Table of Contents

Much like Amazon, when Shopify first began, it was a simple shop and not the ecommerce platform we know today. In fact, perhaps fitting for its Canadian roots, it started off as a snowboard shop!

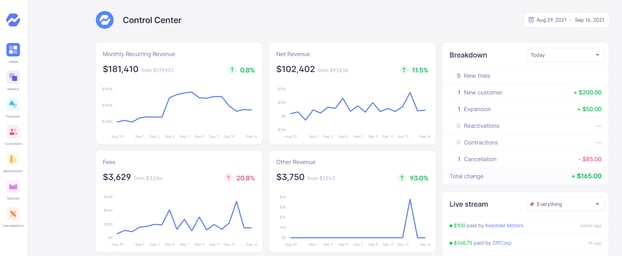

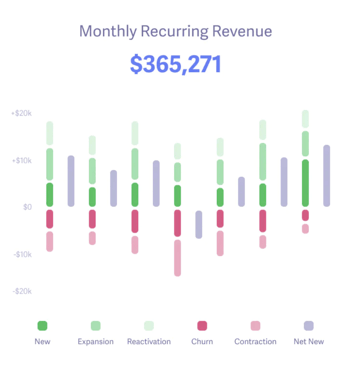

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.

What are Shopify Partners?

Perhaps one of the most interesting features of Shopify is the Shopify Partner system where individuals and third-party companies can sell their services or apps, in the so-called micro-SaaS space.

What is CAC for Shopify Partner Apps?

While industrious developers have collectively put forward great effort developing apps to calculate, track, and project all manner of metrics for Shopify shop owners, where do Shopify Partners track the metrics of their app portfolio?

One of the most important metrics is customer acquisition cost (CAC). CAC represents the total cost to onboard a new paying customer. It can include everything from your sales and marketing expenses per new customer to the per customer cost of running your free trial. However, calculating CAC for Shopify Partner Apps can be difficult.

Use Baremetrics to calculate CAC for Shopify Partner Apps

When it comes to calculating CAC for Shopify Partner Apps, along with all of the related metrics, Baremetrics excels. Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more.

Baremetrics integrates directly with your payment gateways, so information about your customers is automatically piped into the Baremetrics dashboards.

You should sign up for the Baremetrics free trial, and start monitoring your subscription revenue accurately and easily.

CAC for Shopify Partner Apps

Customer acquisition cost (CAC) is basically how much it costs to get a new client to sign up for your app. CAC can be calculated for all of your users to date, but it is more commonly considered over set periods, for example monthly or yearly, to see how the cost structure is changing.

The basic calculation is to add up all of the expenses specifically related to acquiring new customers and then divide them by the number of new customers.

However, the expenses included in CAC vary by company. Most developers will include at least advertising and marketing expenses. You could also include the associated salaries, overhead costs, creative costs, and the technical costs of running a free trial or any software used to track leads or conversions.

In this case, creative costs include everything spent developing content for marketing campaigns across blogs, social media, the Shopify App Store, and so on. That content also has associated publishing and production costs that could be included too.

The share of expenses you include in CAC versus ACS (average cost of service), which is the month-to-month cost of running your Shopify Partner Apps, can be a personal choice, but keep in mind that CAC is used for a lot of more advanced metrics. Therefore, if you choose to inflate/deflate your CAC by shifting costs from/to your ACS, then the target values of these advanced metrics might need to be adjusted as well.

For example, the customer lifetime value (LTV), which is the total amount of revenue collected from the average customer over the duration of a contract, is often combined with CAC as the LTV to CAC ratio. An LTV to CAC ratio of 3 (i.e., you earn $3 in LTV for every $1 spent on CAC) is generally considered sustainable.

However, if you fail to include the parts of overhead, technical costs, and salaries that are devoted to getting new paying customers in your CAC, then you may need a higher LTV to CAC ratio to reach sustainability.

Look at the CAC formula:

CAC = Money Spent Acquiring New Customers/Number of New Customers

As can be seen, you can improve your CAC in two ways. First, you can reduce the amount you are spending on acquiring new customers while maintaining the same customer increase. Second, you can maintain your budget but acquire more paying customers.

Of these situations, the second is the better indicator that your company is becoming more popular and that all the content you are releasing is doing its job.

If you are looking to get even more insight into whether your growth is sustainable, take a look at our article on how to calculate the quick ratio for Shopify Partner Apps. Note that the guidance values are different from those of other SaaS businesses, so it is important to take that into consideration if you are transitioning from SaaS to micro-SaaS.

How do you calculate CAC for Shopify Partner Apps?

Searching the Internet, you can often find posts similar to the following:

Help please!

I’m currently organically growing my Shopify Partner App, but I am planning to start spending money on marketing and sales. What kind of CAC can I expect?

Can anyone recommend a good metrics platform?

TIA

The first question is hard to answer. While 30% of the LTV is a safe number to invest as your CAC, it is likely to be much higher early on. Once you rank higher in the Shopify Partner Apps Shop and have many positive reviews, your lead conversion rate should increase and your CAC decrease.

For the second question, Shopify Partner Apps have made it easy for Shopify shopkeepers to know their growth metrics. However, it can be difficult to calculate all of your needed revenue, customer, churn, and MRR movement metrics including CAC for Shopify Partner Apps. That’s why an analytics dashboard is so important to get the most out of your data.

Baremetrics can calculate CAC for Shopify Partner Apps

Baremetrics monitors subscription revenue for businesses that bring in revenue through subscription-based services. Baremetrics can integrate directly with Shopify and pull information about your customers and their behavior into a crystal-clear dashboard.

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, quick ratio, and more.

Sign up for the Baremetrics free trial and start managing your subscription business right.

Why do you need to calculate CAC for your Shopify Partner Apps?

Calculating CAC for your Shopify Partner Apps can give you insight into many different decision-making processes.

-

It gives you a reasonable understanding of how much you can afford to spend on marketing and sales to acquire new users.

-

By looking at the expenses driving your CAC, you can figure out how to decrease it.

As mentioned above, CAC is an important metric, but it needs to be combined with others to give you the most information possible. In addition to the LTV to CAC ratio, the CAC payback period is an important metric to know.

The CAC payback period tells you the number of months it takes for your company to earn back what it spent on acquiring the new user.

You can calculate the CAC payback period in two ways. In the first case, you simply divide the CAC by the average revenue per user (ARPU). However, this only gives you the number of months when revenue has covered your CAC and not profit.

To know how long it is until your gross profit will cover your CAC, you need to either multiply ARPU by the gross margin percent (GM%) or subtract the average cost of service (ACS):

CAC Payback Period = CAC/(ARPU × GM%)

CAC Payback Period = CAC/(ARPU – ACS)

If the CAC payback period is long, which generally means more than five to seven months but can mean up to a year if you have very high retention, then you may need to act.

For example, you could need to reduce your marketing budget, refocus your pitch to find better leads, or, counterintuitively, you may need to raise prices. If you are not pricing based on how much value you bring to your customers, then you might be undercutting your profitability and adding stress through a too high CAC payback period.

Summary

CAC is an important metric. It can help you with decision making throughout the company, from marketing and sales to development and customer service.

For example, if you have many marketing channels, CAC can help you decide on the ones that are worth focusing on. If your LTV is dragging down your CAC to LTV ratio, then it might be time to work on your dunning.

However, CAC is only part of the picture, and without LTV and a host of other metrics, it is hard to make optimal decisions. Calculating CAC for Shopify Partner Apps, along with all of these other metrics, can be difficult, so use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data. When you have many users, it can be difficult to calculate your MRR, ARR, LTV, and so much more. Thankfully, there is Baremetrics to do all of this for you.

Baremetrics can even monitor your SaaS quick ratio. Integrating this innovative tool can make financial analysis seamless for your Shopify Partners company, and you can start a free trial today.

All the data your Shopify Partners app needs

Know instantly how your Shopify app is performing, what’s working, what needs improving, and where to focus next.