Table of Contents

As a SaaS or subscription-based company, you want to keep a watchful eye on your monthly recurring revenue and net MRR. These metrics are an indicator of the health of your organization and your growth potential.

MRR as a SaaS metric is pretty straightforward, but there are some nuances that you’ll want to take into consideration depending on your business model. This article will point out the difference between MRR growth rate and Net MRR growth rate. Then, we’ll talk about how to grow your Net MRR growth rate and more.

As a business metric tool, Baremetrics provides insight into your monthly recurring revenue and other significant trends. To get a feel for what MRR might look like in a real SaaS or subscription business, check out our demo dashboards today.

Calculate your net MRR growth rate

What is MRR Growth Rate?

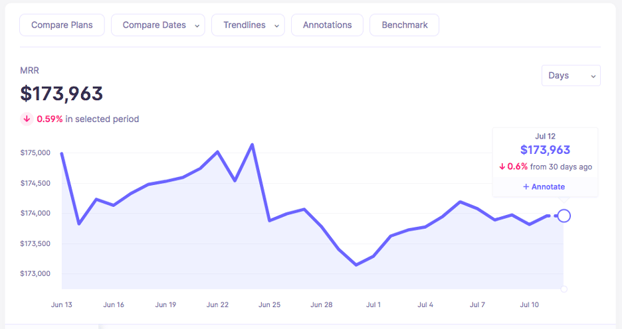

MRR stands for Monthly Recurring Revenue—the monthly income your company can rely on each month. The change in MRR from one period, such as a month, to the next, is the MRR Growth Rate. You can see your MRR Growth rate at a glance in your Baremetrics Dashboard.

You will likely tie this metric into several other calculations, including your churn rate. A declining MRR rate is an early warning indicator that you need to improve your acquisition and retention efforts.

To calculate your Monthly Recurring Revenue, multiply your average revenue per account by the total number of customers for that month:

Monthly Recurring Revenue = number of customers multiplied by the average billed amount.

Of course, finding the correct information for this equation can be challenging. Do you know off-hand how many customers you have? Where is the data coming from? How much money are they paying at the moment?

If your tracking tools aren’t up to scratch, you might not account for everything. Baremetrics keeps track of all of your customers and how much they’re paying you, then automatically calculates your MRR. Using tools like this is typically way more accurate than trying to do it yourself.

What is Net MRR Growth Rate?

Your Net MRR Growth rate is the net increase/decrease in your monthly recurring revenue from one month to the next, shown as a percentage. NET MRR growth rate is one of the most common and essential SaaS metrics to be aware of.

Regardless of the change in the number of customers or the average billing amount, this metric shows you how much more or less you’re making than last month.

“MRR Growth Rate is one of the top metrics SaaS companies should track because it answers the question ‘How fast is the company growing?’”

TOM TUNGUZ

Partner at Redpoint Ventures

MRR Growth rate vs. Net MRR Growth rate

MRR changes as new revenue is obtained or as your customers cancel, upgrade or downgrade their subscription.

Cancellations are customers that stop using your service indefinitely. Upgrades occur when customers change packages (e.g., moving from a package with five users to 10 users). This usually will come with a higher price tag. Downgrades see users move to a lower-tier package (e.g., moving from a package for ten users to one with five).

Your Net MRR Growth Rate shows the net variation of those factors from month to month.

Remember that there is a difference between your MRR growth rate and your Net MRR growth rate. The term Net MRR growth rate has a precise meaning – it refers to all MRR change, including churn, expansion, and new MRR.

MRR growth rate is a less specific term. MRR growth rate is a term that refers to the dollar amount by which your MRR has increased or decreased. For example, our MRR growth was $5000 last month. Depending on the context and how the company uses each term, a company’s MRR growth rate could be the same as the net MRR growth rate, or it could refer to a subset of data.

Simply tracking MRR growth isn’t sufficient because it’s an absolute figure. Net MRR Growth Rate allows you to track your performance month-to-month and provides a solid indicator of your SaaS company’s current/potential growth.

Want to Reduce Your Churn?

Use Baremetrics to measure churn, LTV and other critical business metrics that help them retain more customers. Want to try it for yourself?

How Do You Calculate the Net MRR Growth Rate?

To start calculating your Net MRR, first consider your existing monthly recurring revenue, as well as new business, reactivation, and expansion MRR. Then subtract your churn and downgrades from that amount to get your Net MRR.

As a formula, the calculation looks like this:

Existing MRR + New Business + Reactivation + Expansion – Churn – Contraction = Net MRR

Do this calculation for the most recent and previous month. You could also use a more extended period, such as the last 3-6 months if you’d like to see an overview of trends.

Once you have the Net MRR for at least two months, you can calculate the growth rate by subtracting the first month’s Net MRR from the second month’s Net MRR. Then divide the result by the first month’s Net MRR and multiply by 100 to get the percentage amount.

For example, if you have $1000 MRR in the first month and then $5000 in the second month, your growth rate is 400%.

Here’s the formula:

[ Net MRR Current Month – Net MRR Last Month ] / Net MRR Last Month x 100 = % Net MRR Growth Rate

While the calculation is simple, collecting data from thousands of customers and keeping track of all your changes in MRR is a big task without the right tools. If you don’t want to calculate your relevant metrics manually, you can view your Monthly Recurring Revenue rates and Net MRR Growth Rate in Baremetrics.

Baremetrics will automatically pull in information from all of your customers, their plan changes, and the churns so that you can spend time taking care of your customers. Check out the free trial here!

What Can Net MRR Growth Rate Tell You About Your Business?

Your Net MRR growth rate can reveal a lot about your business, including:

How Fast the Company is Growing

Net MRR is an excellent indicator of growth. For example, suppose your firm generates $550,000 in Month B, adds $100,000 in New MRR, and upsells current clients with $50,000 in add-ons. The firm also loses $20,000 due to churn, leaving you with a Net MRR of $680,000.

From a revenue perspective, the company is growing at a monthly rate of 23.6% month over month.

How Well Sales Teams are Performing

Your Net MRR Growth rate indicates how well your business development reps perform and can be a good indicator of waning performance. You could even incentivize your sales team by tying Net MRR growth rates to commissions.

How healthy your business is

Net MRR Growth rate is an essential indicator of your business’s health and will guide your planning and decision-making throughout the year. If you are consistently adding new clients, but your Net MRR Growth keeps declining month-on-month due to churn, you may need to investigate why the business isn’t retaining clients.

Does Net MRR Growth rate apply to all businesses?

Since your Net MRR Growth rate accounts for all revenue changes (including new customers, upgrades, attrition, contractions, etc.), it is the best way of comparing progress over time. However, it might not be applicable at every stage of your business.

New businesses that have been around for more than a year without breaking even can use the metric to calculate how long it will take to achieve profitability.

Unfortunately, very early-stage startups (under a year old) won’t be able to use the Net MRR Growth rate in a meaningful way. You’ll likely see dramatic and exponential growth in new businesses in the beginning stages because the company is growing from a base of zero sales. As the business grows, the number will start to decline and eventually stabilize.

It’s best to calculate your Net MRR Growth Rate for one year to eighteen months to ensure that your calculations reflect an accurate trend and not a once-off growth curve.

How Do You Grow Your Net MRR Growth Rate?

If your Net MRR Growth Rate is declining or below the industry benchmarks, you’ll want to take swift action to get back on course. Here are five ways to do so:

Set MRR Growth Rate Benchmarks For Your Team

By making MRR growth rate part of your sales team’s key performance indicators, they’ll approach sales differently, focusing on high-value clients.

Focus On Upselling

New customer acquisition can be a lengthy and expensive exercise, so instead focus on your expansion MRR or upselling. Expansion MRR is income generated month-on-month from existing customers through upgrades and add-ons.

You could also push cross-sales if you have complementary, non-core products and services to offer.

Reactivate Lapsed Users

If you’ve made product improvements or seen an uptick in search interest in your product, you should reach out to canceled or lapsed subscribers to see if you can reactivate their subscription.

SaaS businesses should look at the Lifetime Value of Customers

Mitigate Churn

If you notice that high-value customers pause, downgrade, or cancel their accounts, it’s crucial to get in touch and find out why. If possible, negotiate their subscription, offer price cuts, or free premium features. You can always upgrade them again at a later stage.

Other subscribers may churn due to payment failures or declines. An effective way to ensure that you resolve involuntary churn is by using a dunning tool like Baremetrics Recover.

Keep Testing

It can be hard to reach the pricing sweet spot on your first try. Continuing to experiment with packages, tiers, pricing, and features is your best chance at finding the sweet spot for conversion and retention.

What Are Some Other Important Metrics?

Your Net Monthly Recurring Revenue isn’t the only metric you want to keep an eye on. Here are some of the metrics you can track with Baremetrics:

Average Revenue Per User/Account

The Average Revenue Per User (ARPU or sometimes called ARPA) is the revenue generated per account, monthly or yearly. ARPA can expose trends in account expansion and contraction and help companies determine which pricing plans contribute the most to their bottom line.

Lifetime Value (LTV)

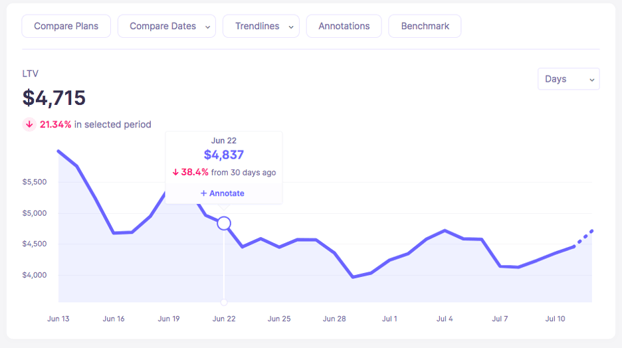

Your Lifetime Value (LTV)—sometimes called Customer Lifetime Value (CLV)—estimates an average customer’s aggregate gross margin contribution over their entire lifetime with the company. In other words, it measures the total amount of money your customer will spend with you.

It’s a fundamental metric for SaaS or subscription model businesses. The higher the lifetime value, the greater the profits. It’s also a good indicator of how valuable customers find your product or service.

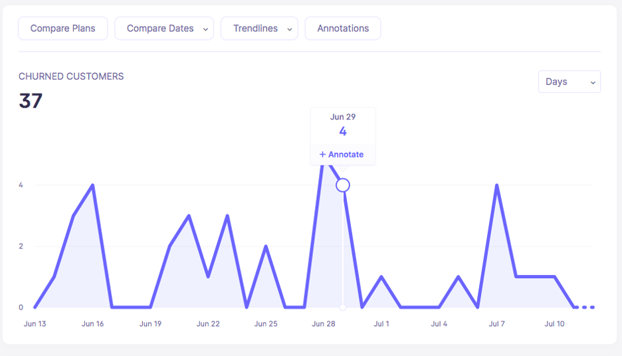

Churn Rates

Churn is the percentage rate at which your customers cancel their recurring revenue subscriptions.

The User Churn Rate calculates the percentage of customers canceling their subscription in a set period.

The Revenue Churn Rate defines the percentage of revenue lost due to cancellations in a period. Some customers are more valuable than others, so it’s essential to see the impact of losing multiple small accounts as well as losing high-value accounts.

Your Net Revenue Churn will calculate the percentage of revenue lost from existing customers in a set period and consider revenue earned from customer upgrades during that period.

What Are the Net MRR Growth Rate Industry Benchmarks?

Now that you know how to calculate your Net MRR Growth Rate, it’s time to see how your company is doing based on your company’s stage.

Venture Capitalist Paul Graham says that you should aim for an MRR growth rate of 5-7% per week or 23-33% per month if you’re an early-stage startup. Redpoint venture capitalist Tomasz Tunguz says that you should aim for a 15% Net MRR Growth Rate for those post-Seed SaaS companies.

For most startups, these growth rates are very high. Successful businesses grow in different ways.

If you want to see how your business stacks up against all of the other Baremetrics users, check out Open Benchmarks with Baremetrics.

This benchmarking data is exceptional because we calculate the benchmarks based on a sample of 900 completely normal businesses. This information is a great starting point for understanding how your business should be doing.

Gain Better Insights into your MRR with Baremetrics

Your MRR growth rate is the most important metric for your SaaS business. This key metric allows you to continually monitor and determine your company’s health, growth, and potential.

Baremetrics’ monitoring tool presents your MRR, ARR, LTV, customer churn, and other critical metrics in a single, easy-to-understand dashboard. You can connect Baremetrics to your revenue sources to gain deeper insights into your most valuable stats with the click of a button.

Never lose sight of your MRR Growth rate and other vital metrics. Sign up for a free trial and start making data-driven decisions about your customers, pricing, and business model today.

All the data your startup needs

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business.