Table of Contents

Deciding between Stripe vs. 2Checkout for the best online payment processing solution? Look no further!

Keep reading to learn everything you need to know including features, pricing, reviews, and more!

Stripe vs. 2Checkout: Features

Both Stripe and 2Checkout have a wide array of features that makes them highly competitive options. Let’s jump in!

Stripe Features

The most important Stripe features to know about include:

- Wide Range of Payment Options

- Stripe accepts many different payment types, including MasterCard, Visa, American Express, Discover, and mobile wallets such as Google Pay and Apple Pay.

- With support for more than 135 different types of currencies, Stripe can help you take your business worldwide.

- Rich Developer Toolkit & Integrations

- For users who have the time and the technical skills to invest, Stripe comes with high-tech developer tools such as Stripe Elements, Stripe Sources, and Stripe Connect to customize your organization’s payment processing.

- Thanks to its popularity, Stripe has many different integrations with third-party services—such as Baremetrics, which gives you smarter analytics about your Stripe transactions. Get started with a free trial today!

- Top-notch Customer Support

- Stripe offers free phone, chat, and email support 24/7. For new developers who want to delve into customization options, the platform also includes extensive documentation.

2Checkout Features

In September 2020, 2Checkout was acquired by Verifone, although the company is still operating under its old name for the time being.

The most noteworthy features of 2Checkout include:

- Wide Range of Payment Options

- Like Stripe, 2Checkout has no shortage of payment types, with more than 45 different payment methods, 100 display and billing currencies, and coverage in 200 countries and territories.

- Reporting and Analytics

- 2Checkout includes a commerce dashboard that shares trends and data and about your payment transactions.

- For even deeper knowledge into the most important SaaS metrics, try Recover by Baremetrics today!

- Excellent Privacy and Security

- The 2Checkout platform is PCI Level 1 certified, the highest level of protection available in the PCI DSS payment card standards.

- 2Checkout is also compliant with user privacy regulations such as the European Union’s GDPR.

How Well Do You Know Your Business?

Get deep insights into churn, LTV, MRR and more to grow your business.

Stripe vs. 2Checkout: Pricing

Both Stripe and 2Checkout have many awesome features, but how does their pricing compare?

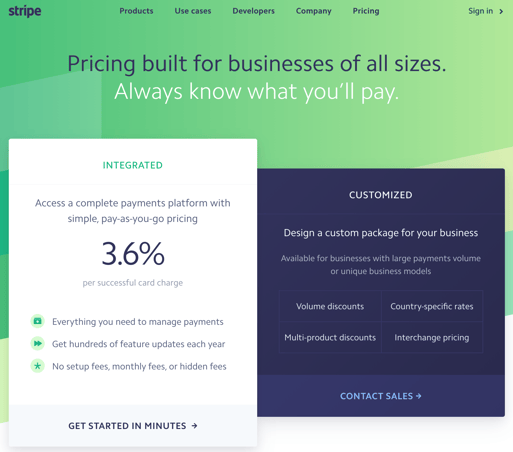

The Stripe pricing model is fairly simple to understand. Most businesses will select the Integrated option, although custom pricing models are also available for organizations with unique needs (e.g. volume discounts, multi-product discounts, and country-specific rates).

For every transaction that passes through the platform, Stripe charges a flat fee of 2.9 percent plus $0.30. A purchase of $100, for example, would cost you $3.20 ($2.90 + $0.30).

Note that this percentage decreases to 2.2 percent for non-profits, and increases by 1 percent for currency conversions or international credit cards.

Is your price model working for your SaaS business? Learn more about the best SaaS pricing strategies here!

ACH Direct Debit payments are significantly cheaper, with a per-transaction fee of 0.8 percent (with a maximum fee of $5.00).

Other international payment methods, such as Bancontact, iDEAL, giropay, Przelewy24, Sofort, and SEPA Direct Debit, are also possible through the Stripe platform, with prices starting at $0.80 per transaction.

2Checkout Pricing

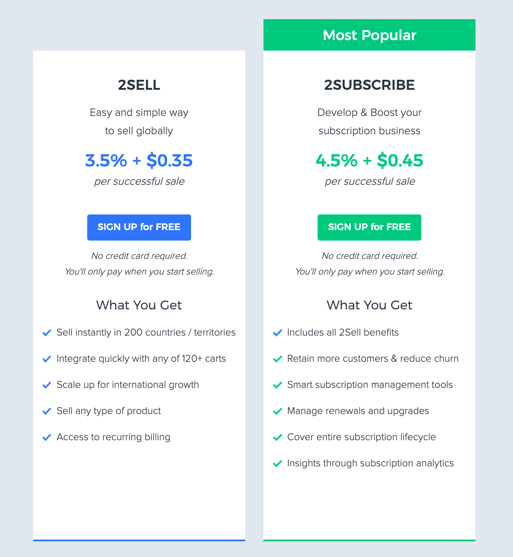

2Checkout pricing combines both multiple tiers and a per-transaction fee:

- 2Sell (3.5 percent + $0.35)

- This first tier allows you to sell any type of product in more than 200 countries and territories. It includes features such as recurring billing and integrations with more than 120 shopping carts.

- 2Subscribe (4.5 percent + $0.45)

- This tier is intended for businesses that sell recurring subscriptions. It includes all of the benefits of the 2Sell tier, plus tools for managing subscriptions, renewals, upgrades, and churn, as well as advanced subscription analytics.

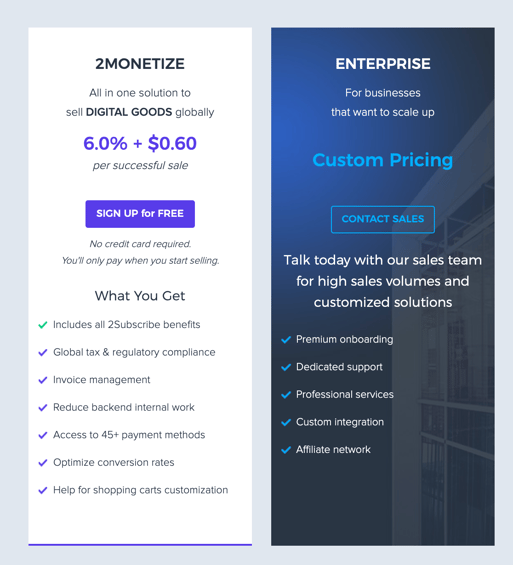

- 2Monetize (6.0 percent + $0.60)

- This tier is intended for businesses that sell digital goods. It includes all of the benefits of the previous tiers, plus invoice management, global tax and regulatory compliance, tools for optimizing conversion rates, and access to more than 45 payment methods.

For example, if you sell a $100 product as a user in the “2Sell” tier, 2Checkout will charge you $3.85 ($3.50 + $0.35).

Like Stripe, 2Checkout also offers a custom “enterprise” pricing plan for larger organizations with unique needs.

Stripe vs. 2Checkout: Reviews

Thus far, we’ve discussed Stripe and 2Checkout features and pricing—but how do these two online payment processors shake out in practice?

Read on to learn what real people have to say about the platforms in Stripe and 2Checkout user reviews.

Stripe Reviews

On the business software review website G2, Stripe has an average rating of 4.4 out of 5 stars, based on 88 Stripe user reviews.

Lead designer Nathan B. says that “Stripe has redefined online payments” in his 5-star Stripe review, adding:

“Stripe has allowed us to easily take online payments not only for our customers, but made it very easy for our developers to incorporate into our website and other platforms.

Our customers love how easy and efficient the entire process is as due our developers when working with the platform. Overall this system has been a game changer for us… Would highly recommend Stripe for all of your payment processing needs.”

2Checkout Reviews

Meanwhile, 2Checkout has an average rating of 4.1 out of 5 stars, based on 134 2Checkout user reviews.

In a 4.5-star review, 2Checkout user David F. calls it a “dependable web payment platform,” writing:

“On both the management and user side, the interface is simple and well-designed. The default checkout design is simple for most customers to navigate. I think the pricing is good and competitive with most of the primary payment solutions available these days…

We use 2Checkout to manage our primary e-commerce needs. We can integrate our payment processing for credit cards, debits cards, bank transfers and other popular payment methods. 2Checkout helps to manage our shopping cart and website integration without having to spend much time programming or dealing with API issues.”

Stripe vs. 2Checkout: The Bottom Line

There’s no single right answer to the question of “Stripe vs. 2Checkout,” so which one better fits your needs?

Stripe is likely better for the following types of customers:

- Users who are Tech-savvy

- Stripe offers a great deal of customization options, but you’ll need a skilled developer on hand to take full advantage of them.

- Price-conscious Users

- At 2.9 percent plus $0.30, Stripe’s per-transaction fees are lower than even the first tier of 2Checkout, which charges 3.5 percent plus $0.35 per transaction.

On the other hand, 2Checkout is likely better for the following types of customers:

- Users who Operate in Many Countries

- 2Checkout sells to more than 200 countries and territories. Moreover, multi-currency management increases authorization rates by up to 25%, limits cart abandonment and improves the customer experience.

- Users who Want More Advanced Features

- 2Checkout’s “2Subscribe” and “2Monetize” tiers offer advanced features such as subscription management and invoice management, which are not available in the basic Stripe offerings.

Conclusion

Whether you ultimately decide to go with Stripe or 2Checkout, every organization needs to have a firm grasp of how cash is flowing throughout its business.

That’s why Baremetrics has built a powerful yet user-friendly analytics platform for Stripe users that uncovers hidden trends and insights in your data, helping you make smarter, data-driven predictions and decisions.

Looking for a robust, feature-rich analytics platform that will empower you to get more from Stripe? Sign up today to start your free trial of Baremetrics.