Table of Contents

.png)

Apple’s App Store is a powerful platform; in 2022 alone, it generated over 900 million subscriptions for app developers. It’s frequently used by mobile users looking to download new apps and is commonly used by app developers driving iOS mobile sales.

In many cases, these developers leverage both the Apple App Store and their own website to drive subscription sales. When they do the latter, they often rely on payment processors like Stripe Billing.

Each of these platforms is useful for their designated purposes, and each can provide basic financial data about the subscriptions they’re processing. They do, however, keep data on separate platforms and have somewhat limited reporting.

That’s where Baremetrics comes in. We offer accurate, detailed reporting data that you can’t get with either of the two other platforms. In this post, we’ll explain why you should connect both the App Store and Stripe to Baremetrics to get a consolidated view and analysis of your revenue.

Why SaaS Businesses Use Both Stripe Billing & The Apple App Store Separately

There are plenty of reasons why businesses end up relying on both Stripe Billing and the Apple App Store (which may charge customers’ cards directly or even use Apple Pay).

The first is that most subscription businesses aren’t selling exclusively to iOS customers. Many app developers today sell products to both iOS and Android users, so the App Store isn’t the only place they’re selling.

And in many cases, businesses prefer to sell subscriptions through their websites when possible. Different app stores can offer potential reach and make for convenient downloads, but they can also be pricey and may result in slightly higher churn rates depending on the user base.

Stripe Billing, for example, has a standard credit card charge of 2.9% + $0.30. Meanwhile, the Apple App Store charges a 15-30% commission, depending on the length of time in the App Store and annual revenue.

Why Stripe’s and the App Store’s Data Isn’t Enough

Stripe and the App Store do have solid data for what they’re tracking: The number of active subscriptions and total payments processed. And that is a great start.

That said, Stripe and the App Store are relatively limited compared to true revenue analytics platforms. Their data is also separate; if you want to view the App Store data, you have to navigate to that platform, and Stripe’s data is on another platform entirely.

This can make it difficult to track data across different platforms, which in turn makes it difficult to assess how these platforms are stacking up against each other.

And this is where a third-party revenue analytics tool (specifically, Baremetrics!) comes into play.

5 Benefits of Using Baremetrics Integrations to Track Financial Reporting

Baremetrics is a revenue analytics platform designed specifically for subscription businesses and SaaS startups. Let’s go over the five most significant benefits of integrating Baremetrics with your Stripe and Apple App Store accounts.

1. Gain Additional Critical Financial Insights

As soon as you integrate Baremetrics with your subscription management platforms, you’re getting all your data in one place, and that data is instantly improved.

Here at Baremetrics, we offer 26 different subscription-focused metrics to help you understand every layer of your revenue. We want app developers to understand what’s happening with revenue on individual platforms, and across all the platforms as a whole.

And, with our platform, you’ll be able to sort data based on platform, audience segments, and more to understand what’s impacting your revenue and why.

2. Centralize Financial Data From All Payment Processors

When you integrate Baremetrics with Stripe and the App Store, you’re getting all your financial and subscription data in one place— regardless of which payment processors were used or where customers purchased.

By centralizing this data, you can get detailed and accurate insights into what’s happening with your revenue across the board, without having to patch together the details across multiple dashboards. This makes it much easier to understand your profit and loss and to track your net revenue.

3. Compare Payment Processor Performance

Baremetrics knows you need to look at your overall subscription and financial metrics to track your revenue, but we also know that gaining insights about the financial performance of individual platforms is essential.

Connect multiple payment processors, app stores, and subscription management providers to Baremetrics to not only get a “big picture” view of what’s happening, but to also compare individual platforms. You can see which platforms are driving the most revenue and new customers, which have the highest churn rates, and how costs associated with each are impacting your bottom line.

4. Receive Actionable, Trustworthy Data

Too many financial analytics platforms aren’t designed for subscription-based businesses, and even those that sometimes make crucial mistakes when calculating revenue.

Baremetrics, for example, is one of the only platforms that doesn’t count all non-canceled memberships towards revenue automatically. We account for subscriptions that are paused or delinquent in payment, for example, where other competitors don’t.

And with the extensive subscription-focused metrics, we can provide detailed insights with clear accuracy. That kind of accuracy creates trustworthy data that you can actually use to make important, data-driven decisions.

5. Get Insights, Not Just Data

We’re proud of the data quality we provide, and those detailed metrics can be a gamechanger for subscription businesses. That said, we also go beyond basic data and provide actual insights.

Baremetrics offers multiple distinct features to provide actionable insights, including the following:

- Get accurate financial forecasting based on current and historical performance.

- Learn more about your subscription members, including discovering high-value audience segments.

- Identify reasons why your customers are canceling (and what you can do to stop it!).

- Use our Recover tool to prevent missed payments from happening and improve revenue and customer retention.

How to Use The Baremetrics Integrations

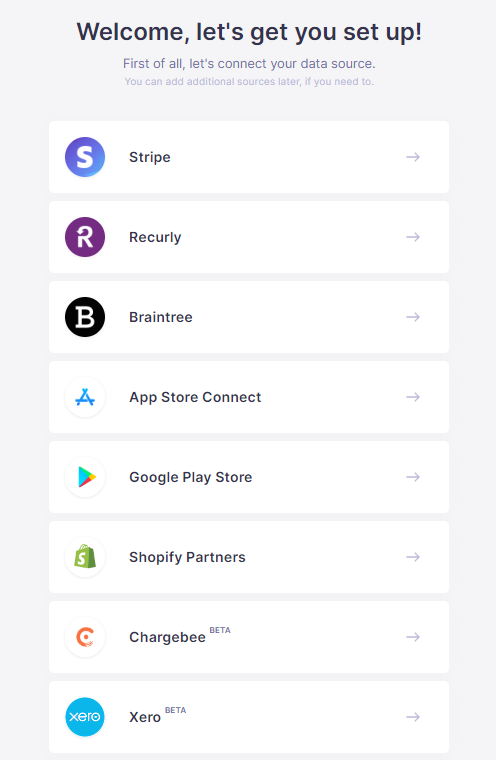

Good news: Integrating your subscription management tools, supported app stores, and billing platforms with Baremetrics has never been easier.

When you first sign up for Baremetrics, you’ll be asked to connect your data sources (including both Stripe and the Apple App Store). All it takes is a few clicks, and you can watch the data come pouring in.

Final Thoughts

Baremetrics is a revenue analytics platform for subscription businesses, so it only makes sense that we’d be able to integrate directly with billing, app store, and subscription management platforms to analyze all relevant data.

Integrating both Stripe Billing and the Apple App Store (and any other platforms you use!) with Baremetrics can provide more accurate and detailed data to help you better optimize your revenue.

Ready to get started? Book your free demo today!