Table of Contents

Ever heard about the golden ratio? No, not that nerdy Fibonacci number thing.

I am talking about the SaaS golden ratio. It’s 3:1. Where did this come from, and why is it important?

This number is the ideal LTV to CAC ratio for SaaS businesses. After reading this article, you will clearly understand how it’s calculated and why it matters.

If you want in-depth metrics for your SaaS or subscription business, start using Baremetrics today with a 14-day free trial.

There are multiple ways to calculate the LTV to CAC ratio, some more complex than others. In this article, I will give you a simple method using only two inputs: CAC and LTV.

I’ll go through them individually so you can clearly understand the topic.

CAC (Customer Acquisition Cost)

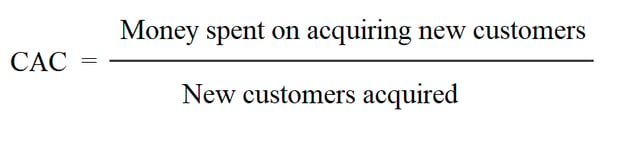

As the name suggests, CAC is the cost of acquiring one new customer. It is the sum of all the money spent on acquiring new customers divided by the total number of new customers acquired

So, if you have spent $10,000 to gain 2000 new customers, your CAC is $5.

The two rules of calculating CAC

Looking at the equation, you might think it’s obvious and straightforward. And you won’t be wrong.

But there are some mistakes you have to avoid while calculating CAC as they can have some serious implications.

You must remember the two rules of calculating CAC.

First, do not count the money spent on retaining the existing customers. You must include only the costs associated with gaining new customers.

Second, do not restrict to marketing expenses only. This one is crucial because it’s a common mistake you might be making.

You must consider all the direct and indirect expenses associated with acquiring new customers, including the marketing team's salaries and other indirect expenses.

Why does CAC matter?

Every business stands on one thing: customers – and they don’t come free.

You have to spend thousands of dollars on various marketing channels to get them. The amount you spend on acquiring those customers, aka CAC, is a crucial figure you can’t ignore.

Understanding your CAC can help you make better decisions and tell you where to allocate your revenue.

This is especially true for SaaS and subscription businesses, as they rely on recurring revenue earned from a customer over a long period. CAC becomes crucial in this case.

If you spend too much money on acquiring a new customer, it will probably take you a long time to recover that money, let alone make any profit from that customer. This is obviously not a good thing.

Also, knowing about CAC for particular marketing channels and the behavior of those customers will help you focus on the channels that bring more customers or more profitable customers.

Let’s imagine a scenario:

Suppose you spend $10,000 on ad campaigns, $5000 on Facebook ads, and $5000 on Google ads. You get 1000 new customers from Facebook ads and 600 from Google ads.

The CAC would be $5 for Facebook ads and $8.3 for Google ads.

As getting new customers is cheaper on Facebook, you might want to focus more on Facebook ads.

But let’s make it more interesting.

Let’s say the customers you got from Facebook are unwilling to spend money on your products. On the other hand, the customers you get from Google ads tend to stick longer with you and are willing to spend money.

What now? How do you decide which customers are more valuable to you and where you should focus more?

This shows us that CAC in itself is just an empty number. It tells us almost nothing. Whenever we talk about the cost of acquiring a new customer, it’s significant only in relation to what we earn from that customer.

Put simply, CAC is important when it’s considered in relation to LTV. Therefore, these two metrics always go hand in hand.

So, let’s talk about LTV.

LTV (Lifetime Value)

The LTV means the amount of money a customer spends on your products over their lifetime.

This figure is crucial for SaaS businesses because their lives depend on it. The only profitable way to run a SaaS or subscription business is to have a pool of customers who stay with you for a long time and are ready to pay.

In short, having customers with a high LTV is the key.

How to calculate LTV?

It seems quite hard to predict how much money a customer will give you over their lifetime, and it actually is.

That’s why we don’t rely on predictions but on calculations.

Considering that a number of variables go into this and how complicated it can look if you are not familiar with it, I will guide you through the process of arriving at the formula for calculating LTV instead of pulling it out of thin air. This will make things easier.

Keep in mind, however, that you cannot calculate LTV in the initial stages of your business because you don’t have enough data for that.

That said, let’s move on to some (not so) nerdy calculations.

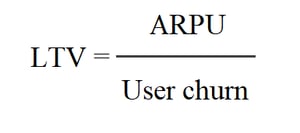

The simplest way of calculating a customer's LTV is to take the money they spend each month and multiply it by their lifetime, which is the number of months they stay with you.

However, this method is not practical since you have (hopefully) more than one customer. Also, predicting how long a customer will stay is virtually impossible.

So, to calculate the LTV of multiple customers, we have to find a metric that considers the monthly recurring revenue (MRR) of a number of customers.

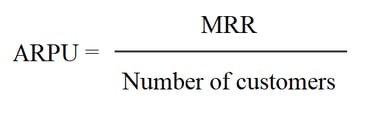

ARPU (Average Revenue Per User) is just what we are looking for. It’s MRR divided by the total number of customers.

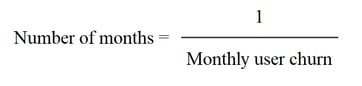

Now, we have to calculate the lifespan of a customer in months. To do that calculation, take the monthly user churn and invert it.

By combining these two equations and bingo, we get our final formula for LTV:

Now, before you proceed to hit me with Thor’s hammer for throwing all this math, let me tell you that you don’t have to go through any of this.

You can see a detailed LTV chart for your business in just a few clicks if you use Baremetrics.

If not, you can start your free trial now.

Why does LTV matter?

What’s the one word that can describe the goals of any business in the world?

PROFIT !!!

From marketing to metrics and everything in between, it’s all intended to maximize profit.

LTV is intimately linked to your financial gains. Increasing customer retention — which, in turn, means increasing the LTV — by 5% can increase the profit by 25% to 95%, says Bain and Company.

LTV to CAC Ratio

Remember that physics lesson from the school where you learned how to lift a massive object with a little force? No worries if you don’t. Here’s a quick review.

It’s something called Leverage, though it also has a fancy name, Torque.

For fear of sounding too nerdy, I won’t go too much into the details. But the point is, if you want to spend the least of your energy, you can lift a heavy load with a little effort by acting smart.

To do this, you simply have to increase the “moment arm,” which is the length of the lever between the pivot and the point where you are exerting force.

Since “efficiency” is simply the ratio between Load and Effort, the more you lift with as little effort as possible, the more “efficient” you are.

This is exactly how I visualize LTV/CAC. Look at the following equation.

It’s the same thing as “efficiency” in my head. To be efficient in business, you have to keep a close look at this ratio.

The more LTV you can create with less CAC, the more profitable your business will be. Reverse the scenario, and you are doomed.

And this is why this ratio is so important.

With just two inputs, the LTV to CAC ratio alone can do you more favor than a bunch of metrics combined.

While benchmarks such as ARR, MRR, and Churn are undoubtedly important, they tell you in bits and pieces about where you are headed, and you might get lost in some dark alley.

LTV/CAC, on the other hand, gives you a zoomed-out, crystal-clear map in a snapshot.

What is a good LTV to CAC Ratio?

Investors look for a good LTV to CAC ratio before investing in your business. I have mentioned this number in the introduction, here I’ll go into some details.

I know I have said earlier that you should focus on maximizing LTV while minimizing CAC. That might have given you the wrong impression that a super high LTV/CAC is always the goal. It’s not.

The ideal LTV to CAC ratio is 3:1. Ideally, you should get $3 in return for every $1 you spend on getting new customers.

If you get 1:1, your business is really struggling. Less than 1:1, you are going to lose money—you are spending more than you are getting in return.

While it may look exciting to see a super high ratio, such as 5:1 or more, it’s not ideal. Yes, you are getting a high return on investment, but it also suggests that there’s room for spending more on acquiring new customers.

A ratio of 5:1 means a really high LTV, which means your customers are happy with your product and are willing to spend. So, getting new users can multiply your revenue.

So, never forget the golden ratio, 3:1.

Conclusion

The LTV to CAC ratio is a must-not-ignore number for SaaS and subscription businesses. It gives a clear and precise overview of your business's performance.

Consider this ratio closely if you want to have a successful SaaS business.

You can use Baremetrics for more detailed insights. Start your free trial now.