Table of Contents

More Founders Journey Articles

GAAP stands for Generally Accepted Accounting Principles and standards. These procedures and principles are issued by the Financial Accounting Standards Board (FASB).

GAAP is important to SaaS Businesses. Revenue recognition, as per GAAP, states that payment is recognized as revenue after delivering the product or service in its entirety. Of course, that’s not how SaaS revenue works. (We wrote more about revenue recognition here!)

In the SaaS industry, subscription fees are paid as monthly recurring revenue (MRR) and can be paid in advance for up to a year. Following GAAP principles mean that revenue – even if received upfront – is calculated over a deferred period, one month at a time.

If you are in the SaaS business, you need to familiarize yourself with GAAP to present your results to shareholders and other role players in a format they are already acquainted with. Fortunately, Baremetrics makes GAAP reporting (and all forms of SaaS financial reporting) easy!

What Is GAAP?

GAAP is the abbreviation of generally accepted accounting principles, standards, and procedures issued by the FASB (Financial Accounting Standards Board). Public companies in the United States follow GAAP principles to compile their financial statements.

GAAP combines the standards set by policy boards and aims to improve the consistency and comparability of the accounting information.

How Is GAAP Used in Accounting?

Financial reporting communicates a company’s financial performance and results. By using a standardized best practice methodology, the company can benchmark accurately against its competitors. That way, the information regarding the financial position, revenues, and expenses are presented in a standardized, comparable accounting method that helps maintain consistency.

Why is GAAP important?

GAAP ensures trust in financial markets. If every company could decide their reporting and calculation methods independently, it would be challenging for investors to analyze companies’ performance. If all companies calculate their results using the same standards, investors and regulators can compare like with like.

What are the rules of GAAP accounting?

There are ten rules that apply to GAAP accounting, including:

- Rule of Regularity: the accountant has adhered to GAAP rules as the standard

- Rule of Consistency: the accountant confirms that the same standards have been applied throughout the reporting process from one period to the next. Any changes to standards are disclosed in the footnotes.

- Rule of Sincerity: the accountant provides a depiction of the company’s financial situation with impartiality and accuracy.

- Rule of Permanence of Methods: the accountants commits to consistent procedures

- Rule of Non-Compensation: all negatives and positives are transparently reported without expectation of compensation by the accountant

- Rule of Prudence: the accountant will only report fact-based financial data is represented, not speculation

- Rule of Continuity: when valuing assets, it is assumed that the business will remain in operation

- Rule of Periodicity: the accountant must distribute entries across the appropriate period

- Rule of Materiality: the accountant must fully disclose all financial data and accounting information in the reports.

- Rule of Utmost Good Faith: this presumes that all parties remain honest in transactions and reporting

These rules make the reporting process transparent and create standards for assumptions, terminology, methods, and definitions so that external parties can compare financial statements.

What Are the 4 Principles of GAAP Accounting?

There are four basic principles of GAAP accounting. These guidelines separate the organization’s transactions from that of the owners, standardizes entries, and explicitly discloses periods used. They also draw on best practices for governance, disclosure, matching, and conservatism.

1. Costs

This principle states that all listed values with accuracy, reflecting only actual cost and not many market value cost items or speculation.

2. Revenues

This was mentioned in the introductory paragraph of this article. Using GAAP’s revenue principle, revenue should only be reported when it’s recognized. This often has an impact on SaaS businesses with deferred revenue streams. (More on this topic later!)

3. Matching

GAAP principles govern how revenues are matched with expenses. Expenses of a revenue-producing activity are reported when the item or service is sold. It’s not reported when the company receives payment or issues an invoice. For example, suppose an API developer is contracted to implement an API feed for a new SaaS client being onboarded. In that case, that expense is reported before the client’s first subscription payment kicks in.

4. Disclosure

All the information that someone making inquiries about the financial status of a company needs is included in the report.

Baremetrics helps you track all your SaaS metrics from a single dashboard

Get deep insights into MRR, churn, LTV and more to grow your business

What Is an Example of GAAP Accounting?

Your GAAP accounting results will likely differ from your other measures. For example, in a SaaS company, you probably keep a close eye on your Monthly Recurring Revenue, but MRR is not a reportable GAAP revenue stream. For GAAP reporting purposes, you will likely report revenue pro-rata each day between the start and end date of the subscription, rather than as a monthly fixed revenue.

In a practical example, you will likely recognize your revenue based on the date of invoice. Still, you would realize the payment over the subscription period (e.g., an entire month).

If your client starts subscribing to your service on Feb 13th, and the subscription ends on March 12th at a $100 monthly fee, their daily fee is $3.57 according to GAAP principles. That means your monthly revenue in February (assuming it has 29 days) will be at $57.14, and the remaining $42.86 is attributed to March.

[($100/days of the month in Month 1) x Days Left in in Month 1]

+

[($100/days of the month in Month 1) x Days Left in Month in Month 2]

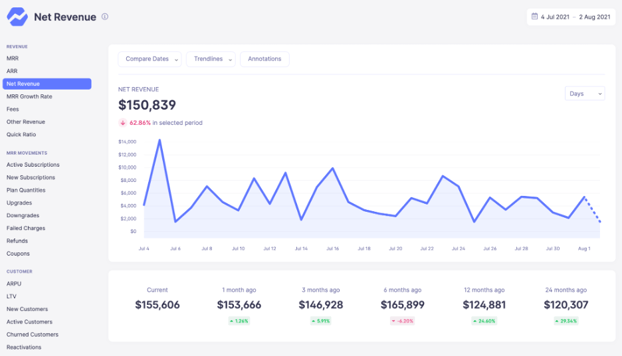

Net Revenue calculation in a typical SaaS company is different to the pro-rata GAAP calculation

Is GAAP accounting legally binding?

GAAP is not legally binding, but all publicly traded and regulated companies must follow GAAP per the US Securities and Exchange Commission. Investors will usually prefer to work with GAAP-compliant companies, so it’s a good idea to follow the principles if you hope to secure additional investment.

Who Sets GAAP Accounting Standards?

While the US Securities and Exchange Commission (SEC) prescribes the use of GAAP accounting standards in reporting, they aren’t involved in setting the actual GAAP standards themselves.

Two boards are responsible for setting GAAP accounting standards, namely the Financial Accounting Standards Board (FASB) and the Government Accounting Standards Board (GASB). The GASB has jurisdiction over financial reporting by government entities, and the FASB is responsible for establishing rules for the private sector.

Both boards are independent, non-governmental agencies. Members are appointed by the trustees of the Financial Accounting Foundation (FAF). The FAF is an independent body responsible for the basic structure for establishing accounting principles. The FAF appoints GASB members, raises funding, and oversees governmental standard creation. FAF and GASB are also supported by the Government Accounting Standards Advisory Council (GASAC).

Differences between GAAP accounting and IFRS accounting frameworksCompanies outside of the US are likely to use the International Financial Reporting Standards (IFRS) and not GAAP. This is an international standard developed by the International Accounting Standards Board. IFRS is used in 110 countries, including many Asian, EU, and South American countries, whereas GAAP is only applicable to the US.

GAAP and IFRS standards generally share more similarities than differences, aside from two key differences.

GAAP is rule-based, whereas IFRS is principle-based, as many industries may have industry-specific rules and guidelines to follow. In general, the IFRS leaves more room for interpretation and for companies to use their judgment.

Does GAAP Accounting Allow Revaluation of Real Estate?

Under IFRS, investment property is defined as property held for rental income or capital appreciation. It’s initially valued at cost and then revalued to market value. Revaluation isn’t allowed under GAAP, but it is allowed under IFRS.

Incorporating GAAP Into Your Business with Baremetrics

You may be wondering whether you should start applying GAAP to your financial reporting. There are several reasons why GAAP reporting is a good idea, even if you aren’t a publicly traded entity.

As mentioned, GAAP is viewed favorably by lenders, creditors, and investors. Many financial institutions will require an annual GAAP-compliant financial statement before issuing a business loan.

Whether or not you apply GAAP to your business’s financial reports, you should be tracking your financial data and metrics. Growing SaaS and subscription businesses use Baremetrics to view their financial data in real-time via dynamic dashboards and forecasting tools. Start your free trial today.

Which Financial Statements Are Required Under GAAP?

If you want to incorporate GAAP principles, you will have to supply three significant statements, including your income statement, balance sheet, and cash flow statement.

You’ll be able to quickly and easily set up these statements in your Baremetrics dashboards and keep up-to-date with the latest GAAP developments using the Baremetrics search functionality.

What Is a GAAP Accounting Balance Sheet?

Your balance sheet applies to a single point in time and covers your assets, liabilities, and shareholder’s equity. Your assets should be listed per subcategories in order of liquidity, followed by liability. The difference between the assets and liabilities is shown as the shareholders’ equity or the company’s net worth.

Your total assets should always be in balance with the sum of liabilities and shareholders’ equity.

If it sounds complicated, don’t worry. You can find the data you need for balance sheets in Baremetrics. You can also check out our curated list of real experts for additional accounting needs.

How Do I Get GAAP Accounting Certified in the US?

There are several options if you would like to get GAAP accounting certified or simply improve your knowledge. Most courses will require prior accounting knowledge.

1. Udemy

Udemy has an affordable GAAP course to explore. It’s aimed at CPAs and other accounting professionals.

2. CPGMA

There’s a $199 course for CIMA members available online. They also have a US GAAP Fundamentals for Finance Professionals course with a certificate for $399.

3. EduCBA

Similar to Udemy, there are self-learning courses from $29 that can help you become familiar with GAAP practices.

4. Ernst & Young

You can obtain a certificate from Ernst & Young following an 8-hour online course.

Limitations of GAAP

While there are many benefits to GAAP, the basic principles of GAAP were designed in the 1980s, when most of a business’s assets were physical. Digital companies have intangible assets, and balance sheets are limited in how it’s displayed, e.g., depreciation and benefits.

Income statements aren’t particularly well suited for digital businesses because internally-created intangible assets like software development aren’t capitalized. In other words, software development that represents an asset is listed as an expense without matching revenue.

Traditional GAAP financial statements don’t account for many SaaS-specific metrics like Annual Recurring Revenue, Customer Lifetime Value, Revenue Churn, and more.

These metrics are critical when it comes to evaluating the health of your business. Baremetrics will help you keep an eye on metrics that matter, as well as the GAAP accounting metrics you need for reporting purposes. It really is the best of both worlds!

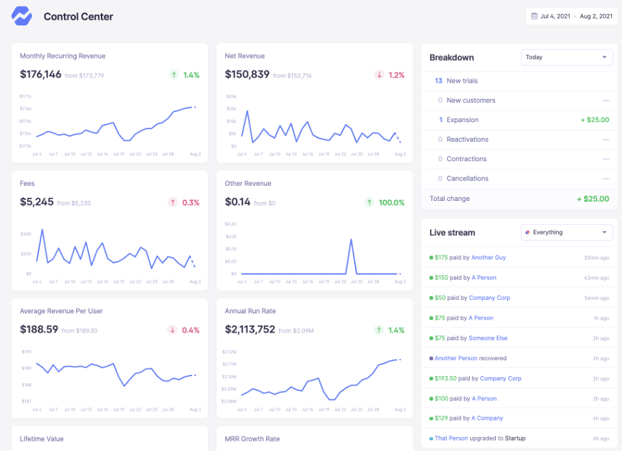

The many metrics visible from the Baremetrics dashboard

Fortunately, Baremetrics can help you track all your SaaS metrics from a single intuitive dashboard. Sign up for a 14-day trial and gain control of your company’s financial health.