Table of Contents

Accuracy is an issue when it comes to financial metrics. Keeping track of all of your different sources of income, and doing so to the extent where you can say “this is the correct MRR for the entire business”, is nearly impossible.

Then, let’s say you succeeded to track MRR with accuracy, how about your expenses? That’s a whole other ball game..

Some people will use PayPal or another payment gateway to keep track of their revenue and expenses – but what if Stripe isn’t the only payment gateway you use? What if some customers are paying by invoice? What if some expenses are on a credit card?

Another major question is deciding which financial metrics are worth tracking for your business. The financial metrics you use depend on your industry, size of the company, types of shareholders, and more.

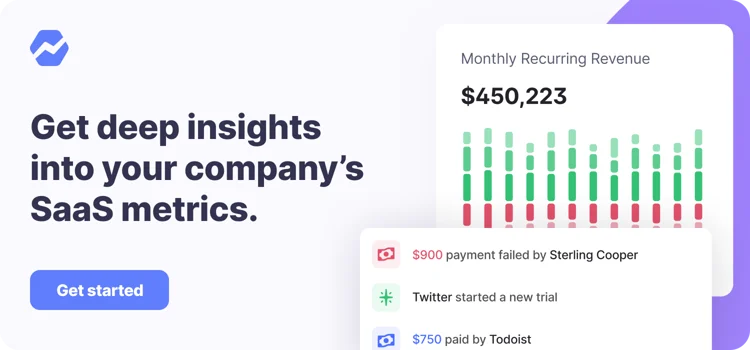

Some people opt to use a tool like Baremetrics that can pull your sources of data together and calculate your metrics quickly and accurately.

This article will go over the key financial metrics you should be monitoring for different kinds of businesses, as well as how to quickly automate actions based on your financial metrics.

Let’s dive in!

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.

An overview of key financial metrics in a traditional business

Let’s take a look at some of the common financial metrics analysts use to better understand businesses. The metrics here may not apply to every situation, as every company has a different capital structure, revenue streams, and expenses.

1. Gross Profit Margin – This metric indicates the amount of money left over from sales after subtracting the cost of your sales.

Gross Profit Margin = (Net Revenue – Cost of Sales) / Net Revenue * 100

2. Net Profit Margin – This metric compares net profit to your revenue. Net profit is a value that is calculated based on revenue, cost of sales, expenses, interest, and taxes. If you compare Net Profit to your Revenue, you will be able to see how much of your Revenue you are retaining as profit after all the environmental factors (taxes/interest rates, etc.) are taken into account.

Net Profit Margin = (Revenue – Cost of Sales – Expenses – Interest – Taxes) / (Revenue) *100

Net Profit Margin = Net Profit / Revenue * 100

3. Working Capital – This is the amount of money a company has to work with. This metric measures. This metric measures the difference between all of your assets and everything you owe to someone else. Your assets are everything of value, such as cash, accounts receivable, raw materials, properties, etc. Your liabilities, or everything you owe, are things such as accounts payable, rent, etc.

Working Capital = Current Assets – Current Liabilities

4. Current Ratio – It indicates the ability of the business to honor its current obligations, or in layman’s terms – does a company have enough assets to pay off all of its dues within this year.

Current Ratio = Current Assets / Current Liabilities

5. Quick Ratio – Similar to the current ratio, the Quick Ratio compares your current assets to your current liabilities. The key difference is Quick Ratio does not count your inventory towards your assets. This means that the Quick Ratio shows only assets that can be sold off quickly to pay off your liabilities.

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

6. Debt to Equity Ratio – This ratio indicates the ratio of total debt or liabilities with the amount of Shareholder equity. This shows you how a company’s capital is weighted, whether it’s weighted more towards debt or more toward equity financing.

Debt to Equity Ratio = Total Liabilities / Total Shareholders Equity

7. Total Asset Turnover – This ratio measures the company’s ability to generate sales using the fixed assets investments. In other words, it assesses the ability of a company to generate net sales from its existing machines and equipment efficiently.

Total Asset Turnover = Revenue / ((Beginning Total Assets + Ending Total Assets) / 2)

8. Return on Equity – The Return on Equity (ROE) ratio is a profitability ratio used for measuring the return that an organization earns on Shareholders’ Equity. In essence, The Net Profit that the organization makes for every unit of Shareholders Equity.

ROE = Net Profit / ((Beginning Equity + Ending Equity) / 2 )

9. Return on Assets – Return on Assets helps to find out how a company is utilizing its assets. ROA is a profitability ratio that tells us how well a company uses its assets to fuel its profits.

ROA = Net Profit / ((Beginning Total Assets + Ending Total Assets ) / 2 )

10. Operating Cash Flow – Indicates the amount of cash a business generates from its operations. It can be calculated via two methods: direct or indirect. The direct method of calculating cash flow uses real receipts and transaction statements to account for everything. The indirect use totals in your assets or liability statements to count for all of the cash moving around.

If your cash flow is positive, it means sufficient money is available to do operations. If negative, it indicates that the business will require additional funding to keep current operations flowing.

This overview is only the start. The next step is deciphering what’s the most important metrics for your business, and building out a financial model based on those metrics.

Let’s take a look at the most basic financial metrics you need to be calculating for an online business.

The first 26 financial metrics you should be tracking for SaaS businesses

SaaS businesses are a specific type of business. SaaS are defined by recurring revenue streams, low cost of sales, and no material product.

When keeping track of your financial metrics for a SaaS company, you need to focus on the basic measurements. Then, you need to focus on doing the basic measurements correctly.

Every business should start with these metrics as your first set of financial metrics, then you can expand on to secondary calculations after that.

Monthly Recurring Revenue (MRR)

- How much revenue you’re pulling in on a monthly basis.

Annual Run Rate (ARR)

- ARR shows your current revenue projected out over 12 months.

- Annual Recurring Revenue = (MRR * 12)

Net Revenue

- This metric shows the actual money received on a day-by-day basis.

MRR Growth Rate

- This metric is simply equal to the percentage change in MRR from one month to the next.

Other Revenue

- This metric accounts for all of the one-off charges your business receives.

Quick Ratio

- In SaaS, the Quick Ratio expresses a basic measurement of the growth rate of a company.

Active Subscriptions

- This metric shows how many paying customers the account has.

New Subscriptions

- This shows how many new subscribers you have within a date range, or by day or week.

Plan Quantities

- This metric outlines how many customers you have and the quantity of the subscriptions.

Upgrades

- This metric shows when customers go from one paid plan to a more expensive one.

Downgrades

- This metric shows customers who have moved from one higher paid subscription to a lower priced subscription.

Failed Charges

- This metric shows anytime your payment provider attempts a charge and it is not successful.

Refunds

- The Refunds metric shows all of the money you’ve given back to your customers through a refund.

Coupons

- This metric displays the amount of money you are “losing” due to coupons applied to active subscribers.

Average Revenue Per User (ARPU)

- How much value (in dollar amounts) is each of your subscribers bringing? ARPU takes the total revenue and divides it by the amount of your active customers.

- How much do your customers make you before they churn?

New Customers

- This metric shows the customers going from free plan, a trial, or no plan, directly to a paid plan. Think of this as “New Paying Customers.”

Active Customers

- This metric shows customers who are active and actively paying.

Churned Customers

- These are the customers who stopped using your companies’ services.

Reactivations

- Reactivations are when a previous customer from a trial or a paid subscription realizes how amazing you are and comes back!

User Churn

- User Churn is a percentage showing the number of customers who left in the previous 30-day period relative to your total customer count 30 days ago.

Revenue Churn

- Revenue Churn is a percentage showing the amount of MRR that has been lost in the last 30 days relative to your total MRR 30 days ago.

Net Revenue Churn

- Net Revenue Churn shows the lost revenue from cancellations and downgrades.

Churned Subscriptions

This shows you the subscribers who have downgraded from one subscription to a free plan, as well as true cancelations (the people who are no longer paying you).

You can see more information about each of these metrics, such as how to calculate them and why you need to know about them here.

As well, all of these metrics can be monitored in Baremetrics. You can see each of those metrics right in the side panel on the left hand menu of the UI.

Financial metrics for SaaS are customized to SaaS

The financial metrics that you want to know about for your company highly depend on your industry and type of business. For heavy industry businesses, metrics related to assets such as machinery and logistics will be critical. For SaaS, not so much.

For each business, you will need to build a customized financial model that explains exactly which metrics you are focusing on. For SaaS, check out this financial model that you can download and use directly in Sheets. Baremetrics integrates with google sheets so you can easily pipe your data right into your financial model.

This financial model was built by a finance consulting agency to specifically cater to SaaS businesses, and the metrics necessary for them. Definitely check it out!

As well, the actual names and meanings of metrics can change from industry to industry. For example, Quick Ratio for a brick and mortar commodities company is about comparing your assets and liabilities. For SaaS, the Quick Ratio has a completely different definition. The SaaS Quick Ratio compares growth in MRR from sales, expansions, or reactivations to losses in MRR due to churn.

Definitely check out the Baremetrics Academy for more information on financial metrics related to SaaS!

Baremetrics provides the most accurate MRR monitoring tool for SaaS

Each product or tool will collect information about your metrics in their own way. It is up to the discretion of the analyst to choose a tool that matches the way they want to measure their metrics.

For example:

- Do you count overages in your MRR metric? If you have a subscription customer who’s minimum monthly payment is $10.00, but frequently pays $3-5 dollars more per month due to optional extra services, do you count the extra $3 dollars as MRR or as one-time-payments?

- If your customer has cancelled, but will continue to pay for 6 months, do you count the remaining 6 months of revenue in your MRR? Some people say you shouldn’t because it’s no longer guaranteed to recur. However, some products still count this value until it disappears.

Baremetrics has taken tons of considerations like this into account when designing how our metrics are calculated.

Reach out to the Baremetrics team for a full description of how our metrics are calculated. Get your Baremetrics free trial and check it out!

Automate actions and insights based on your financial metrics

Not only do you want to have accurate financial metrics, you want to take action on your financial metrics.

When there is a failed payment causing reduced churn, you want to have a system in place that reacts and makes sure the proper actions are taken to recover that transaction.

You can use the Baremetrics Recover tool to automatically take action on failed payments. This tool will identify failed payments, automatically reach out to the customer with the failed payment, and then get the customer to re-enter their credit card information to make the transaction successful. This saves business owners thousands of dollars a year that typically goes lost and untraced due to the difficulty of keeping track of everything.

As well, you want to be able to easily segment, forecast, and monitor the financial behaviour of your customers and expenses.

Using the Baremetrics tool for customer segmentation, you can break down your MRR by plan, service type, and any other customized behaviour you track within your app.

Check out the graph below which shows revenue segmented by geography. You can easily see the difference between Canadian and British customers, where the revenue from Canadian customers is still growing, but the revenue from British customers has plateaued.

Use Baremetrics to not only see your financial metrics, but to power automatic actions and insights based on your financial metrics.

Conclusion

Understanding your financial metrics is critical, but the problem extends far beyond the question “which financial metrics should I measure”. You need to be keeping on top of your financial metrics from an operational point of view, and be constantly in touch so data doesn’t get dropped.

Then, making the most of your financial metrics is another critical and challenging question.

Baremetrics automatically pulls information relating to your finances from your payment gateways and gets all of your financial metrics in one place. Then, Baremetrics powers you to act on your financial data, as well as share and analyze it.