Table of Contents

Whether you’re just starting or have already established a robust company, knowing where you stand financially is essential for running a business.

A core element of handling your financials is an accounting solution to track costs and revenue on top of managing your invoicing.

Fortunately, the days of business accounting on giant paper spreadsheets are long gone. Instead, we have a seemingly unfathomable selection of cloud-based accounting solutions at our fingertips. QuickBooks Online and Xero are among the most popular accounting tools.

Both possess strengths and weaknesses aimed at attracting similar yet distinct audiences.

Deciding on an accounting solution is a very personal decision, so let’s start at the beginning.

What are Xero and QuickBooks Online?

These web-based accounting tools target growing and established business customers.

Because QuickBooks Online (QBO) and Xero compete for similar audiences, they share many features and similarities. Each provider’s various subscription plans offer something for everyone — from the solopreneur sending just a handful of invoices each year to the medium-sized enterprise managing inventory and fixed assets.

Accounting is a critical business process with wide-reaching impacts. So it goes without saying that an accounting system must be stable and robust. Founders and managers make decisions based on the information provided by their accounting tools, and financial data from those systems are used to file tax returns and pay suppliers.

These similarities make deciding on one over the other a tricky proposition. The best one for you depends mainly on your business’s specific operational and accounting needs and may even change over time.

Commonalities between QuickBooks Online and Xero

These popular accounting tools are robust and easy to use. First-time implementers can quickly get started and scale up as their business grows.

Although the software solutions can be relied on to manage your accounting, you as the end-user are ultimately responsible. Refreshing your basic accounting knowledge will ensure you understand what’s happening in the tools and help you get the most from both.

The backbone of both tools is the link to your bank accounts, which establishes the basis for your financial reporting. Integrating the feeds and reconciling bank transactions with your bookkeeping accounts involves a semi-manual matching and categorizing of your transactions.

Both Xero and QBO will suggest matches based on previous account activity, and you’ll need to confirm that the proposal makes sense. If the match is incorrect, you’ll be able to add a new transaction type or manually allocate the booking.

Further, providing your accountant access to your books is not an issue with either tool. Simply share a link by email, and they should be up and running in a matter of minutes.

Where does Xero win?

Xero offers three plans: Early, Growing, and Established. Beyond the low starting price of the Early package, all three levels are slightly less expensive than the comparable package from QuickBooks Online.

Although choosing an accounting software based on price alone probably isn’t wise, it can help prevent you from getting more functionality than you need.

Number of users

Besides the Early tier’s low price point (especially for self-employed people sending less than 20 invoices a year), all Xero pricing tiers permit access to an unlimited number of users. For businesses with many people requiring access to financial data, Xero is generally better, as QuickBooks Online maxes out at 25 on the most expensive plan.

Xero lets businesses manage inventory tracking and fixed assets on all plans. With QBO, inventory is only available on the higher-tier plans, and users must manually create fixed assets.

Integration and support

One outstanding element of Xero is the number of available third-party integration tools across a wide range of industries and categories. This level of expansion can make up for Xero’s limited options for reporting and customization.

Finally, Xero offers 24/7 online customer support for all users. And they doesn’t outsource this support to third parties; their employees provide it.

Where does QuickBooks Online win?

QuickBooks Online vs. Xero is a relatively equal match in many respects. However, there are a few spots where QBO has a clear edge.

Accountants and transaction tagging

Both tools make data-sharing with accountants straightforward. But because QBO has more users (especially in the US), your accountant is more likely to be familiar with the tools and setup.

When it comes to tracking transactions, QBO is much more flexible than Xero.

While both Xero and QBO link to your bank feed, QuickBooks allows up to 40 tags for the three main tiers, plus unlimited tags for the advanced plan. Xero limits you to two active tracking categories. A complex business with a wide variety of transactions can benefit from the granularity provided by QuickBooks.

Scalability and reporting

Another significant benefit to choosing QuickBooks Online over Xero is scalability. As your business grows and you become more advanced, the level of reporting detail you desire might change.

Although QBO limits the overall number of users, experienced business owners who need more complex reporting now and in the future will benefit from customizable reporting features.

A business’s cash flow statement is essential for managing cash flow and ensuring the company can pay its workers and cover obligations to suppliers. QuickBooks permits both the indirect and direct methods of calculating your cash flow statement, whereas Xero users are limited to the direct approach. Some business models lead to a strong preference for one over the other.

In terms of other tools, QBO offers a bit more surrounding general business topics:

-

Time tracking capabilities at all service levels

-

Easy managing of 1099s

-

Ability to plan quarterly taxes

-

Tax exports to help your accountant better prepare your taxes

To sum it up, both Xero and QuickBooks Online are attractive accounting software options. Although the best choice for your business will depend on your specific requirements, QBO has a slight edge for many applications. It’s been around longer, is more customizable, and offers a good variety of reporting and other tools.

Where do Xero and QBO fall short?

Accounting is an essential element of running a business, but it’s primarily a reflection of the past. Equally important, and often far more interesting to a business owner, is where you’re going.

Many people believe that a historical trajectory will continue indefinitely. But that’s often not the case, especially in business.

Forecasting is a critical aspect of building a successful business because it requires you to regularly redefine (or confirm) your business’s trajectory based on your current situation and latest assumptions. Because a forecast is a hypothetical model of the future, you have the opportunity to make changes if it doesn’t look like you’re heading in the right direction.

While QuickBooks Online and Xero are capable accounting solutions, they’re light in the forecasting department.

Fortunately, third-party forecasting solutions like Forecast+ are available to users of both.

Forecast your future with Forecast+

Get modeling, forecasting, and scenario planning all in one tool.

Do you need a forecasting integration?

Most accounting solutions come with only basic forecasting functionality. Here are four main reasons someone using QuickBooks Online or Xero would want to use Forecast+.

1. Customized financial model

To get an automatically updating, customized financial model that works for your business, you’ll need a third-party solution like Baremetrics Forecast+. The ability to link directly with your CRM tools anchors your forecast in financial AND non-financial metrics. Plus, our team is available for hands-on support along the way.

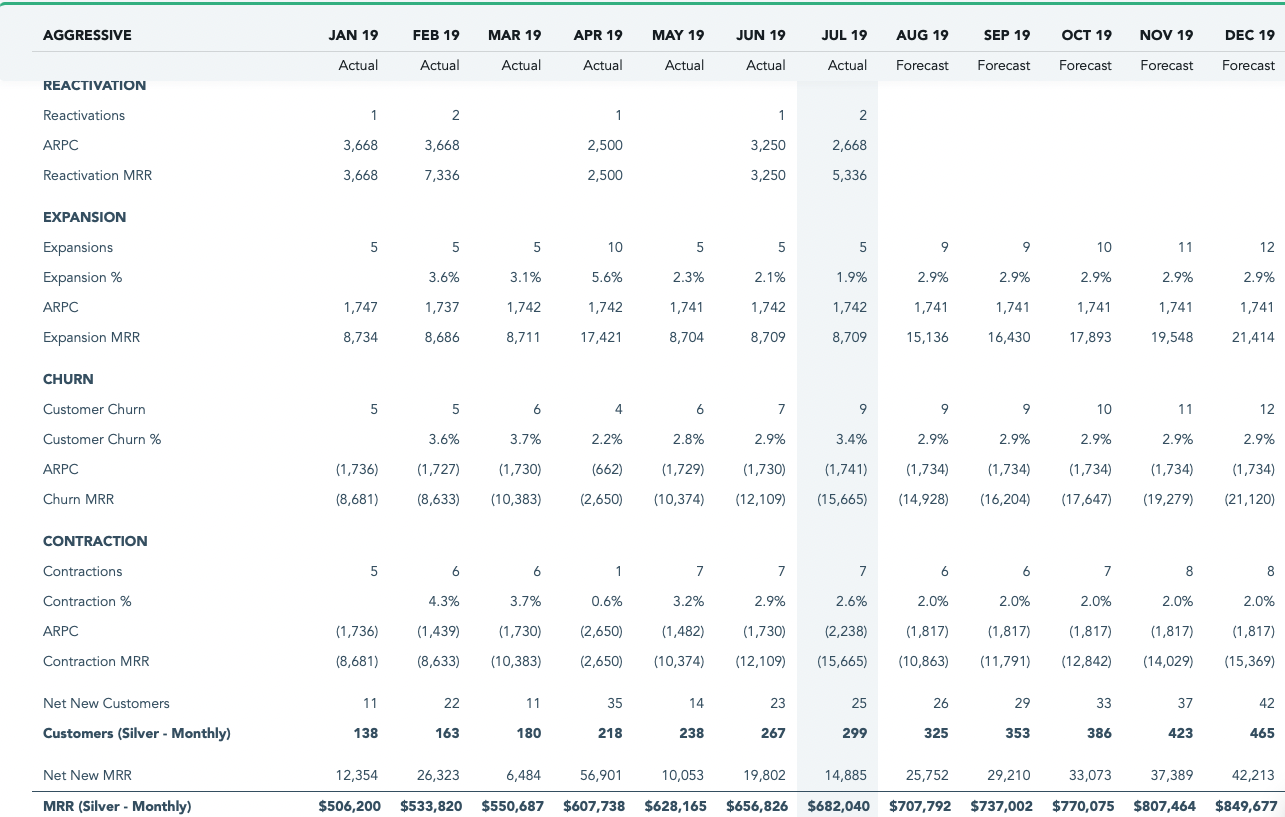

Example: Forecast+ Revenue Model

2. Organize revenue based on sources

The transaction tagging available in QBO is helpful, but bank-level information simply can’t split revenue by channel, product, or source. More granularity means better visibility of how each revenue source is performing and if it’s meeting expectations.

3. Scenario building

Scenario modeling is a powerful tool that too few businesses use. Creating multiple scenarios to model the best case, worst case, and average case based on your sales funnel can help you make better decisions.

Linking to your actual accounting and CRM data allows you to define rules and methods to create a rolling forecast to better model your business’s progress.

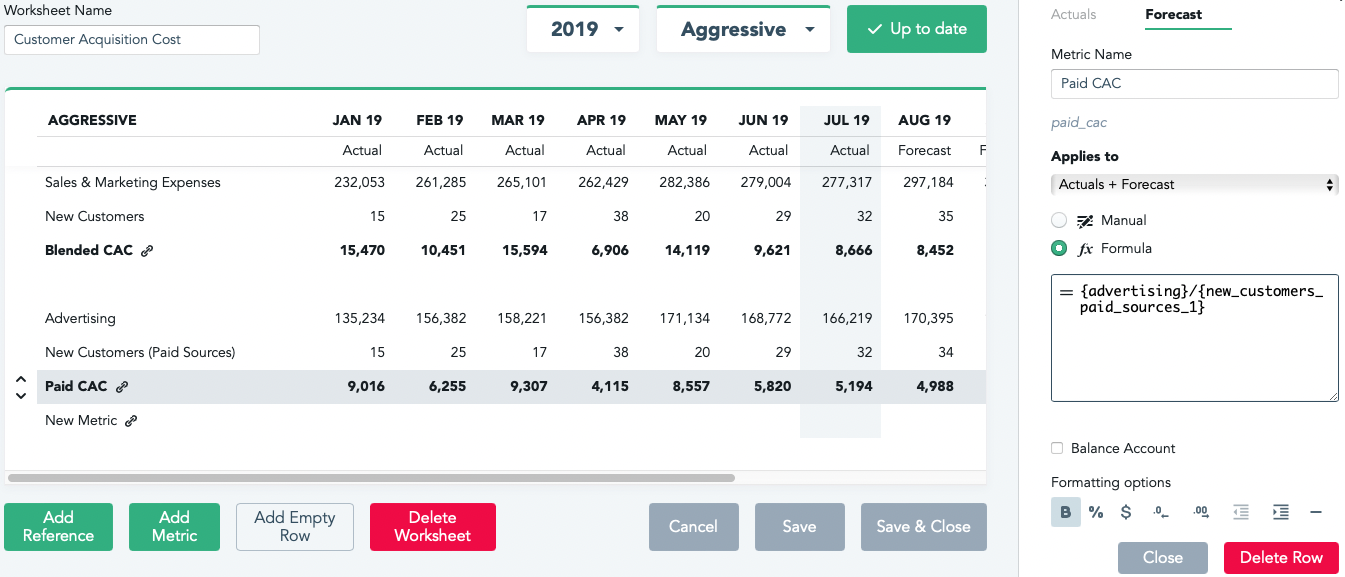

4. Google Sheets integration

Forecast+ integrates with Google Sheets to allow you to work with the worksheets function. This functionality gives team members the ability to create their own metrics and rules for forecasting (i.e., revenue per employee).

Example: Forecast+ Customer Acquisition Cost Worksheet

Which is right for you, QuickBooks Online or Xero?

QuickBooks Online and Xero are both powerful accounting tools with long lists of pros and cons. The best solution for you depends mainly on your business and preferences.

But whether you choose QuickBooks Online or Xero, limited forecasting abilities in both tools make a third-party solution like Baremetrics Forecast+ necessary. Seamlessly integrate data from either system with info from your CRM or other tools and build a forecast model that gives you real insight into your business.

Curious about what you could accomplish with an integrated forecasting solution? Book a consultation with our team today.