Table of Contents

When discussing the financial metrics for a SaaS company, revenue vs. profit is among the most common comparisons encountered. This is because these two terms are essential determinants of a company’s financial position.

When a SaaS product or service has been developed, tracking the ROI (return on investment) involves always keeping revenue vs. profit at the top of mind. However, these two financial terms are sometimes misrepresented in the books.

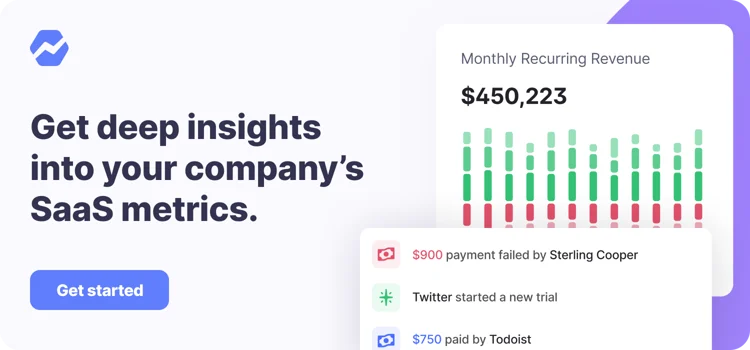

It’s important to keep these two metrics separate. If you are looking for an easy way to keep track of revenue vs. profit, start tracking your subscription data with Baremetrics.

What is revenue?

Revenue is the total income brought into your SaaS company from your core business activities. It is often synonymous with a simpler term that you are already familiar with: sales.

Revenue is measured over a certain period (daily, weekly, monthly, or yearly). When calculating your company’s revenue, no deductions are made. All monies, no matter how little, add up to yield the company’s total revenue.

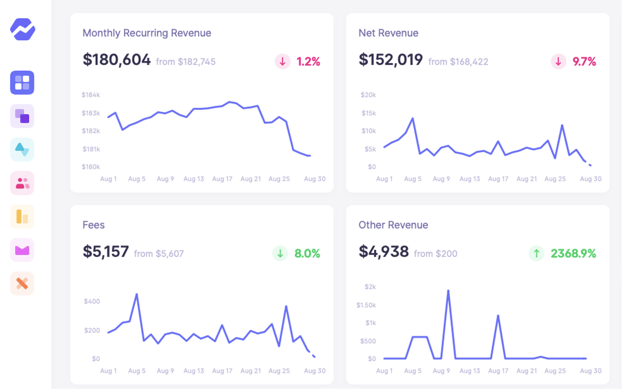

Net revenue, however, does deduct the returns, discounts, and refunds made.

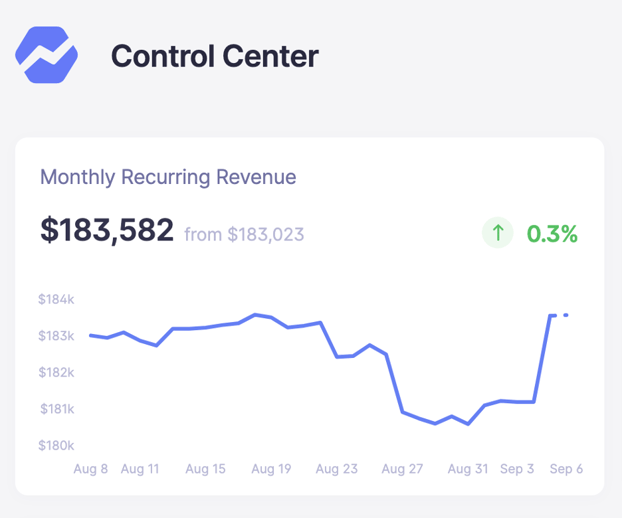

You can monitor your monthly recurring revenue (MRR) when you sign up for Baremetrics. Get on the Baremetrics platform to get better measurements of your revenue!

Understanding your revenue alone may be insufficient to give you a holistic view of your company’s financial health. The reason is simple: revenue does not represent your company’s “true” return on investment.

Here, profit can give you more information.

What is profit?

Profit is the amount that remains after operating costs and variable costs have been deducted from the total revenue. Profit shows you the money on your income statement that belongs to your company after all expenses have been deducted from your revenue. It can then be added to the owner’s equity on the balance sheet under the title “retained earnings”.

When someone purchases your SaaS subscription, that sale must be filtered before you can get a profit value. Cost of goods sold and operating expenses take a chunk out of the total sales amount. After these costs are deducted, the remaining amount is your company’s profit or net profit.

Profit, as with revenue, is calculated for a specific period (i.e., daily, weekly, monthly, or annually).

Understanding revenue for your SaaS business

A SaaS company can count on several ways to grow its sales. Revenue for a SaaS business may be challenging to track due to the different channels (e.g., different subscription packages, upgrades, or add-on) from which SaaS products and services make sales.

Baremetrics helps you keep track of the different kinds of revenue that your company may acquire.

Calculating revenue from disparate sources is why SaaS financial accounting is so different from the financials in traditional industries. However, revenue can be easily tracked and visualized when you have Baremetrics integrated with your system.

There are clear reasons you need to understand your company’s revenue over specified periods:

- Revenue makes it possible to calculate other financial ratios for your business.

- Revenue shows you the market size your company has captured.

- Revenue shows you that your target audience is interested in your product (or not!).

- Revenue is needed to calculate profit.

Later in this article, you will find discussions on revenue vs. profit as well as revenue vs. other financial metrics relationships. Together, these financial metrics boost your knowledge of your company’s financial health.

Understanding profit: what does your profit margin tell you about your business?

The profit margin is the percentage of profit made by a company from its sales. It’s a financial metric used to assess a business’s ability to generate earnings relative to its revenue. If a business reports that its profit margin during the first quarter of the year was 40%, it means that the business had a net income of $0.4 for every dollar of sales created.

There are four different types of margins. These margins are used to measure a company’s profitability at different cost levels. They include:

- Gross margin: The gross margin measures how much money a business makes after accounting for the cost of goods sold.

- Net profit margin: The net profit margin measures a company’s ability to generate earnings after all expenses and taxes.

- Pretax margin: The pretax margin depicts a company’s profitability before taxes have been paid.

- Operating margin: The operating margin shows the percentage of sales left after settling the operating expenses and the cost of goods sold.

The profit margin is among many other profitability ratios that present an excellent way to evaluate a SaaS company’s profit-generating ability. The profit margin also makes it possible to compare your profitability to your competitors relative to an industry benchmark. A company with a higher profit margin relative to its competitor or relative to a previous period shows a clear indicator of a healthy business.

Suppose you wish to compare your SaaS profitability ratios such as profit margin with other companies in your industry.

Baremetrics offers SaaS financial benchmarks that will show you, at a glance, what’s standard in your industry.

Sign up for the Baremetrics free trial and start seeing more into your subscription revenues now.

The relationship between revenue and cost

Simply put, revenue is total sales, and the costs are the expenses involved in creating those products and services for sales. Revenue and expenses are represented on an income statement for every product or service a business sells. The general goal of a company is to reduce costs while increasing sales so that the profit margin continues to increase.

Understanding the revenue vs. profit relationship: when the revenue is growing

An important dynamic to note for revenue vs. profit is that a company can have revenue without making a profit. When a business collects payments for goods or services rendered to customers, it’s easy to think that business is also making profit. However, revenue values alone aren’t a true mark of profitability because, if the expenses of a business exceed its revenue, the company will make a loss rather than a profit.

A company may have significant revenue but enjoy minimal profits from its sales. It often happens because the company’s expenses are so high that it is difficult to earn profit.

Understanding the revenue vs. profit relationship: when the cost of business is growing

An increase in business costs could dwindle profits if the business is not bringing in enough revenue. Business costs include direct costs such as wages and materials, indirect costs, and operating costs such as overhead. A business’s profit margin can be improved by carefully finding new ways to manage costs.

An aspect of strategic management is resource management. Your SaaS company can choose dunning management solutions such as Baremetrics Recover as their resource management tool for failed credit card payments.

However, resource management should never be at the expense of the quality of goods or services delivered. A continued increase in the cost of business would eventually lead to losses even if revenue increases.

Understanding the revenue vs. profit relationship: when the cost of business is going down, but revenue is staying the same

When the cost of business is reduced, but the revenue remains constant, the profits should increase. However, if cost reduction means lowering the quality of the company’s goods or services, the company might also need to reduce their price to maintain the same level of sales.

Any reduction of quality (as a result of reducing the cost of business) will likely eventually lead to a gradual loss of market share. Market share is lost because it is usually challenging to maintain revenue when the quality of service is reduced. Companies that reduce cost without affecting quality and sales price can find a clear path to higher profitability.

Understanding the revenue vs. profit relationship: when there is a huge one-time loss

Sometimes, a business may meet misfortunes, for instance, a lawsuit that affects the business so much that it takes a huge loss. A situation such as this is usually called an extraordinary item in accounting because it’s not expected to occur again. If a company suffers a one-time loss, profits will suffer. Still, a focus on revenue can help the company return its fortunes quickly enough to show stakeholders that it is determined to get back to profitability.

The goal of any business is to maximize profit by reducing costs and/or increasing revenue. A company’s effectiveness at achieving that goal depends on the relationship between its total revenue and total costs. While every business will strive to reduce costs, increase revenue, and improve profit margins, it’s crucial to always keep an eye on industry benchmarks with in-depth cohort comparisons.

The Baremetrics Benchmarks feature provides your company with the vital signs it needs to grow and succeed. Check out more of what the Open Benchmarks say here, or start a free trial today!