Table of Contents

Revenue Churn: Assess Lost Profit

Revenue churn measures the amount of lost gross revenue over a specific period. In most contexts, revenue means Monthly Recurring Revenue (MRR) — the revenue your business expects to receive over 30 days.

Example: Your company has 90 customers who pay $1 a month for a subscription and 10 customers who pay $100 a month for a subscription. (Your MRR is $1,090)

- If your company loses 10 of the existing customers who pay $1 a month, your customer churn rate is 10 percent, and your revenue churn rate is 1 percent.

- If your company loses one customer who pays $100 a month, your customer churn rate is 1 percent, and your revenue churn rate is 10 percent.

Are you concerned about accurately analyzing your churn metrics? Baremetrics is the leading metrics dashboard for data-driven SaaS businesses, offering valuable churn insights to inform your next decisions.

How to Calculate Customer Churn vs. Revenue Churn

Calculating customer churn vs. revenue churn lets subscription and SaaS companies like yours compare churn from month to month.

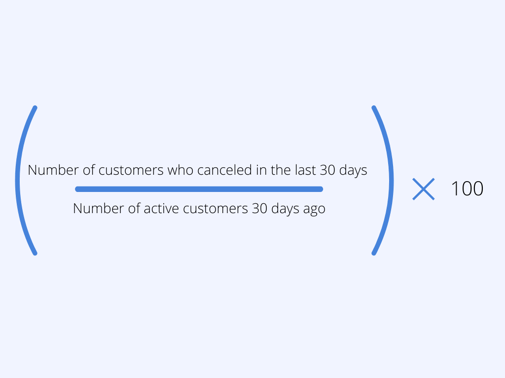

Monthly Customer Churn Calculation

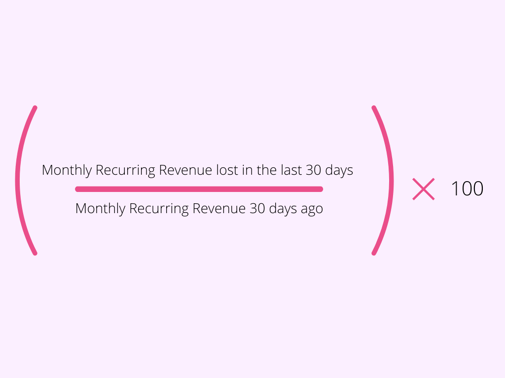

Monthly Revenue Churn Calculation

Keep in mind you can also track both gross and net revenue churn, too.

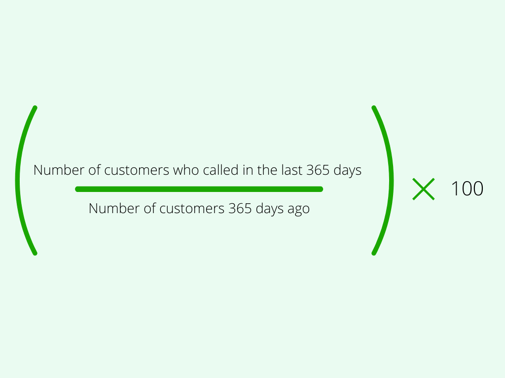

Calculating Annual Churned Customers

You can also compare customer churn every year.

There are multiple churn metrics— these are just a few. Calculating churn is different depending on the metric, and it’s also important to know how to use different metrics like LTV to assess churn.

Read more: What is Net Revenue Churn? (And How Does It Impact Your Business?)

Which Churn Metrics Should Subscription Businesses Use?

Understanding customer and revenue churn is critical because both metrics provide value.

Simply put, using both metrics tells you how many customers have left your business and how much money these customers took with them.

How to Prevent Customer Churn and Revenue Churn

You can prevent churn by identifying key insights you need to make profitable decisions that propel the business forward. Baremetrics generates daily, weekly, or monthly email reports with the following metric benchmarks:

- MRR for the given period

- New MRR added in the last seven days

- Annual Run Rate (ARR)

- The average total revenue per user

- Lifetime value for subscribers

- New, canceled, upgraded, and downgraded accounts

Tracking subscription and SaaS metrics helps you:

- Identify new and long-standing customers at-risk of churn

- Improve retention rates and attrition

- Increase customer lifetime value

- Identify new revenue sources and pricing and upsell solutions that reduce churn

- Improve customer success

In particular, Recover by Baremetrics keeps track of when customers’ credit cards are due to expire so you can contact customers and encourage them to update their card details. This way, customers never miss a payment.

Recover from Baremetrics is a simple way to prevent customers on monthly and annual subscription plans from churning, making it an invaluable tool for your business. Try it free.

Traci Accurate Churn Metrics with Baremetrics

Tracking customer churn and revenue churn provides your business unparalleled insights into how your customer base behaves. Using both metrics tells you:

- The number of long-standing and new customers who have become delinquent

- How much money these customers took from your business.

Daily, weekly, and monthly reports and Recover from Baremetrics are two features of many that help prevent customers from churning in the first place.

Identify what’s happening today and make changes that promote growth with Baremetrics, the leading metrics dashboard for your subscription or SaaS business. Start your free trial today!

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!