Table of Contents

Key takeaways:

- Dunning management is the process of managing and recovering failed payments from customers to ideally retain both the revenue and the customer

- Failed payments are often the result of incorrect billing information, insufficient funds, and an expired credit card, so it’s not a standard pause or cancellation churn

- SaaS companies lose around 9% of their (recoverable!) MRR to failed payments and involuntary churn, so all subscription companies need a dunning management process and software

- Dunning management software like Baremetrics can help you recover missed payments with proactive outreach and email campaigns

Failed payments are part of running a subscription or SaaS business. It’s normal for credit card payments to get declined. But unless you have dunning management in place, chances are those failed payments are costing you a lot of money.

In this guide, I’m going to break down what dunning management is, how it works, how to completely automate the dunning process, and some best practices to follow in order to recover more revenue from failed payments.

What is dunning management?

In short, dunning is recovering failed payments from customers, and dunning management is the process of doing it.

When you have a recurring billing/subscription business model, failed payments are inevitable. At some point, you will attempt to charge one of your customers, but the payment isn’t go through. Usually as a result of:

- Insufficient funds

- Incorrect billing information

- Expired credit card

When payments fail, you have two options:

- Sit back and wait for the customer to notice and do something about it

- Be proactive and reach out to get them to update their payment method

If you don’t have a dunning management solution in place, chances are you’re using option #1.

Unless you’re ok with losing monthly recurring revenue (MRR) and customers, you’re much better off going with option #2 and setting up a process to contact customers after a failed transaction and collect the payment.

Why Every Subscription Company Needs Dunning Management

You’re probably already starting to understand why dunning management isn’t just a “nice to have”, and really a necessity for any company that collects recurring payments (i.e. a SaaS or subscription service).

But just in case you need a little more convincing, or you just want to know exactly what’s at stake, here are some of the main ways dunning management will help you grow.

Saves 9% of Your MRR

This should be enough of a reason alone to use dunning management.

Based on our data, on average, SaaS companies lose about 9% of their MRR due to failed payments and involuntary churn.

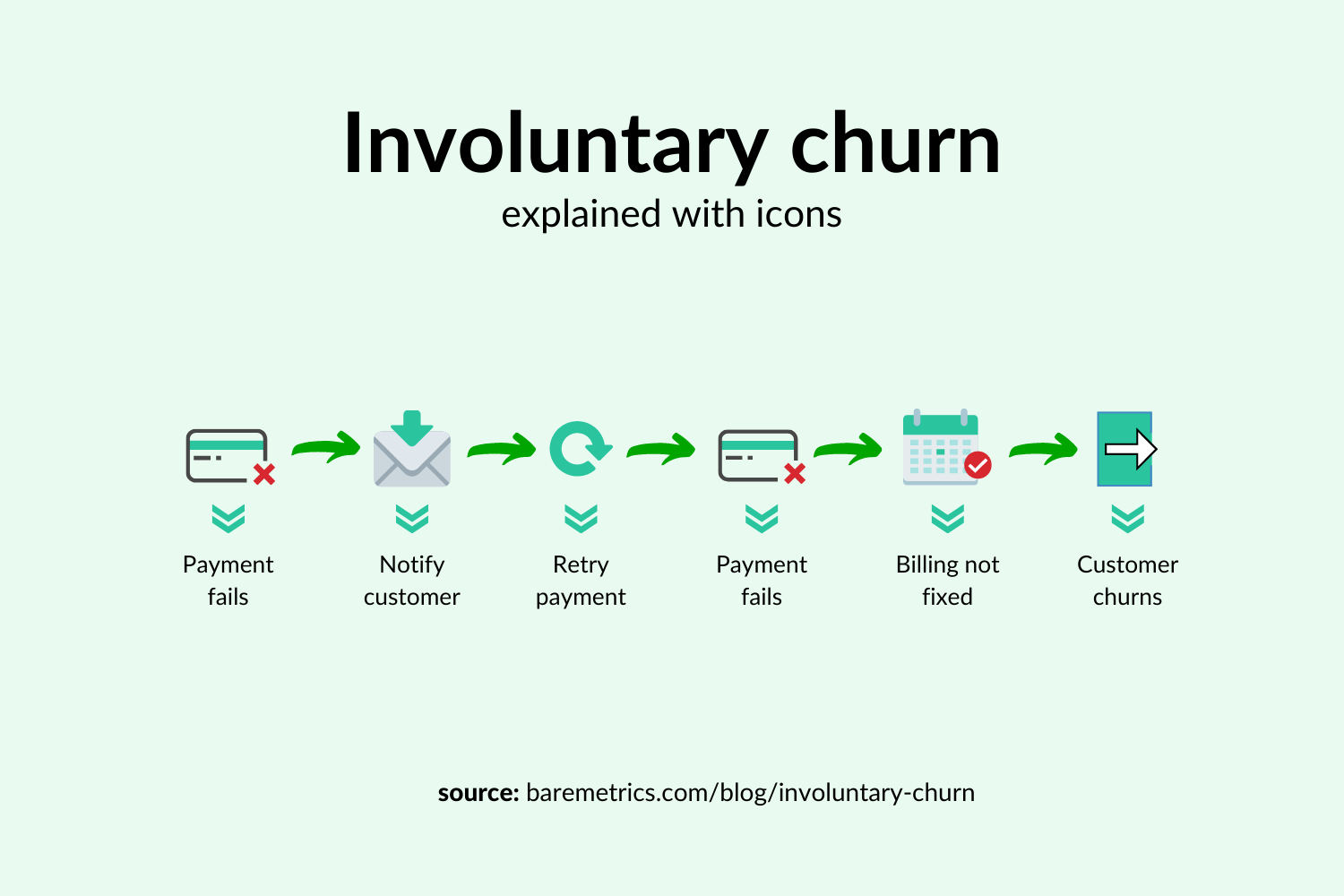

Involuntary churn is when a customer’s subscription ends unintentionally. It’s usually as a result of a failed payment that never got fixed.

Some companies assume that customers know when their payments fail and just wait for them to update their payment information. But we’ve found that’s not always the case.

You’ve probably even experienced it first-hand when your credit card expires, and you completely forget to update your own subscriptions with the new billing details. It’s an easy mistake to make.

And unless the customer logs into your product frequently, they could go an entire month without noticing unless you tell them.

That’s why implementing dunning management is a quick and easy win for business growth. It’s simple to set up and pretty much runs itself. I’ll show you how later on.

Prevents Service Disruptions

Depending on the type of business you run, this could be a very important reason to have a dunning management solution in place.

Let’s say you own a SaaS company that monitors website downtime. Your customers depend on your software to let them know when their website has issues, so every minute that their service is interrupted means potential lost revenue for them.

What happens when their monthly payment fails and goes unpaid for weeks? Unless you keep the service going for delinquent customers (which is probably a good idea), it can create unnecessary service disruptions.

Which brings me to my next point...

Create a Better Customer Experience

Yes, dunning management helps you make (and keep) more revenue. But it also helps your customer.

Unlike voluntary churn, customers who have failed payments usually don’t want to cancel their service.

So just as much as dunning helps you, it also gives your customers a layer of protection to make sure they don’t experience any type of disruption with their account.

How the Dunning Process Works

Now that you know the what and why, let’s talk about how dunning management actually works.

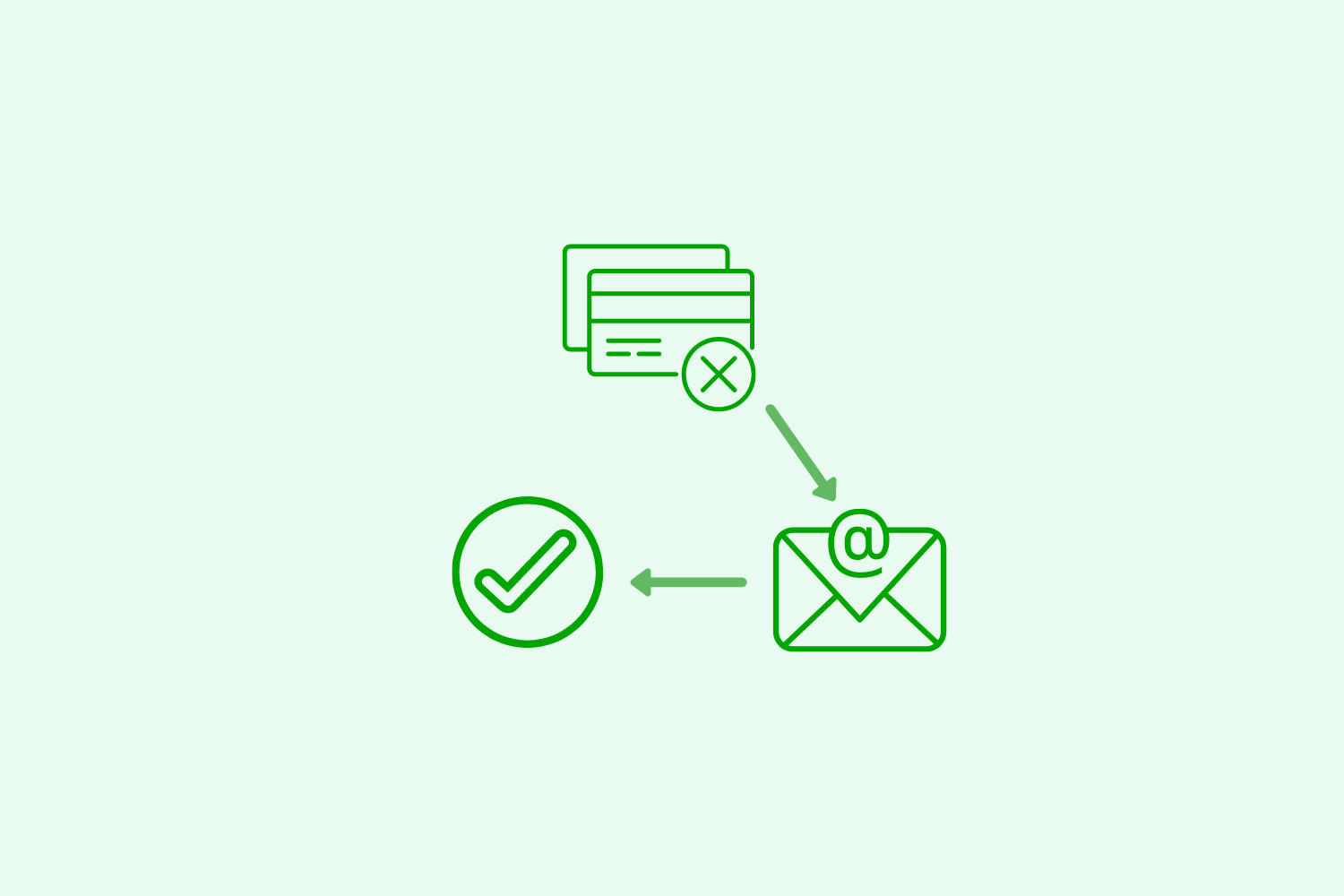

The involuntary churn graphic I showed earlier is an example of what a lot of companies without a dunning management process do—and results in involuntary churn.

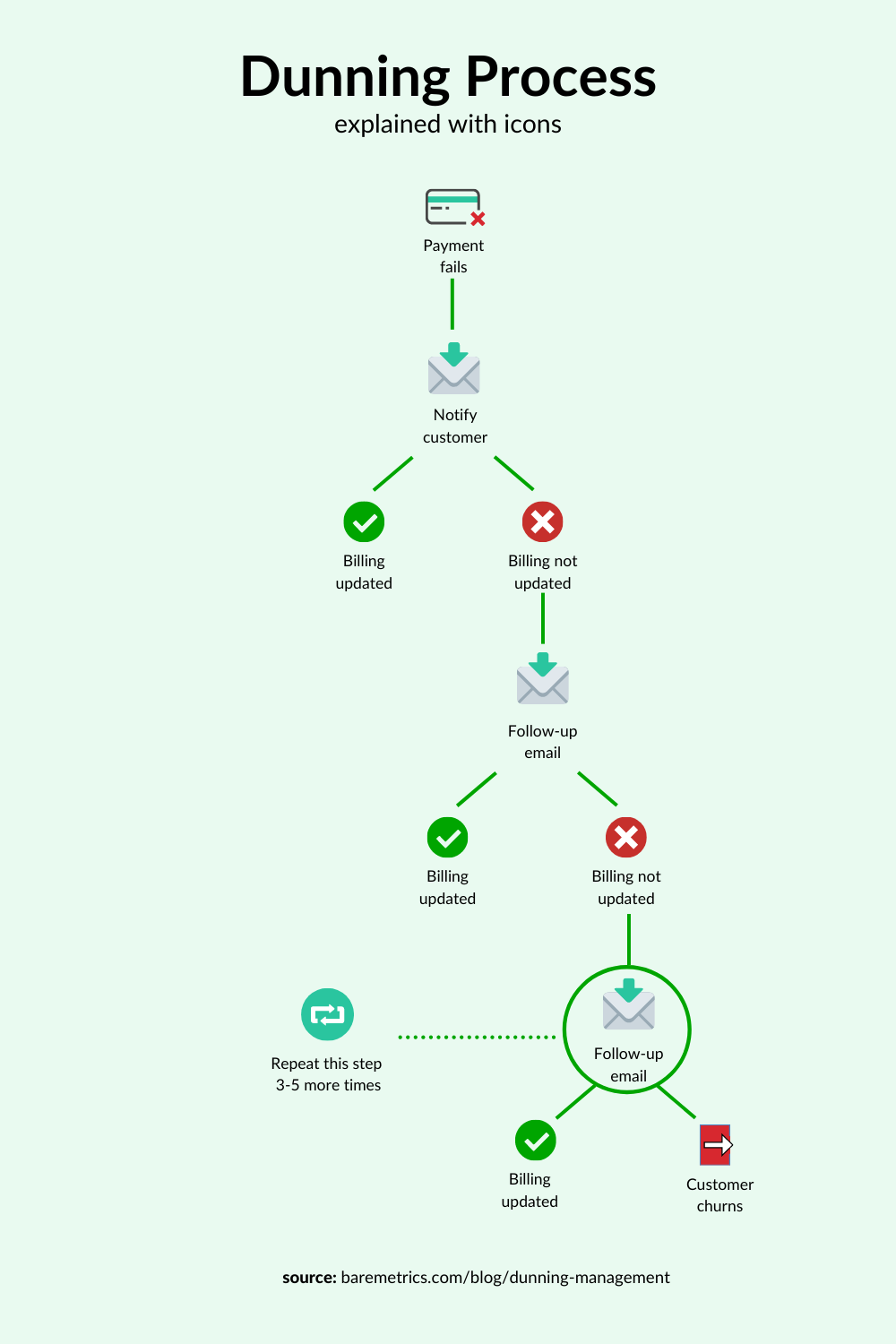

But here’s what a more effective dunning process looks like:

Step 1: The Customer’s Payment Fails

This is the event that triggers the entire process. Whether their credit card is expired, they have insufficient funds, or for any other reason, a customer’s payment fails, and the charge doesn’t go through.

Step 2: Send a dunning email to the customer

Customer communication is key here.

The day that your customer’s payment fails, send them an email letting them know the payment failed and providing a link to update their billing information.

Your billing software might have automated payment retries that will try charging the card again at this point.

If there was a soft declined payment, that might work. But if not, move on to step 3.

Step 3: They update their billing information (or don’t)

The customer will either log in and update their billing information or wait/not see your email. If they update their billing information, great! You’ll recover the payment, and everything is right in the world.

If they don’t make a payment, move to step four.

Step 4: Send a follow-up dunning email

Emails get missed, and people get busy. It’s life. However, that means that there’s a chance your first dunning email will get passed up. And unfortunately, that’s where many subscription companies stop the dunning process.

But not you, because you read this article!

You need to send a follow-up dunning email (just a gentle reminder) to be proactive about collecting failed payments. However, you don’t have to send it the very next day.

For instance, at Baremetrics we wait until a few days after the first email to send our follow-up.

According to our data, follow-up dunning emails are important because many customers won’t update their billing information after the first email.

You can continue to send a few more dunning emails until the customer updates their billing information. But we suggest spacing them out. For instance, we send a total of six emails over 30 days.

At this point, you should also set up a reminder notification in-app or paywall to update their billing information.

If you offer a grace period for customers to make an overdue payment, you can mention that in your email as well.

Step 5: Churn

If, after all of your attempts, the customer still hasn’t updated their billing information, you’ll likely have a churned customer.

Between the email notification, in-app reminders, and a paywall when they log in, most customers will fix the payment issue if they can. But if not, sometimes you’ll have to accept a bump in your churn rate.

If this all sounds like a lot, don’t worry. It can all be automated!

Using Dunning Management Software

Unless you plan to manually send emails to each customer when their payment fails, you’ll need some type of dunning management software to automate the process.

And while most dunning management tools have similar functionality, they’re not all equal. Here’s a look at some of the best dunning management software to recover failed payments.

Baremetrics dunning (Recover)

We couldn’t make a list of the best dunning management software and not include our own product!

Recover does everything you need from dunning software from sending emails, to making it easy for customers to make payments, in-app payment reminders and provides you with dunning analytics so you can see exactly how much revenue you’ve saved.

But aside from the fact that we developed it, there are plenty of reasons to go with Recover. For one, it’s integrated with the rest of our metrics, so you can get deeper insights than other dunning tools.

For example, you can see your complete customer profile, including what plan they’re on, and a timeline of any failed charges, dunning emails sent, and more, all in one place.

On top of that, you can also see your most common failed payment reasons...

And a breakdown of how each dunning email performed (including how much revenue you recovered from each email).

If you’re interested in trying Recover, you can get a free trial here.

Dunning Software From Payment Processors

Some subscription companies prefer to use out-of-the-box dunning software from their subscription billing software.

However, we find that these tools are often more limited than what you’d get from a standalone dunning tool like Recover.

Most dunning tools from payment processors/subscription billing providers:

- Don’t offer the same level of reporting and analytics

- Don’t send enough follow-up emails

- Do little to nothing in terms of in-app dunning

But in case you’re interested, here are some other dunning software options:

I can’t stress it enough though, I highly recommend going with a standalone dunning tool if you’re serious about reducing customer churn and recovering more revenue.

Best practices for dunning management

Getting some type of dunning management up and running will likely get you some results. Almost anything is better than doing nothing.

But if you want to maximize the amount of MRR you recover each month from failed payments, here are some best practices to follow.

1. Automate Dunning Management

I can’t stress this enough! Use dunning management software to automate this entire process. It’s so simple, and it can save you thousands of dollars in revenue churn.

Even if you think, “I only have 100 customers, is it worth paying for?” The answer is yes!

All the time you spend manually sending emails and tracking down customers who haven’t paid is time you could spend elsewhere on things you can’t automate.

Seriously, do it.

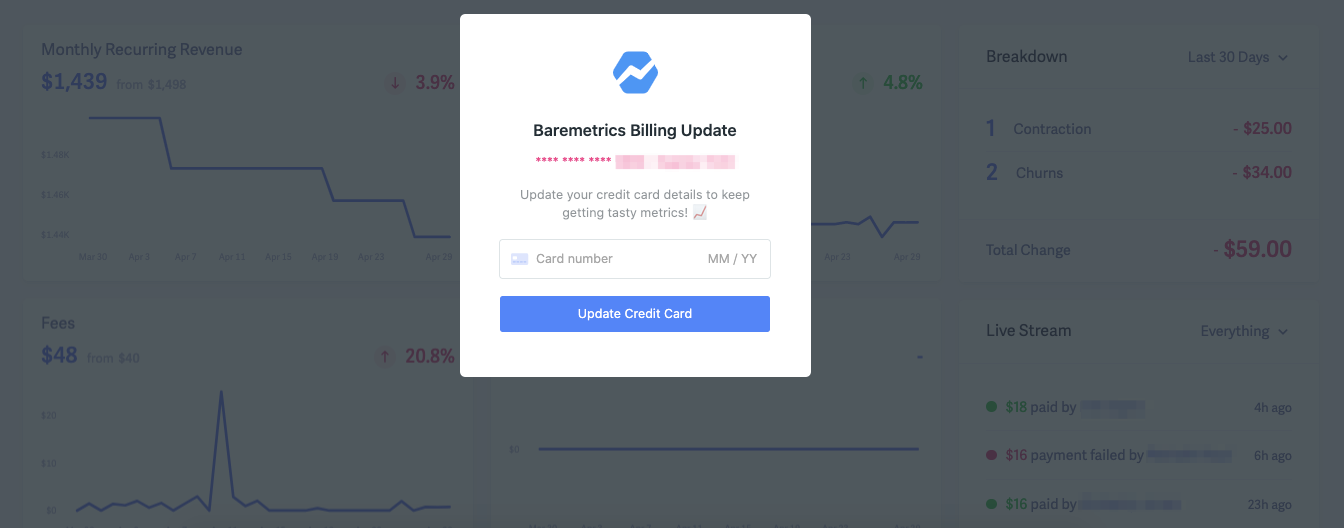

2. Don’t Forget the In-App Experience

Dunning emails are very effective for recovering failed payments. But you can double down by including in-app reminders for customers to update their billing information.

As I mentioned earlier, you can set this up in Recover so that when customers log in to your software, they’ll see a pop-up asking them to update their billing information.

If customers ignore this message, it means they either:

- They aren’t logging into your tool, so they never saw it (which is a bad sign)

- Probably plan to cancel anyway so they’re not going to update their billing information

3. Make it Simple to Update their Billing Information

Generally speaking, the easier it is to do something, the more likely people will do it. That applies to most things in life, including updating billing information.

Customers should be able to update their billing information with less than two clicks. For instance, if you send an email, they should be able to click the link and be taken directly to a credit card form.

If it’s an in-app reminder, they should be able to update their information directly in the form that pops up.

4. Use These Dunning Email Templates To Get Started

A while back, I contacted over 30 different SaaS and subscription companies and asked them to share the dunning emails they send to customers.

You can take a look at it all here: How to Write Effective Dunning Emails (30+ Examples Included)

It’s a great resource if you’re setting up a dunning management process for the first time or if you’re just looking to refresh your current emails.

Dunning Management is a Must

I know I sound like a broken record by now, but every SaaS and subscription company should have a dunning solution.

I’m speaking from experience. Using Recover has helped us recover over $30,000 in potential lost revenue in just the past nine months.

And if you’re currently not doing anything about dunning, there’s a strong chance you don’t know how much revenue you’re losing each year from failed payments.

Whether you use Recover or another tool, setting up dunning management should be on your to-do list ASAP.