Table of Contents

Braintree is a popular payment gateway platform amongst SaaS brands and some mobile apps. It allows customers to pay merchants using multiple methods, including credit and debit cards, PayPal, and digital wallets like Google Pay or Apple Pay. They offer security features to ensure a safe transaction process for customers and businesses alike.

Some businesses will take advantage of both Stripe and Braintree, either as standalone or integrating tools. Stripe is also a payment processing tool, but also offers native invoicing features, more readily available support, and is available in two more countries and five more currencies than Braintree.

And while you might think that with two payment processing tools, you’d have all the financial and revenue reporting data you need, but in many ways, this data actually falls short when you’re using only these two platforms.

In this post, we’ll explain how Stripe and Braintree users can benefit from Baremetrics integrations for improved revenue analytics and insights.

Where Stripe and Braintree Data May Fall Short

Stripe and Braintree are outstanding tools in their own right, but there are some pain points many businesses have when using both platforms.

To start with, data silos become a significant concern. You’ve got one set of data in Briantree’s platform, and another set of data in Stripe’s platform. It’s frustrating to go back and forth between the two platforms to piece together the full picture.

Having two separate platforms for data reporting can also create consistency issues. Braintree might have some metrics that Stripe doesn’t. Similarly, they might calculate or report certain metrics differently, making it difficult to get an accurate understanding of what’s happening with your business’s revenue— and that’s something you never want to leave room for misunderstanding.

These lags in data reporting can prevent you from making strong optimization decisions, which means you could be leaving money on the table.

How Baremetrics' Stripe and Braintree Integrations Can Improve Financial Reporting

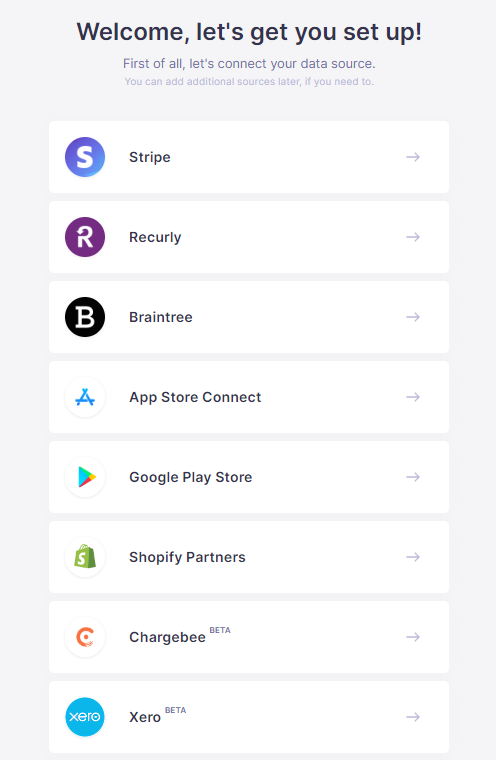

Baremetrics allows you to connect multiple data sources to our platform, meaning you can leverage both Stripe and Braintree integrations with Baremetrics (plus additional platforms like Google Play, Shopify Partners, and more).

Let’s take a look at exactly how Baremetrics’ integrations can improve your financial reporting.

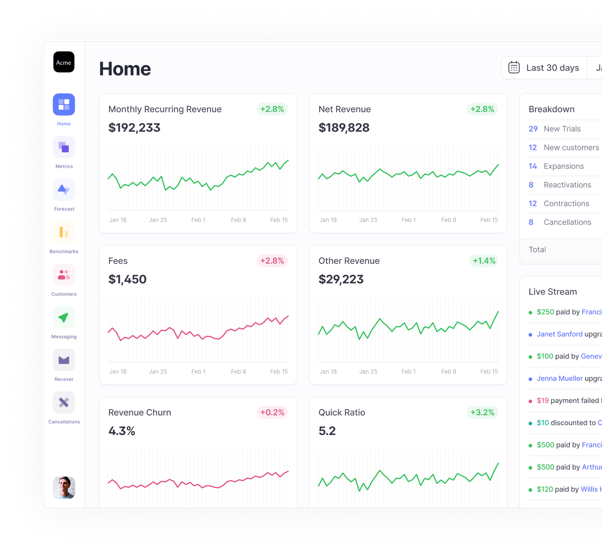

1. Access All Revenue Data in One Dashboard

When you’ve got questions about your revenue, you don’t want to go digging in multiple dashboards across several different tools. You want a single dashboard offering a comprehensive view of all data—and we can give you that.

2. Compare Platform Performance

With Baremetrics, you can see overall subscription revenue data, including monthly recurring revenue (MRR), churn rates, and net revenue from all data sources.

You also have the option, however, to break down the data on a platform-by-platform basis. If you want to see how Braintree payers differ from those who make purchases through Stripe (and other platforms like Google Play or the Apple App Store), you can do so.

By breaking the metrics down by data source, you can see which platforms are driving the most revenue and the highest value customers. Some platforms may be more likely to deliver customers that churn faster, for example, while others may have higher average purchase value. This may be pivotal information for optimization decisions.

3. Get Detailed Revenue Analytics With More KPIs

Most payment processors or subscription management platforms have basic KPIs about revenue and processed sales, but that’s about it.

Here at Baremetrics, we offer 26 distinct financial metrics, all of which are relevant to subscription-based and SaaS businesses. We do aim to provide a true complete look at everything happening with your revenue, and we want it to be accurate.

Which brings us to our next point...

4. Know You’re Getting Accurate Data

We don’t just have a lot of data. We also make sure that data is accurate enough to trust when you’re making financial decisions— which means it needs to be as accurate as you can get it.

This starts by creating a consistent approach to data reporting. You don’t have to worry that Braintree calculates MRR differently than Stripe does; we’ll take care of that for you.

And, perhaps most importantly, we ensure that the data you’re getting is giving you that total-picture view of what’s happening.

Many subscription or revenue analytics platforms, for example, may count all non-canceled subscriptions in your MRR, even if some subscriptions are paused or delinquent on payment. We do not do this, only counting paid, active subscriptions in good standing. We can also show you how many subscriptions are paused or churn for your reference.

5. Leverage Actionable Insights

Baremetrics has plenty of data, and that includes detailed insights that go beyond static metrics and KPIs.

Use Baremetrics to access and leverage the following insights for revenue-boosting changes:

- Revenue forecasting that projects revenue estimates year-over-year.

- Cancellation insights that can help you identify why customers are churning, flag churn risks, and help you reduce churn to boost retention rates.

- Trial insights that offer suggestions for how to improve the trial-to-customer conversion rate.

- Recover, which leverages automation to help you identify and prevent lost revenue that can happen as a result of missed payments before they happen due to reasons like expired credit cards.

How to Integrate Baremetrics with Braintree and Stripe

Baremetrics makes it easy to integrate with different payment processors or subscription management tools— including both our Braintree and Stripe integrations!

When creating your account, simply connect your data sources with a few fast clicks.

Click on the platform you use, and you’ll be asked to connect your third-party account. Once you do, we’ll start syncing the data right away.

Final Thoughts

Here at Baremetrics, we pride ourselves on providing subscription businesses with detailed revenue analytics and 26+ crucial metrics, delivered with unparalleled accuracy. We can help you track your revenue so you can make strategic, data-driven financial decisions.

Ready to get started with Baremetrics? Book your free demo today.