Table of Contents

When you’re running a business, you always want as much information as possible to make the best business decisions you can. Just as you want to understand what’s happening in your market so you can make smart investments with product development, you also need a firm grasp on what’s happening with your company's financials

Whether you’re a startup or an enterprise-grade SaaS corporation, it’s essential to use revenue forecasting methods to keep track of projected revenue. Without accurate-as-possible revenue projections, it’s easy to mismanage your funds, accelerate your burn rate, and wind up with cash flow issues. Alternatively, being too conservative could result in missed growth or revenue opportunities.

Starting with strong revenue forecasting software, therefore, is key. And in this post, we’re going to talk about the best SaaS revenue forecasting software for 2025.

What is Revenue Forecasting Software?

Revenue forecasting software, also called “financial forecasting software” or “financial projection software”, is used to assess a business’s financial data, sales history, and current business trends to provide projections that estimate how much your business is likely to make in a set time period.

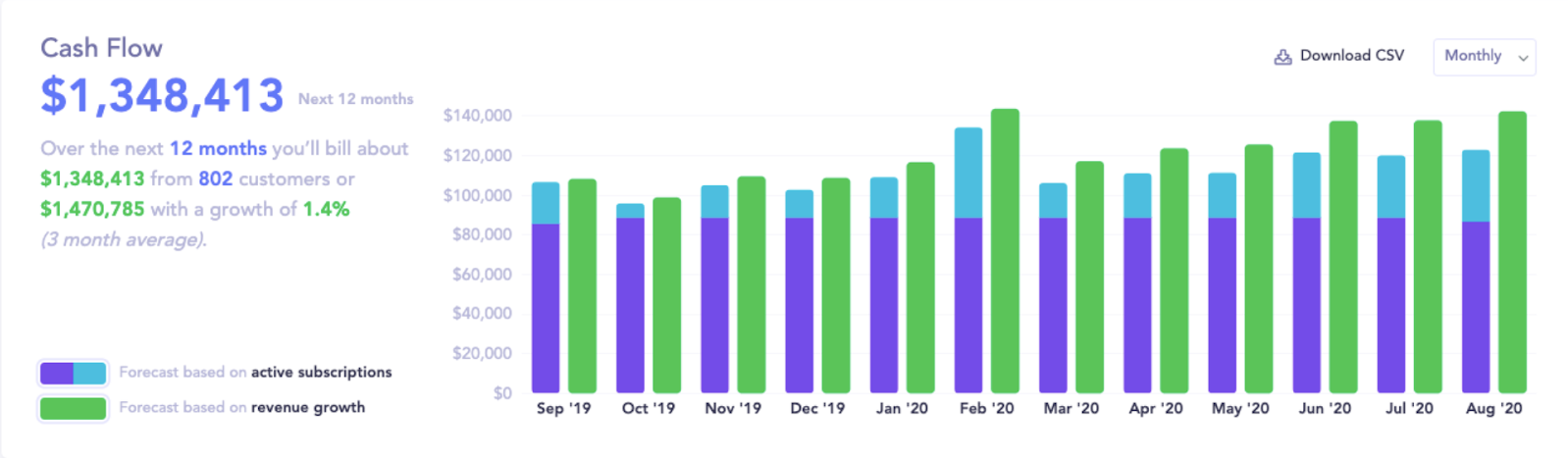

Image source: Baremetrics

SaaS revenue forecasting is often built around subscription business models and uses various models to give you the most accurate view of your potential revenue (assuming nothing significant changes).

Why Use Revenue Forecasting Software?

Revenue forecasting software allows companies to forecast revenue and efficiently allocate resources in a way that optimizes growth and cash flow. With more knowledge and reliable predictions, it becomes possible to confidently make important decisions in a way that impacts your bottom line.

This kind of software usually includes predictive templates and complex algorithms to help you forecast revenue more accurately based on proven statistical models. These templates are used to analyze historical financial data and sales reports.

4 Types of Revenue Forecasting Models

There are different revenue forecasting techniques and models which businesses can use to project their potential profit.

These include the following:

- The pipeline revenue forecasting model. This method makes revenue projections based on leads currently in your pipeline, estimating that a percentage of those deals will be closed. Pipeline data is often readily accessible, but this model alone doesn’t often give an accurate assessment because deal size can sometimes be difficult to assess upfront.

- The backlog revenue forecasting model. This model looks at all the revenue that you’ve been contracted for but haven’t yet earned. For SaaS businesses, that may mean looking at monthly recurring revenue (MRR) that you haven’t been paid for yet, or new deals that been signed but not paid.

- Bottom-up forecasting. This is a detailed and often accurate forecast model that allows teams to plan their work and align resources to projects accordingly, and can include both in-pipeline and active projects.

- Revenue forecasting through historical performance. All revenue forecasting models should be looking at historical data, and this is a particularly great choice for SaaS businesses. This revenue forecast model reviews historical data and compares it to your current performance to assess financial projections in the coming period.

What to Look For in Revenue Forecasting Software

When SaaS and subscription businesses are choosing revenue forecasting software, there are plenty of options on the market. Knowing what to look for can help you choose a reliable tool that aligns with your business models and that can provide the most accurate projections possible.

We recommend looking for revenue forecast software with the following qualities:

- Revenue tools that align with your business model. Not all revenue forecasting software has features for subscription businesses, for example, so it’s imperative to choose one that does if you’re a SaaS subscription brand.

- Tools that account for nuance. Too many subscription analytics tools will lump all existing customers into revenue projections, even those that are delinquent on payment or who have paused their memberships. Choose a tool like Baremetrics Forecast+ that exclusively considers active subscriptions in good standing.

- Integrations with your existing tech stack. You likely already have sales software, a CRM, and subscription management software. You want to choose a revenue forecasting tool that can integrate with the software you’re already using, and ideally, one that allows for you to add your own through their API.

- Reliability. Look at reviews online using platforms like G2 and B2B SaaS reviews to see what customers are saying about how the tool actually works. Reliability and accuracy is important, and reviews will show the full picture.

- Transparent pricing models. Too many forecasting tools don’t have transparent pricing; they may charge out the nose for revenue projection features, or have complex contracts that lock you in. Here at Baremetrics, our Forecast software is free with any of our subscription plans.

The 6 Best Financial Projection Software Tools for 2025

Ready to discover the six best financial projection software options for 2025 based on your specific business model and needs? We’ve got you covered. These are our top choices.

1. Baremetrics Forecast+

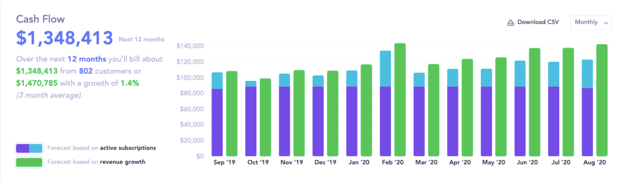

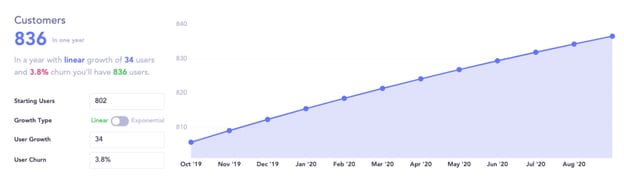

Subscription businesses and SaaS startups should first consider Baremetrics’ Forecast+ tool. It allows you to not only project your net revenue, but also your customer count and your MRR through the next year based on historical data and your current performance.

Image source: Baremetrics

Our tool considers factors specific to your business, including churn rate, linear or exponential growth, and more. We also love nuance, so we want to give you a big-picture look at what to expect with your business. That means we provide details that most businesses won’t, like offering revenue forecasts based on both active customers and your current revenue growth.

Unlike many other tools on the market, we also only consider active, paying customers whose accounts are in good standing when calculating MRR. You won’t have your revenue projections skewed by a list of customers who haven’t renewed their memberships (or progressed beyond a free trial) in months. This subscription revenue forecast is SaaS-friendly, and a popular tool for startups.

Tired of spending hours on spreadsheets? Forecast+ is free with any Baremetrics account, get a free trial today!

2. Forecast Pro

Forecast Pro, unlike some other tools on this list, is a dedicated forecasting tool that was designed to work across almost all industries.

It incorporates AI and machine learning combined with statistical forecasting to create accurate forecasts that your business can trust. Since it accounts for multiple business models and forecasting options, there’s decent customization— though in many cases, we’d probably recommend choosing a tool created for your specific business model if that’s available.

Forecast Pro starts at $1,495. You can see how it works by watching this video.

3. Jirav

This financial projection software offers an all-in-one solution for budgets, forecasts, reports, and more.

Jirav is fast and easy to implement, and its intuitive interface meets the needs of any sized business up to 500 employees. Integrations with accounting solutions you already use for things like your balance sheet, such as QuickBooks Online, Xero, or NetSuite, means you’ll see the value from the moment you set it up.

Their software does allow for plenty of customization with revenue models, and their template system is incredibly simple to use. They also have dynamic forecasting models, allowing you to see how changes in customer count, staffing, or expected sales could impact future revenue.

Image source: Jirav

Jirav starts at $10,000/year, but many of their best features require the $15,000/year pricing tier. This can be a great solution for enterprise businesses with high sales volumes, but is often not a fit for startups and small or medium SaaS businesses.

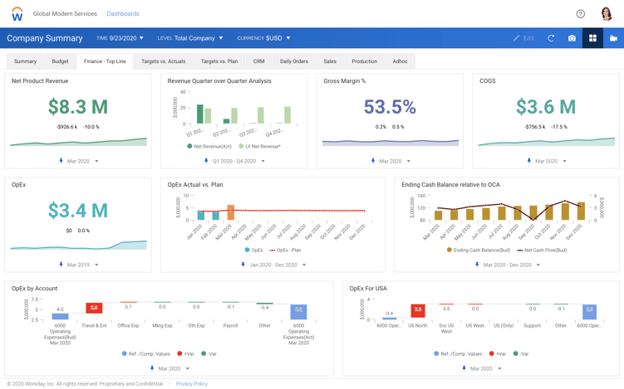

4. Workday Adaptive Planning

Take your cash flow statements, budgets, plans, financial reports, and models to a whole new level with this financial planning solution.

Workday Adaptive Planning helps you streamline your processes and offer shareholders financial statements with strategic insights. You can configure Adaptive Planning to your specific requirements, create customized calculations, and adapt it to your evolving needs as you grow.

Image source: Workday Adaptive Planning

Targeted at mid to large-scale businesses, Adaptive Planning addresses challenges like manual financial workflows, data inconsistencies, limited scalability, and subpar data visualization. It's an ideal choice for companies facing issues with disjointed spreadsheets or those seeking enhanced FP&A professional growth. Moreover, businesses already familiar with Workday solutions will find Adaptive Planning particularly beneficial.

While some customer reviews say this software is a little difficult to set up, many are happy with the advanced features (which are often being updated). For large, enterprise-grade companies, this is a good tool to consider, but probably not one we’d recommend for small SaaS businesses or startups.

5. Vena

Vena’s financial projection software combines incredible integration and planning ability with a familiar, Excel-like interface, allowing departments to cooperate more effectively toward shared company goals.

It’s interface is intuitive, making the tool easy to use, flexible, scalable, and lets companies orchestrate budgets, forecasts, models, reports, and more.

One caveat to note here: While many users appreciated the platform’s ease of use, Capterra reviews often noted that it took a long time to create templates or upload data. Their pricing models may also be confusing, so make sure you understand what you’re paying for.

Image source: Vena

6. NetSuite CRM

NetSuite CRM is, first and foremost, a fantastic Customer Relationship Management (CRM) tool. It comes with expansive features, including (of course!) forecasting software.

If you’re already using NetSuite as your CRM, using their financial forecast software is a no-brainer. Their sales forecasting models consider factors like unbilled sales orders, cash sales and invoices within the time period you’re assessing, sales that haven’t converted yet, and opportunities with or without estimates attached based on historical data.

While NetSuite’s sales forecasting tool is native to the platform, it also isn’t specific to SaaS businesses or subscription models; if you fall under that category, we recommend looking for a specialized tool.

You can see how it works by watching this video.

Final Thoughts: Choosing Revenue Forecasting Software That's Right for You

Revenue forecasting software isn’t all created equal, and even all the amazing and highly-rated tools on our list aren’t right for everyone— especially since financial projections vary wildly depending on the models and revenue forecast formulas being used.

That means that the best financial projection software depends entirely on your business.

Startups and SaaS subscription businesses should look for revenue forecasting tools created specifically with them in mind, like Baremetrics.

And larger corporations may want to look for an enterprise-grade tool geared towards their size and the features needed for widespread collaboration across huge teams.

No matter what, remember to ask the following questions when narrowing down your list of tools:

- Does it have all the features I need for my budget now?

- Does this tool work with my existing tech stack?

- Does this software have the specific features I need and use revenue forecasting models that align with my business?

- Are customer reviews online positive, and written by customers with businesses like mine? What pain points did they stress?

- Is customer support good, based on reviews online?

- Do I like the interface, and would it be easy to train my team on?

Since many tools offer extensive demos or free trials, you can come up with a list of tools that you think may work for you and test them out! That may be the best way to be sure in your decision and to find the right fit.

Ready to stop wasting hours on spreadsheets to get accurate forecasting? Book your demo with Baremetrics today.