Table of Contents

“One accurate measurement is worth more than a thousand expert opinions.”

– Grace M. Hopper

How can you know if your SaaS business is profitable or not? Do you know what works well for your business and what doesn’t?

That’s where SaaS metrics come into play and tell you what you need to know. They give you the data you need to help you make informed decisions about your business. Using the wrong metrics, using them in the wrong way, or overlooking the crucial ones can be a disaster for your business.

There are so many business metrics platforms out there that it becomes hard to choose the one you actually need.

In this article, we have compared Stripe vs. Profitwell to see what each tool can do for you and what they can’t. By the end of the article, you will have a clear overview of both these platforms.

To get a brief overview:

Profitwell is a tool that can provide analytics for SaaS businesses. It has a variety of tools that monitor and analyze the performance of SaaS businesses.

Stripe is different. Stripe is an online payment processing platform for Internet businesses, something like PayPal. It does provide some metrics but not that many. You can integrate Stripe with a metrics platform such as Baremetrics to get more detailed insights in the Smart SaaS Dashboard.

While Stripe is a payment processing platform, both Profitwell and Baremetrics are strictly business metrics monitoring tools that integrate with Stripe to bring you more in-depth knowledge about your transactions.

If you want to see it all first-hand, signup for a Baremetrics free trial and monitor your subscription revenues with ease.

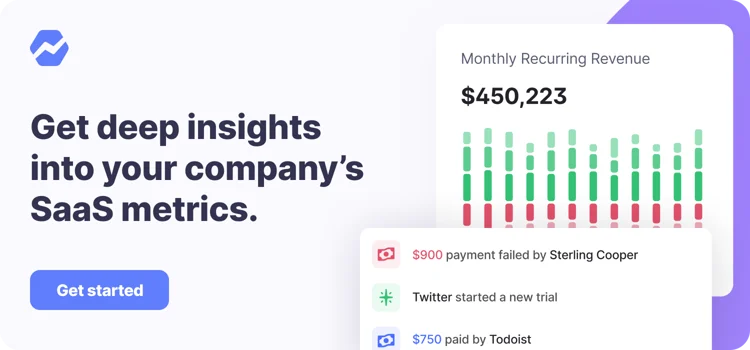

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.

What is Profitwell?

Profitwell is a SaaS analytics platform that provides subscription analytics, retention, and pricing solutions for both B2B and B2C subscription services.

Founded by Patrick Campbell in 2019, the platform can monitor several metrics such as lifetime value (LTV), average revenue per user (ARPU), monthly recurring revenue (MRR), user engagement, etc.

The tools it offers are:

· Profitwell Metrics, the flagship product of Profitwell that monitors the metrics mentioned above.

· Recognized, which tracks finances and handles revenue recognition.

· Retain, the churn reduction tool.

· Price Intelligently, which figures out pricing for subscription businesses.

Profitwell is a freemium service having some of its features available for free, while others ranging from $1000/month to $15,000/month or even more.

What is Stripe?

Stripe is a payment processing tool or sometimes called a payment gateway. Without getting too technical here, let me briefly explain what a payment gateway is.

A payment gateway is an online software for managing transactions. When a customer makes a purchase on your website, the payment gateway sends the cardholder information to the merchant account—a dedicated bank account for holding funds coming from credit card transactions. The transaction is confirmed after verifying the information provided.

Now, let’s look at Stripe specifically —the Internet’s Middleman, founded by Collison brothers. Stripe takes payments from credit or debit cards of your customers from all over the world and transfers the funds directly to your business bank account.

Stripe charges you 2.9% plus 30 cents for every successful transaction. You can visit their website to see more details on their pricing.

Stripe also helps you reduce churn with its dunning tools that recover about 41% of failed recurring payments. You can automate payments and power any billing model.

For SaaS businesses like yours, Stripe provides a set of tools that help you collect recurring payments with support for a variety of pricing models. It also offers a few metrics to help you monitor the growth, products, subscribers, retention, and a few other things.

However, Stripe’s metrics are not enough to get the complete picture. This is where tools like Baremetrics or Profitwell or Profitwell come into play.

Stripe vs. Profitwell: How are Stripe and Profitwell the same?

Both Stripe and Profitwell can provide you with several metrics to monitor your business.

Stripe Billing Analytics dashboard gives you metrics such as MRR, MRR growth, net revenue, LTV, subscriber cohort and cohort retention. Stripe’s dunning tools help you reduce involuntary churn and recover failed recurring payments.

Profitwell also gives you all these analytics as well as some advanced ones. Profitwell’s Retain feature is designed to reduce churn and recover customers.

Stripe vs. Profitwell: How are Stripe and Profitwell different?

Despite the few similarities, Stripe and Profitwell are widely different from each other as they are designed for different purposes.

As we have seen earlier, Profitwell is a platform that monitors various metrics for SaaS and other subscription based businesses. It also provides pricing solutions for B2B and B2C services. It tracks finances, provides pricing solutions, and displays user engagement stats.

Stripe is designed for a whole different purpose. It’s a payment gateway that facilitates online transactions on your website.

It also provides a bunch of metrics, but they are not extensive. You will need a dedicated SaaS metrics monitoring platform such as Baremetrics to get deeper insights.

Want to Reduce Your Churn?

Use Baremetrics to measure churn, LTV and other critical business metrics that help them retain more customers. Want to try it for yourself?

What is Baremetrics?

What exactly is Baremetrics and how can it help you if you are already using Stripe?

Baremetrics has been helping B2B and B2C SaaS companies and subscription businesses since 2013 with its accurate metrics, as well as its dunning and engagement tools. By providing you real-time metrics and revealing crucial insights, it helps you make profitable decisions.

To use Baremetrics, all you have to do is connect your Stripe account to Baremetrics. It then pulls in all of your revenue data using Stripe Connect to give you more details and insights about your payments that you can’t get on Stripe.

Whether you are just starting out or you have already established yourself, Baremetrics has got you covered at every stage of your business. The custom-tailored pricing of Baremetrics allows you to monitor your business without breaking the bank.

With Baremetrics, you can get tons of analytics that give you a crystal clear picture of your business. Here is a non-exhaustive list of the metrics you can get on Baremetrics.

· Monthly Recurring Revenue (MRR)

· Annual Run Rate (ARR)

· Average Revenue Per User (ARPU)

· Lifetime Value (LTV)

· MRR growth rate

· Active subscriptions

· New subscriptions

· User churn

The list goes on and on.

To get a hint of the awesome features Baremetrics offers, you can look at these easy to follow, in-depth Baremetrics dashboards for ConvertKit—an email marketing tool for creators. You can get these metrics (and many more tools) for your business right now with just a few clicks.

Conclusion

In this article, we discussed the importance of using the right metrics for your business. For a successful SaaS business, you need accurate metrics to see if everything is on track.

We also compared Stripe vs. Profitwell to understand their similarities and differences. Profitwell provides analytics and pricing solutions for SaaS and subscription businesses.

Stripe, on the other hand, is a payment processing platform which also provides some analytics.

You can use Stripe and Baremetrics together to get seamless payments on your website plus accurate and clear insights about your business.

Get your Baremetrics 14-day free trial now and see your business thriving.