Table of Contents

SaaS companies often seek outside funding to either bootstrap the business at the outset or raise capital to scale further. But what are investors looking for? Finding and convincing the right investors to invest can be a challenge.

In this guide, we’ll discuss the different types of investors and what they’re looking for in a startup. This can help you make your SaaS business more attractive to potential investors and make fundraising much easier.

Types of Investors

According to Brian Sierakowski, CEO of Baremetrics, “Not all investors are the same. Some feel more comfortable in specific types of businesses, or categories like social impact, for example. There is definitely such a thing of investor/founder fit.”

With this in mind, here’s a breakdown of some of the types of investors that might work with a startup.

Friends and Family

One of the first ways a startup founder might raise capital is from friends and family. This can be in the form of a personal loan, an equity stake in the company, or even a gift. There’s usually a low limit to how much capital a startup can raise from friends and family before they’ll need to consider other options.

Angels

Angel investing can involve a single high-net-worth individual or a group of investors. Most individual angels will invest in the form of a convertible note or SAFE note, both of which offer the investor the potential for equity in the future. Angel groups typically invest using either of those types of notes or with preferred equity.

Incubators & Accelerators

Startup incubators and accelerators are programs that offer capital and other resources to promising startups. Like angel investors, these investments often take the form of convertible or SAFE notes but might also include a common equity stake. Incubators and accelerators are great for founders that need additional mentorship and networking opportunities.

Venture Capital

Venture capital is funding that’s aimed at startups that are already beginning to experience rapid growth. Most venture capital funding takes the form of preferred equity investments made by limited partnership investment vehicles. Since VCs take on some risk with an equity stake, they’re much more selective in the startups they choose to invest in.

Crowdfunding

Crowdfunding is a way to raise capital from a large number of investors. This method of investment has gained in popularity recently with the Internet and new regulations. Crowdfunding can be a great way to raise capital (sometimes even more than intended), but founders will lose out on the chance to work with experienced investors and advisors.

What Are Investors Looking for in a Startup?

While every investor will evaluate a startup using different criteria, here are some of the most common metrics and other things they want to see.

A Strong Idea and Product

Before a potential investor will look into a startup’s financials, they’ll likely evaluate the business on a much higher level by asking: Does the company already have a good idea and minimum viable product (MVP)?

They’ll basically want to assess whether the company is solving a pain point in the market that enough people care about.

Past Performance Data

The past might not always predict the future, but it’s a good starting point. While this might not matter for earlier investments from friends and family, a strong track record is crucial when it comes time to obtain funding from VCs

Revenue Growth (ARR + MRR)

Annual recurring revenue (ARR) and monthly recurring revenue (MRR) are generally the most critical metrics for SaaS and subscription businesses.

MRR dashboard in Baremetrics

Potential investors often consider MRR a key indicator of revenue growth rather than ARR because many startups offer discounted annual plans to attract customers.

In short, investors want their investment to grow, so strong revenue growth potential with an up-trending MRR amount is a key due diligence criterion.

Churn

Churn is the amount of revenue or customers lost in a certain period. This helps investors understand the long-term growth potential of the business, as a low churn rate allows recurring revenue to grow. Conversely, overcoming a high churn rate through customer acquisition is an uphill battle.

User Churn Dashboard in Baremetrics

Customer Acquisition Cost & Lifetime Value

Customer acquisition cost (CAC) is the average amount spent on marketing, sales, and other expenses to attract new customers. This is often evaluated along with customer lifetime value (LTV), which is the estimated total revenue the average customer will generate over their entire relationship with the business.

LTV dashboard in Baremetrics

Many investors look at the ratio between LTV and CAC to determine whether business growth by attracting new customers is sustainable.

Gross Margin

Gross margin is the revenue generated after subtracting the cost of goods sold. A high revenue growth rate and low churn rate are great signs of business health, but a low gross margin can still indicate uncertain growth potential. That’s why investors look for a high gross margin, so they’re confident the startup has enough money left over to reinvest in scaling the business.

Revenue Per Employee

Revenue per employee tracks how much the business is making at its current employee headcount. This is a valuable benchmark for tracking how efficiently the business is operating and scaling. Since revenue per employee is a much broader metric and lagging indicator, most investors simply look for an upward trend.

Clear Outcomes and KPIs

We’ve outlined some of the most important metrics investors might look at, but there are so many more KPIs that SaaS and subscription companies should be tracking, such as quick rate, active subscriptions, and more.

Even if investors aren’t analyzing these other metrics themselves, they’ll want to know the startup is using data to optimize and scale business performance.

Financial Forecasting and Projections

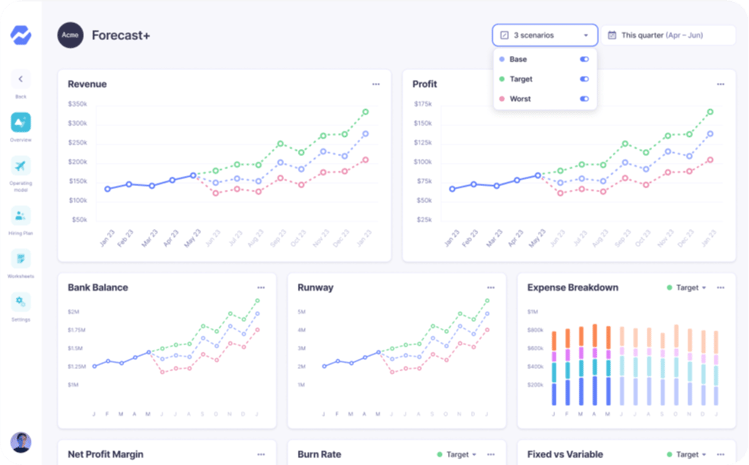

Investors will want to see accurate projections of business growth in addition to current and past performance. This requires building a financial model that leverages best practices from traditional forecasting, scenario forecasting, and other methods for predicting future SaaS business performance.

Scenario modeling in Forecast+ by Baremetrics

Product Market Fit and Market Size

Along with financial projections, it’s important to predict the traction and momentum the SaaS product will have in a particular market. This helps startups determine their scalability and future opportunities for growth while demonstrating consumer interest to investors.

For example, Baremetrics forecasting tools include a feature for predicting the number of potential customers based on the existing customer base and the average customer growth and churn rates over the past few months.

Leaders

Before they choose to invest, investors will ensure the company has a true leader or champion that knows how to motivate their team, allocate resources effectively, and make educated business decisions. Investors want to feel confident that those running the businesses they invest in are competent and dedicated to growth.

A Clear Narrative

All of the previous metrics and data points can be summarized into a single idea: is there a straightforward narrative that suggests this will be a strong investment? This is ultimately what investors will look for before they’re willing to put up any capital.

I’ve listened to hundreds of pitches, and sometimes after the pitch

you’re like ‘… what?’

Having a clear narrative that people can understand is really important. Sometimes it’s as simple as making the “X for Y” argument.

Building a Business Narrative for Fundraising With Baremetrics

Baremetrics can help SaaS and subscription companies build a compelling business narrative through accurate and straightforward analytics dashboards.

Along with tracking the most essential metrics, the platform can help create revenue and cash flow forecasts. This is a great way to streamline your reporting efforts during fundraising. If you’re ready to scale, sign-up for your free trial of Baremetrics today.