Table of Contents

More Founders Journey Articles

Price skimming is one of the many pricing strategies employed by companies in an attempt to increase their revenue and/or profit.

Price skimming is a pricing strategy for when a product enters the market. The price is initially set at the highest possible number some customers will find acceptable and then lowered slowly over time to improve the volume of transactions.

This pricing strategy is named for “skimming” the top layers of cream from milk. This is meant to signify the company getting more of the consumer surplus as it works the price down the demand curve.

If that is confusing or too theoretical, don’t fret as we will go through what that means with some graphs and an example below. We’ll also walk you through the pros and cons of using a price skimming strategy as well as compare it to its mirror strategy, penetration pricing.

Whatever pricing strategy you choose, use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data, including your MRR, ARR, LTV, and so much more.

Integrating this innovative tool can make evaluating your pricing strategy seamless for your SaaS company, and you can start a free trial today.

How price skimming works

Price skimming in a nutshell is a firm selling its product or service for a very high price when it is first released only to slowly lower its price over time until it reaches the desired long-term price.

Price skimming usually relies on the product being unique or especially desirable, so you often find price skimming happens in new markets or when timely ownership has a greater perceived value. This is part of the “first mover” principle.

An example of the former is a new electronics device. When a new PlayStation or iPhone drops, the increased functionality appeals to so-called early adopters enough that they’ll pay more for the product. By offering the product initially at a higher price, Sony or Apple can obtain increased profits from that motivated segment of society before bringing the price in line with the true market equilibrium for higher volume.

An example of the latter is clothing. Fashion companies routinely set high prices for new apparel only to rapidly discount the price (sometimes dishonestly using psychological pricing) week on week. To some people, a shirt is a shirt, while, to others, it is an expression of their personality, a status symbol, or evidence of their style. In that case, there are two separate markets for the product, and by going from the high price to the low price the company can benefit maximally from both.

Rationale Behind Price Skimming

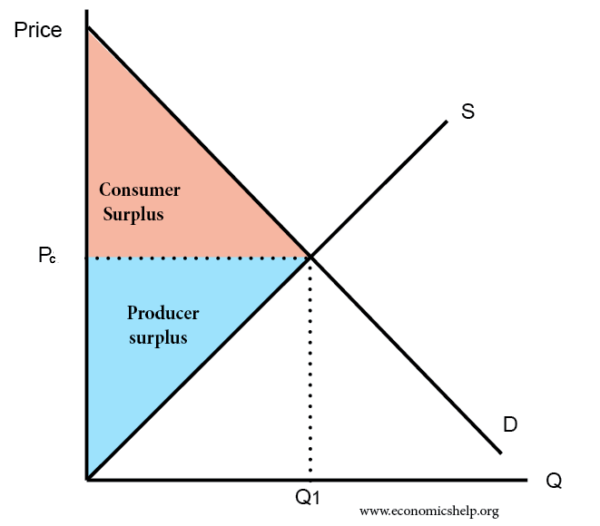

In a perfectly competitive market, the price is set where supply meets demand. From the perspective of the company, this is where the short-run marginal cost meets the marginal revenue. In this case, the demand and supply curve make an “X” on a price/quantity graph. The left side of the price–quantity graph shows the consumer surplus above the price and the producer surplus below the price.

The consumer surplus is essentially all the added benefit provided to the group of people who bought the product (“utility”). Since the people on the demand curve above the price (Pc) would have been willing to pay more for the product than the market price, they got more joy than they needed to be satisfied by the purchase.

The producer surplus, similarly, is the amount of excess benefit gained by the producer based on the number of products sold.

We can see this in the graph below:

Instead of being satisfied with the blue part, companies that use the price skimming strategy attempt to take part of the red area by setting price higher at first and then slowly reducing the price over time as they capture those particularly motivated buyers.

The graphs below show how using price skimming, instead of the competitive equilibrium price, the company can segment the demand into groups and charge P1, then P2, and finally Pc (c for competitive) over time to get bigger and bigger chunks of the total surplus.

The main reason companies use price skimming is to recover their fixed costs more quickly. In the SaaS world, the amount of money spent on developing, testing, and refining a platform can far outweigh the costs of hosting and maintaining the service. With a carefully designed price skimming strategy, the company can reduce the time it takes to recover their initial sunk costs.

Price skimming vs. penetration pricing

Penetration pricing and price skimming are essentially the opposite strategies. Whereas price skimming uses initial high prices to earn more revenue, penetration pricing uses initial low prices to get more sales.

While price skimming is best used with unique or new products, penetration is best used when the market is highly competitive and customers are usually quite loyal to their brand of choice.

Both price skimming and penetration pricing are best used for a short time. While penetration pricing will leave you earning less revenue per client when used for too long, price skimming will start to attract competitors that feel they can beat your prices if given the chance.

Example of price skimming

A company releases a new smartphone. It has conducted a lot of market research and knows that its most loyal 10% of customers are willing to pay almost any price to get the product on Day 1, another 40% are willing to pay elevated costs to get their phone before the end of the year, and the remaining 50% of potential customers do not see much value in the brand image or the new technology and are only willing to pay the competitive market rate for smartphones.

The company decides on a release price (P1) of $800, a follow up Back-to-School campaign price of $700 (P2), and then to lower the price on Black Friday to the competitive price (Pc) of $500. The company expects 1 million people to buy on release, 4 million to buy during their Back-to-School event, and 5 million to buy a phone on Black Friday.

In a competitive pricing scheme, the company would have earned $500 × 10 million = $5 billion.

However, by price skimming, they earn ($800 × 1 million) + ($700 × 4 million) + ($500 × 5 million) = $6.1 billion.

Baremetrics is the obvious choice for SaaS businesses

Get deep insights into MRR, churn, LTV and more to grow your business

The pros and cons of price skimming

Price skimming has a lot of benefits, but it also can be a dangerous pricing strategy.

Let’s take a look at some of the pros and cons of price skimming.

The advantages of price skimming

The following are some of the advantages of price skimming.

- Quicker payback of fixed costs: The cost to develop new services, market them, and get customers to sign up can be expensive. This can lead to very long pay back periods. By getting some early clients signed up at a higher rate, you can more quickly pay off those high R&D expenses.

- It helps create and maintain your brand image: Price skimming can actually be a marketing strategy as well. By offering your product or service at a higher price initially, you can build an image as being high quality.

- It segments the market: By finding the customers who are willing to pay more to get your service first, you can segment your different customer groups. This will help with future advertising and sales pushes.

- Early adopters can help test new services: The higher prices up front can help you balance needing real users to test your services with the risk of being overwhelmed before your minimum viable product matures into a robust platform.

The disadvantages of price skimming

While the focus has mostly been on the advantages of price skimming, there are some notable disadvantages as well. Let’s take a look at some of them.

- It only works if your customers are price sensitive: Price sensitivity simply means how much the price affects the demand. If your customers are price sensitive, then they will balk at the early high prices and probably not think to look again when they have been lowered.

- It’s not a great strategy in a crowded market: Similarly, if the market is crowded, then your potential customers, even those early adopters, might just scoff at the price and head to a competitor.

- Skimming attracts competitors: Even if the market is not crowded initially, the high prices might gain the attention of would-be competitors.

- It can infuriate your early adopters: Those most loyal customers who signed up at the high prices might be very upset if suddenly new customers are paying less.

- Inefficient long-term strategy: Ultimately, it is a short-term strategy only, and you will still need to figure out the optimum price and stick with it.

Summary

While price skimming can be a good driver of excess profits and help you recoup development costs quickly, it can also harm your relationship with your most loyal customers. Finding the balance between these issues is the key to this strategy improving the standing of your company.

Baremetrics is the obvious choice for SaaS businesses seeking to better track their revenue while making major pricing strategy changes.

If you’re looking for a smarter way to approach your SaaS business’s revenue performance, get in touch or sign up for the Baremetrics free trial today.

Marketing channels are only as good as their results. Have a look at the demo to see which marketing and business insights Baremetrics can unlock for you.

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.