Table of Contents

More Glossary Articles

Key takeaways:

- MMR churn shows businesses the amount of monthly recurring revenue they’ve lost from canceled contracts

- It’s a vital metric to help businesses track how customer churn impacts a business’s revenue and profits

- You can track MRR churn and MMR churn rate to see both exact financial figures and percentages of revenue lost

- Expansions and contractions— including upgrades, downgrades, and add-on purchases— can impact MRR churn

Churn MRR (also called “MRR churn”) is the amount of monthly recurring revenue lost due to customer cancellations. It’s often calculated against MRR to extract a percentage called Churn MRR Rate. Putting Churn MRR into a percentage provides a quicker understanding of the impact of churn on the business.

Understanding MRR Churn

MRR churn refers to the total amount of Monthly Recurring Revenue (MRR) lost during a specific period due to customer cancellations or downgrades.

How to Calculate MMR Churn

Calculating MMR churn is understandably different from calculating monthly recurring revenue on its own.

You calculate MRR churn by adding all the MRR lost from the customers who churned in a specific period of time.

MRR Churn = Sum of MRR lost from all customers who churned

For example:

A SaaS company loses five customers in a month, and each customer contributes $100 in MRR, this is the MRR churn calculation you’d use:

MRR Churn = 5 × 100 = $500

Make sure to avoid these common MRR calculation mistakes to get accurate metrics, and make sure you know the difference between MRR growth rate and net MRR growth rates.

Churn MRR Rate

Churn MRR Rate is the percentage of total MRR lost during a specific period due to customer cancellations or downgrades. It provides a relative measure of churn's impact on overall revenue.

How to Calculate Churn MRR Rate

To calculate the Churn MRR Rate, divide the Churn MRR by MRR for the same time period.

This is the formula you’d use:

[(MRR of Lost Customer #1 + MRR of Lost Customer #2 + …) + (MRR or Downgrade #1 + MRR of Downgrade #2 + …)] / (Time * MRR)

The top part of the equation is your Churn MRR, and the result is your Churn MRR Rate. The Time can be any time interval from hours to years.

If you allow customers to downgrade their plan to a lower pricing tier, you have to factor this in, too. Simply add these losses to the top part of the equation. (We’ll discuss this more in a bit.)

Continuing with the previous example, if the total MRR at the beginning of the month was $10,000, then the Churn MRR Rate is:

MRR Churn Rate = $500 / $10,000 = 5%

Simply put, MRR Churn gives you a raw number of lost revenue, while Churn MRR Rate helps you understand the significance of that loss in the context of your overall revenue. Both are important for understanding a SaaS business's customer retention and revenue stability.

Churn MRR for SaaS Pricing Tiers

Churn MRR is a good metric to track for SaaS businesses that have different pricing tiers, with customers paying different amounts. For these businesses, one customer isn’t usually worth the same as the next. One customer may generate $5 per month, while another generates $500 per month.

Looking at the number of cancellations doesn’t show the impact they have on the bottom line, but looking at Churn MRR does. It adds meaning to the number of cancellations.

Assume you lose 10 customers this month and 5 customers the next month. The value of the 10 cancellations was $50 (ten $5/month customers), and the value of the 5 cancellations was $500 (five $100/month customers).

These scenarios show that if you only look at the number of cancellations and not the value of cancellations, you’ll miss out on discovering deficiencies in your service. Perhaps you improved the experience for lower-paying customers but, in doing so, damaged the experience for higher-paying customers.

Churn MRR and the numbers responsible for it help you identify weaknesses as a whole and for specific types of customers.

Don’t forget that MRR is different from accounting revenue, so treat the two (and their associated metrics) accordingly.

Contributors Impacting Churn MRR

Cancellations usually account for the bulk of lost MRR, but downgrades are also a contributor.

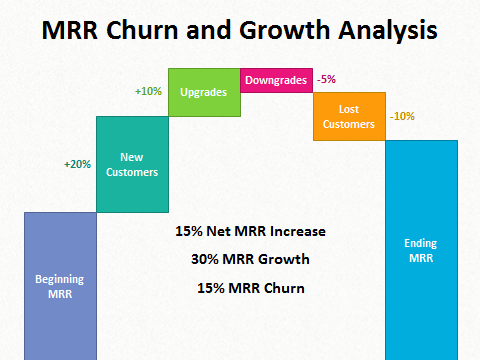

As shown in a visual from Chaotic Flow, calculating your gained MRR (new customers and upgrades) against lost MRR (cancellations and downgrades) paints a clear picture of how churn affects growth.

The two primary sources of MRR churn—lost customers and downgrades—are shown on the right side of the visual.

Lost customers include active cancellations and delinquent cancellations. The former are customers who go through a formal cancellation process; the latter are customers who have credit cards on file you cannot charge. To reduce delinquent cancellations, you can use a dunning management service to remind customers when their card is invalid.

Downgrades include the removal of a monthly add-on service or a switch to a lower-priced base service. To reduce downgrades, think of ways to enforce the value of a customer’s current plan or add more inclusive features to their existing plan.

As a note, you can track how expansions and downgrades impact revenue alone with expansion MRR and contraction MRR, respectively. You can also track committed MRR for forecasting purposes, and new MRR to assess business growth.

Discover how to increase recurring revenue in our post about improving MRR growth rate.

Accurately Track Your MRR Churn

If you have lower pricing tiers that customers can downgrade to or add-ons they can remove, it’s important to expand the top part of the equation beyond lost customers:

[(MRR of Lost Customer #1 + MRR of Lost Customer #2 + …) + (MRR or Downgrade #1 + MRR of Downgrade #2 + …)] / (Time * MRR)

Like our initial equation, the result here is your Churn MRR Rate.

An article by Lighter Capital shows another approach to calculating Churn MRR that’s worth checking out. It discusses how to use contraction MRR, expansion MRR, and reactivation MRR—combined with Churn MRR—to calculate your Churn MRR Rate.

And of course, you can always use an accurate subscription analytics tool like Baremetrics to do the heavy lifting for you. We provide access to 26 different subscription-focused financial and performance metrics, including key MRR metrics, so you can get a clear look at what’s impacting your bottom line without the math or guesswork.

Tired of wasting time on spreadsheets? Get a free trial of Baremetrics today!

SaveSave