Table of Contents

Following in the footsteps of Amazon, Shopify first began its journey as a simple online shop, selling snowboards. That’s probably not surprising for a company founded in the winter wonderland of Ottawa!

What is a Shopify Partner App?

Shopify has built a strong network of Shopify Partners to expand the functionality of the ecosystem. Shopify Partner Apps are third party companies that sell their services or Apps to Shopify store owners. For example, a Shopify Partner App might enable a shopify store owner to email all of their customers.

This app owner charges a subscription fee to their customers (who are Shopify store owners) and collects a monthly or annual fee based on the plan size of their service.

This article is for Shopify Partner App developers and how to calculate LTV for your subscription customers.

Let’s dive into how to calculate LTV for Shopify Partner Apps.

What is LTV?

One of the most important metrics for Shopify Partners is customer lifetime value (LTV). The lifetime value of a customer is just that—the total amount of revenue earned by the average customer during the duration of their contract.

On the surface it is a simple concept, but calculating the average revenue per user (ARPU), customer lifetime, and customer churn, which are necessary components of the LTV calculation, is complicated because the information is coming from many sources.

This complication can only increase when your customers tend to change pricing tiers, purchase add-ons, or you implement usage-based pricing.

But, where do Shopify Partners track the metrics of their app?

Use Baremetrics to calculate LTV for Shopify Partner Apps

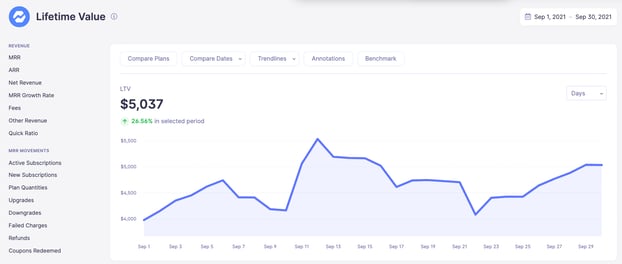

Thankfully, when it comes to calculating LTV for Shopify Partner Apps, along with all of the related metrics, Baremetrics excels. There is no need to calculate LTV for Shopify Partner Apps by hand because Baremetrics can do it for you.

Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, ARPU, churn, total customers, and more.

Baremetrics integrates directly with your payment gateways, so information about your customers is automatically piped into the Baremetrics dashboards.

You should sign up for the Baremetrics free trial, and start monitoring your subscription revenue accurately and easily.

Just check out how easy it is right here:

How do you calculate LTV for Shopify Partner Apps?

The lifetime value (LTV) is the average revenue generated by your users during the entire time they subscribe to your app. It can be calculated in two ways.

Method 1

LTV = ARPU × Customer Lifetime

The average revenue per user (ARPU) is the amount of money your average customer generates per month. The customer lifetime is the average number of months your users continue to subscribe to your app.

For example, if your ARPU is $200/month and your average customer lifetime is 30 months, then your LTV would be $200 × 30 = $6000. While the math is easy, getting the numbers isn’t.

A customer’s lifetime can only be known for sure after they churn. The average customer lifetime can only be known after a statistically significant number of customers have churned. That’s where Method 2 can come in handy.

Method 2

Customer Churn = (Churned Customers/Total Customers) × 100

For example, if you have 2000 users and 100 leave your site over the course of a month, then your customer churn is: (100/2000) × 100 = 5%.

Using the same ARPU as above ($200), then the 5% churn value, written in decimal form (0.05), would give you an LTV of $200/0.05 = $4000.

Finally, it should be mentioned that ARPU is also not easy to calculate. While in any given month you can take your MRR and divide it by the total number of customers, this doesn’t give you enough information for LTV.

Since pricing optimization means that you probably won’t charge the same amount for your app forever, your customers can jump between different tiers, and there might be add-ons or usage pricing, among many other issues, calculating an accurate ARPU value by hand, and therefore an accurate LTV, is impossible.

Since LTV is used for many other metrics, not to mention is central to every decision you’ll make from budgeting for customer acquisition cost (CAC) to pricing, further developing your app, and everything in between, this number needs to be as accurate as possible.

Use Baremetrics to calculate all of your metrics including LTV for Shopify Partner Apps

It can be difficult to calculate all of your needed revenue, customer, churn, and MRR movement metrics including LTV for Shopify Partner Apps. That’s why it is important to use Baremetrics to get the most out of your data.

Baremetrics monitors subscription revenue for Shopify Partners. Baremetrics can integrate directly with Shopify and pull information about your customers and their behavior into a crystal-clear dashboard.

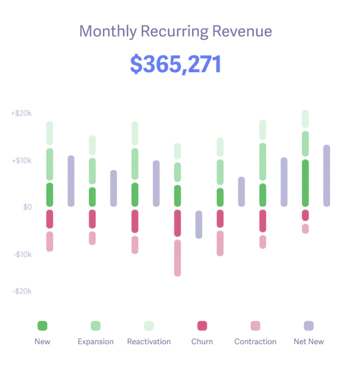

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, quick ratio, and more.

Sign up for the Baremetrics free trial and start managing your subscription business right.

Customer acquisition cost (CAC) and LTV

As mentioned above, LTV gives you the most information when it is combined with customer acquisition cost (CAC). CAC is the average cost of getting one new paid customer. The LTV to CAC ratio tells you what percentage of the revenue generated from the average user is spent getting them to sign up for a paid subscription.

For example, it costs you $2500 in advertising, content marketing, customer service outreach, and running the free trial to get a customer to sign up for your app. The average user spends $15,000 on your app subscription before they churn. Then, your LTV to CAC ratio is $15,000/$2500 = 6.

An LTV to CAC ratio of 3 (i.e., you earn $3 for every $1 spent on CAC) is generally considered sustainable, so in this case you are doing very well.

While an LTV to CAC ratio of under 3 is not uncommon for new companies (it takes a long time to generate good word of mouth, find the bugs to keep users from churning, and get enough five-star ratings to show up at the top of the Shopify Partners App Store), long term it is a problem.

If your LTV to CAC ratio is lower than 3, then you need to answer one or more of the following questions:

-

How can I keep my users happy and subscribed for longer?

-

How can I improve my sales and marketing funnel to increase my conversion rate?

-

How can I increase the amount I earn per user per month?

To succeed here, you need to segment your client population and direct different actions to each group.

Knowing what your LTV is for each customer segment is critical

Trying to calculate your LTV for Shopify Partner Apps, as well as the other needed SaaS metrics, alone can be difficult. It also leads to coarser calculations that reduce the actionability of your metrics.

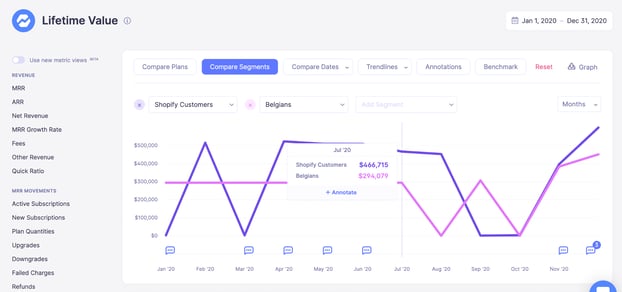

For example, it is important to understand the variation in your LTV based on different segments of your customers, such as shop age, location, average price point, service tier subscribed to, etc. This is something that Baremetrics can do automatically.

Why is it important to segment the LTV for Shopify Customer Apps?

Calculating metrics by segment allows you to target your actions more effectively.

Here are some examples.

If your American users are keeping their services three times longer than those in the UK, you might want to figure out what value Americans are getting out of your service that the British are not.

If your annual subscribers are far less likely to churn than monthly users, then you might want to increase the discount you offer for paying on an annual basis.

If you offer three tiers and the cheapest one has a very low LTV compared to the others, then you might want to scrap it. It could be that the reduced functionality removes that magic element that makes your app worth using and forcing clients to upgrade would get them to see the true value of the platform you provide and increase their longevity.

You can easily segment your Shopify customers in Baremetrics. Check out our segmentation tool here:

Summary

LTV is used for decision making throughout the company. LTV is used to calculate your CAC budget, and its components ARPU and churn are used in many of your growth metrics.

However, LTV is only part of the picture. Without a host of other metrics including your quick ratio, it is hard to make optimal decisions. Calculating LTV for Shopify Partner Apps, along with all of these other metrics, by hand is difficult.

That’s why you should use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data. When you have many clients, it can be difficult to calculate your MRR, ARR, LTV, etc. Indeed, Baremetrics does all of this for you, and more.

Baremetrics can even monitor your SaaS quick ratio. Integrating this innovative tool can make financial analysis seamless for your SaaS company, and you can start a free trial today.

All the data your Shopify Partners app needs

Know instantly how your Shopify app is performing, what’s working, what needs improving, and where to focus next.