Table of Contents

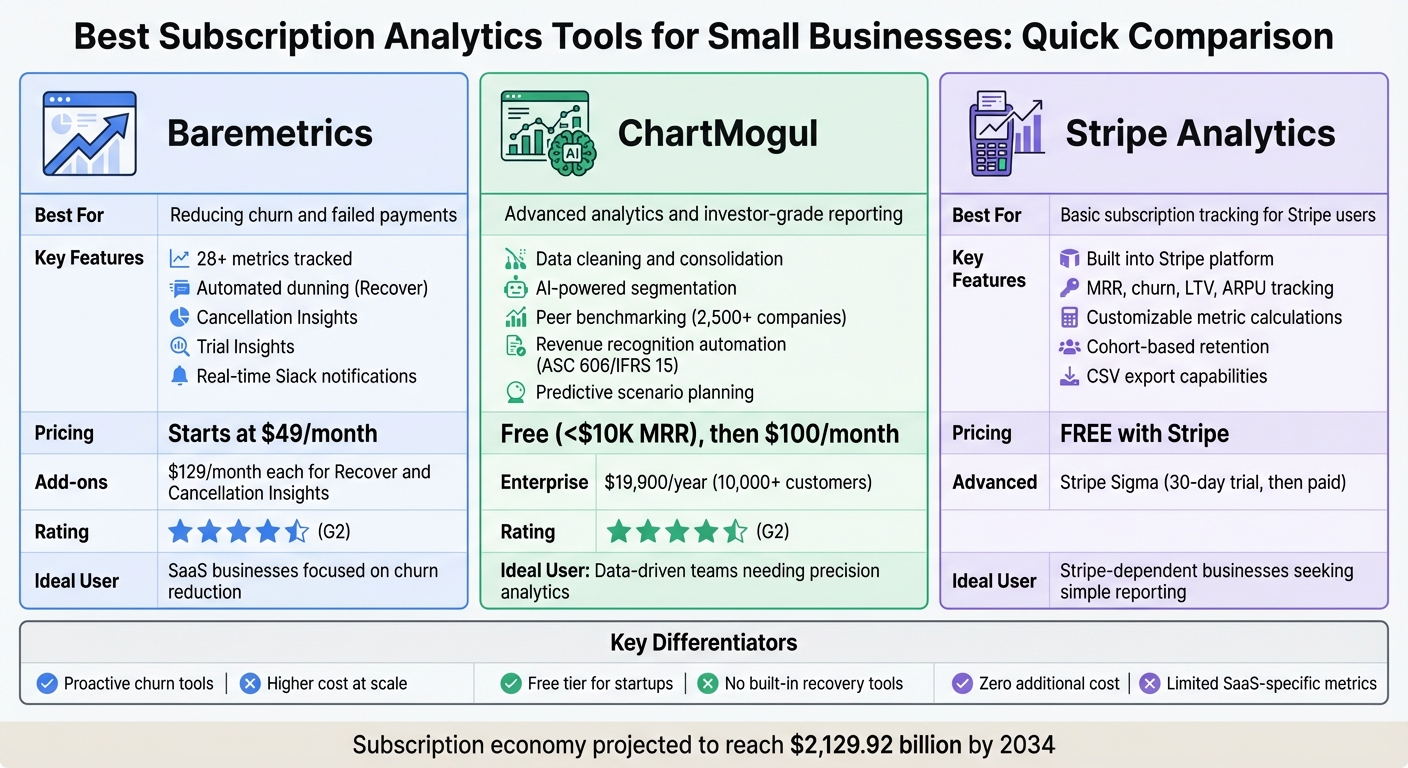

Running a subscription business without proper analytics is risky. Tools like Baremetrics, ChartMogul, and Stripe Analytics simplify subscription tracking, helping you monitor metrics like MRR, churn, and customer lifetime value. These platforms integrate with payment processors, automate data collection, and provide actionable insights to improve revenue and retention. Here's a quick breakdown:

- Baremetrics: Focuses on reducing churn and recovering failed payments with tools like "Recover" and "Cancellation Insights." Pricing starts at $49/month (but ask about our free "Accelerator" deal...).

- ChartMogul: Offers advanced analytics and investor-grade reporting. Free for businesses with <$10K MRR; paid plans start at $100/month.

- Stripe Analytics: Free for Stripe users, ideal for basic subscription tracking, with advanced features available via Stripe Sigma.

Quick Comparison:

| Tool | Best For | Key Features | Pricing |

|---|---|---|---|

| Baremetrics | Reducing churn and failed payments | 28+ metrics, automated dunning, insights | Free Accelerator $49/month |

| ChartMogul | Advanced analytics and reporting | Data cleaning, AI segmentation, compliance | Free (<$10K MRR), $100+ |

| Stripe Analytics | Basic subscription tracking | Built into Stripe, customizable metrics | Free with Stripe |

Choose based on your goals (e.g., churn reduction, advanced reporting, or budget-friendly tracking).

Subscription Analytics Tools Comparison: Baremetrics vs ChartMogul vs Stripe Analytics

1. Baremetrics

Let’s start with Baremetrics, a platform that delivers real-time financial insights specifically tailored for small subscription businesses.

Baremetrics is built for businesses that need instant access to financial data without the hassle of manual processes. With a simple one-click setup, the platform seamlessly integrates with popular payment processors, such as Stripe and Chargebee, automatically pulling both current and historical data. This means no more spreadsheets, manual data entry, or coding headaches.

Features

Baremetrics tracks over 28 key subscription metrics in real time, such as Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), churn rate, customer lifetime value (LTV), and average revenue per user (ARPU). The Control Center offers a live activity feed for every transaction - whether it’s a new signup, an upgrade, a downgrade, or a cancellation - showing exactly how each event impacts your revenue.

Two standout tools tackle common business challenges:

- Recover: This automates the dunning process to recapture failed payments through customizable email reminders and in-app paywalls.

- Cancellation Insights: This feature helps you dig into why customers leave.

"The Cancellation Insights feature is a no-brainer. It replaced our in-house solution in less than an hour, and it provides exactly the insights we need." - Ben Bartling, Co-founder, Zoomshift

Other handy tools include Trial Insights, which tracks customer behavior during trial periods to boost onboarding and conversions, and Benchmarks, which lets you compare your metrics like growth and churn against companies of similar size. Plus, real-time Slack notifications ensure your team stays in the loop about new customers, upgrades, or cancellations as they happen.

Pricing

Baremetrics offers tiered pricing based on your Annual Recurring Revenue (ARR), with three main plans:

| Plan | Monthly Cost | ARR Range | Key Features |

|---|---|---|---|

| Launch | Free-$49 | $0–$360K | 28+ metrics, Trial Insights, Email Reports, One Integration |

| Growth | $189 | $360K–$3.6M | All Launch features plus custom dashboards, Benchmarks, Slack/Intercom integrations (2 integrations) |

| Scale | $749 | $3.6M+ | All Growth features plus scenario planning, Analytics API, unlimited integrations, dedicated support |

| Custom | $$ | Varies | Sit down with our team and craft a custom plan to suit your needs |

Add-ons like Payment Recovery (Recover) and Cancellation Insights are available for $129/month each. All plans include a 14-day free trial, giving you a chance to explore the platform before committing.

Integrations

Baremetrics connects seamlessly with Stripe and Chargebee as well as platforms like App Store Connect, Google Play Store, and Shopify Partners for mobile and e-commerce subscriptions. For accounting, it integrates with QuickBooks Online and Xero. Operational updates and customer support data flow easily through integrations with Slack, Intercom and Hubspot.

If your business uses a custom billing system, Baremetrics provides options like the Universal Connector, Analytics API, and CSV import. The Unified Connections feature helps you manage subscriptions from multiple providers in one dashboard.

Use Cases

Baremetrics is the go-to solution for small businesses looking to replace manual tracking with actionable insights. It’s especially useful for making data-driven decisions when hiring, scaling, or refining pricing strategies - moments where accurate, real-time data is critical. The platform also helps businesses maintain historical data for better forecasting as they grow.

With a 4.5 out of 5-star rating on G2, users frequently highlight the “wow moment” during setup and how Baremetrics becomes a trusted resource for their entire team.

2. ChartMogul

ChartMogul takes real-time insights to the next level by offering analytics, data cleaning, and predictive segmentation. With investor-grade metrics and detailed analysis that doesn’t require custom reporting, it’s a trusted tool for over 2,500 SaaS companies. On G2, it holds an impressive 4.6 out of 5-star rating.

Features

ChartMogul offers basic reporting by tracking essential subscription metrics while introducing some advanced features. One standout is its data cleaning capability, which consolidates customer information to avoid false churn when payment details are updated.

Segmentation enriches subscriber data with industry and company-specific insights, helping small teams pinpoint which customer segments drive the most value over time. The peer benchmarking feature allows businesses to see how their growth and retention metrics stack up against a dataset of over 2,500 SaaS companies.

The platform also automates revenue recognition, ensuring compliance with ASC 606 and IFRS 15 standards. Additionally, its predictive tools let users simulate scenarios such as pricing adjustments and conversion rate changes, providing actionable foresight for decision-making.

"ChartMogul has helped us at Brizy to unclutter the different streams of revenue we have, and present our growth to investors in a streamlined fashion!" - Nils Decker, Customer

Pricing

For SaaS companies just starting out, ChartMogul offers a free tier for businesses with less than $10,000 in Monthly Recurring Revenue. Paid plans begin at $100 per month, covering up to 1,000 paying customers. For larger enterprises managing over 10,000 customers, pricing starts at $19,900 annually.

Integrations

ChartMogul integrates seamlessly with over 25 billing platforms, including, Chargebee, Recurly, Braintree, PayPal, GoCardless, and Zuora. It also connects with tools like HubSpot, Intercom, and Segment to align sales and customer success teams with revenue insights.

For more advanced needs, the platform supports data exports to warehouses like BigQuery and Snowflake, along with cloud storage solutions such as Amazon S3, Azure Blob, and Google Storage. Businesses with unique invoicing requirements can import data via API, CSV uploads, or a dedicated Google Sheets app.

Use Cases

ChartMogul is a valuable tool for small businesses looking to present clear growth data to investors and stakeholders. Its cohort analysis and churn tracking features help teams identify retention trends and take a data-driven approach to reducing customer loss.

While Baremetrics focuses on providing real-time financial streams and advanced customer segmentation, ChartMogul delivers streamlined investor reporting through data management and predictive insights.

3. Stripe Analytics

Stripe Analytics is a built-in feature of the Stripe payment platform that provides key subscription metrics like Monthly Recurring Revenue (MRR), churn rates, lifetime value (LTV), average revenue per user (ARPU), trial conversion rates, and cohort-based retention. All of this data is accessible through a single dashboard.

One of its standout features is the ability to customize how metrics are calculated. For example, you can choose to exclude discounts from MRR or decide when a subscriber becomes "active" - whether at the start of their subscription or after their first successful payment. The "Explore" feature adds another layer of usability by allowing you to dig into specific data points. For instance, if you notice a spike in churned revenue, you can click on it to see which customers left and whether particular products or pricing tiers are driving the trend. Automated CSV reports keep a record of every upgrade, downgrade, and reactivation, while built-in benchmarking tools let you compare your performance to similar businesses. This comprehensive analytics tool provides a solid foundation for deeper insights.

If you're looking for more detailed analysis, Stripe Sigma steps in. Powered by SQL, it allows you to run custom queries, schedule automated reports, and even generate plain-English summaries using its Sigma Assistant.

Pricing

Stripe keeps things simple when it comes to pricing. Stripe Analytics is included for free with Stripe's payment processing services. For those interested in Stripe Sigma, new users can take advantage of a 30-day free trial, after which paid plans are available.

Integrations

Since Stripe Analytics is built directly into the Stripe platform, it automatically gathers data from all payment activity - no extra setup or integrations required. For users needing external analysis, reports can be exported in CSV format to work with tools like accounting software. Stripe Sigma takes it a step further by allowing you to combine Stripe's payment data with other business metadata for even more advanced insights.

Use Cases

Stripe Analytics is particularly well-suited for small businesses that rely on Stripe for all their payment processing. It offers straightforward, real-time tracking of subscription metrics, making it a valuable tool for businesses that need insights without the complexity of external tools. Finance teams can use it to reconcile revenue, fees, and payouts while keeping tabs on live MRR and ARR figures. The ability to tweak metric configurations - like excluding discounts from MRR - offers a more conservative and accurate view of revenue. Additionally, cohort-based retention reports help identify which customer segments are the most loyal, guiding decisions in product development and marketing. Keep in mind that changes to metric configurations typically take 24–48 hours to reflect.

sbb-itb-18a9912

Advantages and Disadvantages

Choosing the right platform for your business starts with understanding the strengths and weaknesses of each tool. Each option brings something different to the table, so knowing where they shine - and where they don’t - can help you make a more informed decision.

Baremetrics stands out with its proactive features that turn raw data into actionable strategies. Tools like Recover, which automates dunning, and Cancellation Insights are designed to tackle churn and failed payments head-on. As your Monthly Recurring Revenue (MRR) increases, the value of accessing the full suite of features is beneficial. Although extras like Payment Recovery and Cancellation Insights each come with an additional $129/month price tag it is well worth it to have an all in one solution.

On the other hand, ChartMogul is a strong choice for teams that prioritize advanced data mobility. It offers robust data management and reporting capabilities that meet investor-grade standards. But it’s worth noting that ChartMogul is more of a passive analytics tool. To address issues like failed payments or customer recovery, you’ll need to integrate it with external solutions.

Stripe Analytics is a budget-friendly option that’s easy to integrate, especially for businesses already using Stripe for payment processing. Since it comes included at no extra cost, it’s a great pick for those seeking basic financial insights. That said, it lacks the in-depth SaaS-specific metrics many businesses need, and advanced customizations require SQL knowledge through Stripe Sigma, which might be a hurdle for teams without technical expertise.

| Tool | Best For | Key Strength | Key Weakness |

|---|---|---|---|

| Baremetrics | SaaS businesses aiming to reduce churn and recover failed payments | Proactive tools (Recover, Cancellation Insights) and user-friendly design | Costs can rise as MRR grows |

| ChartMogul | Data-driven teams focused on precision and visualization | Free tier for small startups; advanced data editing | Lacks proactive features; requires external tools |

| Stripe Analytics | Businesses already using Stripe seeking basic reporting | Free integration with Stripe; simple to set up | Limited SaaS metrics; advanced features need SQL knowledge |

This breakdown offers a clear snapshot of each platform's capabilities, helping you align your choice with your business priorities - whether that's proactive tools, detailed analytics, or cost-effective reporting.

Conclusion

To wrap things up, selecting the best subscription analytics tool boils down to matching your business goals with the unique advantages each platform offers. If tackling churn and failed payments is at the top of your list, Baremetrics could be your go-to option. Its features like Recover for automated dunning and Cancellation Insights turn raw data into actionable steps that deliver measurable results.

For smaller businesses keeping an eye on costs, Baremetrics' pricing is designed with value in mind. Tools like automated payment recovery help offset expenses by recapturing lost revenue. For instance, Zoomshift replaced its internal feedback system with Cancellation Insights and immediately gained practical data to address revenue loss effectively.

The key takeaway? Tools that actively address churn and payment recovery go beyond just reporting numbers. Baremetrics simplifies these challenges by offering built-in solutions - no extra integrations required. It helps businesses understand cancellation reasons while recovering failed payments automatically.

Ultimately, the right tool is the one that aligns with both your immediate priorities and long-term goals. A well-chosen platform can turn complex data into actionable insights, reduce manual work, and fuel revenue growth.

With the subscription economy expected to hit $2,129.92 billion by 2034, there’s no better time to adopt proactive analytics. These tools can streamline your operations and position your business for lasting success.

FAQs

How does Baremetrics help reduce customer churn and recover failed payments?

Baremetrics tackles customer churn head-on with its Cancellation Insights feature. This tool uncovers the main reasons customers cancel their subscriptions, giving businesses the chance to address those issues and keep more customers on board.

When it comes to failed payments, Baremetrics has you covered with automated dunning tools. These tools retry declined transactions and send follow-up reminders to customers, making the payment recovery process smoother. The result? You can recover revenue that might have otherwise slipped through the cracks.

What features does Baremetrics offer to help small businesses manage subscriptions effectively?

Baremetrics delivers real-time subscription analytics dashboards that simplify tracking essential metrics such as Monthly Recurring Revenue (MRR), churn rates, and overall growth. It also includes payment recovery tools to minimize revenue loss and cancellation insight reports that offer actionable data to help reduce churn.

With its financial forecasting tools, small businesses can plan their future with greater certainty. Plus, native integrations with platforms like Stripe, Shopify, and various app stores ensure smooth and automatic data syncing. These features allow small SaaS businesses to manage their operations efficiently and make informed decisions without the hassle of manual work.

How does Baremetrics work with other platforms and tools?

Baremetrics connects effortlessly with top payment processors, app stores, e-commerce platforms, and accounting tools. By syncing with platforms like Stripe, Braintree, Shopify, Apple App Store, Google Play, Chargebee, and Recurly, it pulls subscription and revenue data in real-time. This means no more tedious manual data entry - just an always-updated view of essential SaaS metrics like MRR, churn, and retention.

When it comes to accounting, Baremetrics works with tools like QuickBooks Online and Xero, seamlessly transferring financial data into your bookkeeping system. For platforms not covered by its pre-built integrations, the Universal Connector API makes it easy to link nearly any system, consolidating all your subscription data into one dashboard.

These integrations give small business owners a real-time snapshot of their subscription performance, simplifying decision-making and eliminating the need to juggle multiple tools.