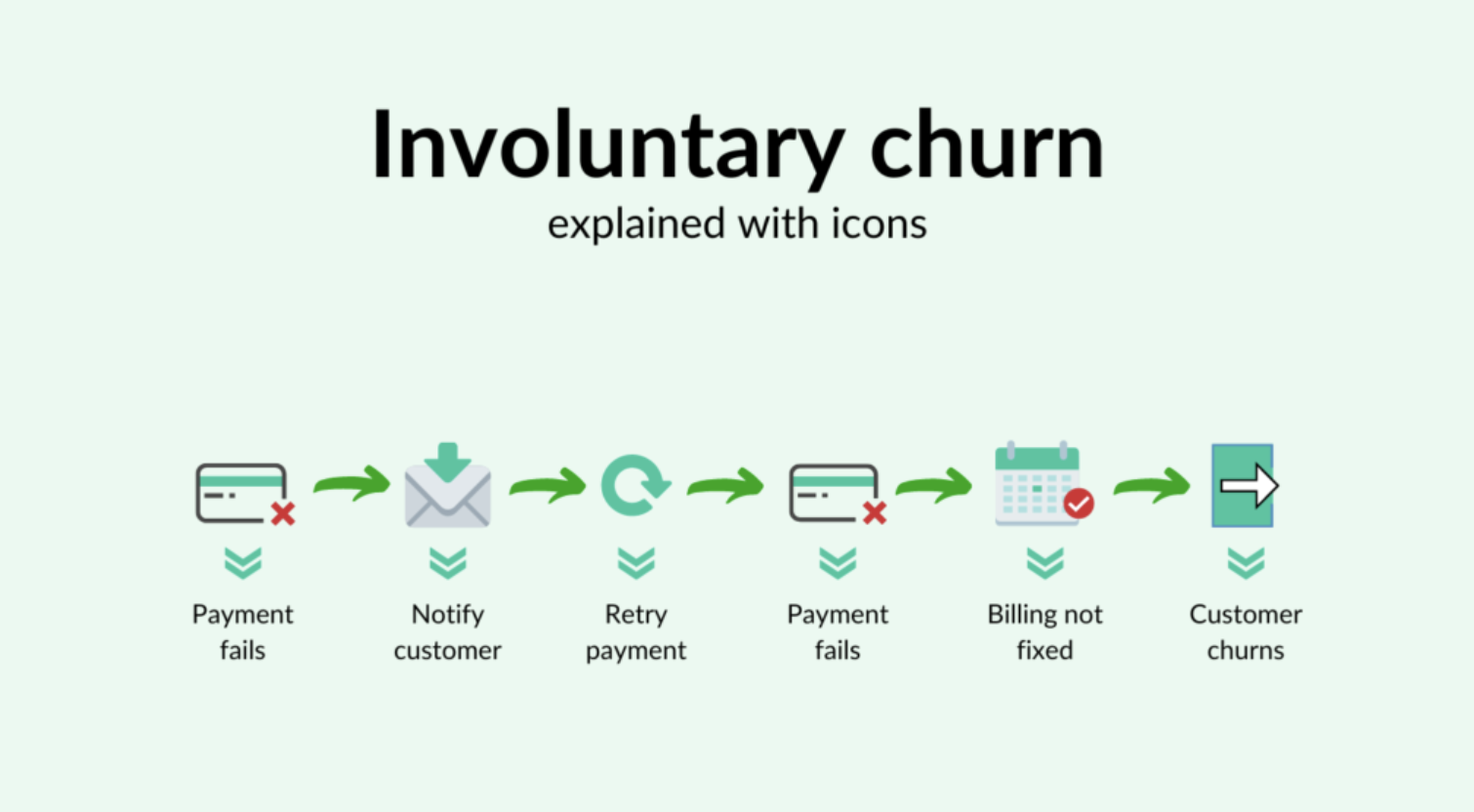

Dunning is a process used by businesses to recover failed payments from customers. Payments can fail due to insufficient funds, incorrect billing information, an expired credit card, and many other reasons. Dunning involves preventing failed payments beforehand and resolving payment issues after they occur improving churn-based LTV metrics and revenue retention.

Dunning management is particularly important for SaaS companies as one of the primary advantages of a subscription model is recurring revenue. However, failed payments and subsequent involuntary churn can negatively impact monthly recurring revenue (MRR).

How Dunning Reduces Churn & Improves Revenue Recovery

Reducing churn is an important goal for many large SaaS companies and startups. By implementing an effective dunning process, companies can identify failed payments and resolve them before they lead to customer cancellations.

Involuntary churn usually occurs because companies aren’t proactively recovering failed payments. We’ve found that SaaS and subscription companies lose an average of around 9% of monthly recurring revenue (MRR). Dunning is a great way to reduce churn and increase revenue for enterprise companies and startups.

Unsure of how involuntary churn is impacting your SaaS business? Check out our resources on calculating churn and analyzing churn to learn more.

6 Dunning Management Best Practices to Improve Revenue Retention

Ready to use dunning management to identify users at risk for churn and ideally reduce both customer and revenue churn?

1. Perfect Your Pre-Dunning Process

Before we get into tips for optimizing the dunning process itself, there are also ways to prevent the need for dunning, which is often called pre-dunning.

So, what is pre-dunning?

Pre-dunning is a way to warn customers about expiring credit cards and other things that could lead to a failed payment or involuntary churn.

This is an efficient way to reduce churn, as you prevent issues before they occur.

Involuntary churn doesn’t happen overnight, but if you’re not paying attention, it can seriously impact your revenue.

We recommend automatically sending customers a heads-up 30 days before their credit card expires so they have plenty of time to update their information.

2. Develop Effective Dunning Emails

Dunning has a bad rap because it’s often implemented with boring and generic email blasts. These emails typically have poor results because they look like spam, and customers won’t take action or even open them.

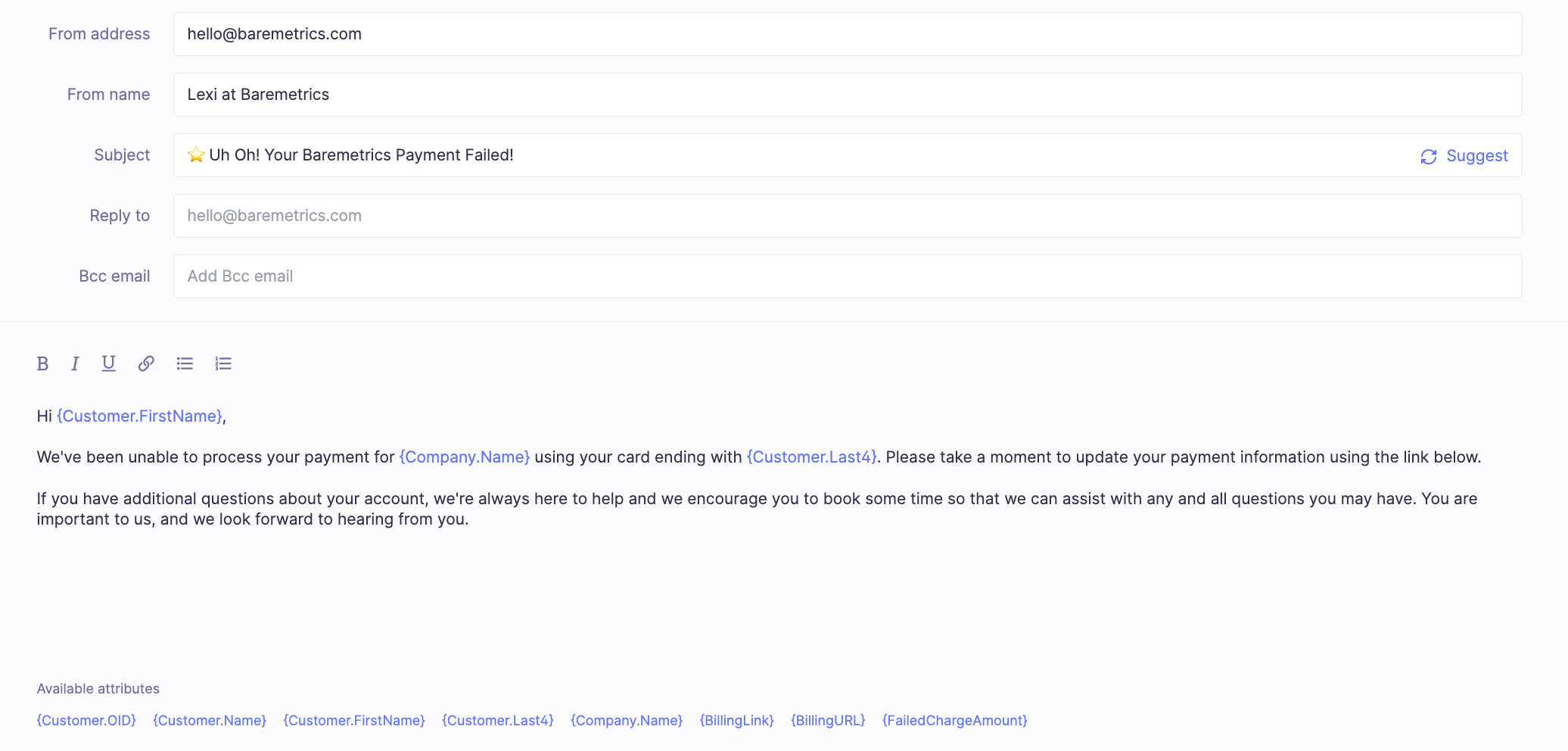

An effective dunning process requires writing compelling dunning emails that encourage customers to update their payment information. A simple way to do so is by using a tool like Recover. It offers nearly a dozen turn-key templates you can use to craft effective dunning email sequences in just a few clicks. Here is an example of customizable emails in Recover::

Customizable emails in Recover

3. Automate Dunning Emails

Although we recommend customizing dunning emails, sending them can (and should) still be automated. While many credit card processors like Stripe send a limited number of emails, you’ll need more extensive custom email campaigns to build an effective dunning process. This requires automation to scale.

The best approach for recovery is a series of automated dunning emails spaced out during the days and weeks after a failed payment. Recover makes it easy to set up and automate customer email campaigns so you can immediately begin recovering revenue. You can also track the effectiveness of each email to optimize this process even further.

4. Optimize Billing Capture Tools

A simple but often overlooked aspect of dunning is collecting accurate payment information. If there’s any friction when it comes to entering payment information, customers might be slow to provide an update when necessary. You can eliminate many failed payments due to incorrect credit card data by improving your billing capture forms.

Using a tool to customize credit card capture forms to match your company branding can help improve your recovery rate. Combining this with in-app paywalls ensures customers have a seamless payment experience, which can also help reduce failed payments.

5. Track & Use Your Data

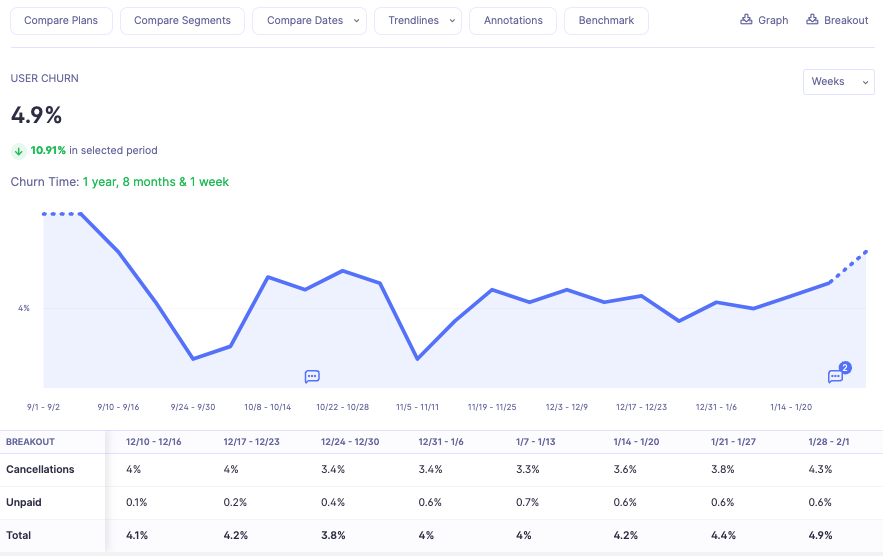

Tracking customer and billing metrics is a great way to see if your dunning process works and how it can be improved. For example, an analytics dashboard that tracks metrics such as customer churn and recurring revenue helps you see if you’re trending in the right direction.

User churn dashboard in Baremetrics.

You can also track in-depth information about customers to uncover any failed payments or other transaction issues. And by surveying customers during cancellation, you can discover whether they left voluntarily or because of a simple mistake. These insights allow you to take a data-driven approach to optimizing your dunning process.

6. Use a Dunning Management Tool

Since failed payments can significantly impact MRR, every SaaS and subscription business should use a dunning management tool. This is the best way to ensure you’re taking action to overcome failed payments and involuntary churn.

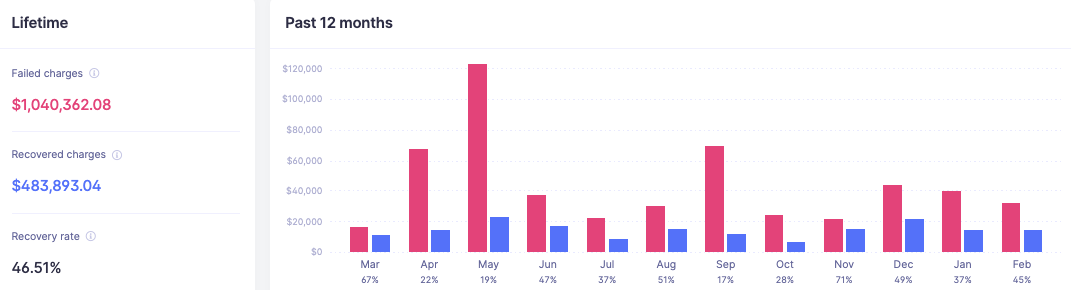

For example, Baremetrics Recover is an automated dunning solution that goes beyond other dunning management platforms by offering customizable email campaigns, in-app reminders and paywalls, and other tactics for combating failed payments.

Besides Recover, the Baremetrics analytics platform itself allows you to track the results of your dunning efforts as well.

Keep your hard-earned revenue with Recover by Baremetrics.

Improve Revenue Recovery With Baremetrics

As you can see, dunning is essential for SaaS businesses of all sizes. By following the dunning best practices outlined above, you’ll be able to improve your dunning process, dramatically reduce involuntary churn, and grow your SaaS business.

Baremetrics Recover allows you to put dunning on autopilot reducing both gross and net churn. If you’re already using Baremetrics for analytics, all you have to do is enable Recover in your dashboard to begin recovering revenue. You can then optimize Recover by setting up automated drip campaigns, implementing in-app paywalls, and tracking everything along the way.

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!