Table of Contents

More Founders Journey Articles

Few business owners are as passionate about what they do as those of SaaS companies. Baremetrics has supported hundreds of SMEs with comprehensive analytics as they develop, build and maintain their business over time. In fact, many of these owners remain in the industry for years, while others sell their businesses for a healthy profit.

In both cases, these businesses need to understand the owner’s equity to make strategic decisions about the company’s future. The owner’s equity is used to obtain investment loans or when selling a company as an investment.

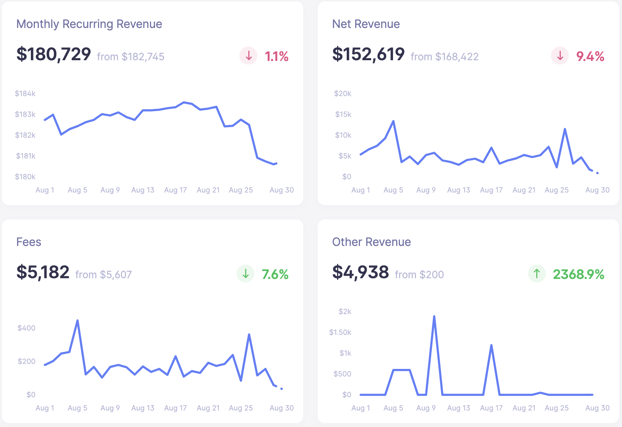

Connect Baremetrics to your revenue sources and start seeing all of your revenue on a crystal-clear dashboard. You can even see your customer segmentation, deeper insights about who your customers are, forecast into the future, and use automated tools to recover failed payments.

Sign up for the Baremetrics free trial and start seeing more into your subscription revenue now.

What Is owner’s equity in SaaS?

Owner’s equity is the proportion of the total value of an organization’s assets that its owners and shareholders can claim. To calculate the owner’s equity, add up the book value of all your assets.

Assets can either be current or non-current assets. Current assets are any items that can be converted to cash within a year, such as inventory or accounts receivable. Your non-current or long-term assets are items that aren’t consumed or converted to cash within a fiscal year, including real estate properties, equipment, patents, etc.

Once you’ve established the value of your assets, all the liabilities (loans, payroll, accounts payable, etc.) are deducted from the total amount. The amount left after the deduction is the owner’s equity or net worth.

For example, if you have $400,000 of assets in your company and took a loan of $300,000 to cover expenses, your owner’s equity is $100,000.

Your owner’s equity increases when the owner or partners increase their capital contribution or if profits increase through sales. Your owner’s equity is lowered by making withdrawals, the depreciation of assets, or any losses.

Why is owner’s equity important?

First and foremost, owner’s equity helps you evaluate your finances. At the same time, it helps you make crucial decisions about expansion and maintenance. You can compare your owner’s equity from one period to the next to determine if you’re gaining or losing value over time. Remember, when you’re seeking financing, you need to show equity to investors and lenders.

Furthermore, the owner’s equity only shows the book value of the business and not the market value. Market value is the price of assets sold, while book value reflects the purchased amount of an asset. Therefore, your market value can be either higher or lower than the book value because of your business’s earning potential and revenue.

What’s included in owner’s equity in SaaS?

Owner’s equity includes the money invested by the owner of the business and the profits generated since its inception, minus any funds taken out of the company or lost by the business.

In the case the company is structured as a corporation and ownership is widely held by shareholders, your equity will also include the following.

i. Retained earnings

Companies may opt to distribute their profits as dividends to shareholders or retain and reinvest the money into the business. The funds kept on the balance sheet and not paid out in dividends form a part of equity.

ii. Outstanding shares

The shares of a corporation issued and purchased by investors are known as outstanding shares. In other words, these are the shares on the open market held by insiders and company officers. However, outstanding shares can fluctuate if the company issues new ones when exercising employee stock options or raising extra capital. These decrease in number if the company repurchases shares.

iii. Treasury stock

Treasury stock or treasury shares are previously outstanding stock bought back from shareholders and held by the company. Companies often do this if they feel their stock is undervalued. To raise the market value of the remaining shares and earnings per share, the company might reduce the circulating number of outstanding shares through repurchasing.

iv. Additional paid-in capital

Additional paid-in capital or contributed capital is the amount paid for shares above their par value. Simply put, it’s the amount of money investors paid for shares above their nominal value. It cannot be distributed as dividends.

Want to Reduce Your Churn

Baremetrics measures churn, LTV and other critical business metrics that help them retain more customers. Want to try it for yourself?

Is owner’s equity an asset?

While owner’s equity is calculated based on the assets owned by the company, it isn’t reflected as an asset on the balance sheet. Technically speaking, owner’s equity is the assets of the business owner and not the business itself.

Business assets are all the items of value owned by the company, while owner’s equity represents the owner’s claim to what would be leftover if the business sold all of its assets and settled its debts.

Can owner’s equity be negative?

The owner’s equity can be either negative or positive depending on the company’s balance of assets and liabilities.

If a business’s liabilities are more significant than its assets, the owner’s equity will be negative, and the owner may wish to invest additional capital in the company to cover the shortfall. Negative owner’s equity can have tax implications, too. If the owner draws money from the business, the draws are taxable as capital gains.

It’s critical that the business monitors its capital accounts and avoids withdrawals if the balance is negative. Read more about the importance of understanding equity as a start-up on our blog.

How is owner’s equity shown on the balance sheet?

The owner’s equity is recorded on your balance sheet at the end of the accounting period. Assets are shown on the left side, while, on the right side, you can find the liabilities and owner’s equity.

Keep in mind that the owner’s equity is always indicated as a net amount, showing the amount of money taken out as withdrawals by the owner or partners throughout a designated accounting period. The company will also maintain a capital account that reveals the net equity resulting from the owner’s investments.

How to calculate owner’s equity

Finding owner’s equity isn’t rocket science, as basic math is more than enough.

Just deduct liabilities from the total value of assets to calculate it:

Owner’s Equity = Total Assets – Total Liabilities

The same calculation also determines shareholder’s equity if the company is a registered corporation.

The fundamental difference between the balance sheet of a SaaS company and other businesses is the way revenue is generated. To determine your net profit, you’ll need several metrics on hand, including:

i. Annual Contract Value (ACV)

This metric represents the average annual contract value of a customer subscription, including new bookings and renewals. Additionally, you’ll also need to account for lost ACV that occurred through churn. Keep an eye on your ACV in Baremetrics.

ii. Annual revenue

This includes your total subscription and usage-based revenue for the year.

iii. Cost of revenue and operating costs

Companies selling physical products would list the Cost of Goods Sold (COGS) on their income statement, but SaaS companies use the Cost of Revenue (COR) instead. They are the direct costs incurred by delivering your product in the accounting period. That can include hosting and infrastructure costs, customer support, cloud operations, third-party software, or data fees.

Operating expenses include marketing, administration, and product development. These costs determine your net profits, found at the bottom of your income statement. Net profit can also be recorded on the balance sheet under retained earnings if it is not, for example, divested through dividends.

How is owner’s equity calculated when there are shareholders?

Your shareholders’ equity is calculated in the same way as the owner’s equity where a sole proprietorship or partnership is registered. It represents the total dollar amount that would be returned to shareholders if its total assets were sold and debts settled.

Shareholders’ equity is also recorded on the balance sheet at the end of a financial reporting period and determines financial health.

The simple calculation is:

Shareholders’ Equity = Total Assets – Total Liabilities

Conclusion

As a business owner, understanding your equity is vital to determining your growth and your business’s potential if sold as an investment. You can’t assess your equity without understanding your revenue, which is why you need a comprehensive tool designed to measure and manage your critical SaaS metrics.

Baremetrics is a metrics, forecasting, and engagement tool for SaaS businesses. Track your most important revenue metrics and benchmark against other companies to gain complete insight into your company’s health, wealth, and potential.