Table of Contents

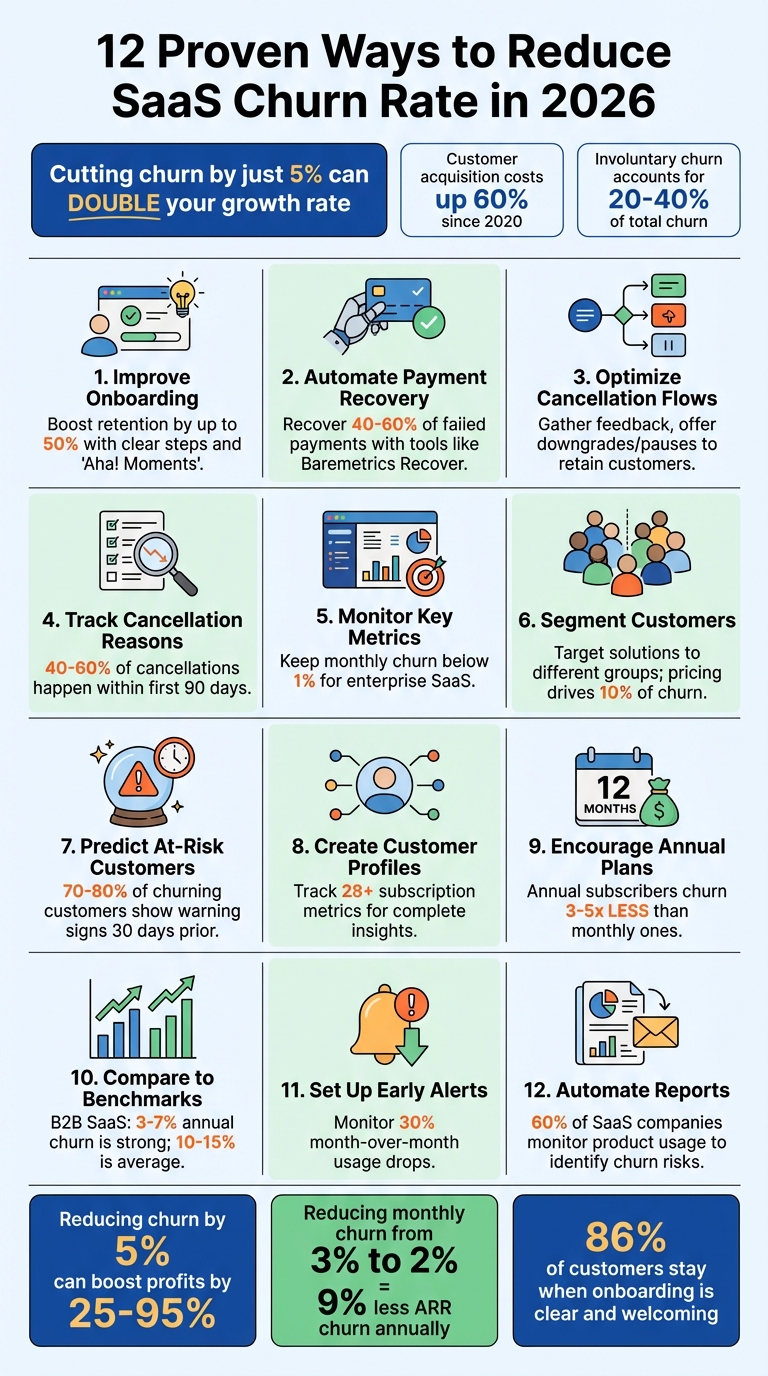

Churn can destroy your SaaS growth. Losing customers faster than you gain them erodes revenue, especially with rising customer acquisition costs (up 60% since 2020). Here's the bottom line: cutting churn by just 5% can double your growth rate. In 2026, focusing on retention is no longer optional - it’s a necessity.

Here’s how to lower churn effectively:

- Improve onboarding: Help users find value quickly. Clear steps and “Aha! Moments” boost retention by up to 50%.

- Automate payment recovery: Tools like Baremetrics Recover reduce involuntary churn (20–40% of total churn) by recovering failed payments.

- Optimize cancellation flows: Gather feedback, offer downgrades or pauses, and address issues proactively.

- Track key metrics: Monitor churn, MRR, and Net Revenue Retention (NRR) to spot risks early.

- Segment customers: Understand why different groups leave and tailor solutions to their needs.

- Encourage annual plans: Annual subscribers churn 3–5x less than monthly ones.

- Set alerts for warning signs: Drops in usage or payment issues signal at-risk customers.

- Leverage customer data: Use tools like Baremetrics to create profiles, predict churn, and personalize outreach.

Retention isn’t just about keeping customers - it’s about driving long-term revenue. Start with these strategies to protect your ARR and fuel growth.

12 Proven Strategies to Reduce SaaS Churn Rate in 2026

Reduce Customer Churn: 7 Proven Strategies

1. Improve Customer Onboarding for Early Success

Onboarding is where customer retention truly begins. Did you know that over half of B2B SaaS customers will quit if they don’t fully understand how to use the product? On the flip side, 86% are more likely to stick around when the onboarding process is clear and welcoming. A poor first experience doesn’t just frustrate users - it directly impacts your bottom line.

The secret to great onboarding lies in identifying your product’s "Aha! Moment" - that pivotal point where users first experience the core value of your offering. For example, HubSpot’s "Aha! Moment" happens when a new user engages with five key features within their first 30 days. For Stripe, it’s all about helping users process their first payment. Once you’ve nailed down this moment, design your onboarding process to guide users there as quickly and effortlessly as possible.

Take Shawn Plummer, CEO of The Annuity Expert, for example. He revamped his onboarding approach with personalized welcome messages and guided steps, which led to a 20% boost in customer retention within six months. Similarly, Fig Loans CEO Jeff Zhou introduced a gamified rewards system for onboarding tasks, like watching educational videos or setting up direct debits. This tweak increased onboarding completion rates by an impressive 50%. These real-world examples highlight how thoughtful onboarding improvements can make a massive difference in reducing churn.

"If you can help your customer quickly adopt your product and start to see value, chances are they're going to want to keep using it." - Althea Storm, Customer Success Manager, HubSpot

To optimize onboarding, focus on cutting out unnecessary steps between signup and that first big "win." Use checklists, offer ready-made templates, and celebrate milestones with in-app notifications to keep users engaged. By speeding up the time it takes for customers to see value, you’re not just improving their experience - you’re building a stronger foundation for long-term loyalty. In fact, effective onboarding can increase customer retention by 50%, making it one of the most impactful strategies you can implement.

2. Use Baremetrics Recover to Automate Payment Recovery

In the SaaS world, not all churn happens by choice. A significant portion - 20–40% - comes from involuntary churn. This occurs when subscriptions are canceled because of failed payments, often caused by expired cards or insufficient funds. The upside? With the right tools, this type of churn can be avoided almost entirely.

Baremetrics Recover is designed to take the hassle out of managing failed payments. It automates the dunning process, starting with pre-dunning emails sent 30 days before a card's expiration date, reducing the risk of payment failures. If a payment does fail, Recover steps in with a multi-step retry sequence: a soft retry within 24 hours, followed by additional attempts on days 3 and 7. This process helps recover an average of 40–60% of failed payments.

Recover also sends targeted email sequences with one-click links for updating payment details, shows in-app notifications for active users, and enforces paywalls after a grace period if the issue persists. Even soft declines - temporary problems like a card hitting its limit - are addressed with automatic retries at the best possible times.

This level of automation not only simplifies the dunning process but also protects your bottom line.

"The average startup is losing thousands of dollars every month to failing charges. Most of these customers don't even realize their card is failing." - Baremetrics Business Academy

Companies that have embraced automated dunning have seen impressive results. One example reduced involuntary churn from 12% to just 2% in three months, recovering over $50,000 in annual recurring revenue. Best of all, the setup is quick - less than 30 minutes with Stripe or PayPal - and the impact on revenue is immediate.

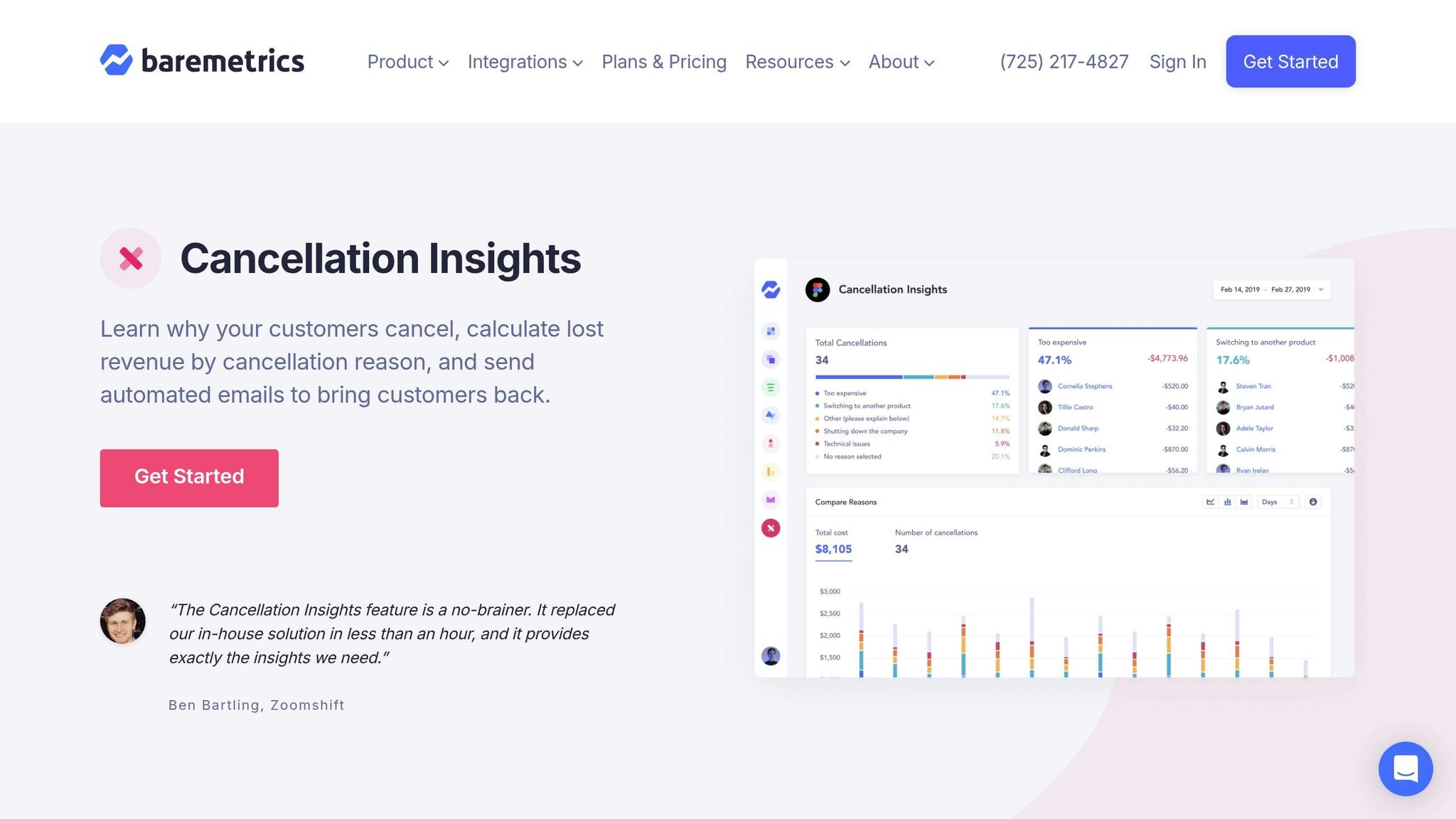

3. Create Better Cancellation Flows with Cancellation Insights

When a customer chooses to cancel, it’s not just the end of their journey - it’s an opportunity to turn things around. By improving your cancellation flow, you can address the reasons behind their decision and present alternatives like pausing, downgrading, or even reconsidering. A thoughtful approach here can make a big difference.

Baremetrics Cancellation Insights simplifies this process. With an in-app survey, you can capture real-time data on why customers are canceling. Whether it’s pricing, missing features, or other concerns, you’ll have a clear picture of what’s driving churn. Even better, the tool calculates the revenue impact of each reason, helping you focus on the issues that matter most. This information enables you to send automated, targeted responses that could save accounts at risk.

For example, if a customer cancels due to cost, you can offer a discount or suggest a more affordable plan. If they no longer need the service right now, why not give them the option to pause their account instead of canceling outright? These personalized solutions can help retain subscriptions that might otherwise be lost.

"The Cancellation Insights feature is a no-brainer. It replaced our in-house solution in less than an hour, and it provides exactly the insights we need." - Ben Bartling, Zoomshift

You can also monitor activity on your cancellation page. If someone lingers there, consider sending an email highlighting support options or features they may not have explored. This proactive step can re-engage customers before they fully commit to canceling, giving you one last chance to keep them on board.

4. Track Why Customers Cancel with Baremetrics Cancellation Insights

Understanding why customers decide to leave is a game-changer when it comes to managing churn. Without clear feedback, you're left guessing at the root causes, which makes it harder to address the real issues. That’s where Baremetrics Cancellation Insights steps in, offering a streamlined way to gather and analyze customer exit feedback.

This tool integrates directly with your payment processor and triggers a customizable survey when customers initiate cancellations. These surveys feature predefined reasons for cancellation, but you can take it a step further by adding follow-up questions with conditional logic. For instance, if a customer selects "too expensive", you could ask what price range they’d find acceptable. The setup process is quick - usually under 30 minutes - and the insights start rolling in almost immediately.

Once the data is collected, Baremetrics organizes it into visual dashboards that make spotting trends easy. For example, you might notice recurring technical issues or a high percentage of early cancellations (40–60% of cancellations typically happen within the first 90 days). The dashboard also breaks down feedback by customer type, cohort, or usage patterns, helping you prioritize solutions based on their revenue impact.

These insights don’t just sit there - they guide action. If "missing features" is a common complaint, it might be time to adjust your product roadmap. If technical issues dominate the feedback, focusing on customer support could be the key. These targeted efforts have been shown to reduce churn by 15–30%.

Pair this feedback with other performance metrics to catch signs of declining usage early. By addressing issues before they escalate, you can resolve problems proactively, relying on real customer input rather than guesswork. This approach not only helps retain customers but also protects your bottom line.

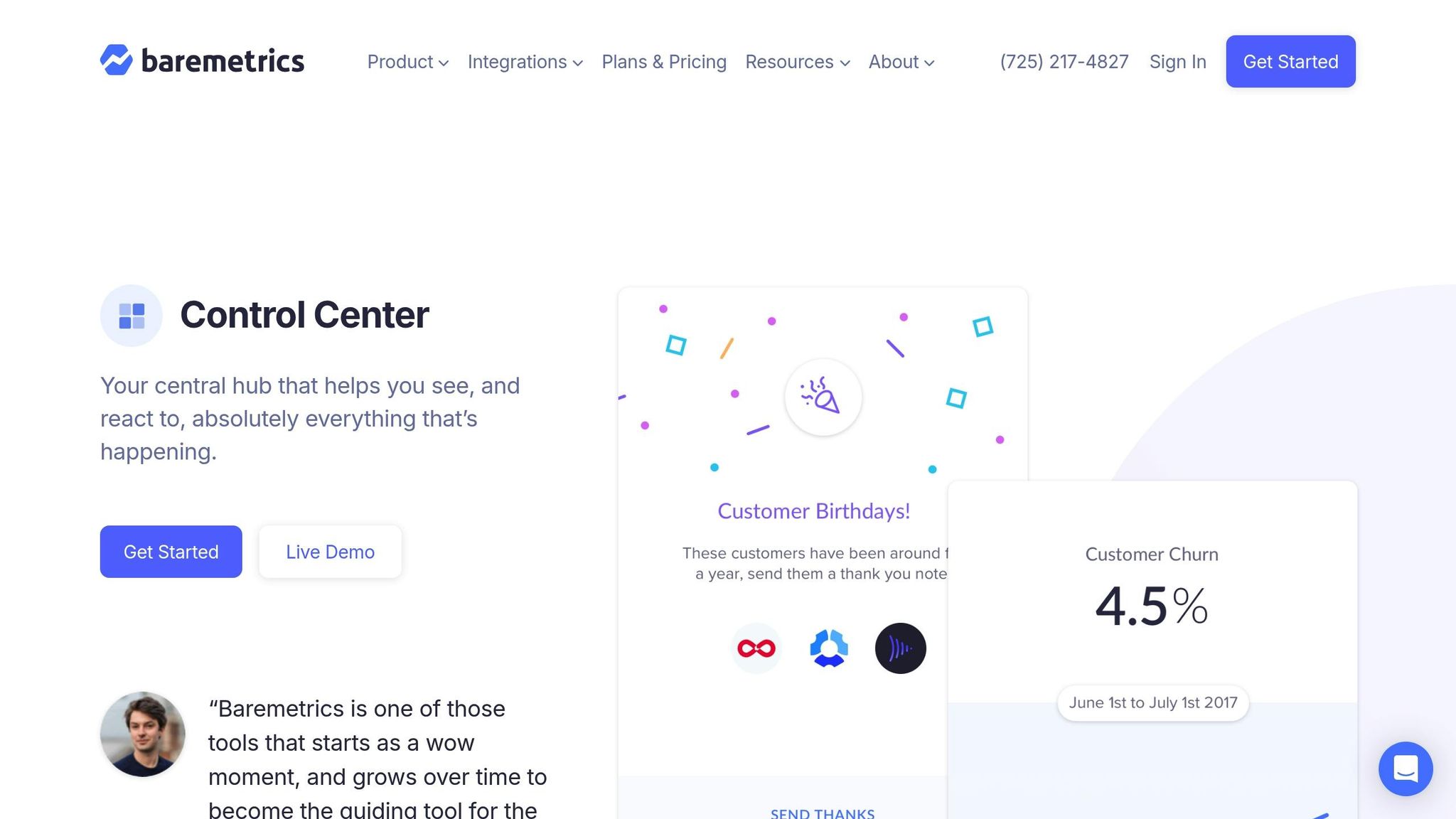

5. Track Key Metrics with Baremetrics Dashboards

Analyzing why customers cancel is just one piece of the puzzle. To truly manage churn, you need to monitor your metrics in real time. Tools like Baremetrics Dashboards make this possible by turning your subscription data into easy-to-read visuals, helping you spot potential issues before they spiral out of control.

The first step is identifying the right metrics to track. For instance, User Churn reflects the percentage of customers who canceled in the last 30 days - essentially your raw cancellation rate. On the other hand, Revenue Churn dives deeper, showing the actual Monthly Recurring Revenue (MRR) lost due to cancellations or downgrades. For enterprise SaaS products, keeping your monthly churn rate below 1% is a solid benchmark. Many SaaS businesses aim for a retention rate of 90%, though top performers often exceed this.

Other essential metrics include:

- Net Revenue Retention (NRR): Measures revenue growth from existing customers through upsells and expansions.

- Lifetime Value (LTV): Predicts the total revenue a customer will generate before they churn.

- Quick Ratio: A snapshot of business health, calculated as (New + Expansion + Reactivation MRR) ÷ (Contraction + Churned MRR).

- Average Revenue Per User (ARPU): Helps determine whether you’re attracting high-value customers who are less likely to churn.

As Baremetrics puts it:

"Churn is the antithesis of growth. It's the undoing of all your hard work, and money spent acquiring customers."

Matt Smith, COO and Founder of Later, highlights the value of Baremetrics:

"Thanks to Baremetrics, we're able to know what's going on with our revenue and customers, in real-time. Absolutely invaluable and miles ahead of doing it in spreadsheets or coding your own".

The platform also offers automated email reports - daily, weekly, or monthly - so your team stays updated on churn metrics. Plus, you can integrate with Slack for instant alerts when cancellations occur, allowing for immediate action. This comprehensive approach to tracking metrics pairs perfectly with proactive retention strategies, giving you the tools to stay ahead of churn.

6. Use Customer Segmentation and Cohort Analysis

Different customer groups leave for different reasons. For example, startups might outgrow certain features, while large enterprises could require more advanced support. By using customer segmentation, you can organize users based on behavior, subscription plans, or usage patterns. This makes it easier to pinpoint which groups are most at risk of leaving and why. Combined with tracking key metrics, segmentation helps identify specific risk factors, allowing for more targeted solutions.

To start, create acquisition cohorts based on when users signed up or the marketing channel that brought them in. Next, build behavioral cohorts around critical actions, like completing the onboarding process or integrating third-party tools. Acquisition cohorts help you understand when users leave - such as a sharp drop-off on Day 3 - while behavioral cohorts shed light on why they leave, like skipping the onboarding process, which often leads to higher churn rates. Together, these insights help you focus on the customers who need the most attention.

Visual tools like cohort tables can make these patterns even clearer. For example, color-coded tables can highlight retention drop-offs, such as users who sign up during the holidays but churn by February. This could point to seasonal trends or issues with onboarding. Similarly, you can evaluate "sticky" features by comparing retention rates between users who adopt those features and those who don’t. If users who engage with a particular feature stay longer, it’s a sign that you should prioritize promoting that feature.

The data is clear: engaged users are far less likely to churn. Customers who consistently find value in your product tend to stick around. By using segmentation tools, you can analyze performance across different customer groups, identifying which ones have the highest lifetime value and which ones require immediate attention.

Lastly, since pricing concerns drive about 10% of customer churn, consider offering a pause option for budget-conscious users. This can help retain those customers for longer periods.

sbb-itb-18a9912

7. Predict Revenue and Find At-Risk Customers

Taking proactive steps to retain customers is only part of the equation - predicting revenue trends adds another layer of insight, helping you spot potential churn risks before they escalate.

Revenue forecasting serves as a kind of early warning system. By comparing actual performance metrics to forecasts, you can pinpoint accounts that are underperforming or showing signs of decline. This gives you the opportunity to step in and address issues before a cancellation becomes inevitable.

Research reveals that 70% to 80% of customers who churn exhibit clear warning signs at least 30 days prior to canceling. The most telling indicator? A significant drop in product usage - for example, when login frequency or feature adoption falls by more than 30% from one month to the next. Other red flags include unresolved support tickets, failed payment attempts, or customers switching from annual to monthly billing plans.

"Forecasts provide insights into future trends, resource needs, and potential risks. This foresight enables you to make strategic decisions with confidence." - Baremetrics

To act on these insights, set up automated alerts for accounts experiencing a 30% or greater decline in engagement compared to the previous month. Pay special attention to the first 30 days of a customer's journey - if they don’t find meaningful value during this time, they’re unlikely to stick around past the 90-day mark.

You might also consider introducing a risk scoring system to prioritize customer outreach. For example, categorize accounts into three tiers based on their risk level: Healthy (0-33), At-risk (34-66), and Critical (67-100). This allows your Customer Success team to focus their efforts on the most urgent cases, while medium-risk accounts can be placed into automated nurture campaigns. The payoff is worth it: studies show that reducing churn by just 5% can boost profits by anywhere from 25% to 95%. This kind of proactive strategy isn’t just smart - it’s essential for long-term growth.

8. Create Detailed Customer Profiles with People Insights

Understanding your customers' behaviors, payment habits, and engagement levels is key to staying ahead of churn. By digging deeper into these patterns, you can set the stage for tools that bring all customer intelligence into one place.

This is where Baremetrics People Insights shines. It pulls together financial, behavioral, and support data to create complete customer profiles. With this tool, you can view everything in one place - monthly recurring revenue (MRR), lifetime value (LTV), login frequency, feature usage, support ticket history, and even cancellation reasons. Baremetrics tracks over 28 subscription metrics, giving you the insights needed to build a full picture of your customers’ habits and preferences.

Bringing together this data allows you to predict churn more effectively. Financial metrics like MRR and payment history highlight your most valuable accounts. Meanwhile, behavioral data - like how often customers log in, how long they stay, and how they use features - can give you a clearer picture of engagement, which often predicts churn more accurately than customer sentiment surveys. As Chris Cahill from Revenera puts it:

"Churn risk is often more accurately predicted by low product engagement or reduced feature adoption, which CSAT and NPS do not capture".

Support interactions can reveal pain points, while details like signup date and location help uncover patterns in customer behavior.

Take Lemlist, for example. Founder Guillaume Moubeche used detailed customer data to discover that sales reps were their most valuable segment, with the highest lifetime value and lowest churn rates. By focusing their product and marketing efforts on this group, Lemlist grew from $10 million to $30 million in annual recurring revenue (ARR) within two years - all while dramatically cutting churn. This success came from going beyond basic demographics to build rich customer profiles.

With these profiles, you can also create health scores to monitor customer engagement. If a health score drops - indicating reduced activity or unresolved issues - you can trigger automated retention strategies or assign follow-up tasks to your Customer Success team. Personalized outreach based on these insights performs significantly better, with 29% higher open rates and 41% higher click-through rates compared to generic messaging.

9. Encourage Annual Plans to Reduce Monthly Churn

Switching customers to annual plans can significantly cut down churn rates. Studies indicate that annual subscribers are three to five times less likely to churn compared to monthly subscribers. Why? Paying upfront creates a sense of commitment, which naturally leads to higher engagement with your product. This upfront payment also reduces the hassle of frequent billing, making the experience smoother for customers.

Another benefit of annual billing is fewer payment-related issues. With monthly plans, there are twelve opportunities for expired cards or failed payments to disrupt the process - problems that can account for 20–40% of churn. By consolidating payments into a single annual transaction, you minimize this risk, reducing potential payment failures by up to 12 times.

Here’s a practical example: A $100 monthly plan generates $600 over six months. In contrast, offering a $960 annual plan (a 20% discount) not only brings in 60% more revenue upfront but also secures customer loyalty for an entire year. This immediate cash flow can then be reinvested to fuel further growth.

To encourage customers to make the switch, highlight the added value of annual plans. Sweeten the deal with perks like exclusive features, priority support, or free training sessions. Use in-app notifications to showcase the savings clearly, and follow up with targeted email campaigns aimed at engaged monthly subscribers.

10. Compare Your Retention Against Industry Benchmarks

Understanding how your retention rates stack up against industry benchmarks can shed light on whether you're dealing with a deeper product-market fit issue or just need to tweak your strategy. For example, a churn rate exceeding 20% might signal a fundamental problem with product-market alignment that calls for a significant shift in approach. Benchmarks help clarify whether your challenges are isolated or part of a larger trend.

Tools like Baremetrics Benchmarks make it easier to see how your retention compares to similar SaaS companies. For B2B SaaS, an annual churn rate of 3–7% is considered strong, while 10–15% is more typical for average performers. On the other hand, B2C subscription services often face higher churn, with monthly rates around 5–7%. If you're offering enterprise-level products with prices in the thousands per month, aim for a monthly churn rate under 1%. In contrast, SaaS companies targeting SMBs tend to see healthy churn rates of 3–5% per month.

It's essential to align benchmarks with your specific market. For instance, enterprise products with an ACV (Annual Contract Value) of $50,000 or more should aim for a Net Revenue Retention (NRR) of 120% or higher. Meanwhile, mid-market products with a $5,000 ACV might target an NRR between 105% and 115%. Early-stage companies often experience higher churn, typically around 10–15% in their first year.

These benchmarks aren't just for comparison - they're a tool for setting practical goals. Even a small reduction in churn, say 5%, can lead to a profit increase of 25% to 95%. When comparing your performance, focus on companies with similar pricing models and customer bases. For example, a marketing software company serving SMBs shouldn't be measured against enterprise IT solutions, as their acceptable annual churn rates differ significantly (5–7% versus 3–5%).

11. Set Up Alerts for Early Warning Signs

By the time a customer cancels, it’s already too late to salvage the relationship. That’s why setting up automated alerts for early warning signs is essential. These alerts help you take action the moment a customer starts to disengage. But the real trick lies in knowing what to monitor and responding quickly.

Keep an eye on specific signals like drops in usage (e.g., a 30% month-over-month decline), payment issues (failed transactions or expired cards), and behavioral patterns (visits to cancellation or billing pages without completing any actions). For example, a customer who previously logged in daily but now only checks in weekly is sending clear warning signs. Similarly, if someone views your cancellation screen but doesn’t follow through, they’re likely considering leaving.

"When a user views your cancellation screen but doesn't cancel, it can be a sign that they're at least thinking of cancelling." - Baremetrics

Once you’ve identified these signals, use a scoring system to quantify the risk. A 0–100 scale works well, factoring in metrics like usage, support interactions, and payment history. Customers scoring between 67 and 100 require immediate intervention. Ideally, you want to reach out when the risk score climbs above 50% but before it hits 75%, ensuring you can still re-engage them effectively. Pay special attention to the first 30 days of the customer lifecycle - this is a critical period. If users don’t see value early on, they’re unlikely to stick around beyond 90 days.

Tailor your response to the specific trigger. If usage is dropping, send educational materials highlighting features they might have missed. For unresolved support tickets, escalate their case to a senior account manager. Payment issues? Automated dunning emails through tools like Baremetrics Recover can handle those immediately. And here’s the bottom line: reducing churn by just 5% can boost profits by an impressive 25% to 95%.

12. Automate Reports and Monitor Trial Conversions

Manually gathering data can pull your focus away from tackling churn. Instead, automate your reporting to deliver key retention metrics straight to your inbox. This way, you can quickly spot both engaged users and those at risk of dropping off, without wasting time on manual tracking. Automation allows you to stay ahead by actively monitoring trial performance.

Trial periods are critical. If users don’t see value quickly, they’re unlikely to convert. Tools like Baremetrics Trial Insights can help you track important milestones, flag low engagement, and set up alerts for when activity dips or trials approach expiration. These insights give you the chance to act before it’s too late.

Once you’re tracking engagement, the next step is to pinpoint your "retention point" - that moment when users truly experience the value of your product. Streamline your trial process to help users reach this point faster. Automated reminders can also reinforce the benefits they’re gaining. For example, a message like "You saved 12 hours this week using our tool" can highlight the return on investment right before their trial ends.

Make sure your automated reports cover the essentials: trial conversion rates, active users (daily and monthly), milestone completions, and support ticket trends. These metrics can help you catch early warning signs of churn. In fact, data from February 2025 shows that 60% of SaaS companies rely on monitoring product usage and activity to identify churn risks.

Keeping user engagement high is the key to reducing churn:

"If the engagement rate goes down, they are going to churn. There's a very simple rule behind it – if you don't use something it means you don't need it or have found a better replacement for it."

– Mateusz Calik, CEO of Delante

Conclusion

Reducing churn means rethinking how you manage the entire customer journey. The 12 strategies we've explored provide a roadmap, covering everything from improving onboarding experiences to automating payment recovery and analyzing why customers cancel. Each of these strategies addresses a specific cause of churn, working together to transform potential losses into opportunities to retain revenue.

Consider this: cutting churn by just 5% can double your growth rate. Even reducing monthly churn from 3% to 2% slashes annual recurring revenue (ARR) churn by 9% over a year. And since failed payments account for 20%–40% of churn, the financial impact of addressing this issue is hard to ignore.

With numbers like these, acting proactively is essential. Leverage real-time data to identify and address churn risks before they escalate. Tools like Baremetrics can help you pinpoint critical trends - whether it's a surge in cancellations, a dip in trial conversions, or a specific customer segment showing reduced engagement. As Axel Quantic from dontchurn.io aptly says:

"Retention is the difference between a SaaS at $100K ARR and one at $100M+ ARR".

Begin with the most direct fixes, like resolving failed payments and optimizing cancellation flows, as these can deliver measurable results within weeks. Then, focus on long-term improvements such as refining onboarding, studying customer cohorts, and introducing features that make your product indispensable - creating what some call "social entanglement", where leaving becomes inconvenient for the entire team. Combining these immediate actions with forward-thinking strategies can create a powerful compounding effect.

Pick two or three strategies to implement this month, measure their impact, and refine your approach. The companies that thrive in the coming years won't just be those that attract the most customers - they'll be the ones that hold onto them.

FAQs

How does improving customer onboarding help reduce churn in SaaS businesses?

Improving how you onboard new customers is one of the smartest ways to lower churn. Why? Because it helps users quickly grasp how your product addresses their specific challenges. A well-thought-out onboarding process cuts down on confusion and frustration - two big reasons people abandon a service early. When customers see value right away, they’re far more likely to stick with you.

An effective onboarding flow should focus on delivering quick wins, setting clear expectations, and walking users through essential features. This approach builds confidence, encourages regular use, and helps create habits that make cancellations less appealing. Even small tweaks to the process can significantly lower churn, leading to better customer retention and increased revenue over time.

To ensure your onboarding hits the mark, keep an eye on metrics like time-to-first-login, feature adoption rates, and milestone completions. These insights can guide you in fine-tuning the process so it consistently meets customer needs and fosters long-term loyalty.

How does automating payment recovery help reduce involuntary churn?

Automating payment recovery is a key strategy for reducing involuntary churn. By swiftly identifying and addressing failed payments, this system ensures that missed transactions are retried automatically, recovering revenue without the need for manual effort.

This approach doesn't just safeguard revenue - it also helps retain customers who might otherwise leave due to payment issues. Additionally, it saves time and minimizes the risk of revenue loss. Implementing automated payment recovery allows businesses to keep cash flow steady while improving the overall customer experience.

Why should SaaS businesses encourage customers to choose annual subscription plans?

Encouraging customers to choose annual subscription plans can make a big difference in reducing churn and keeping retention rates strong. With a longer commitment period, annual plans naturally lower the chances of cancellations compared to monthly subscriptions.

From a business perspective, annual subscriptions create a steadier and more predictable revenue stream, which can improve cash flow and boost Annual Recurring Revenue (ARR). For customers, these plans often come with discounted rates, offering them cost savings that can enhance satisfaction and build loyalty. It’s a setup where both the company and its customers come out ahead.