Table of Contents

More Founders Journey Articles

Key Takeaways:

- Setting your prices can be one of the biggest challenges SaaS brands face.

- Different pricing models impact how you’ll charge customers, with some options including flat-rate pricing with set features, per-user pricing, or usage-based pricing.

- Pricing strategies determine how you market and position your product and pricing in order to attract customers and increase sales.

- Finding the right price point can be difficult, with factors like market needs, competition, audience segments, and perceived value being crucial.

- Pricing details, including the actual pricing costs, should be tested regularly, as even a tiny, incremental change can make a substantial impact on revenue.

Pricing can be one of the most overwhelming and puzzling parts of business.

SaaS businesses, in particular, have a unique challenge with pricing for a few reasons:

- There’s an almost infinite number of different ways to price a SaaS product.

- The cost to produce and maintain a SaaS product is generally unrelated to the value a customer receives, so pricing based on how much margin (profit) doesn’t make sense for the most part.

- The recurring nature of SaaS means that value is spread out and captured over time.

- Many SaaS products are packaged into different plans, essentially creating different versions of a product, which introduces multiple layers of complexity.

Whether you’re sitting down for the first time to figure out pricing for a new product or revisiting pricing for the 10th time this year, the process can easily stump you.

The goal of this article is to walk you through, step-by-step, everything you need to know to optimize your pricing and clear your head of all the anxiety and stress that goes into it. Most of the articles/ebooks I’ve read are either super brief or extremely scattered. I want to create something that’s actually actionable to help you with pricing and packaging your products.

The core information will cover:

- Pricing Models: The method by which a user pays to use your product and for how much (+ screenshots and examples).

- Activation Models: The method by which a user starts using your product (+ more screenshots and examples).

- Pricing Strategies: The way your pricing model is presented and marketed.

What is SaaS pricing?

Pricing is how you sell and how much you charge a customer for your product(s). It’s often synonymous with “packaging” and “plans,” which are different pricing components, but for the sake of this post, we’ll refer to everything related to price, packaging, and plans simply as pricing.

The importance of pricing in your business

Pricing is not a set it and forget it part of your business. It inevitably evolves and requires more attention than most give it. It’s also one of the most important underutilized growth levers you can pull.

Pricing is far more than just the amount you charge customers every month. It’s also a large determinant of your Average Revenue Per User (ARPU), how many customers you need to reach your revenue goals, your Churn Rate, which channels are viable to acquire customers, and how Expansion Revenue plays into your business model.

If there’s only one thing you take away from reading this article today, it’s the understanding that you should be revisiting your pricing at least once a year, if not twice a year, to ensure it matches the value you’re creating for your customers.

Unfortunately, it’s an afterthought for many. More often than not, founders spend a few hours together in the early days to set the price when they launch, briefly revisit once a year, and only make major changes when a customer segment or investor essentially forces them to.

The reality is that it deserves just as much attention as every other critical part of the business: product, marketing, operations, etc.

Think of pricing as the intersection of every part of the business.

It impacts your brand and how the market perceives you, your position versus competitors, the expected value from customers, how your product spreads, the types of users you target, and so much more.

Given the weight of its importance, how do you decide on a pricing model that makes sense for your business?

How to Choose a Pricing Model and Strategy

Brian Balfour explores the idea of Model-Market Fit in his series on 4 Frameworks to Grow to $100M+. Model-Market Fit is the concept that your market influences your model (i.e. pricing model and strategy) and is derived from Christoph Janz’s Five ways to build a $100 million business. In it, he explores the relationship between ARPU and the number of customers you need to reach your revenue goal.

Now, not everyone is trying to build a $100M+ business. But the principles remain. Delete one or two zeros from the number of customers you need for each ARPU threshold and you can translate this same framework for your business.

Want to build a $1M+ business? A low ARPU means you need a large number of customers, which also dictates how you acquire and subsequently retain those customers. A high ARPU means you don’t need so many customers, but they may be harder to acquire and more critical to retain.

Am I suggesting that you simply choose your target ARPU, set a price that matches the ARPU you want to see, and then magically find Model-Market Fit?

Not so fast. As Brian explores with Model-Market Fit, your market dictates your model; you don’t.

Introducing a free plan to attract more users won’t solve your startup woes. Charging more won’t solve your startup woes. “Going upmarket” won’t solve your startup woes either.

The market determines the value of your product, it’s your job to find out what that value is and then decide on the Value/Price Ratio you want to deliver — which we’ll get into below.

Pricing your product at $100,000/year would never make sense for a stay-at-home mom selling earrings online but for a national jewelry retailer? It’s probably normal. In fact, it could be a bargain.

Ultimately, a sales price analysis is critical to helping you determine if your pricing strategy is working for you.

Why SaaS Pricing is All About Perceived Value

“Price is what you pay, value is what you get.” — Warren Buffet

Reilly Chase, founder of Hostifi, explained how he shifted his pricing from cost-based to value-based. For his particular service, a $5 server can typically handle 125 UniFi devices, and he wanted to have around a 75% profit margin, so he charged $19/month. What he didn’t realize was that 80% of his customers used less than 30 devices and many of those only used 1-10 devices. Potential customers weren’t signing up because the price was too high for their needs, and current customers felt they were overpaying for what they were actually using.

By changing the price points and features for each tier, he could align much more closely with the value each customer got from his product. Not only that, there’s now a much more viable path to customer growth and expansion revenue. Whereas before, only a small minority of customers would reach the 125 device limit and upgrade to the next pricing tier, now customers are incentivized to upgrade to higher tiers at a much lower device limit and for more features as their needs get more sophisticated.

Before:

After:

$49 – 250 devices, $99 – 500 devices plans not shown above

$49 – 250 devices, $99 – 500 devices plans not shown above

And this brings up another important lesson: Just because you could charge more doesn’t mean you should.

For Reilly and Hostifi, it actually meant charging less for a segment of his customers. But it also paved a path to charge more to other segments who were realizing more value from the product.

Sure, he could have kept the old pricing model and continued to charge smaller users $19/month, but they likely wouldn’t actually receive that much value in the end.

As Justin Jackson explores in his post Should we always charge more? it’s important to realize that customers should undoubtedly receive more value than what they’re charged for. If the customer is receiving just as much value as they are paying, they haven’t actually gained much and likely won’t realize the value in using your product.

“Let your customers think they got a great deal. They’ll tell friends about you, who then become new customers. And those customers will love you, because you’ll give them good deals too.” — Ryan Kulp

The best way to describe “getting a great deal” is to compare the value a customer receives to the price they pay, in what I call the Value/Price Ratio.

A 1:1 Value/Price Ratio means customers are getting just as much value as they’re paying for, and while this seems reasonable, they’ll likely feel that they’re not getting much out of it and will try to find something at a lower price. Whereas with a 10:1 Value/Price Ratio, customers will practically feel obligated to tell others about it and stick around for a long, long time.

What about when a customer, who by all means qualifies as a great fit and match for the product, cancels and says that it’s too expensive? It could be an indicator that the Value/Price Ratio wasn’t high enough in their perspective. But don’t go lowering your prices just yet.

This feedback could mean a couple of different things for you:

- Your price is too high for the value your product delivers

- They didn’t realize the full value potential of your product

- They actually weren’t a great fit for your product

Choose who you listen to wisely. But also, carefully consider every piece of feedback about your pricing.

You might also be tempted to just sweep that feedback under the rug and call it an anomaly. Think critically about the Value/Price Ratio you want to deliver and then work to understand why a customer isn’t achieving it.

Instead of reverse-engineering the profit margin you want like in a cost-based pricing model, reverse-engineer the Value/Price Ratio you want to deliver and use that to determine your pricing model.

Learn more about when to raise prices and how even small price changes can influence revenue.

What If You’re Just Starting Out?

Pricing, like every other part of the business, is going to be constantly evolving.

So instead of sweating over finding the perfect pricing model before you even have users, focus on finding a starting point.

- Keep it simple: Be careful not to over-engineer it. Especially with little to no users, you’re working off of assumptions and invalidated research. Err on the side of simplicity so you can get customers who can provide the feedback and insights you need to find the right pricing.

- Be flexible: Everyone will have a different opinion about pricing, which will be both frustrating and insightful. Don’t be afraid to make exceptions or give a little wiggle room to get someone in the door.

- Test and iterate: Getting a lot of signups but no customers? Change the price. Customers telling you they’d easily pay more? Charge more! It’s impossible to find the right pricing model without testing and iterating.

- Consider your revenue needs. Some businesses focus on cost-plus pricing, which bases your product pricing on your desired profit margin after expenses. This is a good way to ensure you’re profitable long-term. Others focus on value-based pricing, considering what they think customers are willing to pay based on perceived value.

The Intercom founders have mentioned how when they were first deciding on a price, they asked Jason Fried for advice, who told them to essentially pick a price and be done with it. The details could be worked out later and the pricing will evolve. Especially in the early days, sometimes it’s important to just make a quick decision so you don’t waste time.

Pricing should be tested and evaluated every few months anyway.

Here’s what Jordi of BugFender told me about his experience testing pricing:

“When we decided to increase our prices we had the fear it would hurt our growth, so we changed the prices and re-evaluated after a few months. In order to not bother our existing customers, we decided to ‘grandfather’ them and apply the new prices only to people who purchased new plans. By doing that, we kept growing our revenue at the same rate (see the trend keeps steady after June 2018 — even if summer was not very good) and at the same time, we kept our customers happy. Even some upgraded to the new plans when they saw fit, giving us some extra expansion revenue.”

Jordan Gal of Carthook thought that demand would slow down when they decided to increase prices, but he didn’t expect what happened:

“Pricing started at $100/month because that’s where the incumbent was and we figured it was a good starting point. We got overwhelmed with demand so we moved to $300/month to slow things down. Demand stayed exactly the same!”

Similarly, Davis Baer of OneUp explained how their pricing changed over time:

“We increased our pricing based on feedback from a few customers that said our pricing was ‘crazy cheap.’ It was actually a part of our initial acquisition strategy, but we needed to test what an increase in pricing would do. Our hypothesis was that the number of new paying customers would decrease slightly but that our MRR would still increase at a higher rate. After 2 months of data, it turns out our hypothesis was spot on.”

You can also use Louis Nicholls’ price calculator to get started.

As we’ll explore below, you can use many pricing models, activation models, and pricing strategies to find the ideal pricing strategy for your SaaS products.

7 SaaS Pricing Models

The method by which user(s) pay to use your product and for how much is called the pricing model:

- Flat rate pricing

- Usage-based pricing

- Tier-based pricing

- User-based pricing

- Feature-based pricing

- Credit-based pricing

- Hybrid pricing

1. Flat-Rate Pricing

The flat-rate model is the simplest way to sell a product. In flat-rate, there is only one package with one price. The price may vary based on monthly or annual billing. In flat-rate, the user gets access to all features and has a set policy on how many users there are on the account. Many flat-rate plans are paired with a free trial.

The pros of using a flat-rate model are that it will be much easier to communicate, and in turn, much easier to sell. Marketing one plan is a lot more straightforward than marketing 3-4 plans. With one plan, you can focus everything you do on the one plan.

Using a flat-rate model will also make predicting revenue growth, churn, and lifetime value much easier. With every additional plan and rate, forecasting becomes exponentially more complex.

The cons of using a flat-rate model are that some customers may perceive your product as too expensive or too inexpensive to be a good fit for them. What I mean by this is simply that with a single rate and plan, it may be difficult to attract different types of users who have very different opinions about price. Customers may tell you that they really don’t need certain features or parts of the plan and that they would buy it if you stripped away certain parts and offered it at a lower price. The opposite is also possible: Customers want more features and services that the current plan can’t justify.

It’s also difficult to extract value from all the different kinds of customers on the plan. Some customers could generate a lot more revenue for you if you changed the pricing on certain seemingly insignificant variables. Flat-rate pricing essentially eliminates the opportunity for any expansion revenue. Getting that price right the first time can be tough. You have to test and iterate fast to nail down that magic number.

Example: Basecamp

Part of Basecamp’s core value proposition is simplicity, which is exemplified in its pricing. A single plan with a flat-rate. It’s a statement.

2. Usage-Based Pricing

The usage-based model is essentially a “pay as you go” model where a customer will be charged more the more they use the product. Some common ways SaaS businesses use usage-based pricing is by charging per action (like per post, email, API call, etc), charging a percentage of revenue made, charging a percentage of a transaction processed, or charging for storage used.

The pros of the usage-based model are that the pricing scales with the customer. As the customer grows or uses the product more, the price increases. This is also a good way to attract multiple types of customers who may greatly vary in their price sensitivity. A user who doesn’t want to use the product much only gets charged for what they use and a superuser generates a lot of revenue for you.

The cons of the usage-based model are that it may disconnect the value from the product. Maybe a small customer makes a large number of API calls and a large customer makes a small number of API calls.

It may also be difficult for prospective customers to calculate how much they will be paying. It might be too granular to do a quick calculation in your head or keep track of how much is actually being used.

Another possibility is that customers will be discouraged from using the product since they will be charged for using it more. Customers may adopt a frugal mindset and not use the product as much as they would with a different pricing model. It also makes it much harder to predict revenue in the future since you have no control over your customers’ usage of the product. You may experience slumps or erratic spikes in revenue that make managing your cash flow difficult.

Example: Stripe

Stripe charges a percentage of charges processed plus a fixed amount per charge. More charges processed through Stripe results in more revenue for Stripe.

Example: Postmark

Even though it could technically be considered more a hybrid model, notice how it’s still based on how many emails are sent, including a fee for every additional thousand emails.

Example: ConvertKit

ConvertKit takes a different approach by only charging for how many subscribers an account has.

3. Tier-Based Pricing

The tier-based model essentially creates different versions of the product to use at different price points. This is the most common pricing model used in SaaS today. Usually, companies will create 2-4 tiers for customers to choose from.

The pros of the tier-based model are that you can appeal to multiple types of customers without basing the price on usage. Multiple tiers allow you to appeal to multiple types of customers, thus expanding your market and increasing revenue potential. Each tier can tailor to a different kind of buyer.

Tiers also have a unique advantage to be able to upsell to customers. A company could attract many customers with the lowest tier, and then work to graduate them and upsell them to a higher tier.

The cons of the tier-based model are that the tiers could potentially be confusing to customers. Tiers have to be very carefully constructed and communicated to avoid as much confusion as possible. Every tier increases the complexity of the decision for the customer, so more tiers mean more complexity for the customer, which creates a harder decision for the customer.

If you do use a tier-based model, it’s very important to get the names for each tier right. It needs to be in alignment with how the tiers are created. If the tiers are largely separated by the number of users, you’ll want to name the tiers according to user size, and so on.

Anchoring, a strategy we’ll cover below, is also critical with tier-based pricing. The differences between each tier all serve as anchors, and it’s important to structure each tier appropriately.

Example: Fomo

Fomo splits out tiers first by upgraded support and then second by advanced service and features.

Example: Kinsta

Kinsta offers several different tiers based on a variety of factors like WordPress installs, monthly website traffic, storage, and more.

4. User-Based Pricing

The user-based model is also a very popular choice for SaaS companies as it’s simple to understand and provides huge potential for expansion. In a user-based model, companies charge “per seat.” In other words, if you want to add a colleague to your account, the price increases. Every extra user on the account is charged.

The pros of the user-based model are that it’s easy to understand. Similar to the flat-rate model, the user-based model usually gives customers full access to the product. It’s very easy for customers to calculate what they would pay depending on how many people they want to add to the account.

It’s also advantageous because the revenue will scale along with the adoption of the product in the company. As the company grows or the use of the product increases across the company, revenue grows with it.

The cons of the user based model are that it may limit the adoption of the product. Similar to the usage-based model, customers may be discouraged to further use and adopt the product because it will cost them more.

One of the other major cons is that it may not reflect the value of the product. If you are just granting access to the product, users will probably just use a shared login. The amount of users needs to be tightly aligned with the value and actual use of the product. Some customers may be off-put by charging per user because they don’t want to have to worry about how many seats to buy the team.

A lot of SaaS companies choose a user-based pricing model simply because it seems attractive. But a user-based model should only be used for products in which each user sees or experiences something different. Otherwise, users will probably just share a login.

Example: Notion

Notion offers a few tiers with various options for storage, features, and service, but all are centered around the number of users.

Example: Calendly

Similarly, Calendly bases pricing on the number of users, but offers different tiers for the level of features and branding needed.

Example: Close

Close creates three tiers all priced per user based on the level of sophistication of each type of user.

5. Feature-Based Pricing

Many confuse feature-based pricing with tier-based pricing, but they’re actually very different. With tier-based pricing, different features could be available in different tiers, whereas with feature-based pricing, certain features are an additional price altogether.

This could also be described as “add-on” or “modular” pricing. The lines between feature-based pricing and an entirely different product are often blurry, but the concept remains the same: charge an additional amount for an additional set of features that are separate from the core product subscription.

Feature-based pricing provides a nice path to expansion revenue as these upgrades can offset or even exceed churned revenue from canceled customers. It can also be easier to communicate and market to your customer base than including it in a higher tier.

The disadvantage comes in the form of perception. Customers may be reluctant to pay more or simply don’t understand the additional value. Add-on features can seem less necessary.

Example: Intercom

Intercom might be the ultimate example of the hybrid model. Notice how products and features are bundled and unbundled, with an upsell path for any combination that a user chooses.

Example: Baremetrics

At Baremetrics, we offer two add-on features to help reduce churn. Since they differ from the core analytics product and provide new value, each is offered as an additional subscription and each with a unique pricing model.

6. Credit-Based Pricing

Credit-based pricing offers a unique model for products that don’t require continuous use. Credits can be purchased either through a subscription or through a one-time transaction and then redeemed in the app for some sort of use.

Lorenzo Frattini of Clayton explained how they decided to try this model since they perform vulnerability/security scanning of codebases, which by nature are rather discrete and don’t require continuous use. They started offering subscriptions with credits and the response with users has been very positive so far.

Another great example is Audible, the audiobook platform. Their plans start at $14.95/month for one credit a month and expand to $22.95/month for two credits a month. Each credit can be redeemed for a single audiobook, but more credits can be purchased at any time in packages of three.

The pros of credit-based pricing are that you can provide users a way to pay for your service without having to worry about when they’ll actually use it. A subscription purchase of credits supplies you with recurring revenue without users having to worry about which tier or feature is best for them. The main difference between usage-based pricing and credit-based pricing is that the user is charged before they use your app, whereas they’d be charged afterward in a usage-based model.

The cons are that the likelihood a customer cancels or asks for a refund because they have a surplus of credits is high if they’re not using the product regularly.

7. Hybrid Pricing

Each of these models can be mixed and matched for a custom combination.

The pros of the hybrid approach are that you can differentiate your pricing and plans from your competitors and offer a new package that may serve your customers better.

The cons of the hybrid approach are that it can very easily get too complicated. Mixing features, users, usage, tiers, freemium, and enterprise models will make it too complex for customers to understand how to pick the right package for themselves.

Example: Drift

Drift mixes tier-based with user-based with feature-based with basically every other type of pricing model.

Example: Appcues

Appcues shows a variety of both pricing models and activation models, along with a hybrid of tier-based, user-based, and feature-based plans.

SaaS Pricing Model Template

If you’re feeling a little overwhelmed right now, don’t worry– we know this is a lot of information, so we created a free SaaS pricing template that can help. Our operational template helps businesses understand how revenue coming from pricing strategies fits into your larger financial status, assessing whether subscription revenue is high enough to offset costs.

Activation Models

The method by which a user starts using your product is called the activation model. While it could be argued that the activation model — freemium, free trial, demo, etc — isn’t technically a part of pricing, it’s absolutely a part of packaging.

Packaging is how a product is presented to be sold and used.

In the world of physical products, packaging describes all the casing, protection, labeling, package design, and wrapping. But in the world of SaaS and on-demand digital products, packaging describes the purchase process and terms.

Sure, it’s $20/month, but can you try it before you buy? Or do you have to talk to someone? Can anyone figure out how to use it or does it require training and set up? Is there a free version or do you have to pay to try it?

There’s also a unique price point for each market and circumstance in which a customer won’t feel comfortable purchasing or even trying a product without the help or guidance of a person. That price point is usually somewhere in the mid-hundreds of dollars, although it varies widely.

The right pricing model with the wrong activation model can be just as detrimental as the wrong pricing model.

1. Freemium

The freemium model offers a version of your product for free and for an unlimited amount of time. Freemium essentially operates as a lead generation tool to lead users to upgrade to a paid version of the product.

The advantage freemium is that it makes it incredibly easy for your customers to experience the product. It can also be a competitive advantage in marketing when you can use a phrase like “Get started right now, completely free forever.”

The freemium model can attract mass adoption and even some virality. A strong referral program paired with happy free users can be a powerful marketing channel. Testing and validating acquisition and growth tactics on a larger user base is also easier.

There are also many disadvantages. Free-to-paid upgrade rates are often incredibly low. Free customers are often your worst customers, with negative attitudes or unnecessary criticism. They may also suck up support and engineering time while giving nothing back.

It’s also possible that you’ll lose out on users that would have paid you but opted for the free plan instead. And while they’re probably cheaper to acquire, they still cost you money if they come through any paid marketing channels (ads, affiliate, etc.), which can be difficult to justify if it takes several months to convert a reasonable portion of those free users into paid users.

Weigh the costs carefully. Freemium almost caused Baremetrics to explode.

Freemium is best suited for products that:

- Get more valuable the more you use them

- Can afford possibly high technical or support costs

- Target beginner-level users

- Best communicate the value of using the product by experience

Example: Mailchimp

Mailchimp disrupted the email marketing space several years ago when it first introduced its free plan. It’s been a staple to the business’s value prop and strategy to acquire and grow users.

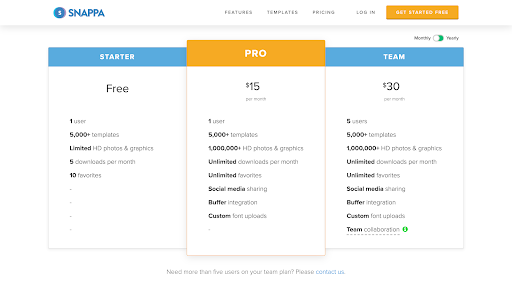

Example: Snappa

Snappa offers just enough in their free plan for users to sign up, use, and get hooked on the product.

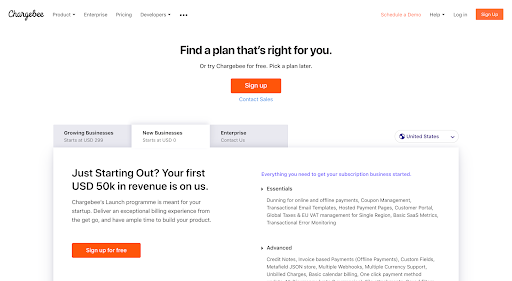

Example: Chargebee

Chargebee takes a unique approach to its freemium model with $50,000 in revenue processed for free.

Example: Webflow

Notice the subtle messaging to try Webflow for free. Use Webflow all you want, and then when you’re ready to use it for a real project, upgrade to unlock more features and get it hosted on your own domain.

2. Free Trial

The free trial model offers a version of your product for free, but for a limited time. Products using a free trial either require a credit card to sign up or wait to require a credit card to upgrade to the paid version of the product. Each has their advantages, but as a rule of thumb it’s best to start with a lower-friction option (no credit card required) and then you can require it later if needed.

Requiring a credit card upfront will almost certainly do two things for you: lower your sign up rate and increase your lead quality. A credit card indicates more purchase intent so it’ll likely weed out many unqualified or lookie-loo users. If you already have a large number of signups or unqualified trialing users are taking too much of your resources, this could be a great way to focus more on qualified users.

One disadvantage that I can speak from experience with many business SaaS apps, is that not everyone has access to the company credit card or feels comfortable putting in their own credit card for the trial. If a user doesn’t feel comfortable asking for access to the company credit card, having someone with a company credit card start a trial for them, or putting in their own credit card, you’ll lose out on the opportunity entirely. Unless you can say with confidence that 95%+ of your users have access to a company credit card or will use their own, requiring a credit card upfront is not advisable.

If you do require a credit card and many of your users don’t have access to a company credit card, consider adding a mechanism that encourages those users to invite someone to the account to add a credit card for them.

Not requiring a credit card upfront requires the lowest amount of commitment and ensures you’re not prematurely disqualifying or turning away users. Especially in the early days, it may be more important to get the most users into your product as possible, even if some don’t have any intention of becoming a customer.

For more on this topic, read Chargebee’s Credit Card vs No Credit Card article.

The length of free trials can vary from a couple of days, a week, two weeks, or even a month. This limited window of time creates urgency for users and gives you opportunities to engage while you have them for a short while. Generally, the shorter the trial the better it is for you as it reduces the length of your sales cycle and gets you to revenue quicker, but it’s important to still give users adequate time.

Free trials are best suited for products that:

- Need to be experienced and evaluated to make a purchasing decision

- Can give users a complete picture of how your product benefits them during the trial period

- Are simple or intuitive enough to use with minimal guidance

- Can’t be abused or used for the wrong reasons

Example: Calm

Calm offers a full week for free to make a habit of meditation and see if it’s for you before subscribing to an annual plan.

Example: RightMessage

With a bit more set up and education required in a B2B SaaS app, RightMessage offers two weeks for free.

Example: Customer.io

Customer.io offers a full 30 days for free, given it takes a considerable amount of time to migrate, set up, get acquainted, and test to see if it’s a good fit.

3. Paid Trial

The paid trial model offers a version of your product for a fee and for a limited time. Paid trials are also often described as “Pilots.” Products using the paid trial amount often require a fixed or fractional amount of the normal subscription price to prevent users not serious about using the product or potential abusers.

The length of paid trials can also vary from a couple of days, a week, two weeks, or even a month.

Paid trials are best suited for products that:

- Need to be experienced and evaluated to make a purchasing decision

- Can give users a complete picture of how your product benefits them during the trial period

- Are simple or intuitive enough to use with minimal guidance

- Could be abused or used for the wrong reasons

- Could give away too much value in a free trial

- The extent of the product’s usage is unknown or unclear without trying

Example: Ahrefs

The Ahrefs team noticed that many of their novice users and consultants were signing up for their free trial, using the product extensively, but then never subscribing to a paid plan. So they decided to move to a paid trial model, which is beneficial to both sides.

4. Money-Back Guarantee

The money-back guarantee model offers a version of your product for the full or discounted price with the promise of issuing a refund if the customer wants to cancel within a certain time period.

Here’s what Manuel Frigerio of ReferralHero told me about why he decided on the money-back guarantee model:

“I have tested many models: free trials, freemium model and money-back guarantee just to name a few. I ultimately decided to adopt a money-back guarantee model for two reasons: more committed users and better feedback from people who don’t stick around. ReferralHero is not a one-click type of web app. You need to invest some time to think about your campaign, create it and embed it onto your website. I think this model works well to curb out people who are not ready. This, in turn, gives me more time to help the people who are actually ready to give it a go.”

The money-back guarantee model is best suited for products that:

- Are simple or intuitive enough to use with minimal guidance

- Could give away too much value in a free or paid trial

- Is priced low-enough that a user feels comfortable risking that money

- The value and functionality is clear immediately or within a short amount of time

- Requires considerable setup and commitment to understanding the value

Example: MeetEdgar

While many other social media tools start with a free plan or free trial, MeetEdgar took a starkly different approach.

Example: Mailshake

Mailshake leads with a 30-day guarantee on their pricing page to make it clear as day to everyone who’s interested in starting a subscription.

Example: Kinsta

Kinsta takes a slightly more subtle approach, presenting their money-back guarantee for each selected plan.

Consultation

The consultation model requires a meeting, discussion, or demo before allowing users into the product. The consultation can either act as a gateway to one of the other models mentioned above or could completely replace them. For example, after a consultation, the next step could either be a free trial, a paid trial, a money-back guarantee, a setup fee, a signed contract, or just an activated paid subscription.

One advantage of using a consultation model is that you don’t have to publish pricing and can build pricing around the customers’ needs. It’s difficult to test and gauge demand for price points in a self-serve model, but a consultation model allows you to get feedback directly from potential customers and create a price point you can be confident about. It also allows you to build a more personal relationship with users, handle objections, and understand your customers on a deeper level.

A notable disadvantage is that it requires considerably more commitment from the user. Time, privacy, and even the energy to decide whether or not to contact you are all real factors you have to consider.

The consultation model is best suited for products that:

- Need a walk-through, tour, demo, or training to understand the value

- Requires extensive setup or commitment

- Has an extensive decision-making process

- Requires a fundamental shift or change in process

- Requires an extensive migration or transfer of data or workflow

- Sufficient lifetime value from your customers to warrant the extra work.

- Have a hefty price tag

- Have many products or modules packaged and sold together

Example: Superhuman

Even with a relatively low price and an elusive “prosumer” market, Superhuman has managed to create scarcity and demand for their product through a waitlist that ultimately requires a personal onboarding meeting. Unorthodox, but also very effective at educating and creating a personal relationship with each and every user.

Example: UpLaunch

UpLaunch leads with a gentle request to spend 30 minutes with them.

Example: Cordial

Cordial positions their consultation as a personalized demo rather than a discovery call, pre-recorded demo, or presentation.

Pricing Strategies

The way your pricing model is marketed is called the pricing strategy.

We’ll go over the most common pricing strategies below, but check out these pricing strategy examples for more information.

- Positioning

- Discounting

- Anchoring

- Charm pricing

- Bundling

- Perks

- Localization

- Making a recommendation

- Penetration pricing

- Price skimming

- Bundle pricing

- Optional product pricing

Positioning

Price can be used as a positioning tactic when done the right way. Especially if features and support are at competitors with competitors, the price can help differentiate yourself. But it must be done with caution.

The three dominant price positions you could look to take are:

- Low-cost: The most affordable solution amongst competitors and alternatives.

- Best-value: The most featureful solution given price comparatively.

- Premium: The most comprehensive and comparatively expensive solution.

The low-cost position often attracts beginners, bargain-hunters, and price-sensitive buyers in an industry where software and digital products are usually expensive. Think about Mailchimp, for example, and how their freemium model has made them the go-to option for many beginners and price-sensitive small businesses. Be careful you don’t discount yourself too heavily in a race to the bottom or churn out customers who soon need a more comprehensive solution.

The best-value position delicately places you between two opposite ends of the spectrum in an attempt to show potential customers that you can provide the best of both worlds: affordable price without sacrificing features or functionality.

The premium position attempts to appeal to the high-end customers, often with extensive or specific requirements, at a cost. The premium position can be held with a moat of features, technology, expertise, or even aesthetic that can’t be matched.

Discounting

Discounting: The double-edged sword.

It can nudge prospective customers just enough to make a decision in your favor, and it can also cost you thousands of dollars in revenue over the lifetime of the customer with you.

“Most of the time, discounts are a cop-out. It’s just easier to lower the price than to do the work necessary to sell at full price (or even higher).” — Lincoln Murphy

As we mentioned before, the Value/Price Ratio shows the relationship between the value someone sees in your product and the price it will cost them to get that value. Discounting works to reduce the price, which will, in turn, increase the Value/Price Ratio.

But there are ways to use discounting without sacrificing your revenue:

- Use discounting to get people to pay more, not less: Discounting is often used reactively. A price-sensitive prospect or customer ready to cancel can force your hand to offer a discount. But what if you could use discount proactively? Making special offers to customers to upgrade to a higher-priced plan can increase ARPU and LTV with little work, and your customers will love you for it.

- Minimize the long-term impact: Instead of offering lifetime discounts, consider offering multimonth or one-year discounts. Even a 50% discount for three months is far more profitable than a 30% discount for twelve months over the span of a year.

- Use terms to your advantage: Offering a discount doesn’t have to be a one-sided deal. Asking for a referral, case study, quote, or other forms of co-marketing is perfectly acceptable.

Another way to utilize discounting, especially for products with ARPU in the single digits and low double digits, is to offer scaled discounting for annual plans.

Offering 50% off an annual plan at your lowest-priced tier, 35% off a mid-tier annual plan, and 20% off the highest-priced tier can help incentivize longer commitments from lower-paying users while still capturing more revenue upfront. This can reduce churn, increase working capital, and increase the adoption of annual plans.

Anchoring and Psychological Pricing

Price anchoring is psychological pricing strategy of referring to another price that makes the other price point(s) look more attractive. The “anchor” is often the first price point someone sees, although it isn’t always.

How to use price anchoring:

- Show the highest price first: Makes subsequent plans appear more affordable and less expensive.

- Show the lowest price first: This can make higher-priced and more featureful or beneficial plans seem more attractive if the price difference is marginal.

- Compare with competitors prices: More affordable than competitions? Show how much they could save by switching to you.

- Compare with alternative options: Show how affordable your price is compared with building themselves, going on with their current solution, or hiring someone.

- Show the original price before discount or promotion: Emphasize savings and appeal to the bargain-hunter as well.

Charm Pricing

Charm pricing is based on the theory that certain price points have a psychological impact and favorable outcome over other price points. In practice, price points that end in 9, 8, 7 or a number of other odd combinations perform better.

Charm pricing is actually very similar to anchoring. Judgments of numerical differences are anchored on left-most digits, a behavioral phenomenon referred to as the left-digit anchoring effect. It suggests that people perceive the difference between 1.99 and 3.00 to be closer to 2.01 than to 1.01 because their judgments are anchored on the left-most digit.

With software and digital products, it doesn’t make much sense to use decimal points which will just add complexity, so whole numbers are recommended.

While there’s definitely merit to charm pricing, you could also argue that doing the opposite could be just as effective. Since so many companies use charm pricing, by not using it, you can differentiate yourself and engrain it as part of your brand and company ethos.

Bundling

Price bundling is combining several products or services into a single comprehensive package for an all-inclusive reduced price. Bundling can help you increase your ARPU while at the same time delivering more value to customers.

Since the incremental cost of software products is often very marginal, bundling even at a discount to capture more revenue than you would have before can be worth it.

Perks

Utilizing perks is often overlooked, but extremely beneficial for customers. Offering a concierge migration (for all or certain plans), a free consultation, discounts to partner products, a free book or course material, are a minor inconvenience at most to you and a huge benefit to many customers.

Localization

For Harrison Rose, CCO of Paddle, it’s because of the power of the market that he advocates for “true localization” — charging a price based on willingness to pay in each market instead of offering the same cost in a variety of currencies.

He believes this is the first step when selling into new territories, even before supporting a second currency. “Customers won’t pay for your product in their currency — or any other — if the price is wrong”, he explains. “True localization should always come first. Look at how customers in that geography view the software you’re selling and how much they’re willing to pay for it.”

Making A Recommendation

Some companies take the liberty of highlighting a plan or product offering to viewers. Ethically, this gets into some murky water, as there are many wrong and unethical ways to do this.

You can make a recommendation by showing a plan to be:

- The Most Popular: If you do this, show which plan actually is the most popular, not just because it’s a higher price point or the plan you want to push.

- The Best Value: If you do this, elaborate on why it’s the best value. Showing a plan as the Best Value without an explanation will build skepticism with your users.

- The Recommended option: Again, if you do this, explain why it’s recommended. Honestly recommending the most affordable option may help increase the conversion rate to that plan and reduce the number of downgrades and churn.

Penetration Pricing

Penetration pricing is the strategy of offering extremely low prices when entering a market to attract and acquire new customers. It works best in very crowded markets where it is hard to attract customers away from more established brands.

Then, once you’ve acquired more customers and snagged clients from your competition, you can increase pricing to drive up sales volume.

Price Skimming

Price skimming is the opposite of penetration pricing. You start by launching the product at a high price, and slowly lowering the cost overtime until you find the ideal cost. This is often most effective when the product is unique or highly desirable, and leverages early excitement to generate revenue upfront.

Learn more about price skimming to see if it’s a fit for you.

Bundle Pricing

Bundling is a common pricing strategy where brands combine multiple individual products or services into a bundle, offering a slight discount on the bundle compared to individual purchases. This helps SaaS companies increase their average subscription value while customers still feel like they’re getting a good deal.

Optional Product Pricing

Optional product pricing sells a core product at a basic price, with plenty of optional add-on products or services available for separate costs. Salesforce is a prime example of this, offering base packages with what feels like a million-and-one add-on purchases.

Putting Pricing Models Into Practice

Putting advice to use, in real life, is hard. Especially with pricing models and strategies.

As mentioned before, if you don’t take anything else away from this guide, test and re-evaluate your pricing at least a couple of times a year. Pricing is not something you can set and forget.

When making a pricing change, it’s always important to communicate why. Ideally, communicate the upcoming changes weeks or even months in advance.

A simple note from the founder about the evolution of the product, how the new pricing aligns better with the customer base, and how it’ll help drive new product innovations can go a long way to make pricing adjustments go a lot smoother.

To actually test a new pricing model or strategy, there are a few approaches to consider:

- Don’t grandfather existing customers

- Grandfather existing customers

- Test new pricing only for new customers and then revisit options 1 or 2 later

There’s a lot of debate between grandfathering vs not grandfathering, but really you should go with what makes the most sense for your customers and your relationship with them.

Remember that you don’t have to test new pricing with everyone, either. You can start with small cohorts or make incremental changes as you go.

Finally, leverage detailed revenue analytics to help you assess the true impact of your pricing changes. Baremetrics is a subscription revenue platform with 26 key metrics that can help you assess how pricing changes are impacting your business. Watch how monthly recurring revenue, upgrades, and churn impact your total bottom line in real-time to improve your pricing strategies.

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!