Table of Contents

When it comes to your unique payment processing needs, which is better— Stripe vs. Authorize.net?

This article will cover everything you need to know, including features, pricing, reviews, and more.

Stripe vs. Authorize.net: Features

Both Stripe and Authorize.net are mature, feature-rich payment processing solutions that have their own advantages. But which is better for your business?

Stripe Features

The Stripe features you should know about include:

- Wide Range of Payment Options

- Stripe accepts many different payment types, including MasterCard, Visa, American Express, Discover, and mobile wallets such as Google Pay and Apple Pay.

- Currency Conversions

- Stripe is able to process more than 135 different types of currencies, helping you take your business worldwide.

- Rich Developer Toolkit

- Stripe includes high-tech developer tools such as Stripe Elements, Stripe Sources, and Stripe Connect for putting your own touch on how your business handles payments.

- Stripe also integrates easily with other platforms including Baremetrics, which gives you smarter insights about your Stripe transactions. Get started with a free trial today!

- Excellent Customer Support

- Stripe provides 24/7 customer support through numerous channels, including phone, live chat, and email.

- Stripe also includes extensive documentation for developers who are new to the Stripe platform.

Suggested reading: Customer Support for SaaS: How to Do it Right

Authorize.net Features

The Authorize.net features you should know about include:

- Wide Range of Payment Options

- Like Stripe, Authorize.net accepts many different payment types, including MasterCard, Visa, American Express, Discover, Apple Pay, PayPal, and eChecks.

- Advanced Security and Anti-Fraud Features

- Authorize.net’s free Advanced Fraud Detection Suite includes 13 different filters for blocking fraudulent activity, including limits on the number of transactions per day, IP address and IP region blocking, and more.

- Recurring Billing

- Authorize.net allows users to set up recurring payments for both your and your customers’ convenience.

- Customer Support

- The Authorize.net Support Center is available 24/7; users can also contact the support team by phone or online chat, or open a support ticket.

Stripe vs. Authorize.net: Pricing

Both platforms have great features. But for a complete Stripe vs. Authorize.net comparison, businesses must consider their pricing.

Stripe Pricing

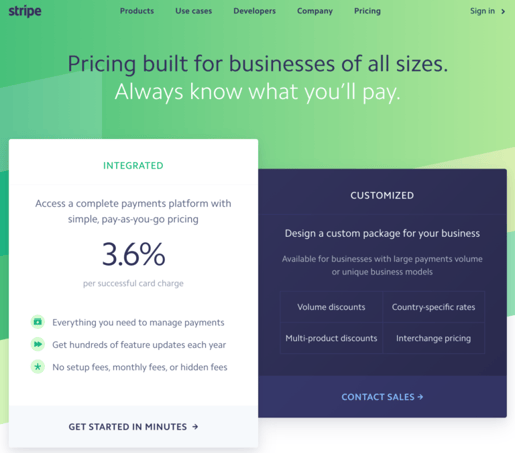

The Stripe pricing model has two main options, which it calls “integrated” and “customized.”

The integrated option has a pay-as-you-go model that charges 2.9 percent, plus 30 cents, for every successful card charge. A few things to note about Stripe’s integrated pricing:

- This rate decreases to 2.2 percent for non-profit organizations, and increases by 1 percent if you’re handling international cards or doing currency conversions.

- ACH direct debit costs 0.8 percent per transaction, with a cap of $5.00.

- Stripe also supports additional payment methods around the world such as Bancontact, iDEAL, giropay, Przelewy24, Sofort, and SEPA Direct Debit, with prices starting at $0.80 per transaction.

In addition to these flat rates, the Stripe pricing model also includes customized options.

This might be a better solution for organizations with very high transaction volumes or unique business models. The possibilities include volume discounts, multi-product discounts, and country-specific rates.

Authorize.net Pricing

Like Stripe, the Authorize.net pricing model also has two main options, which it calls “all-in-one” and “payment gateway only”; both are free to set up and have a monthly gateway fee of $25.

The “All-in-One” option is for businesses that don’t have a merchant account (a special bank account for accepting debit and credit card payments). Authorize.net will set you up with a merchant account and a payment gateway. This option charges 2.9 percent plus $0.30 for each transaction, exactly the same as the integrated option for Stripe.

The “Payment Gateway Only” option is for businesses that already have a merchant account. In this option, businesses are charged $0.10 per transaction plus a daily batch fee of $0.10.

Authorize.net also offers custom pricing for larger enterprises that process more than $500,000 per year. Finally, Authorize.net charges 0.75 percent on eCheck transactions, which is billed separately from any of the options listed above.

Stripe vs. Authorize.net: Reviews

Stripe Reviews

As of writing, the business software review website G2 gives Stripe an average rating of 4.4 out of 5 stars, based on 88 Stripe user reviews. Executive director Caroline J. calls Stripe “the best payment processor out there with the most flexible and custom options” in her Stripe review, adding:

Stripe is very tech-forward and can be customized to look and feel just about any way you want it to on your website. The branding possibilities are endless… Their pricing is fairly reasonable and it’s easy to connect Stripe Payments to any API source.

They provide a very robust documentation library. In my experience, their support is very responsive at all hours, even on weekends and holidays… The dashboard and reporting systems are very robust and easy to use.

However, the review also notes two negatives of the Stripe platform:

- Merchants who issue refunds to customers no longer receive their fees back from Stripe, which means that they’re losing money with each refund.

- Stripe is highly customizable with a skilled developer on hand, but this flexibility can also make it seem intimidating for new users who aren’t familiar with the platform.

Authorize.net Reviews

Meanwhile, Authorize.net has an average rating of 4.0 out of 5 stars on G2, based on 105 Authorize.net user reviews. In a 4-star Authorize.net review, VP of fulfillment Frances W. says that the platform “provides all the basic tools that a business owner needs to collect payment”:

I am able to process a card, set up a card to process, delay the process but capture the information, set up recurring billing, organize accounts and subscriptions into groups and categories, and export data for further organization…

We are satisfied with the fees in place and the ability to do what we need it to. It is simple to set up and doesn’t take long to learn to navigate the features and familiarize yourself with the terminology.

However, the review goes on to cite a few negatives of the Authorize.net platform, including:

- Users cannot send notifications to more than one email address when a transaction is successfully completed.

- Basic reporting features are lacking and some functionality is hard to find.

- Cards used for payment are sometimes declined, which may contribute to failed payments and missed revenue.

- Prevent this loss with Recover by Baremetrics, the smartest way to manage missed payments and churn for SaaS businesses. Start your free trial today!

Stripe vs. Authorize.net: The Bottom Line

We’ve gone over Stripe and Authorize.net features, pricing, and reviews—so what’s the ultimate verdict when it comes to Stripe vs. Authorize.net?

Stripe is better for the following types of customers:

- Users who don’t want to pay a monthly fee.

- The Stripe pricing model is based only on transactions, whereas Authorize.net charges a monthly gateway fee of $25.

- Users who are tech-savvy.

- Stripe offers a great deal of customization options, but taking advantage of them will require having a skilled developer who’s familiar with coding.

Authorize.net is better for the following types of customers:

- Users who need robust anti-fraud and security measures.

- Authorize.net has advanced security features that protect your business against fraudulent activity.

- Users who want to accept PayPal.

- Stripe and PayPal are essentially direct competitors, so Stripe doesn’t accept payments through PayPal—but Authorize.net does.

Conclusion

Both platforms simplify the payment process and serve thousands of happy customers. But because it has no monthly fee, and doesn’t require a merchant account, Stripe will be the preferred all-in-one choice for many organizations.

Whether you choose Stripe or Authorize.net for your payment processing needs, it’s crucial to make sure that your business has a healthy cash flow, now and into the future.

That’s why Baremetrics has built a powerful, user-friendly analytics tool for hidden insights from your Stripe data, helping you make smarter, data-driven predictions and decisions.