Table of Contents

More Founders Journey Articles

Any online firm or business must deal with a large volume of complex data. Managing this data manually, however, results in erroneous results, aggravation, and a loss of productive time.

Thanks to the many business intelligence solutions available, you may delegate these difficult jobs to them and receive accurate information to help you make the best decisions possible. One of these tools is Baremetrics.

You can sign up for a free Baremetrics trial to start tracking your earnings in real-time.

Overview

In general conversation, the terms revenue and income are interchangeable. However, net revenue and operating income are two separate items on your financial statements. The money you made from selling goods or services for the month, quarter, or year is referred to as net revenue or net sales. After subtracting expenses from net revenue, operating income is the amount remaining.

Net revenue and operating income are two different things, and the gap between them indicates how much your revenue stream is depleted by expenses.

One of the most essential lines on the income statement is operating income. It displays how much money you made from your normal company activity during the reporting period. It’s distinguished from other types of income, such as investment earnings, on the income statement.

Anyone looking at your income statement will be able to tell how much money your business generates and whether it is profitable. Not only for you but also for investors and lenders, this information is crucial. Combining investment revenue with operations income would distort the company’s image.

The importance of net revenue is mostly in connection to other items on the income statement. When net sales are much lower than gross sales, for example, the product may be defective, resulting in a high number of returns, or the company’s return policy may be too lenient.

The difference between net revenue and operating income indicates how much your revenue stream is depleted by expenses; it may be time to cut the budget if net sales are high but operating income is low. Luckily, we have a great how to guide for managing total expenses.

Baremetrics

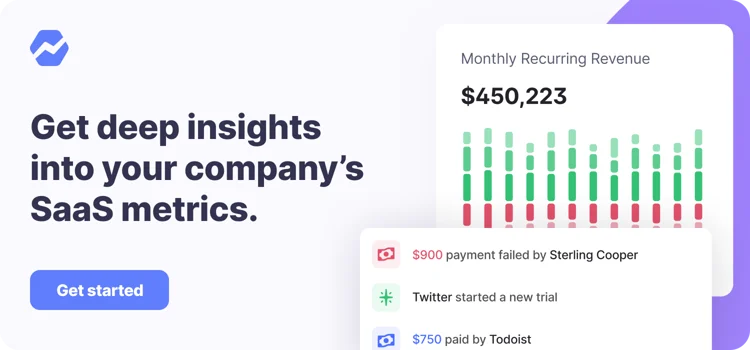

This tool is important since it offers a multitude of features that will help you improve the revenue of your business. Baremetrics is a subscription analytics platform designed for companies offering subscription services or products. It is a SaaS analytics platform.

It displays all subscription-related indicators such as MRR (Monthly Recurring Revenue), LTV (Customer Lifetime Value), churn rate, and so on. These metrics are important in a subscription type of business.

Sign up for a free Baremetrics trial and start tracking your subscription revenue easily and accurately.

Application of Baremetrics on Net Revenue and Operating Income

Determining your company’s net revenue and operating cost is important since the foundation of any e-commerce business is analytics and reporting. These two categories contain the majority of the data that the company requires.

Dashboards as well as metrics, and other sales-growing insights and tools, are also included. When analyzing data, context is key. With this, Baremetrics is more concerned with assisting you in determining what you need to do with numbers rather than displaying them to you. You must be able to see why things change, for example why clients leave.

Therefore, Baremetrics cuts through the clutter and delivers the information you need at the moment in making smart business decisions. Look at what’s going on right now, plan for tomorrow, and prepare for the future.

Dashboards and metrics

This part is used to display statistics and metrics of your business. Due to the target specialty of subscription businesses, Baremetrics reports provide a worldwide dashboard with all relevant subscription metrics.

The dashboards provide 20 metrics in total including annual run rate, monthly recurring revenue, and refunds. Moreover, there is a live broadcast of recent transactions next to the dashboard that includes failed transactions, upgrades, and churned clients.

There are also individual dashboards for each of the 20 metrics. These dashboards highlight the complete details of these metrics. These dashboards have attractive visuals as well as the necessary data. Without a question, Baremetrics has done an excellent job in this area.

Track your subscription revenues in a simple and reliable manner

Get deep insights into MRR, churn, LTV and more to grow your business

Forecasts

This feature is used to protect your business’s flow. There are three categories of forecasts in Baremetrics.

- Cash Flow: This is the total amount you’ll charge a specific group of clients over the next 12 months. You get information based on active subscriptions, customers, and revenue growth. Moreover, you can download a CSV file based on the provided data, on a daily, weekly, or monthly basis. Good cash flow modeling can be the difference between a failed company and a successful one.

- Monthly Recurring Revenue: This is your MRR for one year, considering the churn rate. Analyzing churn can help you maximize this number.

- Customers: This is the number of clients you are going to acquire. These three forecasts, along with several additional metrics, are provided in a graphical format. This makes it simple to comprehend.

Benefits of using Baremetrics

The following are some of the key advantages of Baremetrics:

- Users can connect to their Stripe account in a matter of seconds with only one click. Receiving data becomes simple and natural.

- LTV, MRR, and other metrics help you understand your consumers’ demands and what they really desire.

Why Do You Need Baremetrics?

There are numerous reasons a company could require Baremetrics. The following are some of the reasons:

- Segmentation: Increasing the number of insights on your dashboard is usually beneficial. As a result, segmentation is a requirement of the platform in order for clients to organize and compare their data.

- Track Progress: It’s critical to understand how things work and how much progress you’re making when you’re working on something. Baremetrics enables you to accomplish exactly that by allowing you to do simple tests to evaluate how your clients are progressing.

Conclusion

Baremetrics is an analytics, engagement, and forecasting tool for businesses that use Recurly, Stripe, Chargify, and Braintree. It is a SaaS metric platform designed for businesses that integrate Stripe as their mode of payment.

The user-friendly interface gives a wealth of useful, actionable information as well as client insights. Because the platform is cloud-based, no software installation is required.

Baremetrics’ main goal is to keep track and manage client transactions. To achieve this, the platform allows users to use a dropdown menu, from which they can receive information on fees, upgrades, downgrades, and earnings. They can see every scheduled activity, including customer lifetime value and monthly recurring revenue, using the forecast feature.

Signing up for the free Baremetrics trial will help you track your subscription revenues in a simple and reliable manner.