Table of Contents

Baremetrics offers two powerful features that help you reduce churn and save money: Recover and Cancellation Insights.

Recover is an all-in-one dunning solution that helps prevent failed payments. It offers customizable forms, automated email campaigns, and in-app reminders that engage your customers while analytics track valuable data.

Cancellation Insights shows you why customers cancel, and helps bring them back. The feature calculates lost revenue by cancellation reason, and automates smarter emails to collect actionable feedback.

Both Recover and Cancellation Insights are powerful features, but which one do you need for your business needs?

This article will break down each feature and how they can reduce churn and increase revenue, whether used together or separately.

What is Recover?

Did you know SaaS and subscriptions businesses lose around 9% of their Monthly Recurring Revenue (MRR) due to failed payments?

Recover helps get that revenue back and keep those customers!

It does this by:

- Trying many times, but doing so intelligently.

- Once a customer has been recovered, they are automatically removed from future emails.

- Making it very easy for customers to update their payment information.

- Recover offers a widget for your application which prompts customers to update their payment information as part of their product use. This dramatically increases recovery rates while saving your team coding time.

- We also generate a customizable link if you need to send one to a customer manually.

- Tracking detailed insights on two levels:

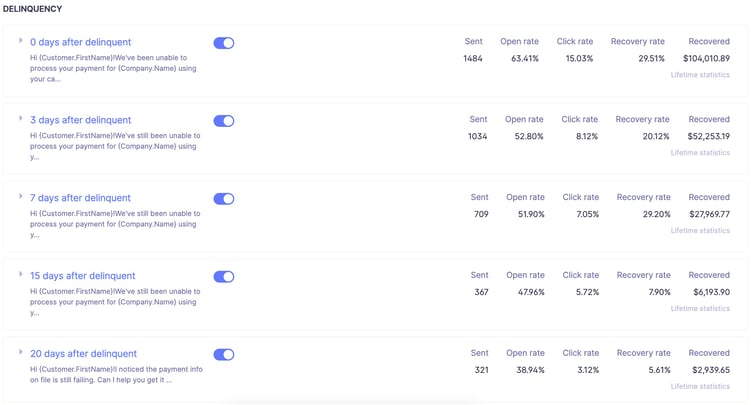

- At the email level so you can optimize your templates and messaging:

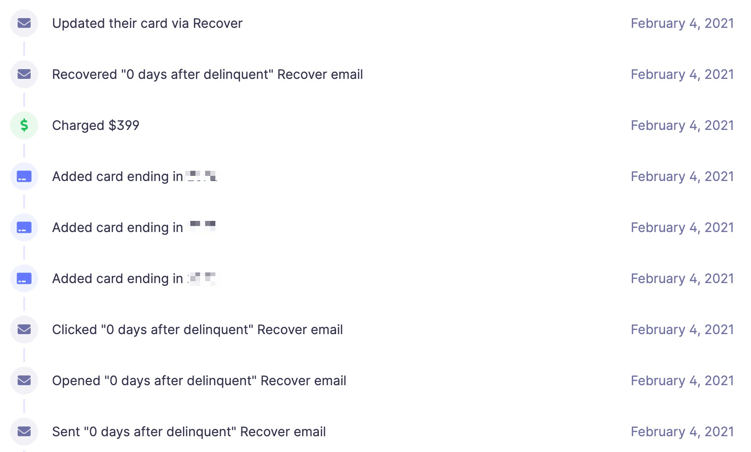

2. On the customer level so you can follow each unique customer journey:

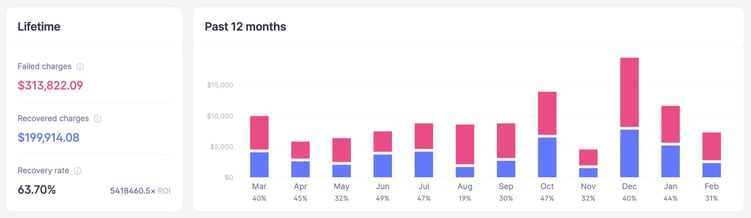

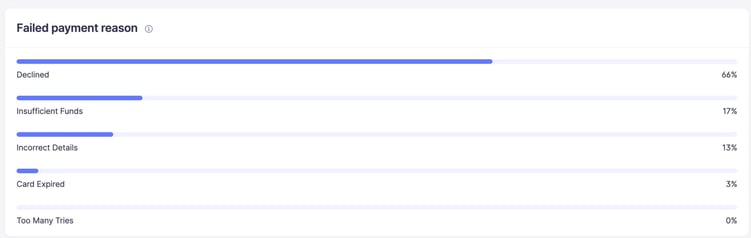

Recover also calculates how much you’ve recovered total and by month, why payments are failing, recovery amount, and recovery rate.

Recovered charges, organized by total and by month.

The reasons why payments are failing.

Recovered amount and recovery rate.

You can think of Recover as a very organized and diligent Accounts Receivable employee that never misses an email and keeps track of everything 🙂

Because we’re so confident that Recover will immediately save you money, we invite you to try Recover for free, no strings attached, for 14 days. Start your free trial today!

What is Cancellation Insights?

To recap, Recover is an amazing tool for saving and preventing failed payments. In other words, it works when when a customer stops using your product involuntarily.

But what about when a customer chooses to leave?

That’s when you need Cancellation Insights!

Cancellation Insights helps you understand the reasons why customers leave. It also quantifies the impact cancellations have on your business, and clarifies areas for improvement.

The first step is easy: integrate our customizable survey into your cancellation flow to start capturing data.

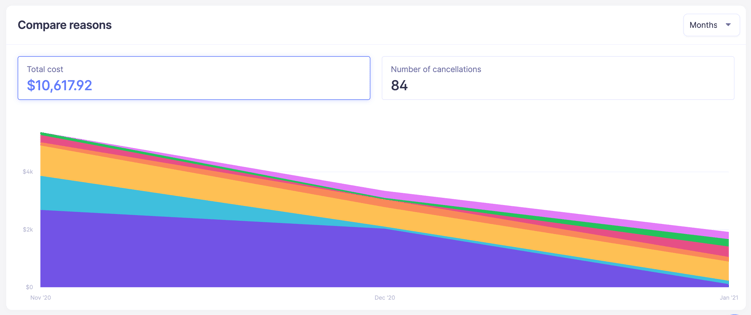

Then, our analytics does its magic! Within minutes, you’ll be able to visualize the change in cancellation volume over time, and put a dollar amount on each cancellation reason.

The below chart was generated by Cancellation Insights. Check out this company’s cancellations organized by reason from November 2020 through January 2021:

We can see a few trends right away:

- Cancellations are decreasing through January

- Cancellations due to “Too Expensive” (light blue) are decreasing

- Cancellations due to “Switching to Another Product” (yellow) are steady

- Cancellations due to “Shutting Down the Company” (green) are increasing

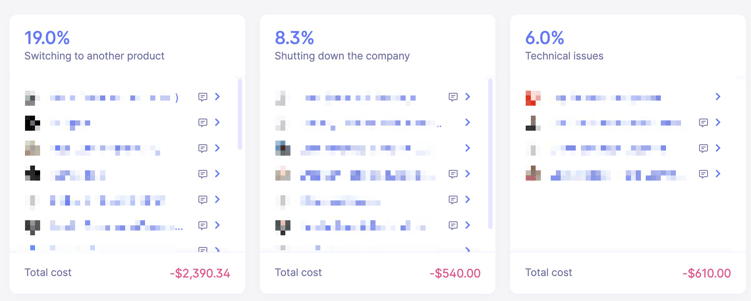

We also track revenue lost by reason, like this:

By providing robust cancellation data, Cancellation Insights helps you make smarter, data driven decisions.

For example, imagine you’re the CEO of a growing software startup. Your sales team wants to focus on building more features to help them sell. Your support team, however, wants to focus on fixing bugs to keep existing customers happy.

By using data uncovered by Cancellation Insights, you can make the right call with confidence.

In the charts above, only $610 in MRR was lost to bugs, but $2,390 in MRR left to competing products. This indicates that this company should prioritize feature development rather than bug fixes.

Conclusion

Every subscription business needs reliable tools for managing churn. Recover and Cancellation Insights by Baremetrics are the solutions you’ve been looking for.

Recover is an all-in-one dunning solution for failed payments. Cancellation Insights optimizes the cancellation flow, helping you save customers and get valuable feedback.

Both features are powerful, but are most impactful when used together as part of the full Baremetrics product.

You can try Baremetrics with Recover and Cancellation Insights free for 14 days. After that, our pricing is based on your business’s MRR.

Start your free trial today, or talk to a member of our team if you have any questions!