Table of Contents

Key takeaways:

- There are a variety of reasons why Stripe customers may churn, including accidental reasons like expired credit cards or billing addresses that customers haven’t updated

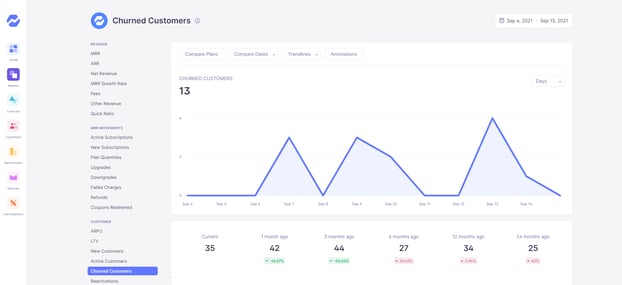

- While Stripe’s reporting dashboard is limited, integrating with Baremetrics allows users to get detailed insights on causes of customer churn

- By understanding churn causes with detailed analytics, you can take proactive measures to re-engage users and prevent accidental churn before it happens

Churn is the share of your customer base that has stopped using your service over a defined period of time. It is usually measured per month. Churn can be calculated in two ways, namely customer churn and revenue churn, and there are good reasons to calculate both.

Churn is an essential metric because it helps you calculate your customer lifetime value (LTV), forecast your MRR, and therefore budget how much you can safely spend on customer acquisition costs (CAC) while maintaining profitability.

When you use Stripe, it can be hard to calculate customer churn as well as many other metrics on their limited analytics dashboard. While Stripe is an amazing payment processor and can help any SaaS business, you can only get the most out of their tools with a third-party analytics dashboard. That’s where Baremetrics becomes essential—you can use Baremetrics to automatically calculate churn for Stripe customers.

Baremetrics monitors subscription revenue for businesses that bring in revenue through subscription-based services. Baremetrics can integrate directly with your payment gateway, including Stripe, and pull information about your customers and their behavior into a crystal-clear dashboard.

Baremetrics offers metrics, dunning, engagement tools, and customer insights. It monitors MRR, ARR, LTV, the total number of customers, total expenses, quick ratio, and more.

Sign up for the Baremetrics free trial and start managing your subscription business right.

Calculating customer churn?

Customer churn is simply the percentage of customers that have quit your service over a set period of time:

Customer churn rate (%) = (Customers that churned over a period of time/Customers at the start of that time period) × 100

This shows you how quickly you are losing contracts month on month. For example, if you have 500 customers and lose 10 customers per month, then your customer churn is 10/500 × 100 = 2%.

What causes customer churn

Customer churn can be separated into two main types: voluntary churn and involuntary churn.

Voluntary churn is a regrettable fact of life. Some customers will choose to quit your service. Cancellation Insights can help you pinpoint why a customer has chosen to leave your platform, in hopes of preventing others from leaving for the same reason and win-back those customers you have lost. This said, it is unrealistic to believe that no one will ever want to leave your service.

Involuntary churn, however, is absolutely frustrating and can be stomped out with enough effort. This situation is where a happy customer is kicked off your platform due to some payment failure. In this case, Recover is a fantastic tool to optimize your dunning system.

An obvious question arises here: What causes Stripe payment failures?

Churn for Stripe Customers

If you are using Stripe as your payment processor, which is a great choice by the way, then you might be wondering how your Stripe customers churn due to failed payments. There are four main reasons that Stripe payments fail as well as many rarer secondary reasons.

Expired Credit Card

While it is possible that a customer has just decided not to activate their new credit card, usually this means they haven’t updated their credit card information on Stripe. Frustrating for you of course, but who can blame a customer for not remembering to update their credit card on some sites when the modern company can be using dozens of subscription software packages?

Proactive is the name of the game here—you need Recover to be proactively notifying customers when their credit cards will be expiring soon so that they remember to update their info before the older information no longer works.

Un-updated Billing Address

People move. That’s a fact of life, and most people have left a trail of spam mail addressed to them at every home they have ever lived. It has become a part of modern life to open up your mailbox and toss random sales pitches addressed to the previous 2, 3, or 10 tenants of your home. Unfortunately, with the rise of identity theft, fraud, and money laundering and therefore the need to strictly prevent them, failing to update your billing address for every single subscription you have will lead to failed payments.

Maxed out Credit Card

It can happen to the best of us—a forgotten payment or an unexpected cost can lead to your credit card reaching its limit. In addition to all the fraud checks mentioned above, in all the intricate handshakes among Stripe, payment gateways, customer banks, credit card companies, and merchant accounts, whether the credit limit has been reached is confirmed. If it has been reached, then the payment will fail.

The Card is Reported Stolen

If your customer reports their card as lost or stolen and then tries to use it, either because they find the card and forgot they have already reported it missing or, more likely, because the details are still stored on Stripe, then the payment will fail.

The Other Possible Reasons

From the outside, online payments look pretty simple. This isn’t a mistake—smart shops, payment processors, and everyone else involved in the process are spending billions of dollars researching how best to make the online payment process as seamless as possible.

However, behind the scenes, there are many things going on, often all within a few milliseconds, and each step in the background process can lead to failures. These mysterious errors are often the result of a bad API, and it can take the collective actions of your customer describing the error in the most detail possible, your technical team, and the Stripe technical support to solve the issue.

Luckily, these issues are exceedingly rare, and in most cases involuntary churn for Stripe customers will be the result from some credit card error that can be prevented or corrected by a good dunning system in place. This is another reason why you should use Baremetrics to calculate churn for Stripe customers.

Preventing Churn for Stripe Customers

While Stripe is an amazing payment processor, preventing involuntary churn requires a concerted effort. Here are some of the most effective ways to assess your involuntary churn and then work to minimize it.

Activate Your Dunning Software

When you are looking to reduce churn, dunning management is only a part of the solution. Baremetrics has found that on average MRR is reduced by about 9% by involuntary churn. While that might seem low compared to the total amount of customer churn experienced by the average SaaS company, it is the low hanging fruit which can be recovered with the automated tools provided by Baremetrics.

Execute a Standard Operating Procedure

When looking at your involuntary churn, try to standardize your procedures as much as possible. This starts with automating the presentation of your customer churn information on your Baremetrics’ dashboard. Instituting a proper dunning process is the next step. In addition, don’t forget to make dunning emails a part of your procedure.

Utilize Collections

This approach should be used with caution. You don’t need to spend too much time on Reddit to read story after story complaining about companies sending customers to collections, often for miniscule sums and years after the completion of service—and sometimes due to error for bills that had already been paid!

Given the potential for bad publicity and ruined relationships, consider this a last option and only for use with clients that owe you enough to make it worth risking bad publicity and after all other reasonable efforts have failed.

Failed Payment Recovery Services

This is where Baremetrics comes in. From Cancellation Insights to Recover, Baremetrics can figure out why customers have chosen to leave or get them back when their churn is involuntary. Baremetrics is so confident in the service, that it is free for the first $1000 of recovered payments.

Summary

On your Baremetrics dashboard, you can learn why customers canceled; you can also correlate lost revenue with cancellation reasons. In addition, Baremetrics can capture fresh insights regarding the reason for cancellation,which is why Baremetrics truly offers the best Stripe analytics dashboard. .

With the insights you’ll gather on your dashboard, you’ll understand which missing features are driving your customers away and whether your retention efforts are working. That’s why Baremetrics is the best third-party dashboard for calculating the churn of your Stripe customers, as we’ll automatically import your Stripe billing history and provide detailed insights you couldn’t get from Stripe.

Preventing churn is super important to any company. Most companies even have someone solely dedicated to churn reduction. The reason for churn usually stems from the product, but there are other subtle reasons, including involuntary churn. Keep in mind that the reasons above are just a start, and integrating Stripe with Baremetrics can help you get to the bottom of it.

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!