Table of Contents

As a SaaS founder, you know that customer churn has the greatest negative impact on your business.

You could continue iterating your onboarding flows, discover new acquisition channels, or even contact customers directly to ask for feedback. But nothing you do will matter until you improve your churn.

Fortunately, there are some easy wins. The easiest kind of churn to improve is involuntary churn.

Involuntary churn (when a customer churns because of failed payments due to an expired credit card) is the churn that will slowly eat away at your business if not addressed.

That’s why Baremetrics Recover exists: to eliminate your pesky failed payments without the hassle of traditional accounts receivable tactics or lack thereof (more on this later).

In this article, we’ll cover how to eliminate involuntary churn, how to get the most out of using Baremetrics Recover, and why it’s the best solution.

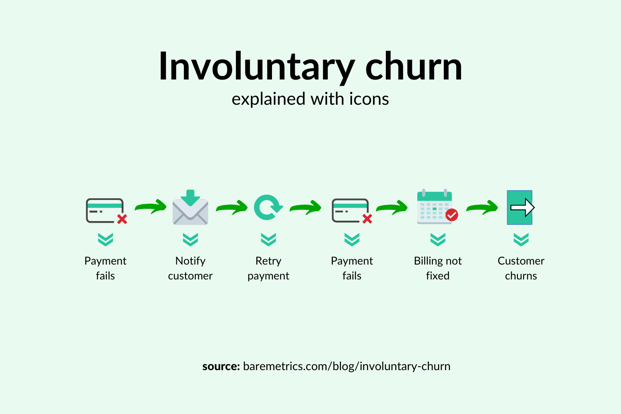

What is Involuntary Churn?

Involuntary or passive churn occurs when a customer’s account ends unintentionally.

This can result from the customer’s payment method failing and never being resolved. After a certain amount of time without payment, their subscription doesn’t renew, which results in churn.

On average, 10% of the churn your company experiences month after month occurs due to involuntary churn. Yes, you heard that right: 10% of the revenue that any given SaaS company is bound to lose… can be avoided.

This is a huge missed opportunity in your company (that most don’t take the time to tackle).

Customers who churned involuntarily aren’t necessarily disappointed with your product, unlike those who canceled themselves. They usually have a billing error that is easy to fix.

How do we suggest combating involuntary churn? Here are the four common ways companies are handling it today:

- Manually retry credit cards on file

- Email customers before cards expire

- Reach out to each individual yourself

- Send renewal reminders for annual plans

Or, instead of running these processes manually, you can use Recover (wink, wink) to communicate directly with your customers and resolve their expired credit cards.

Before you go tackling involuntary churn, it’s necessary to lay some groundwork to help you best understand the two processes at play when dealing with it:

- Accounts receivable

- Dunning

Accounts Receivable and Dunning

Accounts receivable refer to any outstanding invoices or money customers owe your company. They differ from account payables in that they are money that your company is obligated to receive for goods or services.

How you approach AR for your SaaS will depend on which of the following buckets you fall in:

Bucket #1: Your customers pay mostly via credit card

Bucket #2: Your customers pay mostly via ACH (with an itemized invoice involved)

Bucket #3: A mix of 1 and 2

For SaaS companies dealing with large enterprise contracts, their AR process will involve a mix of customer outreach and resolving some failed credit card payments. Most enterprise contracts will be paid annually via ACH transfer (instead of a credit card).

A quick side note on ACH payments:

- ACH stands for “automated clearing house” which is a fancy way of saying “direct payments”. ACH payments are a way to transfer money from one bank account to another without using paper checks, credit card networks, wire transfers, or cash.

- ACH has grown in popularity because it is faster and more reliable than paper checks. Also, ACH payments cost far less to process than credit card payments. This is why companies will opt for customers to pay larger invoices via ACH.

If you find yourself in bucket #1 (as the majority of SaaS companies do), the AR process you should utilize is known as dunning. Dunning is the process of sending emails to your customers who have tried to pay but whose payments have failed for some reason.

Dunning is similar to traditional Accounts Receivable in that it deals with money your company is owed. However, it specifically deals with recovering your customers’ failed payments.

Now that we’ve covered those terms, it’s time to get real.

Hot Take: Regardless of your bucket, every SaaS company should invest in a dunning process.

If you run a SaaS company you need a dunning process because the majority of your customers do pay via credit card. Period. Having a dunning process in place ensures that you don’t continuously leave money on the table.

Baremetric’s Recover: Here’s what you need to know

When it comes to your involuntary churn and receivables, there’s no more need to do manual work, spend all your time chasing one unpaid customer, or, even worse, have zero visibility into what’s going on with customer payments.

There’s a better way and it starts with Baremetrics Recover. Here are five things you need to know about getting the most out of Recover:

Easy setup in your Baremetrics Dashboard

Generally speaking, the easier something is to do, the more likely people are to do it. In this case, setting up Recover in your Baremetrics dashboard and updating billing information is as easy as it gets.

Already set up with our metrics? Perfect. Integrations with your payment processor will already be set up with your core Baremetrics account. Click to enable the Recover add-on to start your dunning email sequence.

Automated and personalized drip campaigns

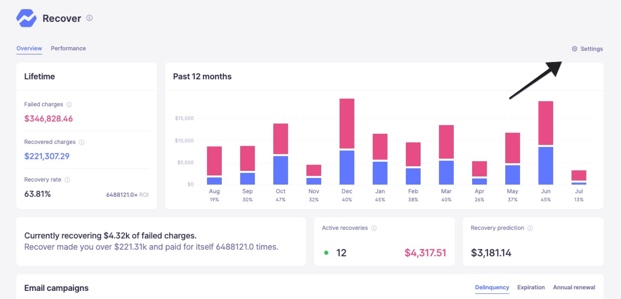

Once you’ve added the Recover add-on to your dashboard, click the Settings icon at the top right corner to begin customizing your dunning campaign.

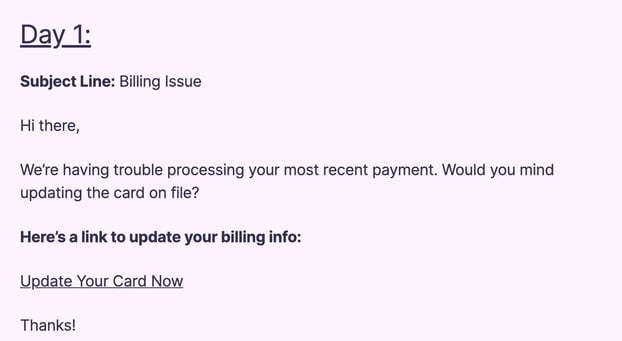

One of the biggest mistakes you can make with your dunning campaigns is to send a single email and hope for the best. People put things off, emails get overlooked, and life happens. If you want to recover more revenue from failed payments, you have to be persistent.

With Baremetrics Recover, you’ll have access to a series of customized and automated emails that will be sent at different points over 30 days.

Here, you can schedule six emails to drip to your customers:

There are two key differences between each of the emails we suggest:

1. How late the payment is

2. What’ll happen if payment isn’t made

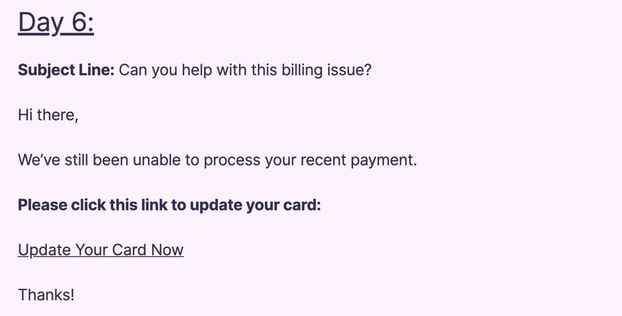

Here is an example of an email sent one day after a payment failed vs. six days after:

In Baremetrics Recover, your email series will span 30 days, but you have full control of what each says and when it is sent. Notice that the emails are spaced apart to avoid bombarding the customer every day. Additionally, the wording changes depending on the number of days it’s been.

If you’re sending a sequence of dunning emails, make sure you’re measuring the success of each one. That way, you know what’s working and what’s not.

For instance, we track the performance of each dunning email we send, making it easy to see where we can improve.

Plus, doing so will allow you to quantify the impact of each email in your dunning campaign.

1. Billing URL

You’ll have the option to choose where the customers will be sent when needing to update their credit card information. The {BillingURL} is the URL customers will land on when they click the link in Recover emails.

In your settings, you can choose between either a Baremetrics-hosted URL or your billing page.

2. Email Visual Style

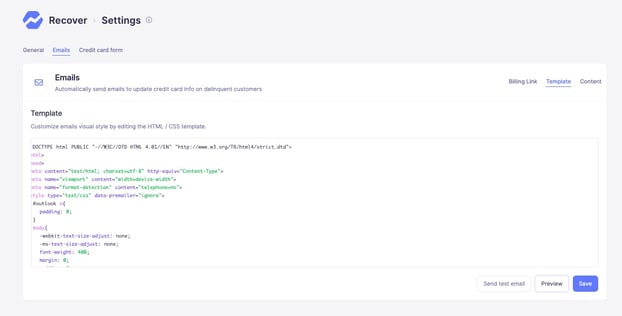

If you want to get even fancier, you can edit the visual style of your emails by editing the HTML / CSS template. To access, go to Recover → Settings → Emails → Template to find the code that will already be saved.

3. Email Content

Finally, you can fully customize the content that will be sent to each of your customers based on the delinquency cadence pre-set in your dashboard. As well, you can customize based on name, plan size, and other attributes associated with your customer’s profile.

To access, go to the ‘Content’ tab within your Emails setting in Recover. Under each email template, you can input different attributes you want to be included.

From there, you can send test emails, preview what it will look like once sent to a customer, and manage which email sequence is live.

In-app reminders and paywalls

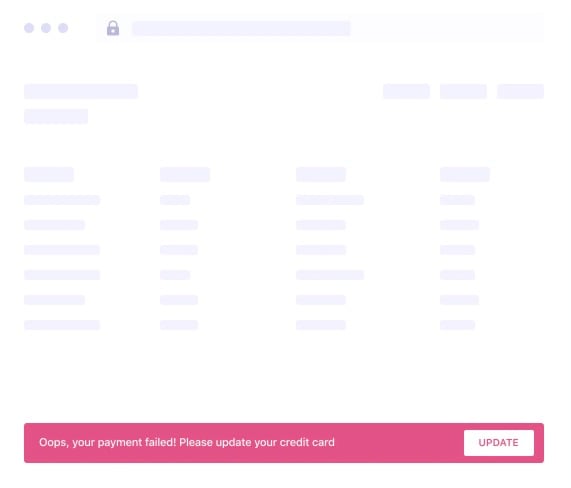

Dunning emails are very effective for recovering failed payments. But you can double down by including in-app reminders for customers to update their billing information.

You can set this up in Recover so that when customers log in to your software, they’ll see a pop-up asking them to update their billing information.

With Recover, you can take it a step further with our in-app callout message:

To do so, copy and paste our JavaScript code snippet and choose how many days you want users to have access before enabling the paywall to force a payment method update. You can find these settings by going to Recover → Settings → Credit Card form → callout.

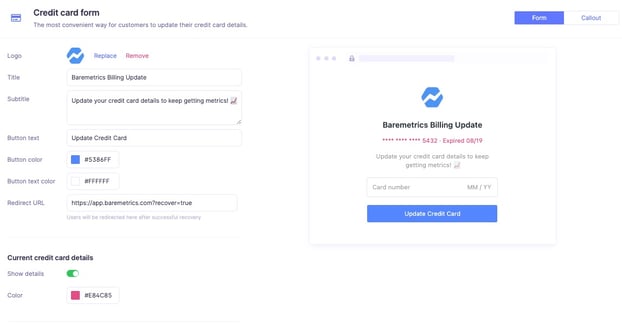

Customized credit card capture form

Another feature that works hand in hand with the in-app paywalls is our credit card capture forms.

Here, you can customize the form to be on-brand for your company. This includes your logo, title, CTA, colors, and URL.

If you would like to use our embedded widget on your website, scroll down to the bottom of the credit card form page and use the code. Load the embed script everywhere on your website where you would like it to appear.

NOTE: Leave everything as is except for the CUSTOMER_ID, which you should programmatically replace with each user’s unique customer number given by your payment provider.

Access to detailed insights

Arguably, Recover's best feature (besides fixing your failed payments, of course) is the detailed insights it offers.

Similar to the Baremetrics home dashboard, you will be able to see an overview of Recover’s performance over its lifetime and the past 12 months.

The image below shows that $345,828.66 was lost due to failed credit card payments. However, $221,307.29 was recovered using Baremetrics Recover. That’s a lot of money saved!

Additional metrics that you can find in your Recover dashboards are:

- Recovery rate

- Number of Failed Charges

- Failed Payment reasons

- Number of emails sent

- Email open rate

- Email bounce rate

- Average delinquency length (in days)

From automating an email sequence to tracking campaigns and creating a customized experience for your customers, Recover makes managing your dunning simpler than ever. And don’t forget, you can save thousands of dollars in revenue churn while you’re at it.

Even if you think, “I only have 100 customers, is it worth paying for?” The answer is yes!

Stripe Dunning vs. Baremetrics’ Recover

Awesome — now that you’re sold on needing a dunning process to tackle your involuntary churn, it’s time to talk dunning solutions. You may be thinking, “Since my company uses Stripe, I’ll just use their dunning tool.”

Tempting as that is, it’s not the best move for someone looking to end their churn, and here’s why:

- Stripe is a fantastic online payment provider. However, It can be difficult to implement without at least some Stripe expertise on the team. The same goes for its dunning solution. Its UI is complex to the point that it’s difficult to find where everything actually is.

- Stripe Smart Retries are convenient and allow you to send an email each time a payment fails or before an annual renewal. But you can’t add in more emails, fully customize the design of those emails, or account for in-app reminders and paywalls. Not to mention, you’d have to code up your custom credit card capture form, too.

Stripe provides the basics for processing your payments, but growing SaaS & subscription companies upgrade to Baremetrics Recover for more depth and accuracy when managing their dunning.

We love and respect the team at Stripe tremendously, but there’s also a reason why we exist.

Reduce Involuntary Churn Today

Your business's goal is to grow revenue month after month. With involuntary churn, that goal becomes very hard to achieve.

Going with a tool like Baremetrics Recover gives you a competitive advantage that most businesses choose to ignore. Not to mention, Recover pays for itself 38× over, so what are you waiting for?

It’s a no-brainer.

We’re so confident that you’ll love using Recover and its positive ROI for your company that we’ll let you try It completely for free, no strings attached, for 14 days. To me, this sounds like a win-win (and by win-win, I mean you-win)!

To start recovering failed payments for your business, sign up for Baremetrics Recover today.