Table of Contents

Deciding between Stripe vs. Chargebee for your online payment processing needs?

Stripe supports online payments for e-commerce businesses, while Chargebee helps SaaS companies set up and manage their recurring payments.

In fact, the question of Stripe vs. Chargebee might be the wrong one to ask—it doesn’t have to be an either/or decision. For example, you can integrate Chargebee with Stripe accept payments through the Stripe payment gateway.

Both platforms have pros and cons worth learning about. In this article, we’ll give a full Stripe vs. Chargebee comparison, and discuss how Baremetrics can expertly analyze data from both platforms.

Stripe vs. Chargebee: Features

Both Stripe and Chargebee are robust, feature-rich payment processing solutions—but which one has the features you need?

Stripe Features

The Stripe features you should be aware of include:

- Wide Range of Payment Options

- Stripe accepts many different payment types, including MasterCard, Visa, American Express, Discover, and mobile wallets such as Google Pay and Apple Pay.

- The platform also accepts more than 135 currencies for businesses that operate internationally.

- Rich Developer Toolkit

- For customers who have the technical chops, Stripe includes high-tech developer tools such as Stripe Elements, Stripe Sources, and Stripe Connect for putting your own touch on how your business handles payments.

- Stripe also integrates with many third-party services including Baremetrics, which gives you smarter analytics and better insights about your Stripe transactions. Start a free trial today!

- Strong Customer Support

- If you run into an issue, Stripe offers free 24/7 customer support via email, phone, and live chat, and also offers extensive documentation for new developers.

Chargebee Features

The Chargebee features you should know about include:

- Wide Range of Payment Options

- Chargebee accepts more than 100 currencies and 23 payment gateways (including Stripe).

- The platform can handle payment methods such as credit cards, ACH Direct Debit, PayPal, Apple Pay, Google Pay, Amazon Pay, and more—plus offline payments such as bank transfers and checks.

- Smart Dunning

- To avoid lost revenue as a result of payment failures, Chargebee includes a variety of dunning features.

- Chargeback Management

- Chargebee elegantly handles chargebacks according to predefined business logic including automatically updating your billing records, resolving customer disputes more quickly, and more.

How Well Do

You Know

Your Business?

Get deep insights into churn, LTV, MRR and more to grow your business

Stripe vs. Chargebee: Pricing

Stripe and Chargebee are both jam-packed full of useful features—but is this functionality worth the cost?

Whereas Stripe uses a per-transaction pricing model, Chargebee has multiple flat monthly pricing tiers for businesses at different levels of revenue.

Wondering what’s the best pricing approach for your business? Learn from the Baremetrics experts!

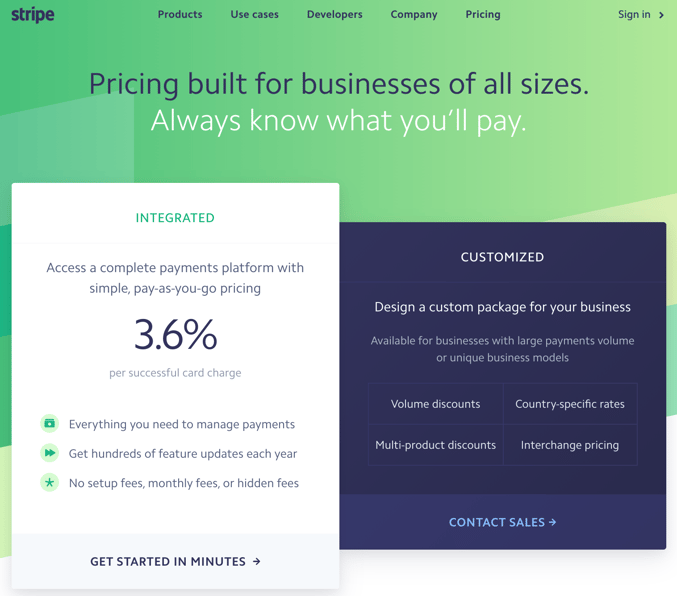

Stripe Pricing

Stripe offers two pricing models: Integrated and Customized.

Most businesses will decide to use the Integrated option in Stripe’s pricing model. This is a “pay as you go” pricing model that charges a per-transaction fee of 2.9 percent, plus a flat rate of $0.30.

For example, if you sell an item for $100, Stripe would charge a fee of $3.20 ($2.90 + $0.30). Note that this fee is lower for non-profit organizations (2.2 percent), but 1 percent higher for international credit cards and currency conversions.

Stripe also offers custom pricing for businesses with special requirements, with options such as volume discounts, multi-product discounts, and country-specific rates—but you’ll need to speak with the Stripe team about your situation first.

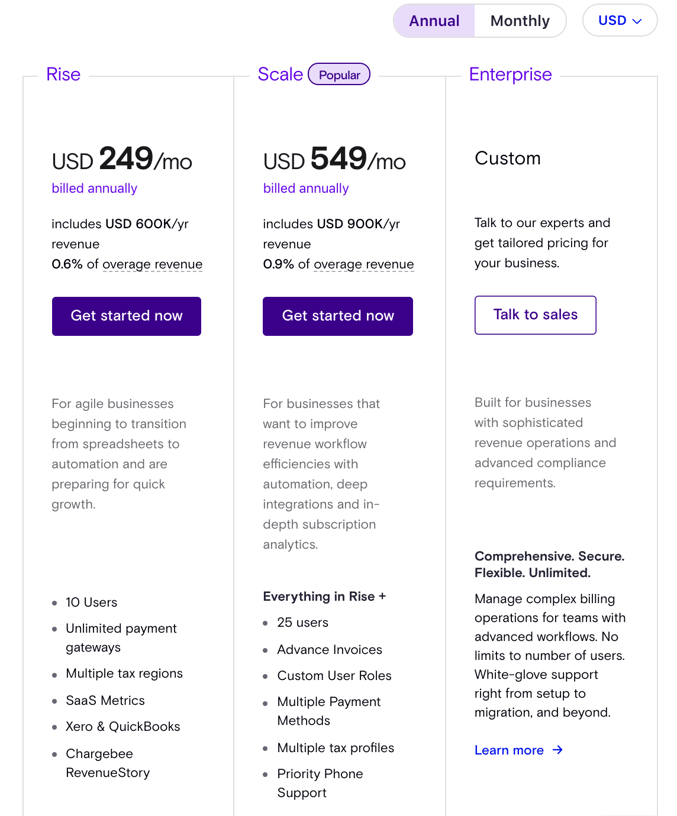

Chargebee Pricing

Chargebee’s prices their software using a tiered model for businesses with different sizes and situations:

- Rise ($249/month)

- This introductory tier allows for $600,000 in annual revenue and 0.6 percent of overage revenue. It includes features such as 10 user accounts, unlimited payment gateways, multiple tax regions, SaaS metrics, and integrations with Xero, Quickbooks, Salesforce, and Avalara.

- Scale ($549/month)

- Businesses with more complex requirements will need to use the next level of Chargebee’s pricing model, which allows for $900,000 in annual revenue and 0.9 percent of overage revenue.

- This tier incorporates all of the features in the Rise tier, plus additional features such as 25 user accounts, advance user invoices, custom user roles, multiple payment methods, multiple tax profiles, priority phone support, and integrations with NetSuite and Sage Intacct.

- Custom

- Chargebee’s custom pricing tier is designed for businesses with unique needs (what it calls “sophisticated revenue operations and advanced compliance requirements”).

In addition, Chargebee offers a limited Chargebee for Startups option designed for early-stage companies that is free up until your first $50,000 in revenue.

Stripe vs. Chargebee: Reviews

We’ve discussed the features and costs of Stripe vs. Chargebee— but what do real people have to say about these two payment processing solutions, in Stripe and Chargebee user reviews?

Stripe Reviews

On the business software review website G2, Stripe has an average of 4.4 out of 5 stars, based on 88 Stripe user reviews. In a 4-star Stripe review, digital merchandising manager Kevin L. says that the platform makes it “easy to find necessary information, and easy to reimburse customers,” adding:

“Stripe is easy to implement and offers a robust API for experienced developers to create highly customized solutions… It is also easy to integrate with other platforms and create unique positions for customers or subscriptions… This tool does a great job of capturing everything we need, while maintaining customer safety and allowing us all the functionality we need on the support side to seek charges and be able to reimburse, recharge and work with disputes.”

However, he also notes a couple of flaws with Stripe, in particular the inability to accept gift cards and the high transaction fees when selling high-dollar items.

Chargebee Reviews

Meanwhile, Chargebee has an average rating of 4.7 out of 5 stars on G2, based on 403 user reviews. In a 5-star Chargebee review, user Braden E. writes that “Chargebee makes it ridiculously easy to add subscription features to your tool,” adding:

“Their price is a lot cheaper than it would have cost our team to build and maintain our own subscription management tool… We needed subscription management in our SaaS product, and we needed a simple dashboard to manage active subscriptions, refunds, upgrades/downgrades, etc. Chargebee has made this super easy to do, taking weeks of wasted engineering time down to just a few days to integrate.”

While most Chargebee reviews are positive on the whole, some common complaints about the platform include:

- The lack of customization options.

- Unclear documentation and technical challenges.

- Slow and ineffective responses from customer support.

Stripe vs. Chargebee: The Bottom Line

Stripe is likely the better payment processing solution for the following types of customers:

- Users with many one-time transactions

- Stripe is a general-purpose payment processor designed for all kinds of e-commerce purchases.If most of your payments will not be recurring, then Stripe is likely the better choice.

- Users who prefer a per-transaction pricing model

- Whereas Chargebee bills users a monthly flat fee, Stripe charges users per transaction.

Chargebee is likely the better payment processing solution for the following types of customers:

- Users who need to manage recurring subscriptions

- Chargebee has been purpose-built for the task of managing recurring payments, with features to help regularize subscribers’ payment situations.

Conclusion

Stripe and Chargebee are both mature, feature-rich payment processing solutions, but ones that are designed for different use cases and different types of businesses.

Whereas Stripe is preferable for handling many one-time purchases, Chargebee is designed for recurring payments for companies that use a subscription business model.

Our suggestion? Consider integrating both and analyze your data seamlessly with Baremetrics.

Baremetrics has created a powerful, user-friendly analytics tool that captures hidden insights and trends from your Stripe data, helping you make smarter, data-driven predictions and decisions.