Table of Contents

A bookkeeper is responsible for keeping accurate and up-to-date information on the financial health of your business.

Although bookkeepers and accountants share some duties, for example preparing tax returns or producing the end of year financial statements, a bookkeeper’s main duty is keeping the basic, daily finances in order.

This is usually accomplished with the double-entry system of accounting discussed below.

Bookkeeping: What not to do

When I first started my online B2B business, my “bookkeeping” consisted of keeping all invoices in a pickle jar along with an apology to my accountant every year.

Not only did this mean a stressful April, but it also meant that I missed valid expenses, had no idea how much money I was spending day to day, and had no actionable data on my company that could be used for strategic planning. Obviously, I don’t recommend this, even if a gherkin is still a great snack.

I was rescued (forcibly) by a banker. They told me bluntly that my “system” of bookkeeping would result in a denial of my bank loan in the short term and the potential for tax trouble in the long term.

Afterall, well-maintained books are the only antidote to a tax audit.

Along with recommendations for bookkeeping software packages available, my favorite advice from them was to take the receipts out of my pickle jar weekly, record all the information into a spreadsheet, write a number on the top of the receipt for easy cross-referencing and then stick the receipt in a photo album as back up.

(Hint: use a code that includes letters indicating the type of expense, the date, and a number starting 0001 for ordering them during the year.)

Of course, there are apps you can use to upload images of your receipts to keep all files digital, but I would discuss this with an accountant before discarding the original receipts.

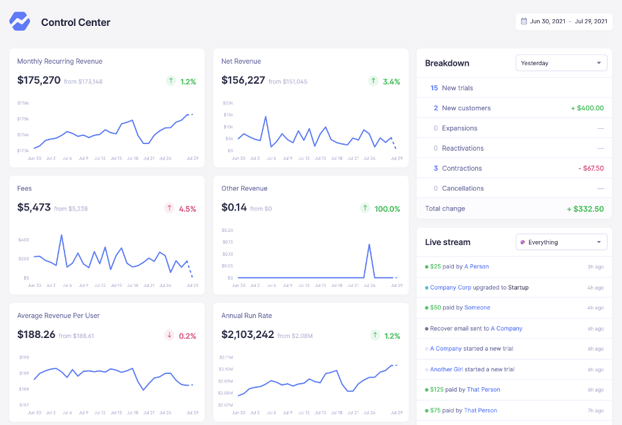

SaaS metrics with Baremetrics

But what if you have too many receipts and invoices to be able to do that?

That’s where Baremetrics comes in. If you are running a small business with subscription revenue, you can monitor all of your finances using Baremetrics.

Wouldn’t something like this be great for your business?

If you want to see your business metrics on an easy to use dashboard, sign up for the Baremetrics free trial and get started.

Before we get into why you need bookkeeping, let’s look at some of the basic terminology used in bookkeeping. Regardless of whether you are thinking about taking a bookkeeping course, pursuing a bookkeeping job, or just want to organize your business, the following are terms that you will encounter regularly and should understand.

Key Bookkeeping Terminology

- Accounts Payable is the account used to track all of the money that you owe to vendors. This is typically a very short-term debt, usually to be paid off within 90 days or less depending on the contract by either longer-term debt (a line of credit) or an asset (cash). A personal example is your credit card: you can pay for a new desk with your credit card today, and then pay it off from your checking account next month.

- Accounts Receivable is conversely the account of all the money that is owed to you by customers. Depending on your billing cycle, whether you use a third-party app to process payments, etc., this is typically money that you can expect to land in your checking account within the next month or two. Accounts receivable of one company are the accounts payable of another. While you record the cost of that desk in your accounts payable, the bank is recording your credit debt in their accounts receivable.

- Assets are everything your company owns. This can be anything from a commercial building to paper clips, from the accounts receivable above to any intellectual property you’ve created. Assets can be purchased with your investments and profits (equity) or loans (liabilities), hence Assets = Liabilities + Equity.

- Balance Sheet: The balance sheet is one of the four main accounting statements, along with the income statement, cash flow statement, and statement of shareholders’ equity. It details the financial situation of your business at a moment in time. The balance sheet helps to show what your business owns and owes, with your assets on the left and the liabilities and equity on the right.

- Capital is all of the company’s assets currently available to invest, spend, etc. It can be used to understand the financial health of your company as more capital helps your company be agile when facing new market conditions.

- Cost of Goods Sold is how much your product costs directly. This includes the labor and materials you put into each product, but not all of the indirect costs such as for distribution and sales.

- Current Assets are all of your cash and anything that can be turned into cash quickly. This includes cash, investments, inventory, and accounts receivable.

- Current Liabilities are all of your debts that need to be paid in the near future. This includes short-term loans from the bank and accounts payable.

- Depreciation is the decrease in an asset’s value over time due to wear and tear, or simply age.

- Double-Entry Accounting is a system that allows you to keep track of all assets, liabilities, and equity. The bookkeeper records every transaction twice in two different journals, once on the left (“debit”) and once on the right (“credit”). In addition to preventing mistakes, the reason each transaction is written twice is to give you a more honest view of your company. If you spend $300 on a credit card to buy a new lighting set up to take photos of your products for your online shop, then your company isn’t magically worth $300 more. It has a $300 new asset to place on the debit side of one account, but it also has a matching $300 liability to place on the credit side of another account.

- Equity is all of the money you invest in the company and all the accumulated profits (that is, the profit you don’t pay yourself to live). Along with liabilities, it is the core way you finance your business activities. Your total equity is approximately how much money you would gain if you liquified your inventory, sold all your assets, and settled all debts.

- Expenses are all of the things you spend money on to operate your business. This can include rent, utilities, wages, and even the interest on your debts.

- Income Statement: The income statement is one of the four main accounting statements along with the balance sheet above. Unlike the balance sheet, which is a snapshot of your company’s financial health, the income statement covers a period of time. It shows all of your revenues and expenses during that time, and (hopefully) the positive difference between them, which is your income.

- Inventory includes all of the items you have purchased for resale but not yet sold.

- Journals are used by bookkeepers to record all of the daily transactions. Each account, for example the accounts payable and receivable mentioned above, has its own journal. These are used by the bookkeeper when performing double-entry accounting.

- Liabilities are just the debts you owe. These range from accounts payable due in the next few days to mortgages you’ll pay off for decades (and student loans forever).

- Payroll is the way you pay your employees, if your company has any. This is a major work function of the bookkeeper because they need to keep track of not just the money owed to employees every Friday, but also the amount that has to be withheld for the government, and all of the other money owed to the government as well. This is a major tax and compliance issue and should be done with care.

- Revenue is the money collected from selling your goods and services. Revenue is one of the major sections of the income statement.

- Trial Balance is a way to test whether your books are in balance before drafting the financial reports and closing the books.

be honest

How well do you know your business?

Get deep insights into MRR, churn, LTV and more to grow your business

The importance of bookkeeping for your small business

Whether you take on the responsibility of bookkeeping yourself, contract bookkeeping services locally or online, or hire a bookkeeper to handle this work, there are numerous benefits bestowed on your company.

- Foremost, this is the best way to prevent an audit as well as successfully deal with one if a tax authority decides to look more deeply into your company.

- Once up and running, bookkeeping saves you time by putting all the key financial information in one place and in a readable way.

- It will make tax season stress-free (no more stress-eating pickles).

- You can find seasonal or other patterns in your revenue.

- Sudden changes in spending habits are immediately clear.

- The key metrics of your financial health are more visible, including revenue, expenses, profitability, etc.

Putting your bookkeeping data to work

Once you have your books in order and are comfortable with day-to-day bookkeeping, you can unlock the full potential of the information in those spreadsheets through data visualization.

Finding hidden patterns in your sales, seeing the growth potential, and knowing which product is poised to be the star of your marketplace can all be done through using Baremetrics. Data collecting and collating are only the first steps, with data analytics being a necessary next stage to maximize sales and keep on top of those past due accounts receivable.