Table of Contents

Unlike some economic terms, this one is pretty self-explanatory. Willingness to pay is the maximum amount a customer is willing to pay for your product or service. Although customers might be happy to pay less than this amount, they will not pay more.

Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more. Sign up for the Baremetrics free trial, and start monitoring your subscription revenue accurately and easily.

How do you calculate willingness to pay?

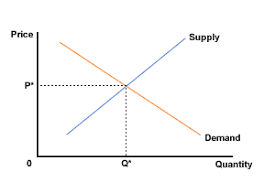

Willingness to pay is calculated separately for each person and then aggregated into a range; the lower bound being where all people are willing to pay for your service (unfortunately, sometimes this is $0), and the upper bound being where one customer is still willing to pay for your service.

As we will explain below, you can ask people if a price is acceptable and then record the responses. At a specific high price (the upper bound) no one will say yes, while at a specific low price (the lower bound, hopefully not $0) all those surveyed will say yes.

In any Econ 101 course, you can see this range of acceptable prices represented as the demand curve on a basic supply and demand graph:

Is willingness to accept the same as willingness to pay?

Although willingness to pay and willingness to accept sound similar and deal with the same topic, they are quite different.

Willingness to pay is the maximum amount a prospective customer is willing to pay for your services. Willingness to accept is the minimum amount you are willing to accept for your service.

Willingness to pay is a consideration of the value your service provides to the prospective client, while willingness to accept is based on your cost structure.

What factors affect willingness to pay?

As mentioned above, willingness to pay varies greatly from one person to the next, and is affected by many factors. At the individual level, much of this variance can be accounted for by the person’s extrinsic and intrinsic differences.

Observable extrinsic differences can include the customer’s gender, age, income, education, and location. Intrinsic differences are harder to spot from the outside and require asking the customer directly. These can include their interest in a subject or behavioral traits.

Beyond the character of the individual customers, there are many other factors that can affect willingness to pay over time.

Indeed, it is worth pointing out here that willingness to pay is not a static value—what a customer is willing to pay today is not the same as what they are willing to pay tomorrow. Van Gogh couldn’t sell a painting when he was alive and now his portfolio is worth billions, while you’d have difficulty selling a VHS cassette today.

The state of the economy has a major impact on willingness to pay. When customers think the economy is doing poorly (or there will be a downturn soon), they are less willing to spend money and become more price sensitive.

The season can change the willingness to pay. While someone might be willing to pay top dollar to replace their snowboard mid-winter, they are more likely to shop around come summer.

Brand recognition is a huge component of willingness to pay. If your company is trendy, you can expect to be able to charge a lot more for the same product.

The rareness of a product is a driver of price. This is another case where perception might be more important than reality too—if customers perceive your product as rare, then they may be willing to pay more.

The quality of a product can change the amount a customer is willing to pay. Sometimes brands focus on high quality at a high price, but there is also money to be made from selling low-quality products at a cheap price in high quantity. It really depends on the cost structure and what your targeted clients demand.

Sudden needs can radically change the perceived value of a product. When a product is suddenly in short supply, its perceived value can skyrocket. This is why small bottles of water are often more expensive than big ones. When you are out on the town and thirsty, you are willing to pay more than you are for water that you will bring home and drink later.

Understanding what your prospective clients are willing to pay is important. When trying to figure out your market, consider all the different SaaS pricing models. If it makes sense, try to segment your customers with a tiered pricing model.

Three ways to determine a customer’s willingness to pay

Without a keen understanding of your clients’ willingness to pay, you will never achieve an optimal pricing strategy. The only sure way to calculate the willingness to pay is by asking your prospective customers.

But how do you get them to tell the truth? The short answer is to ask them in many different ways.

Here are three strategies you can employ to figure out exactly what your customers are willing to pay.

-

Surveys: Surveys are a great way to get information from a large population. There are many different ways to survey people to figure out their willingness to pay. You could directly ask prospective customers what they are willing to pay for your product. This could be an open-ended question where the person writes in a number, a point on a number line, or take the form of anchoring to a specific number, e.g., “Would you be willing to pay $50?”You could also indirectly ask the population by having them rank the value of different features, possibly including products that are better known in your market with familiar price points.You can also directly ask your current customer base how they feel about the price or what potential new products they’d be most interested in seeing added and are willing to pay extra for.

-

Focus Groups: While surveys are a great way to get a little information from many different people, focus groups are a great way to get a lot of information from a small group. Be sure to pick the participants carefully and create an environment where truthfulness is assured.Remember, focus groups give you the chance to gather more detailed information than surveys. Be precise and thoughtful with your questions. Keep them open-ended; they can’t be answered with “yes” or “no”. If you need to elaborate on a participant's answer, ask follow up questions. Should you be new to focus groups, consider employing the services of a specialist market research company.

-

Experiments to ascertain revealed preference: This one is a bit trickier. It requires you to actually adjust prices and pay structures, possibly separately for different client groups. Then, you can see how your actual sales numbers have changed.

This can be challenging, so it might be less risky with a strong and loyal customer base. Likewise, if your customer acquisition costs are higher than your customer’s lifetime value and you need to make a drastic change, this can help you find a better price point.

How does willingness to pay drive pricing strategy?

When considering your pricing strategy, it is important to understand what your customers are willing to pay, but that’s not all. Let’s take a look at the following simple example.

After a well-designed focus group, you have the following information from 10 prospective clients:

As you can see, while all 10 clients would be willing to subscribe to your service for $10/month, none would pay $100. In addition, there are actually two points that maximize your revenue.

While 7 clients would pay $40 for a total revenue of $280, 4 would pay $70 each for the same total revenue of $280.

So what is the best price to pick? Well that depends on many other factors.

If your marginal costs are $5, then with 7 clients you would have a gross profit of $245, while with 4 it would be $260. However, it might be easier to grow your business long term with the lower price point and eventually that would lead to a bigger profit in the long term.

If your marginal costs are $40, however, then you wouldn’t make any money at the lower price point and should choose $70.

Perhaps it would be better to consider why 4 of the 7 clients willing to pay $40 are also willing to pay $70. Maybe your SaaS platform has specific features that are only valuable to some clients.

In that case, it might be possible to offer two service packages, one for $40 that 3 clients would sign up for and another for $70 that 4 more clients would sign up for totaling $400 in subscription revenue.

Sometimes a small pricing change can have outsized changes to your revenue.

Conclusion

Whatever clients are willing to pay, use Baremetrics to monitor your sales data. Maximizing your revenue stream also complicates your accounting. Without the right tools, it can be difficult to understand whether changes are leading to real growth.

Baremetrics makes it easy to collect and visualize all of your sales data. When you have many clients, some are subscribed on an annual basis while others monthly, with multiple tiers and various add-ons, it can be difficult to calculate your MRR (Monthly Recurring Revenue), ARR (Annual Recurring Revenue), LTV (Customer Lifetime Value), and so much more. Thankfully, Baremetrics does this all for you.

Baremetrics can monitor all the data you need to see if you have optimized your pricing model to match your clients’ willingness to pay. Integrating this innovative tool can make financial analysis seamless for your SaaS company, so start a free trial today.