Table of Contents

Revenue and income are sometimes used synonymously in day-to-day conversation, however they are very different terms in business, and it is important to have a strong grasp of both. While revenue refers to all the money your company is bringing in through sales, income is the amount of money left over after your expenses have been paid.

While revenue growth generally indicates an increasing popularity of your product or service, increasing income suggests that not only is your business growing but also you are keeping a good management of your operating expenses. The former is nice to have, but the latter is what will be of interest to investors.

Having a close watch on your revenue and expenses is fundamental to guarantee the longevity of your business. For any company following the SaaS subscription revenue model, that means understanding the basic metrics of your company.

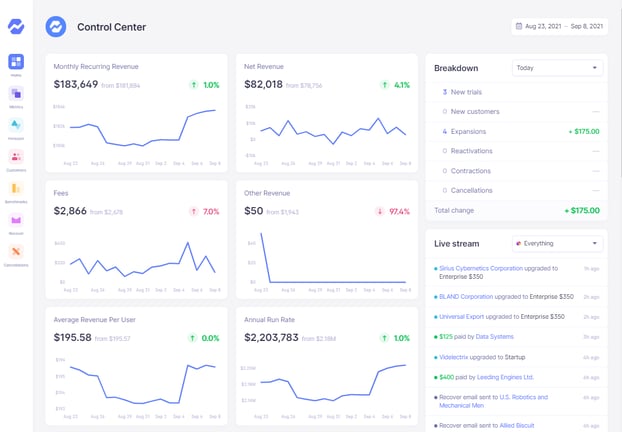

Baremetrics monitors your metrics, dunning, engagement tools, and customer insights. Some of the Baremetrics insights are MRR, ARR, LTV, the total number of customers, total expenses, and quick ratio. With this information on a crystal-clear dashboard, it is easy to see how your company’s profitability is changing over time.

Sign up for the Baremetrics free trial and start managing your subscription business right.

What is revenue?

Revenue is all the money generated by a company from interactions with customers. For most companies, this roughly amounts to total sales, but, for a SaaS company, things can be a little different. To follow the Generally Accepted Accounting Principles (GAAP), you will count your revenue the same way (following either the cash accounting method or the accrual accounting method).

What is projected revenue?

Projected revenue is an estimate of how much money a company will generate. When trying to project your future revenue and revenue trends, there is a quick rule of thumb that we can use.

For a subscription revenue model, we can take a look at a variant of the ecommerce growth formula:

V × CR × LTV = PROJECTED REVENUE

where V is the visitors, CR is the conversion rate, LTV is the lifetime value, and REVENUE is the revenue generated. To put this into plain English, the equation tells you what it takes to drive a prospective client to your page (V), get them to sign up for your service (CR), and keep them happy over time (LTV).

The LTV is calculated using the Average Customer Lifetime (ACL) and the Average Order Value (AOV). Keep in mind that the above equation has no time limit other than the lifetime of the average customer, so it doesn’t coincide with a single reporting period. Your financial period will probably be shorter than your ACL, so the revenue you record on your income statement will only be a portion of the “PROJECTED REVENUE” defined in the equation above.

What is income?

Once you have calculated your revenue, you can begin to understand the profitability of your company. Gross profit is the amount of money a company makes after the Cost Of Goods Sold (COGS) is subtracted from revenue. COGS generally includes all the variable costs associated with the product you sell. For a SaaS business, this can include transaction fees, licensing fees, and development expenses.

EBITDA (earnings before interest, taxes, depreciation, and amortization) is revenue minus the COGS mentioned above as well as operating expenses and selling, general, and administrative expenses. Finally, net income is the final profit remaining after all the above is removed.

In summary, net income, sometimes called “the bottom line” for where it appears on the income statement, is revenue, which is sometimes called “the top line” for the same reason, minus COGS; operating expenses and selling, general, and administrative expenses; and interest, taxes, depreciation, and amortization.

Note that, while EBITDA and net income are also different concepts, EBITDA is also often called net income when there is no chance of confusion.

What is the difference between revenue and income?

Similar to our discussion on net revenue vs. operating income, revenue and net income are closely related subjects but their distinction is important. While revenue is the money coming into your company in the form of sales, net income is the money left over after all the different kinds of expenses have been paid. While revenue changes can help you predict the future growth of your company, net income is more important from the investors’ standpoint as it can tell you whether your pricing model is viable. You can learn more about this by considering the unit economics version of this discussion.

If you’re still using spreadsheets and basic dashboards to monitor and manage your revenue and expenses, you’re not only operating inefficiently, but you’re also probably leaving money on the table.

The advanced analytics and reporting tools offered by Baremetrics bring you an affordable, fast, and flexible means to ensure you stay on top of and optimize your SaaS business’s revenue and net income.

Baremetrics does all the grunt work, intelligently “automating away” meaningless numbers to uncover the true, bigger picture. The easy-to-read dashboard gives you a complete view of your expenses, profit, and net income for your specified financial period. All this allows you to quickly spot inconsistencies, eliminate unnecessary waste, and more accurately model your SaaS business’s future based on multiple scenarios.

Want to Reduce Your Churn?

Use Baremetrics to measure churn, LTV and other critical business metrics that help them retain more customers.Want to try it for yourself?

Revenue and net income example

Revenue and net income both appear on the income statement. Let’s look at the sample income statement below:

Sample Income Statement

|

Period |

||||

|

October |

November |

December |

||

|

Revenue |

||||

|

Monthly Subscriptions |

50,000 |

55,000 |

60,000 |

|

|

Yearly Subscriptions |

20,000 |

20,000 |

20,000 |

|

|

Add-Ons |

1,000 |

2,000 |

3,000 |

|

|

Total Revenue |

71,000 |

77,000 |

83,000 |

|

|

Costs of Goods Sold |

||||

|

3rd Party Fees |

(5,000) |

(5,000) |

(5,000) |

|

|

Transaction Fees |

(1,000) |

(1,000) |

(1,000) |

|

|

Customer support |

(10,000) |

(8,000) |

(12,000) |

|

|

Development Costs |

(5,000) |

(5,000) |

(5,000) |

|

|

Licensing |

(1,000) |

(1,000) |

(1,000) |

|

|

Total Costs of Goods |

(22,000) |

(20,000) |

(24,000) |

|

|

Gross Profit |

49,000 |

57,000 |

59,000 |

|

|

Operating Expense |

||||

|

SG&A* |

(15,000) |

(16,000) |

(17,000) |

|

|

Marketing |

(20,000) |

(22,000) |

(24,000) |

|

|

Total Operating Expenses |

(35,000) |

(38,000) |

(41,000) |

|

|

Net Income (EBITDA) |

14,000 |

19,000 |

18,000 |

|

* Note that SG&A stands for selling, general, and administrative expenses. This includes all the everyday operating expenses of a company that are not included in production and delivery of your service. SG&A typically includes distribution costs, rent, and salaries. It sometimes also includes advertising and marketing as well, but for the sake of this example marketing is listed separately.

The income statement above is reporting three separate monthly periods, from October to December. The company’s revenue has been split up to show that some of the money is coming from monthly subscriptions, some is from annual subscriptions, and the rest is from add-on sales. The total is rising monthly from $71,000 in October to $83,000 in December.

The great news shown by the rising revenue numbers is echoed with rising gross profit as well, from $49,000 in October to $59,000 in December. In fact, the company was able to maintain a very similar COGS structure while raising revenue. This might be a good sign that the company is showing economies of scale—that the marginal cost of providing their service is decreasing as the number of clients increases. That’s a great position to be in!

For net income, the story is a little different. While the net income did increase from $14,000 in October to $18,000 in December, the highest value was in November at $19,000. What is happening to their operating expenses?

It looks like their SG&A is creeping up month to month. This could be the nature of the business—as they scale, the need to hire more staff or increase the size of their office—or it could be a signal that a culture of waste is taking hold. While young startups are famously lean, sometimes with maturity comes the same excess as seen in established corporations. If you are worried about rising expenses, take a look at our guide to managing total expenses.

While marketing expenses are also increasing by $2,000/month, this might not be as big a concern as revenue is also going up by a multiple of 2.5 times the increased marketing budget. While it is always prudent to keep an eye on the marketing budget to confirm that it is driving the right visitors to your site and improving your conversion rate, more is not necessarily worse—as no marketing means no customers!

Determining your company’s revenue and net income is important since the foundation of any ecommerce business is analytics and reporting. These two categories contain the majority of the data that the company requires. Dashboards as well as metrics, and other sales-growing insights and tools, are also included with Baremetrics.

When analyzing data, context is key. With this, Baremetrics is more concerned with assisting you in determining what you need to do with numbers rather than displaying them to you. You must be able to see why things change, for example why clients leave. Therefore, Baremetrics cuts through the clutter and delivers the information you need to make smart business decisions. Look at what’s going on right now, plan for tomorrow, and prepare for the future, all in one place.

Due to the target specialty of subscription businesses, Baremetrics provides a global dashboard with all relevant subscription metrics. The dashboard provides 20 metrics including annual run rate, monthly recurring revenue, and refunds. Moreover, there is a live broadcast of recent transactions next to the dashboard that includes failed transactions, upgrades, and churned clients.