Table of Contents

To boost growth, start with retention.

With saturated markets and well-funded newbies popping up, competition is fierce. But retention is key to long lasting growth. Once you know how to turn customers into loyalists, they will expand and sustain your business on their own.

The common knowledge is it’s 5x cheaper and easier to retain a customer than to gain a new one because you don’t have to spend time or resources starting from scratch with a new lead or prospect.

Why are we focusing on retention over churn?

First, let’s go over the relationship:

This is very simple and slight. They are the same depending on how you frame it—is the glass half empty or half full?

Retention is who or how much revenue stays, and churn is who or how much revenue leaves with a given period.

"Churn is the silent killer of all SaaS businesses. It doesn’t matter if you acquire 100 new customers in a month if 150 of them churn. Besides a strong customer acquisition strategy, every SaaS business needs a strong strategy for combating customer churn."

Dmytro Okunyev, Founder @ Chanty

There is immense value in looking at who churned and why they churned, but I’ll point you to this churn analysis piece by Baremetrics to answer those questions while we dig into the glass-half-full side—retention.

If you have a high retention rate, you’ll, in turn, have a low churn rate. However, as the saying goes, cash is king.

Retention indicates current and future revenue, which is cash in your account and future runway. If you focus on retention, churn will fall into place.

The question is, how do you measure it?

In this guide, we’ll discuss three common retention metrics you should pay attention to and how to improve them.

1. Customer retention

What is customer retention?

Customer retention (aka logo retention) is the number of customers you’re able to retain, not the revenue from each.

How do you calculate customer retention?

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑐𝑢𝑠𝑡𝑜𝑚𝑒𝑟𝑠 𝑡ℎ𝑎𝑡 𝑟𝑒𝑛𝑒𝑤𝑒𝑑 𝑖𝑛 𝑎 𝑝𝑒𝑟𝑖𝑜𝑑 / 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑐𝑢𝑠𝑡𝑜𝑚𝑒𝑟𝑠 𝑢𝑝 𝑓𝑜𝑟 𝑟𝑒𝑛𝑒𝑤𝑎𝑙 𝑖𝑛 𝑡ℎ𝑎𝑡 𝑝𝑒𝑟𝑖𝑜𝑑

Why is customer retention important?

It is an unpopular opinion to say that logo retention is important; some people say it’s a vanity metric so people can hide behind the revenue number they’re losing.

I get it. I said earlier that cash is king, and it still is. But considering the types of customers you are better at retaining may point to the target market your product is more successful with.

You can double down on efforts to retain ideal customers, and it will pay off in the long run.

It may not be a metric you highlight in the next board meeting, but it can narrow your market focus and lead your sales team to the right segment. It can be a strong signal of product market fit.

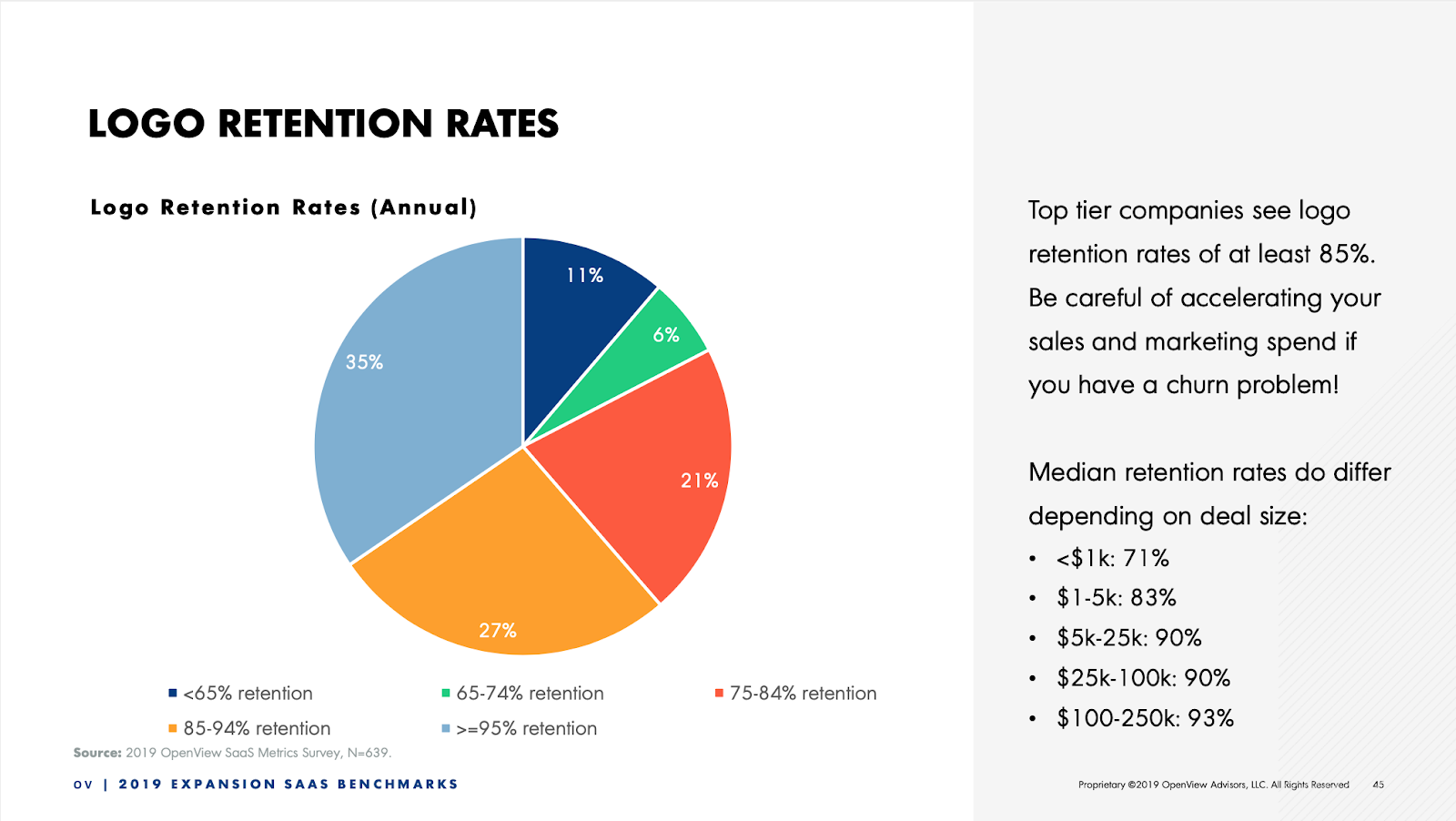

What is a good customer retention rate?

It depends on who you sell to. The larger your contract size, the higher your customer retention rate should be.

How to improve customer retention

To improve retention, you will need a killer customer experience and review your pricing structure.

Improving retention means chipping away at that pesky churn problem.

Since our friends at Baremetrics dive into the customer experience side of churn you can read here, I’ll focus on the pricing side.

It might be worth reviewing your pricing if you’re facing a churn problem.

And no, I’m not going to tell you to drop prices or make it hard to cancel so people will forget about it or justify staying. This is not that neglected gym membership.

1. Give an incentive if you are on a freemium model or offer a free upgrade.

If someone is ready to throw in the towel, offer them a free upgrade or a discount.

This alone will not solve the problems, but it gives your team time to right the wrong and help them get value from your product or service.

The other outcome is that they still don’t get any value, and you get another data point that will lead you to product market fit and further show who you can and cannot work with.

2. Incentivize annual billing vs. monthly.

This will ensure a customer is with you all year giving you a set time for your CS team to work their magic.

A by-product is that it will also help your cashflow since you’ll get all that cash up front.

Also, it’s MRR you can count on for the whole year.

3. Raise your prices.

John Doherty, Founder of Credo, said that when he looked into churn data by payment level, he found that churn rates for the lowest price tier were about five times that of the next tier.

Credo raised prices without offering anything new, and churn plummeted. He learned that the lowest-paying customers churn more and take up most of the support time.

The last one here that isn’t about pricing or CS is to be Product Led. The term “product led growth” was coined by OpenView Partners, and has become a focus for top startups like Slack, Trello, and Zoom.

In a product-led company, the focus is on building an incredible product, and your users will be your sales, marketing, and customer success teams.

Now that we’ve covered customer retention, there are two revenue retention metrics to break down and understand. Net revenue retention and gross revenue retention. Let’s start with net revenue retention.

2. Net revenue retention

What is net revenue retention?

It’s the revenue difference in a group of customers over time. Hmm, isn’t this getting into cohort analysis?

Similar but different, I’ll get to cohort analysis in a bit.

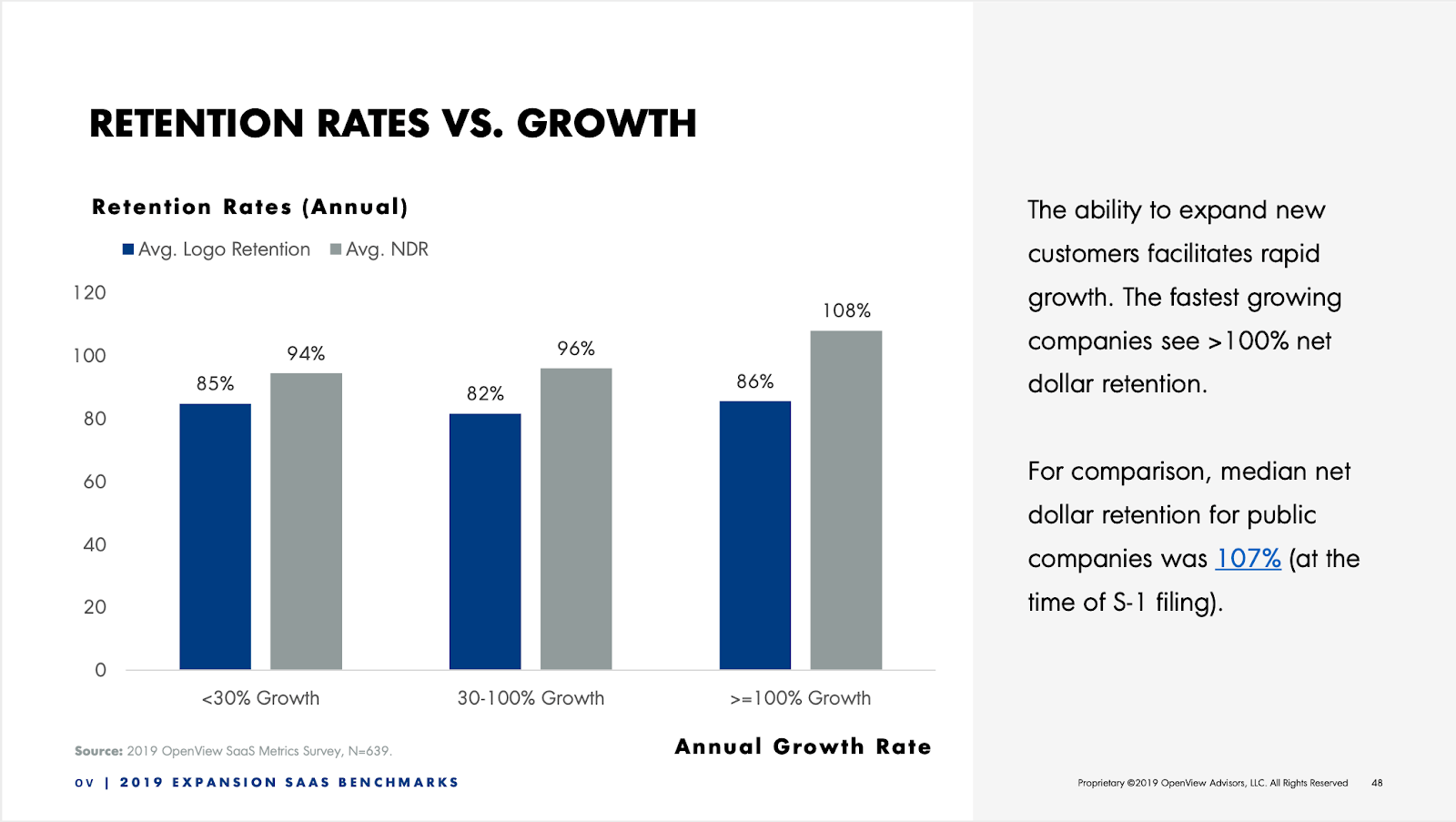

This chart from Openview Partner’s illustrates it nicely.

How do you calculate net revenue retention?

1 + (𝐸𝑥𝑝𝑎𝑛𝑠𝑖𝑜𝑛 – 𝐶ℎ𝑢𝑟𝑛𝑒𝑑 – 𝐷𝑜𝑤𝑛𝑔𝑟𝑎𝑑𝑒𝑑 𝑀𝑅𝑅)/𝑇𝑜𝑡𝑎𝑙 𝑀𝑅𝑅 = 𝑁𝑒𝑡 𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝑅𝑒𝑡𝑒𝑛𝑡𝑖𝑜𝑛

Or another way to think about it:

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑀𝑅𝑅 𝑓𝑟𝑜𝑚 𝑎 𝑔𝑟𝑜𝑢𝑝 𝑜𝑓 𝑐𝑢𝑠𝑡𝑜𝑚𝑒𝑟𝑠 / 𝑀𝑅𝑅 𝑓𝑟𝑜𝑚 𝑠𝑎𝑚𝑒 𝑔𝑟𝑜𝑢𝑝 𝑜𝑓 𝑐𝑢𝑠𝑡𝑜𝑚𝑒𝑟𝑠 𝑖𝑛 𝑝𝑟𝑒𝑣𝑖𝑜𝑢𝑠 𝑡𝑖𝑚𝑒 𝑝𝑒𝑟𝑖𝑜𝑑

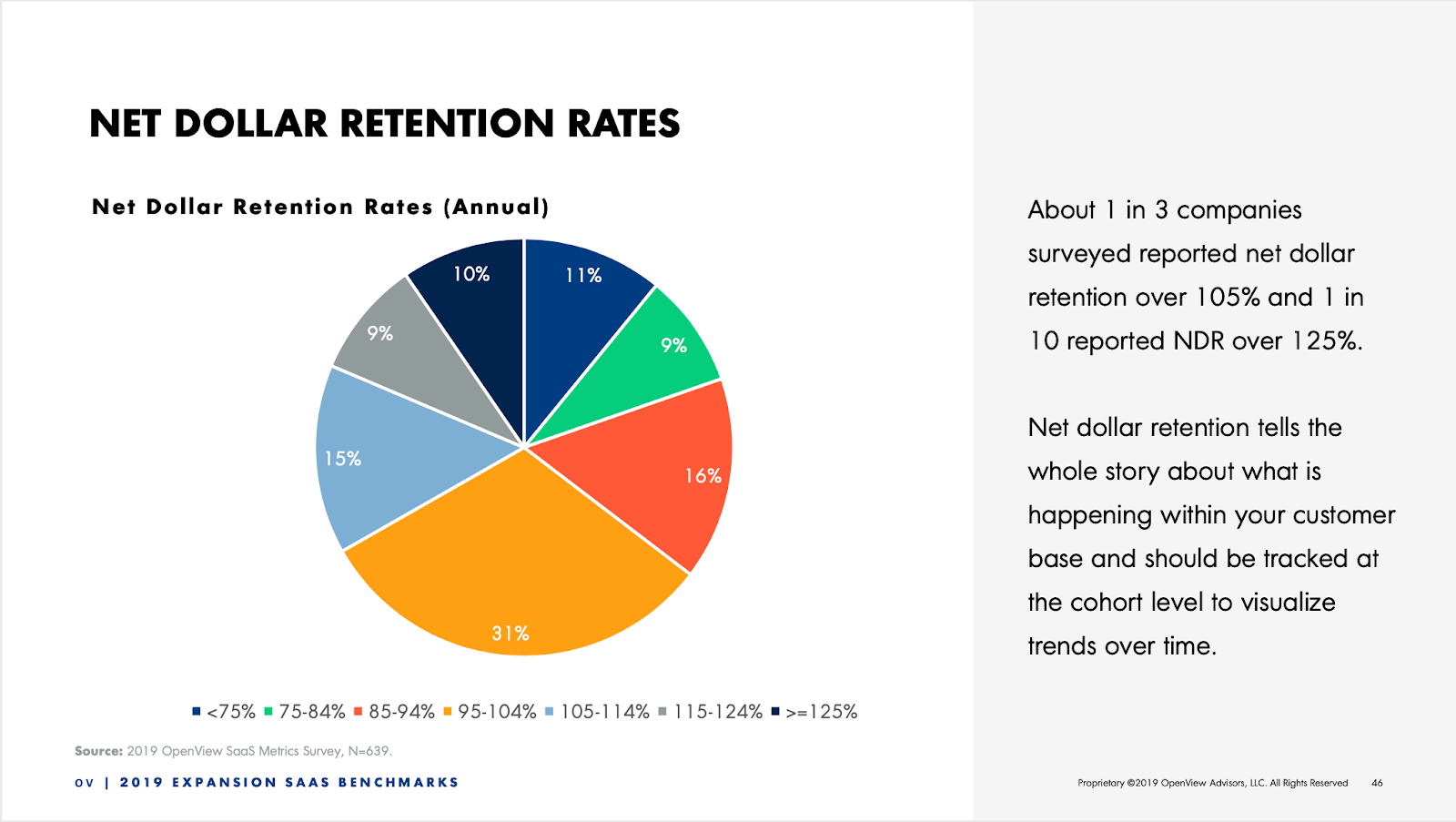

Why is net revenue retention important?

Net revenue retention helps understand how MRR/ARR moves within an existing customer base.

Why does that matter?

It tells us what would happen to revenue if a company didn’t gain a single new customer. It accounts for the impact of churn and the positive impacts of upsells, cross sells, and upgrades. Net revenue retention is the mile-high revenue view.

It’s considered a high-level metric because two companies with the same net revenue retention rate can be very different.

A company who has high churn but is incredible at upselling and cross selling will face different obstacles than a company with low churn who never adds value over time. In the case of slow months or years, the revenue trends of each will be opposite.

"While I look at several customer retention metrics including gross revenue churn, logo churn, and subscription renewal rates, if I had to pick only one metric it would be net revenue retention. It immediately tells me if our overall customer base is healthy. (I’m looking for 105%+)."

Phil Bryant, Product & Engineering @ SKOUT Cybersecurity

What is a good net revenue retention rate?

A net revenue retention rate of 100% or more leads to exponential growth and is the holy grail for SaaS companies.

Anything above 95%, and you’re in incredible shape. Shoot for 90% at a minimum, and continue working your way up from there.

3. Gross Revenue Retention

What is gross revenue retention?

In the simplest terms, gross revenue retention is lost dollars from churned customers.

How do you calculate gross revenue retention?

1 – (churned revenue / Total MRR) = Gross revenue retention

Keep in mind, this will never exceed 100%, if the number you get is more than that, there’s something missing or off in your calculation.

Why is gross revenue retention important?

It helps you understand how good your company is at retaining revenue from your customers over time.

The more efficient your team is at gross revenue retention, the healthier your growth rate will be and it will withstand any lapse or low months from upsells and cross-sells.

It will help you understand which types of customers are leaving as well when you compare to your customer retention.

If your customer retention is less than your gross revenue retention, then your smaller contract value customers are the ones leaving you (not necessarily the worst thing).

How to analyze customer retention

When you’re evaluating these three metrics for your company (particularly revenue retention), I recommend doing so in cohorts rather than across all your customers.

Cohort analysis is a framework for considering these different retention metrics. It can be used to measure the gross or net revenue retention of a group or cohort of customers over time.

While cohort analysis is used by finance experts, it can be broken down and learned by anyone.

If it's taught well from the top down in every company, it’s pretty easy to understand. Since Baremetrics does an incredible job of this, I’ll point you here for a deep dive into analysis.

Ready to review your customer retention metrics?

While it can seem daunting to review metrics and rework strategies to improve retention and decrease churn, you can now rely on your newfound knowledge of cohort analysis to do so.

The answers for what to do as a company and where to pivot or adjust lie in your own data. If you get stuck, phone a friend to help you out. If all else fails and you’re still feeling stuck, Baremetrics and KPI Sense are only an email or phone call away.