Table of Contents

The Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) set out in 2014 to provide a framework to attain consistency in financial reporting, improve comparative analysis and reporting, and simplify the drafting of financial statements.

This framework is what we now call the ASC 606.

The ASC 606 outlines a five-step model for revenue recognition. The five steps are as follows:

-

Identify the contract with a customer.

-

Identify the performance obligations in the contract.

-

Determine the transaction price.

-

Allocate the transaction price.

-

Recognize revenue when or as the entity satisfies a performance obligation.

These rules are now enforced for both private and public businesses. As a subscription-based SaaS enterprise, you need to be aware of these rules and follow them. These rules help you understand when revenue has been earned under the accrual accounting system.

In this article, we briefly explain the five steps of revenue recognition that the ASC 606 outlines so that you can make sure you are implementing it correctly. In addition, we will discuss the implications for SaaS businesses, why the rules were changed, and the meaning of revenue recognition in general.

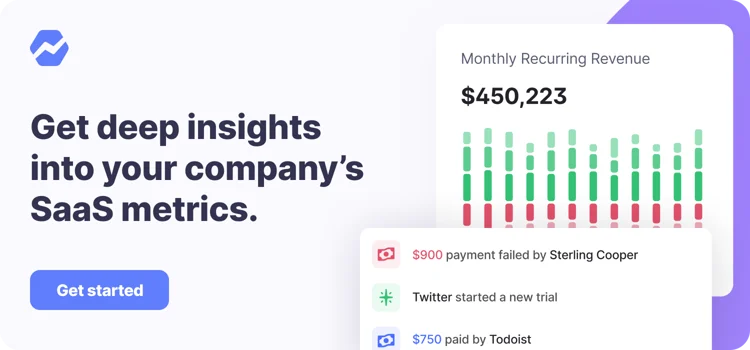

Baremetrics is a business metrics tool that provides 26 metrics about your business, such as MRR, ARR, LTV, total customers, and more. Baremetrics supports the correct implementation of ASC 606 accounting.

Baremetrics integrates directly with your payment gateways, so information about your customers is automatically piped into the Baremetrics dashboards.

You should sign up for the Baremetrics free trial, and start monitoring your subscription revenue accurately and easily.

(Full disclosure: The writer of this article has an educational background in accountancy and well over a decade of experience running a business, but this article does not replace real legal advice. This article is meant to explain the origin and reasoning behind ASC 606 and the five-step model outlined for revenue recognition to demystify the process and reasoning. As always, consult with your licensed accountant before adopting processes you read about online.)

What is revenue recognition?

Revenue recognition is based on the Generally Accepted Accounting Principles (GAAP) and stipulates when you can record your revenue. While in the cash accounting system revenue is recognized when the cash is received, in the accrual accounting system, which tax authorities generally require businesses to follow, it is recognized when the revenue has been earned and realized.

The latter is where ASC 606 comes in. It is designed to make it easier for companies to consistently recognize revenue based on the same standards. By following ASC 606, all SaaS businesses will count their revenue based on the same benchmarks.

Revenue recognition can be incredibly complex, which is why so many companies resort to revenue recognition software that can take complicated data and display it in a clear way. However, with so many applications available, choosing the right software is no easy task.

What to look for in a revenue recognition cloud application?

Powerful and flexible data models: Your SaaS business can bring in revenue through many different models, and you need software that can work with those different models. You need a platform that can calculate your MRR and ARR even when you have multiple pricing tiers. You also need it to be able to segment customers based on different attributes, from geographic location to lifetime of the contract. Baremetrics has you covered with its customer segmentation tools.

Seamless integration with other applications: Your company will never survive relying on a single piece of software. The world is too complex for that now. You probably use a customer relationship service (CRM) as well as a payment gateway (or, more likely, several gateways). If your recognition software isn’t able to integrate with these tools, then it isn’t going to be able to get the most of your data. Baremetrics integrates with Chargify and Stripe, and users can import and analyze PayPal and Chargebee data via the Baremetrics API.

Configurable templates and rules: You need adaptive tools to make sure they work for you—and tools that can change with you so that they keep working into the future.

Forecasting capabilities: It isn’t only about reporting revenue that has already come in, but also forecasting how much will be earned for months or years into the future. For a SaaS business, that means finding a tool that can calculate all your core metrics—ARR, MRR, LTV, etc.

Whether you have earned revenue but not received the cash or have cash coming in that you have not yet earned, use Baremetrics to monitor your sales data.

Baremetrics makes it easy to collect and visualize all of your sales data so that you always know how much cash you have on hand, which clients have paid, and who you still owe services to. When you have many clients, some are subscribed on an annual basis while others monthly, with multiple tiers and various add-ons, it can be difficult to calculate your MRR, ARR, LTV , and so much more. Thankfully, there is Baremetrics to do all of this for you.

Integrating this innovative tool can make financial analysis seamless for your SaaS company, and you can start a free trial today.

The ASC 606 5 Step Model

As mentioned above, ASC 606 presents a five-step model for when revenue should be recognized. Let’s look briefly at each step.

Step 1: Identify the contract with a customer

ASC 606 defines a contract as an agreement between two or more parties that creates enforceable rights and obligations. The following attributes are defined by the standards as essential parts of a contract:

-

All parties have approved the agreement.

-

All parties are committed to fulfilling their obligations.

-

Each party’s rights are identifiable.

-

Payment terms are identified.

-

The contract has commercial substance.

-

Collectibility is probable.

Step 2: Identify the performance obligations in the contract

A performance obligation is the promise by a company to transfer goods or provide services to its customer. Under this step, the company must identify all of its distinct performance obligations in the arrangement defined in Step 1.

A good or service is distinct when two conditions are met:

-

The customer would be able to benefit from the good or service on its own or with resources the customer already has access to.

-

The good or service could be transferred independent of other performance obligations in the contract (even if it will be transferred with other goods or services).

The following issues may affect an entity’s evaluation of performance obligations:

-

Being the principle or agent

-

Warranties

-

Customer options for additional goods or services

-

Non-refundable upfront fees

-

Rights of return

-

Stand-ready obligations (i.e., for the service to be available at all times even when not being used)

Step 3: Determine the transaction price

The transaction price is how much the company expects to be given for providing the goods or services promised in Step 1. This amount can be fixed, variable, or a combination of both (for example, if you charge a certain fee per month to have access to your SaaS offering plus usage fees).

The transaction price is then allocated to the performance obligations identified in Step 2. In doing so, any optional fees are excluded. Sales taxes along with any other amount that third parties will eventually collect are also excluded.

When a fixed amount of cash is transferred at the same time as the services are rendered, this is easy. However, the following complications may require further consideration:

-

Variable consideration

-

Significant financing component

-

Noncash consideration

-

Consideration paid or payable to a customer

-

Non-refundable upfront fees

Step 4: Allocate the transaction price

When a contract has multiple performance obligations, then the seller should allocate the total consideration to each of the performance obligations based on its standalone price.

ASC 606 allows companies to use any method for determining the standalone price—so long as the estimation is accurate. However, the standard does mention three specific methods as being acceptable: adjustment market assessment, expected cost plus margin, and residual.

If variable considerations or discounts exist within the contract, then the seller must determine which performance obligation is discounted or has a variable component and allocate them only to that obligation.

Step 5: Recognize revenue when or as performance obligations are satisfied

Finally, the company must recognize the allocated revenue of each performance obligation as that obligation has been satisfied. When the obligation is satisfied over time, then the revenue is recognized at the end of that period.

There are several issues that companies should consider when applying Step 5 of this method:

-

Determine whether a performance obligation is satisfied over time

-

Indicators of transfer of control

-

Input methods vs. output methods

-

Stand-ready obligations

-

Consignment

-

Bill And hold arrangements

Note that these steps are heavily summarized (in fact, each bullet point under each step can represent several pages of text in the ASC 606), and you should make a point of reading the entire document at some point.

Baremetrics monitors subscription revenue for businesses that bring in revenue through subscription-based services. Baremetrics can integrate directly with your payment gateway, such as Stripe, and pull information about your customers and their behavior into a crystal-clear dashboard.

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, quick ratio, and more.