Table of Contents

The Shopify Partner community has helped Shopify build the premiere ecommerce ecosystem. Shopify Partner Apps are bringing great value to Shopify shop owners.

To maximize the value of your Shopify Partner Apps, you need metrics, and one of the most comprehensive growth metrics is the SaaS quick ratio. We’ll call it the quick ratio for simplicity here, but don’t confuse it with the accounting quick ratio.

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.

Quick Ratio for Shopify Partner Apps Overview

In the simplest terms, the quick ratio tells you how your app is growing. It is essentially the sum of all the good monthly recurring revenue (MRR) types divided by the total of all the bad MRR types.

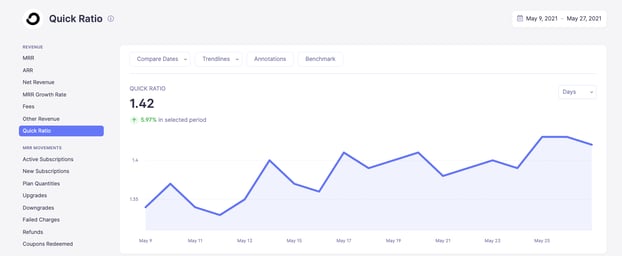

Baremetrics can automatically calculate the quick ratio for Shopify Partner Apps

As we will see below, the quick ratio isn’t easy to calculate by hand because it requires a lot of data that might not be provided in a neat format.

This complication can only increase when your customers tend to change pricing tiers, purchase add-ons, or you implement usage-based pricing.

Thankfully, when it comes to calculating the quick ratio for Shopify Partner Apps, along with all of the related metrics, Baremetrics excels. Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, ARPU, churn, total customers, and more.

Baremetrics integrates directly with Shopify, so information about your customers is automatically piped into the Baremetrics dashboards.

What is the quick ratio for Shopify Partner Apps?

The quick ratio is a benchmarking metric that allows you to see at a glance whether your app’s growth is sustainable. Compare the value of your quick ratio to a chart, and you know immediately whether you’re contracting, stagnating, or seeing healthy growth.

How do you calculate the quick ratio for Shopify Partner Apps?

Do you need to know your quick ratio?

Absolutely. The quick ratio, perhaps only second to the LTV to CAC ratio, is among the most important pieces of information you can have for decision making.

Do you need to know how to calculate the quick ratio?

Again, the answer is yes. Understanding the math behind the quick ratio can make the information provided by the quick ratio for Shopify Partner Apps more actionable. If you don’t understand the components, then it is harder to pick the low hanging fruit to improve your quick ratio.

Do you need to calculate the quick ratio?

While you should understand the quick ratio and how to calculate it so that you can take action, there’s no need to calculate it independently every time. Baremetrics shows you your quick ratio clearly on your dashboard.

Look at your quick ratio here:

What is included in the quick ratio for Shopify Partner Apps?

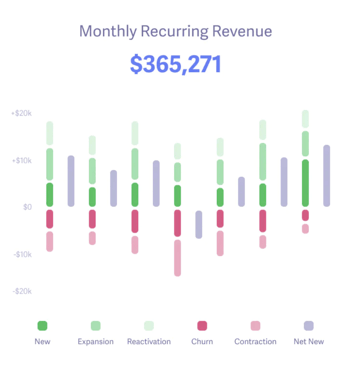

The quick ratio includes all the different types of MRR. While MRR is simply the amount of subscription revenue your app is bringing in monthly, the different components show where MRR is coming from or how it is leaving.

Let’s look at the different pieces of MRR.

What are the different types of MRR?

To fully understand the quick ratio, you need to understand MRR and all the components that affect its movement from month to month.

MRR is the amount of money you are bringing in through subscriptions in the average month. Some things increase your MRR (e.g., new customers and upgrades) and others decrease MRR (e.g., churn and downgrades).

Let’s look all of these MRR components:

-

New MRR is the additional MRR from new customers.

-

Expansion MRR is the additional MRR from existing customers (also known as “upgrade MRR”).

-

Churned MRR is the MRR lost from cancellations.

-

Reactivation MRR is the additional MRR from churned customers who have reactivated their account.

-

Contraction MRR is the MRR lost from existing customers due to downgrades.

How do you calculate the quick ratio for Shopify Partner Apps?

The math that goes into the quick ratio isn’t complicated. Let’s take a look at the equation:

Quick Ratio = (New MRR + Expansion MRR + Reactivation MRR) ÷ (Contraction MRR + Churned MRR)

On the one side, you sum up all the positive influences on your MRR from new customers (new MRR), customers upgrading their plan (expansion MRR), and customers who previously churned and now are coming back (reactivation MRR).

On the other side, you sum up all the negative influences on your MRR from customers downgrading their plan (contraction MRR) or leaving your app (churned MRR).

Finally, you divide the positive influences by the negative ones to get your quick ratio.

This might sound simple when you are starting out and have a handful of customers, but imagine doing this for thousands of users, each rotating through plans, joining or quitting in any given month, paying annually or monthly, and using different coupon codes or referral discounts.

Use Baremetrics to calculate the quick ratio for Shopify Partner Apps

It can be difficult to calculate all the different types of MRR to get your quick ratio for Shopify Partner Apps. That’s why you should use Baremetrics to get the most out of your data.

Baremetrics monitors subscription revenue for Shopify Partners. Baremetrics can integrate directly with Shopify and pull information about your customers and their behavior into a crystal-clear dashboard.

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, and more.

Best of all, it can calculate your quick ratio automatically!

Sign up for the Baremetrics free trial and start managing your subscription business right.

Integrating this innovative tool can make financial analysis seamless

Get deep insights into MRR, churn, LTV and more to grow your business

What’s the right quick ratio for a SaaS company?

The quick ratio at a glance gives you a great deal of information. While there is no perfect quick ratio number, so long as your company can handle the growth, bigger is better.

However, ridiculously high quick ratios can put you at risk of, counterintuitively, being a failure due to success. If your customer service falters, you become less responsive, or your platform can’t handle the influx of data, a too large quick ratio could lead to dissatisfaction.

The SaaS world is competitive, and some negative reviews can quickly scare away would-be customers.

Keeping all that in mind, a quick ratio under 1 is an indication that your MRR is actually decreasing, which should set off alarm bells.

A ratio of between 1 and 4 is an indication of slow growth. Depending on your current MRR, the goals you have for your company, and the niche you occupy, this might be fine. However, it can often be an indication that your churn is too high or you aren’t seeing consistent growth from your sales and marketing campaigns.

A quick ratio above 4, again provided you have the capacity to handle it, is usually a sign of long-term, sustainable growth.

What are the benchmark values for the quick ratio for Shopify Partner Apps and other micro-SaaS companies?

The quick ratio for Shopify Partner Apps has a very different set of benchmarks. The market is highly competitive and more reliant on five-star reviews.

That means you can both expect lower growth and probably need to grow more slowly to maintain the responsive customer service users expect from expensive apps that directly affect their livelihood.

That’s why the quick ratio for your Shopify Partner App can hit as low as 0.9 before you should be really concerned.

A range of 0.9 to 1.1 is showing stagnant growth. Some weeks you are up and others you are down. This is a good place to ramp up experiments and overhaul everything from your dunning process to your pricing.

If you can hit a quick ratio of at least 1.4, then you can be confident that your app is growing steadily. This is a sustainable growth trajectory where you can be confident that your app will keep rising in the Shopify Partner App Store.

Summary

The quick ratio gives you the helicopter view of your company’s growth. With a single number you can see if things are going well or you need to make a change.

Improving the quick ratio of your Shopify Partner Apps requires looking at the MRR components and choosing which ones need your attention.

A high churn MRR means you should focus on reducing voluntary churn and eliminating involuntary churn.

An imbalance between contraction and expansion MRR could be an issue with your pricing tiers.

A low new MRR can be fixed by better inbound marketing and a better lead conversion ratio.

That’s why you should use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data. When you have many clients, it can be difficult to calculate your MRR, ARR, LTV, etc. Baremetrics does all of this for you, and more.

Baremetrics can even monitor your quick ratio. Integrating this innovative tool can make financial analysis seamless for your SaaS company, and you can start a free trial today.

All the data your Shopify Partners app needs

Know instantly how your Shopify app is performing, what’s working, what needs improving, and where to focus next.