Table of Contents

Net Dollar Retention (NDR) is an essential metric for growing SaaS businesses.

Though lesser known, it provides deeper insights than Monthly Recurring Revenue (MRR) and Annual Run Rate (ARR). Many companies mistakenly only track these two benchmarks.

This article will cover everything you need to know about NDR: what it is, how it’s calculated, and how it supports sustainable growth.

What is Net Dollar Retention (NDR)?

NDR is a churn metric that calculates the percentage of recurring revenue retained from existing customers over time.

It’s considered a “high-level” metric because it considers factors that impact recurring revenue — cancelations, downgrades, pause requests, etc.

Other popular metrics such as Monthly Recurring Revenue (MRR) and Annual Run Rate (ARR) show recurring revenue from current customers but not revenue churn — the amount of lost revenue over time. MRR/ARR doesn’t consider customers who:

- Cancel a subscription

- Downgrade a subscription

- Pause or “freeze” a subscription

Here is an example:

You have 100 customers who pay $10 a month for a subscription. In January, seven customers cancel subscriptions. Your MRR for January ($1,000) doesn’t tell you anything about revenue churn.

Also, two companies with the same MRR might have very different circumstances. For instance, Company A’s MRR for January is $1,000. Company B’s MRR for January is $1,000.

However, Company A had three customers who canceled subscriptions in January. MRR reveals nothing about Company A’s revenue churn.

These considerations make NDR an important metric because it reveals customers' behavior over a given period of time. These stats generate deeper insights than MRR/ARR.

Suggested reading: What is Negative Churn? (And How to Achieve It)

You can calculate NDR using metrics tracked in Baremetrics, the one-stop customer intelligence dashboard for SaaS, e-commerce, and subscription businesses. Start a free trial today!

How to Calculate NDR

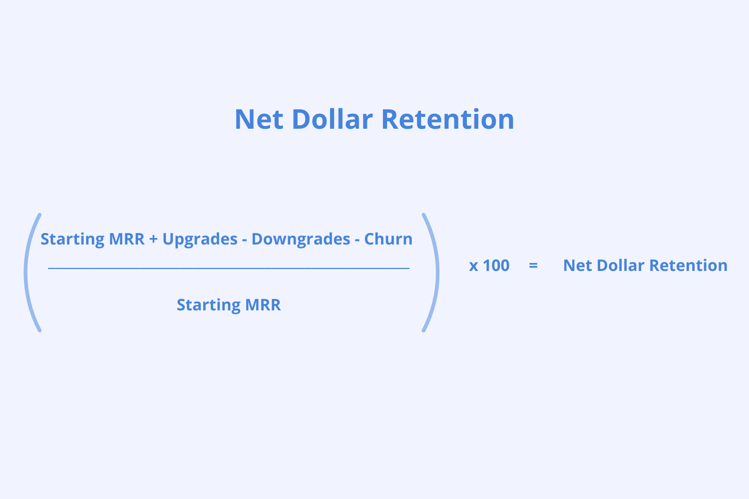

Calculating Net Dollar Retention shows your revenue from current customers and considers upgrades, downgrades, and churn. Here’s the easiest way to calculate NDR:

Here’s an example:

- At the start of a month, a business has $5,000 Starting MRR

- Some customers upgrade their subscriptions: + $2,000 Upgrades

- Other customers downgrade their subscriptions: – $300 Downgrades

- Other customers cancel their subscriptions: – $400 Churn

![]()

- Net Dollar Retention is 126%. That’s excellent! Companies should aim for above 120% NDR.

- NDR below 100% means churn and downgrades were greater than growth. Keep reading to learn how you can improve NDR!

How to Improve NDR

Once you add the NDR metric into your reporting mix, you’ll identify opportunities to improve customer churn.

For example, once you discover cancelations impact recurring revenue, you can establish user retention strategies that minimize future cancelations. These attrition strategies include:

- Upselling

- Encouraging customers to subscribe to premium-level services that provide more value and reverse a lower retention rate.

- Cross-Selling

- Encouraging customers to subscribe to similar services that improve the customer experience and low retention.

- New Customer Acquisition Techniques

- Techniques that reduce the impact of cancelations and increase the total number of customers.

- Key Metrics

- Metrics that identify churn long before it becomes a problem.

- Baremetrics generates invaluable daily, weekly, or monthly reports with a broad range of churn metrics, such as MRR, ARR, lifetime value, new MRR added in the last seven days, average revenue per user, and more. Try it for free!

Pro-tip: Many customers churn when their credit cards expire and receive notification that you can’t collect payments, prompting them to re-evaluate your service.

Baremetrics’ Recover alerts you when credit cards are due to expire, so you can encourage your customer base to update payment details, which improves churn and turnover rate.

Conclusion

Net Dollar Retention is an essential metric for identifying how cancelations, downgrades, pause requests, and other factors influence revenue.

Using the simple calculation above proves far more insightful than using metrics like MRR and ARR alone. You will get increased customer satisfaction and a high retention rate.

Daily, weekly, and monthly reports and Recover from Baremetrics let you identify and reduce churn and improve your customer retention rate.