Table of Contents

This article will dive into the main principles of accounting for SaaS. The Baremetrics blog has a ton of articles about accounting, so be sure to check out some of our other favorites!

Here we will look at what makes accounting for SaaS different from traditional accounting, as well as:

-

Considerations for accounting with SaaS, PaaS, and beyond

-

Bookings, billings, and revenue

-

Balance sheets

-

Income statements

-

Cash flow statement

-

Statement of shareholders’ equity

-

Getting metrics for your accounting

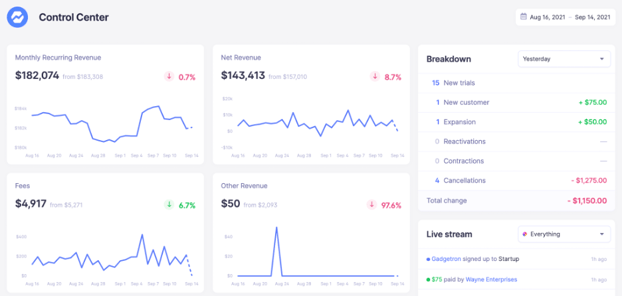

Baremetrics plays a role in your SaaS accounting by providing you the metrics you need to fill out your statement sheets.

Baremetrics can integrate directly with your payment gateway, such as Stripe, and pull information about your customers and their behavior into a crystal-clear dashboard. Sign up for the Baremetrics free trial and check it out here:

What Makes SaaS Accounting Different from Traditional Accounting?

When running a SaaS company, tracking revenue becomes a unique challenge. This is because customers are charged subscription fees, which can change drastically from month to month depending on the pricing model. Customers often change their service level and add or remove extra services, causing MRR for that customer to change.

SaaS products need to have a strong hold on their data as their business changes rapidly month-to-month. Using specific business metrics tools for SaaS is a must when running your SaaS accounting.

Key considerations specific to SaaS accounting

There are many reasons a growth-oriented SaaS company needs SaaS-specific accounting:

-

Small changes in churn, average revenue per user, etc. can drive massive swings in cash flow.

-

Being able to accurately project revenue into the future can help your business maintain a strong cash position so you do not need to look to outside investors.

-

Depending on your jurisdiction and annual revenue, state and federal taxes (and sales tax too) might require you to meet certain accounting criteria.

-

In accordance with the U.S. Generally Accepted Accounting Principles (GAAP), you cannot fully recognize the revenue from your contracts until the services have been delivered. With varying contract lengths, different bundle options, add-on services, etc., SaaS businesses require the ability and flexibility to recognize revenue in a manner consistent with their agreements.

-

SaaS businesses also tend to use specific SaaS accounting software and data tools from other businesses, even other startups, which require your accountant to have specialized knowledge.

-

Early and consistent SaaS accounting standards can keep your data clean, accurate, easily visualizable, and actionable. You don’t want to get into the habit of ad hoc accounting when your business is small only to find it is a costly and difficult mess to unravel later. It is best to stick to the SaaS accounting best practices from day one.

Accrual Accounting vs. Cash Accounting

Although we’ve talked about cash accounting before, here’s a brief summary of cash vs. accrual accounting, and why it might be better for your SaaS company to use accrual accounting as soon as you have the capacity to do so.

Utilizing or providing “XaaS” business complicates your tax situation as you may be required to amortize revenue or expenses over a long period of time. For example, if a company pays you $1200 annually for your service, you may need to recognize that as 12 payments of $100 at the end of each month as the services are rendered. This is where the difference between cash accounting and accrual accounting becomes visible.

Cash accounting is basically what it says. You record revenue when the cash enters your account and you record expenses when the invoice is paid. This drastically simplifies your journals as you do not need to worry about accounts payable or accounts receivable. It is especially useful for small businesses and enterprises that do not require much inventory.

-

Pros

-

Simple

-

Easy to know how much cash you have one hand

-

Can be tax advantageous

-

Cons

-

Difficult to deal with inventory

-

Government tax authorities might not accept it

-

Can make forecasting more difficult

-

Might make the company appear more or less profitable on paper than in reality

Accrual accounting utilizes accounts receivable and accounts payable to record revenue when they are earned and expenses when they are incurred, respectively. This can be complicated, but the reward is a clearer and more accurate view of the company’s financial health. For this reason, accrual accounting is more commonly used by large businesses and is the preferred choice by tax authorities.

-

Pros

-

Makes forecasting easier and more accurate

-

Gives a more accurate representation of the company’s financial health

-

Cons

-

Complex

-

Requires professional bookkeeping and accounting services

-

The company might have to pay taxes on revenue earned but not yet received

Bookings, Billings, and Revenue

Three major considerations when working on SaaS accounting are bookings, billings, and revenue.

Let’s take a look at each of them.

Bookings

Bookings represent your customers’ commitments to pay you money for the services you provide. This is a forward-looking metric and represents the value of the contracts you have signed with customers over a specified period.

Bookings can be separated into different subcategories, including renewal bookings, upgraded bookings, new bookings, and non-recurring bookings (e.g., set up fees or training fees). Bookings that have a forward period of at least one year can be considered based on either the annual contract value of the bookings, which accounts for only the current year portion of the contract, or the total contract value of the bookings, which is calculated based on the complete duration of the contract.

Billings

Billings are the money owed to you by your customers. They are invoice amounts billed to customers. They are usually recorded over a period, usually monthly or for the whole year.

If your SaaS business has high bookings but lower billings, this can be a leading indicator of future cash flow problems. You can find this information easily by generating detailed statements of cash flow on a regular basis, which is discussed a bit more below. Trying to get monthly customers to be annual customers through discounts, or otherwise compelling customers to move up their payments is a good way to avoid this issue.

Revenue

Revenue is the income that you have earned by providing services. If you are using accrual accounting, then you can recognize your sales as the services have been rendered. If you only look at your bookings and billings when assessing performance, it can lead to inflated numbers. You don’t want to be assuming profit monthly for months on end only to find out the customer can no longer pay you for the services rendered. In fact, some companies will decrease their outstanding accounts receivable by some percentage every month they are overdue, assuming that the longer payment is put off, the less likely they will see the money land in their account.

Speaking of revenue, why not check out our article on how to improve revenue growth and build your business faster.

You should sign up for the Baremetrics free trial, and start monitoring your subscription revenue accurately and easily. Check out the revenue metrics right in your Baremetrics dashboard like this:

The Statements

There are four basic financial statements that every company should be producing regularly—not only because tax authorities demand it, but because they offer a clear idea of how your company is doing and where it will be going so that you can double down on what is working. These statements are the balance sheet, income statement, statement of cash flow, and statement of shareholders’ equity.

The balance sheet presents the following information about your company:

-

Assets

-

Cash and cash equivalents (anything that can be turned to cash quickly, e.g., liquid investments)

-

Inventory

-

Accounts receivable

-

Long-term assets including equipment, buildings, furniture, etc.

-

Intangible assets (your brand value, the value of your intellectual property, etc.)

-

Liabilities

-

Accounts payable

-

Sales tax

-

Short-term debt (e.g., credit cards)

-

Long-term debt (bonds issued, mortgages, etc.)

-

Equity

-

Invested equity

-

Retained earnings

Note that, while the balance sheet shows where your company is at a given moment, the following three statements are produced for a period of time and show how the company has changed during that time.

The income statement includes the following information about your company:

-

Revenue

-

Cost of goods sold

-

Gross Profit (revenue minus cost of goods sold)

-

Operating expenses

-

Net profit

The statement of cash flows details the following about your company:

-

Changes in inventory

-

Other working capital changes

-

Operating income

-

Investments in equipment, property, etc.

-

Capital added (investments) or removed from the company (realized profits, e.g., dividends)

-

Any loans paid down or new loans taken out

-

Net cash flow, i.e. the change in your cash position

The statement of shareholders’ equity lists the following about your company:

-

Each shareholder’s ownership at the beginning of the period

-

Their ownership shares at the end of the period

-

Any changes that may have occurred in these positions during the period

Metrics

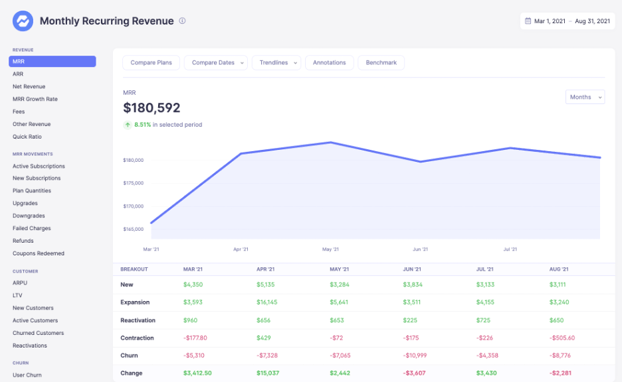

The metrics you can gain, especially when considering your billings, bookings, and revenues, from well drafted books based on SaaS accounting best practices are an essential part of success. Consider checking out our article discussing which metrics you should be tracking today and how Baremetrics can help with that.

Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more.